April 7, 2025 | The Next Lost Decade

Happy Monday Morning!

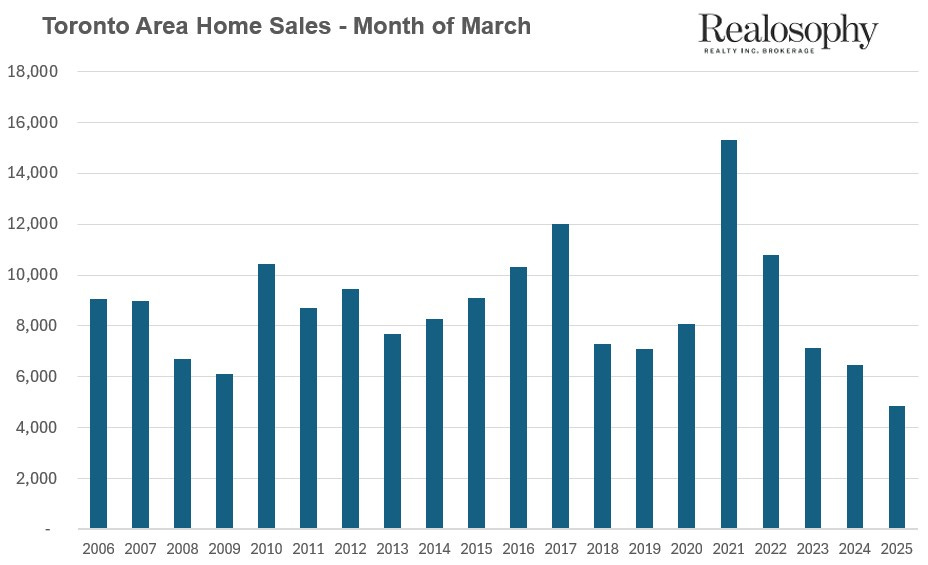

As we reported a few weeks ago, consumer confidence in Canada has plunged to twenty year lows amidst growing job losses and a global tariff war. The lack of confidence is showing up in home sales, which have fallen off a cliff in recent months. Recent data for the month of March reinforces the view that buyers have moved to the sidelines despite lower mortgage rates.

Toronto area home sales fell to their lowest levels in over 20 years for the month of March.

Meanwhile, new listings jumped 23% to their highest levels in three years. Total inventory for sale has swelled by 89% putting downwards pressure on prices, with the home price index sinking 3.8% from last year.

It’s a similar story in Greater Vancouver where home sales, outside of March 2019, hit their lowest levels in more than 20 years. New listings bounced 28%, coming in 15% above the ten year average. There is nearly 7 months of inventory for sale offering buyers plenty of selection.

However, as we’ve highlighted many times in this newsletter, there are pockets of the market that are performing better or worse than others. The most vulnerable segments of the market are the ones that went up the most, where prices completely detached from fundamentals.

The two that stick out the most are pre-sales in the GTA, and condos in the suburbs of Vancouver.

