April 25, 2025 | The Next U.S. Recession will Hit the Stock Market Hard

A recession in the U.S. is coming soon, if it has not started already.

Uncertainty over the impact of higher tariffs is causing business leaders to hesitate, triggering an investment pause. Consumers are on hold with their spending plans. Government spending cuts add a negative impulse to demand.

How will this recession impact the stock market?

There have been twelve recessions since the end of Second World War.

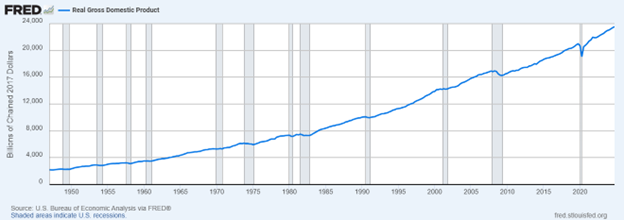

Source: FRED- St. Louis Fed

The shaded areas are recessions. The last serious recession was in 2008-09. The combined effect of the two recessions in 1980 and 1982 was very damaging.

The average recession causes a slight downturn in real GDP, combined with a rise in unemployment and a setback in the stock market.

If it’s just a technical recession the effects on jobs and the stock market are quite mild. For example, the U.S. unemployment rate is about 4.2 percent, and a deep recession would push that rate up to 10 percent. But even then, 90 percent of the workforce would still be employed! The unemployment effect would fall most heavily on workers with less than a high school diploma working for hourly wages.

The old saying goes like this: It’s a recession if your neighbour loses his job and a depression if you become unemployed.

The last serious recession ended in 2009 so there’s been a long expansion since then. The 2020 recession was very brief and mild.

The downturn in 2020 was mild because government spending was used to flood the economy with fresh cash. This policy worked but the subsequent surge in inflation was unprecedented and troublesome.

But this time there is worry about a deeper and lasting recession:

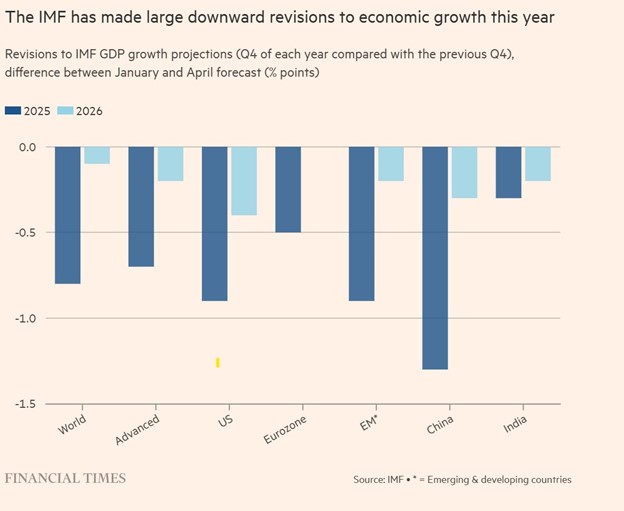

Source: Financial Times

Will the government and the Fed be willing to risk another bout of inflation during the next recession? With the memory of 2021-23 still fresh we can expect a more moderate response to any slowdown.

CEOs are worried about the impact of tariffs on profits as they should be. Their concerns are making investment decisions difficult.