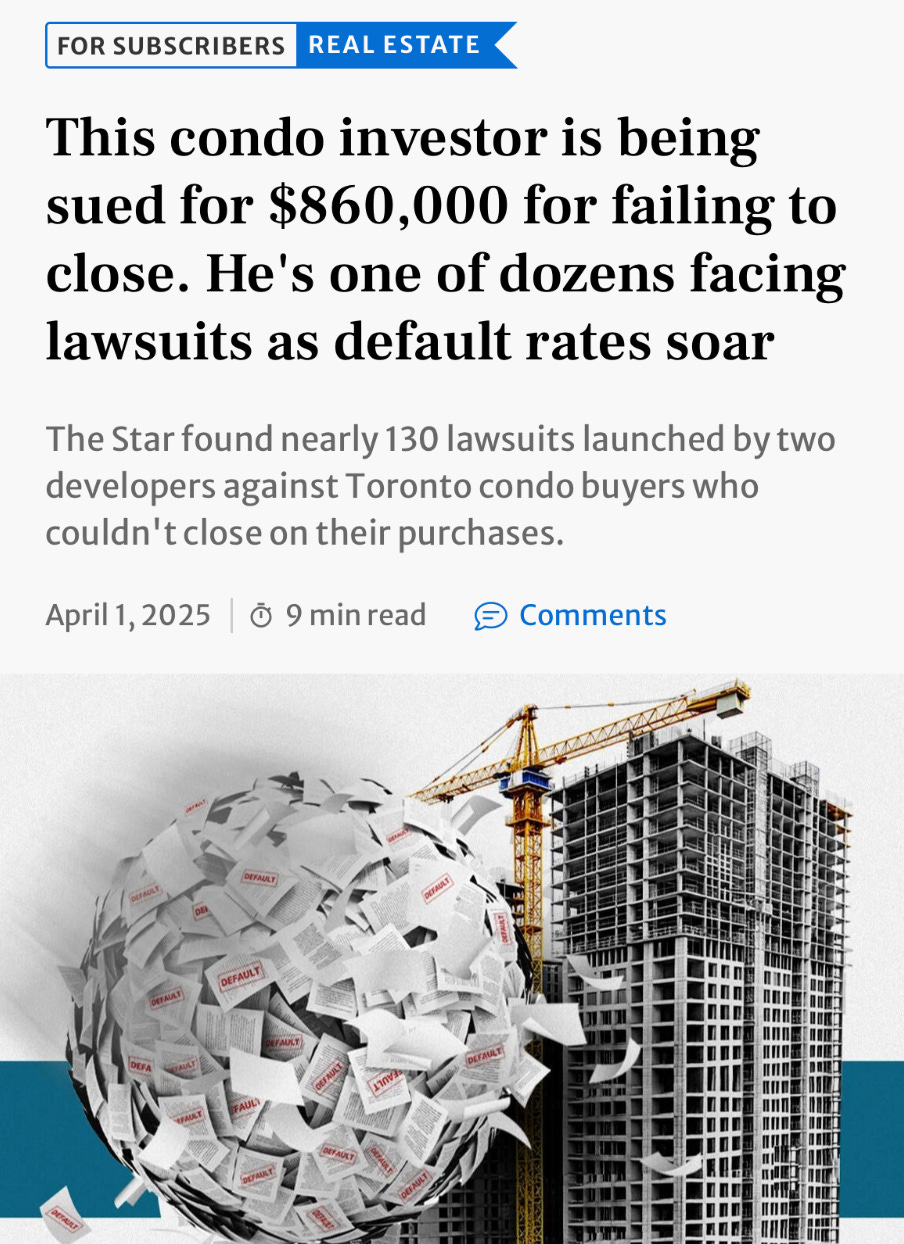

An article published in the Toronto Star this week highlights what’s happening on the ground.

In 2021, Nizar Tajdin was told he could flip a preconstruction condo in Forest Hill for massive profit. He put down $85,500 on an $855K unit he knew he couldn’t qualify a mortgage for. Why? The agent said he’d find another buyer. He never did.

Now, Tajdin is being sued by CentreCourt for $860,000 + taxes. Developers are holding deposits and suing for damages. And he’s not alone — this is happening across the GTA.

Kristiyan Todorov, who bought 10 precons, says it’s been a “living hell.” He lost his $200K deposit on one unit and is now being sued for over $1M in damages. The interest rate on the judgment? A staggering 24% annually.

Developers have launched nearly 130 lawsuits — and it’s only growing. CentreCourt and Mod Developments alone are behind 73 of them. One project at 55 Mercer St. has 19 lawsuits. Another at 82 Dalhousie has 22.

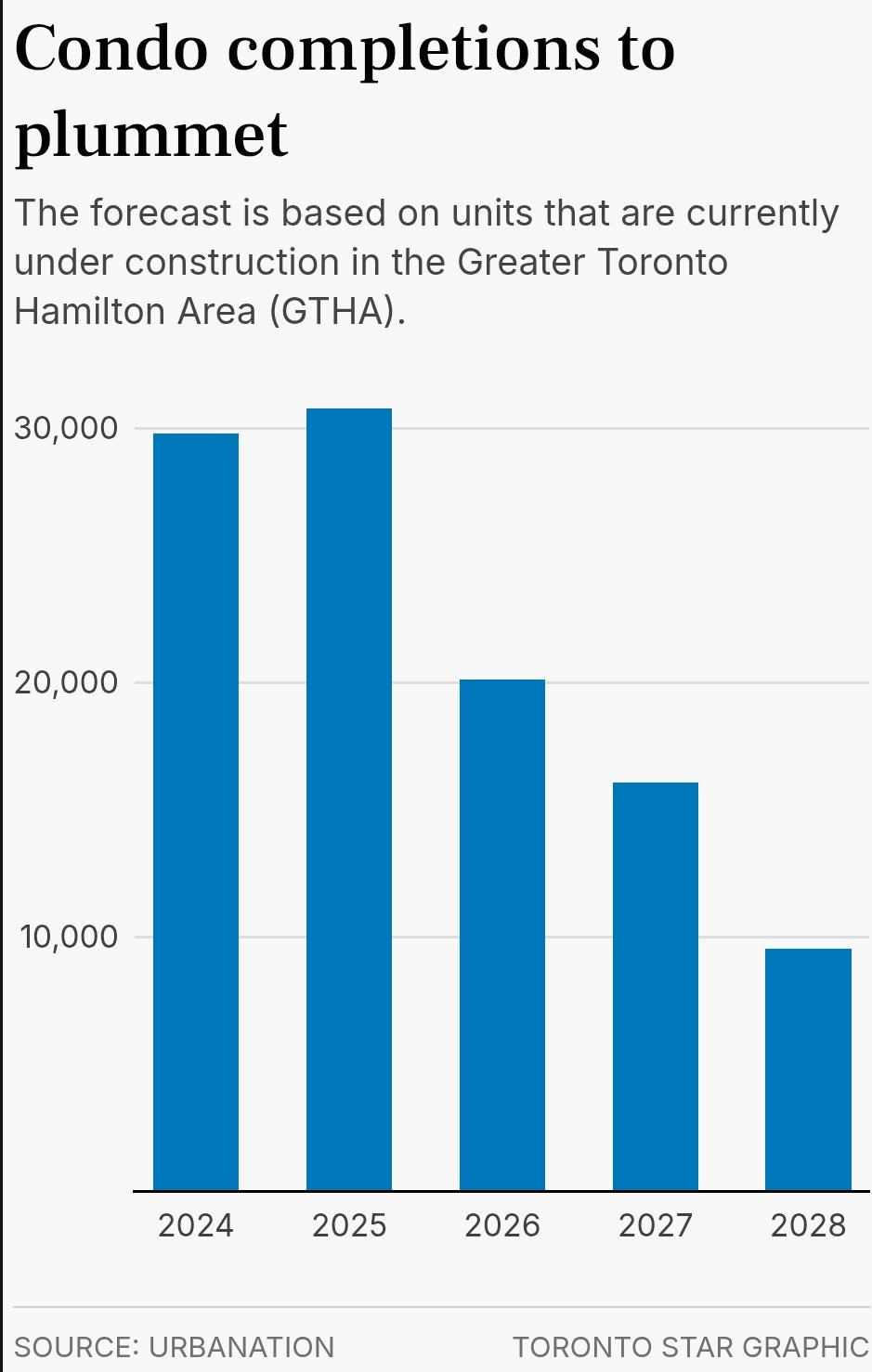

Unfortunately, this story isn’t going away anytime soon. New condo completions will hit record highs in 2025, and another 20,000 units are closing next year, many of which will see appraisals fall short of their original purchase price.