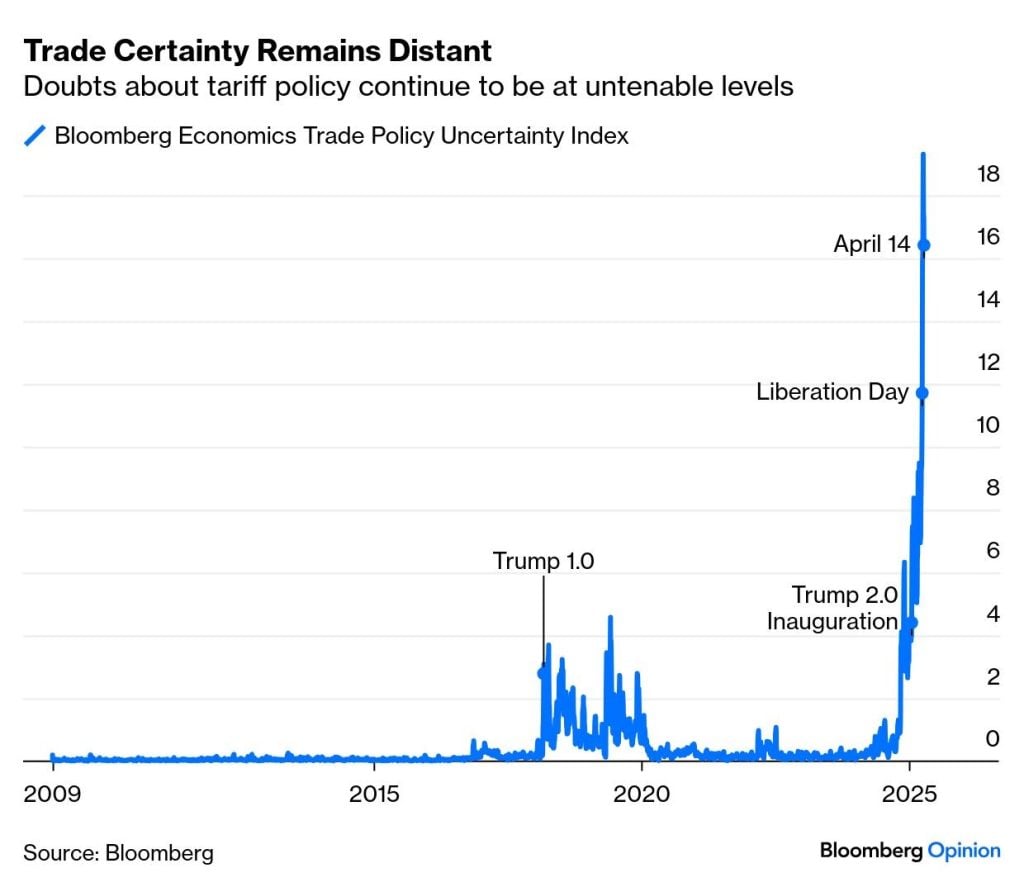

Source: Bloomberg

But tariffs also affect profit margins. At least some of the cost of the tariff is absorbed by the manufacturer, the importer and the retailer. About 2/3s of all U.S. imports are on intermediate goods so the final assembly and distribution will be more expensive, and the customer may not be willing to pay the higher prices needed to generate the same profits as before.

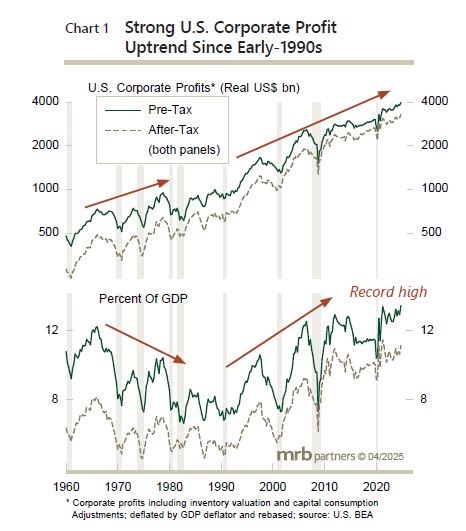

The history in the U.S. for the last 45 years is a steady trend to higher corporate pre-tax profits. Corporate taxes have also declined. This trend resulted in more profits per share and pushed stock prices higher.

Source: MRB Partners

The stock market remains complacent about the possibility of both a recession and weak earnings in 2025 and 2026.

But corporate profits inevitably decline in a severe recession. And currently profit margins cannot be guaranteed by policy actions of the Fed.

A reversion to the historic mean for profit margins would put downward pressure on elevated stock market prices.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth April 25th, 2025

Posted In: Hilliard's Weekend Notebook