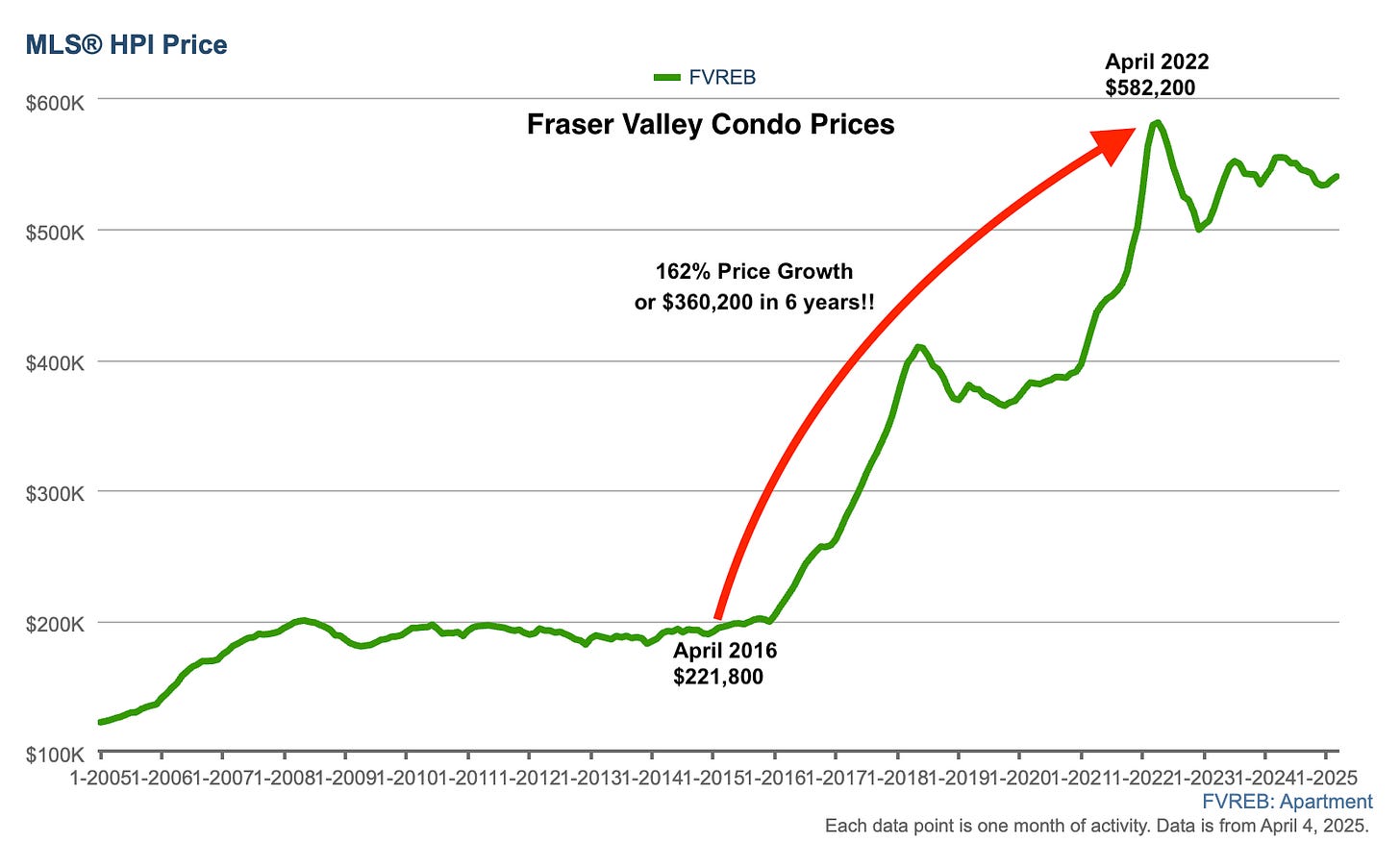

Moving west to the suburbs of Vancouver, also known as the Fraser Valley, similar issues are percolating. From April 2016 to April 2022, condo prices in the Fraser Valley surged by a whopping 162%, rising from $221,800 to $582,200. A staggering 17% CAGR built on rampant immigration, low interest rates, and money printing throughout the pandemic.

The speculative condo bubble is now deflating.

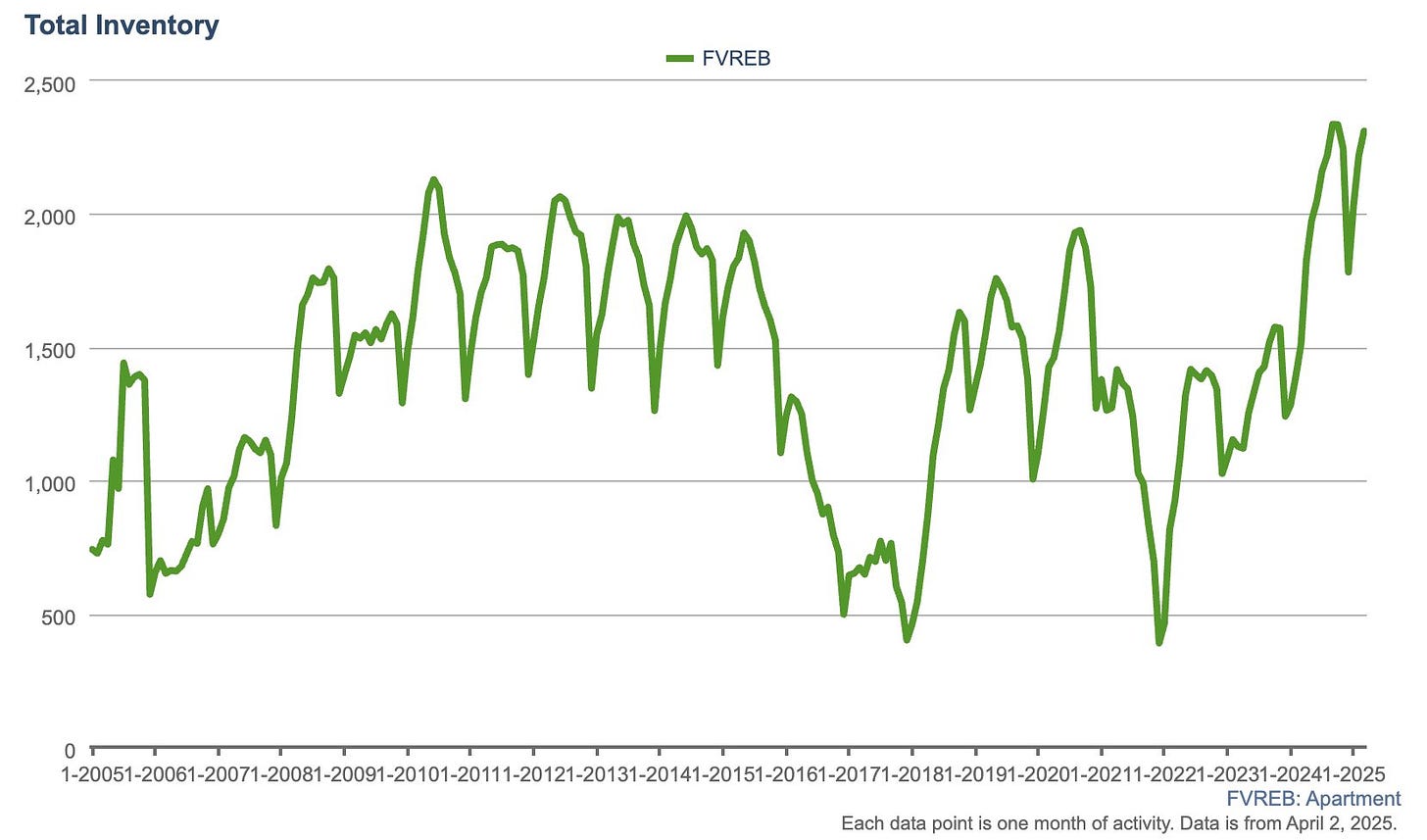

Sales plummeted to ten year lows in the month of March, and inventory for sale has ballooned to record highs.

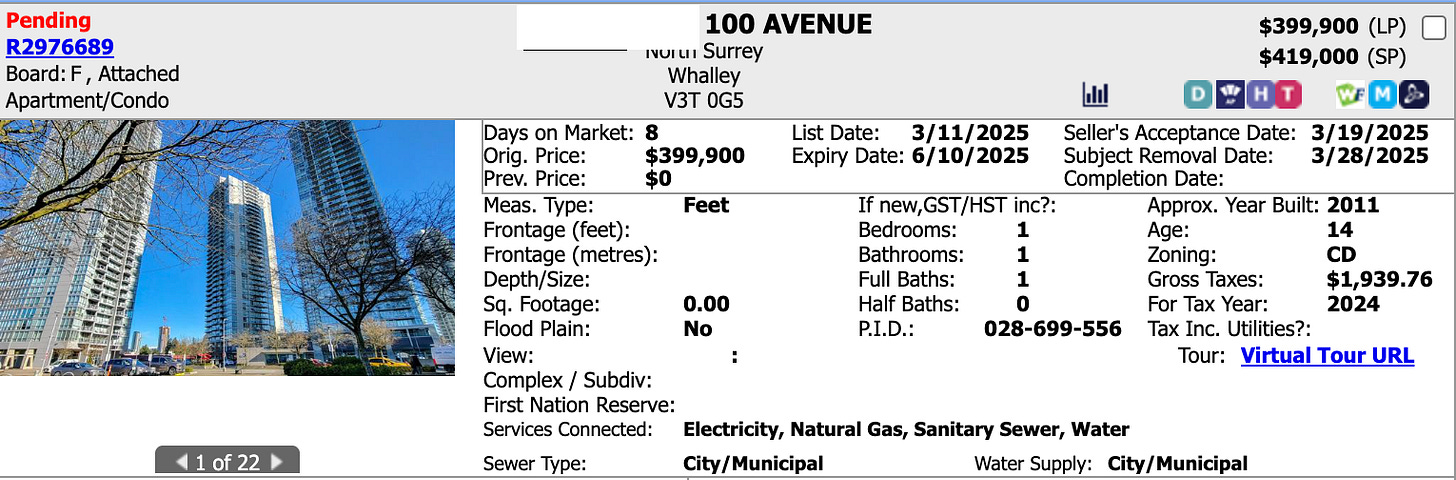

Everything that fuelled the bubble, has now reversed. Rates are up, immigration is frozen, and investors have disappeared. There is perhaps no better illustration of the shifting winds than a recent condo sale in Surrey.

It’s history paints a colorful image.

Sold June 2021- $425,000

Sold December 2021- $464,000

Sold July 2023- $482,900

Sold March 2025- $419,000

The music has stopped and the party is over.

Condo prices in the burbs went up 162% over six years. How much will they go up, or perhaps (GASP) down, over the next six years?

How many false assumptions were made that prices only go up, and how many investment decisions were made on that premise?

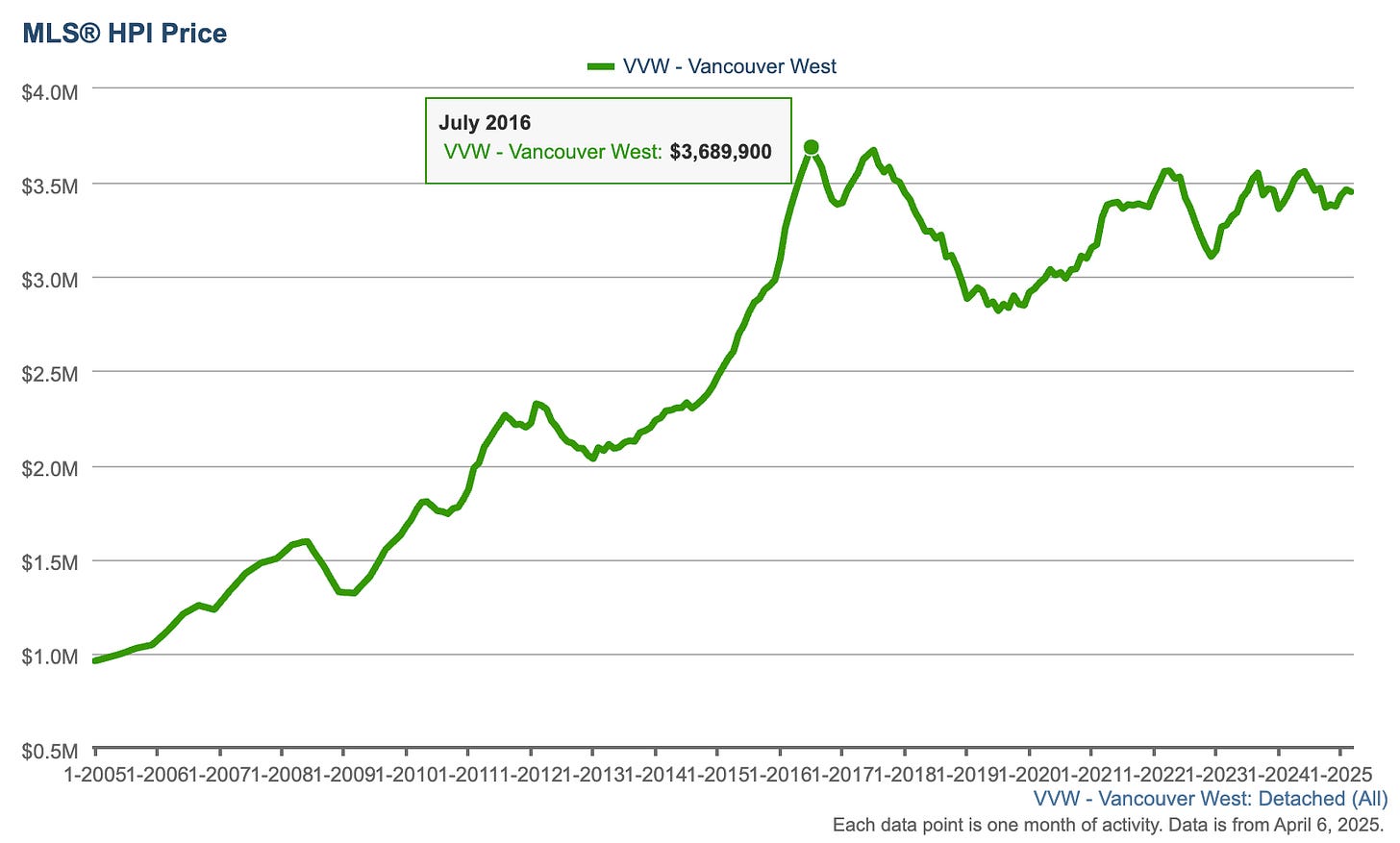

Stubborn sellers would be wise to heed the experience of house sellers on the west side of Vancouver. In what is arguably considered the most prized land in the lower mainland, one that holds legitimate scarcity in that we’re not making any more of it, has seen prices stagnate since peaking in 2016. Nearly a lost decade.

Are Toronto pre-sale and Fraser Valley condo buyers the next victims of the lost decade?

That’s one way to restore housing affordability. Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky April 7th, 2025

Posted In: Steve Saretsky Blog