April 14, 2025 | Rough Ride Exacting a Toll

Preliminary estimates show that the University of Michigan’s consumer sentiment for the US plunged to 50.8 in April—below forecasts of 54.5—and the lowest level since June 2022. Consumer sentiment has fallen 40% since November 2024 (below since 1970, courtesy of The Financial Times). At the same time, tariff announcements drove year-ahead inflation expectations to 6.7% (from 5%), the highest reading since 1981. See Consumer sentiment tanks in April on recession fears, and it’s not only consumers who are expressing angst about the outlook:

At the same time, tariff announcements drove year-ahead inflation expectations to 6.7% (from 5%), the highest reading since 1981. See Consumer sentiment tanks in April on recession fears, and it’s not only consumers who are expressing angst about the outlook:

“Consumers report multiple warning signs that raise the risk of recession: expectations for business conditions, personal finances, incomes, inflation, and labor markets all continued to deteriorate this month,” survey director Joanne Hsu said.

Friday’s survey is the first major read on consumer sentiment since President Trump’s April 2 “Liberation Day” announcement of sweeping tariffs, which triggered a steep market selloff. The survey period ended April 8, the day before Trump announced a 90-day pause on some tariffs.”

According to the Bank of Canada’s Q1 Business Outlook Survey, business investment and hiring intentions have weakened considerably, with employment plans falling below pandemic-era lows. Thirty-two percent of firms surveyed expect a recession in the next 12 months, up from 15% in the previous quarter. March employment data reinforced these concerns with the job count falling and unemployment rising.

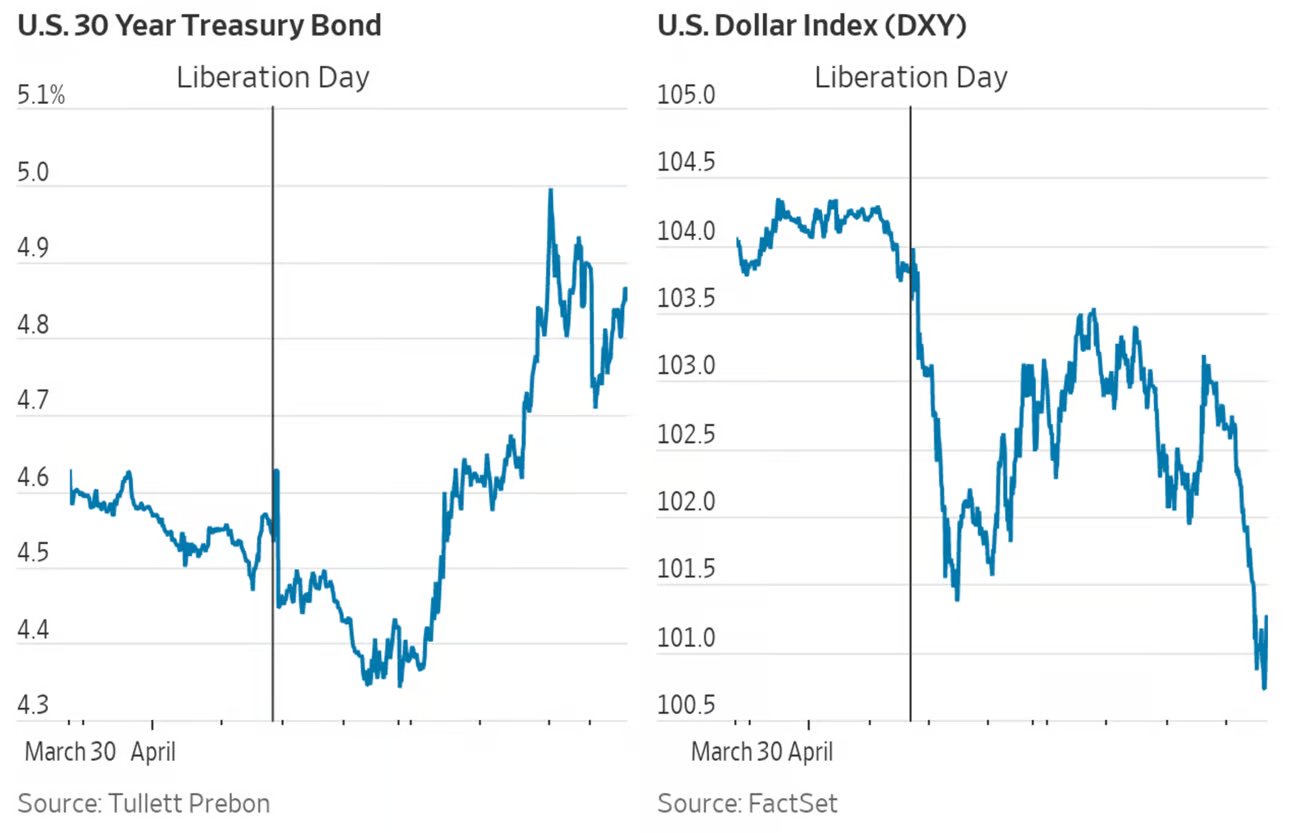

While most are banking on lower interest rates this year, a recent backup in Treasury yields has increased financing costs for the public and private sectors. The US 10-year Treasury yield leapt 63 basis points (bps) from 3.86% on April 4 to 4.497% on April 11.

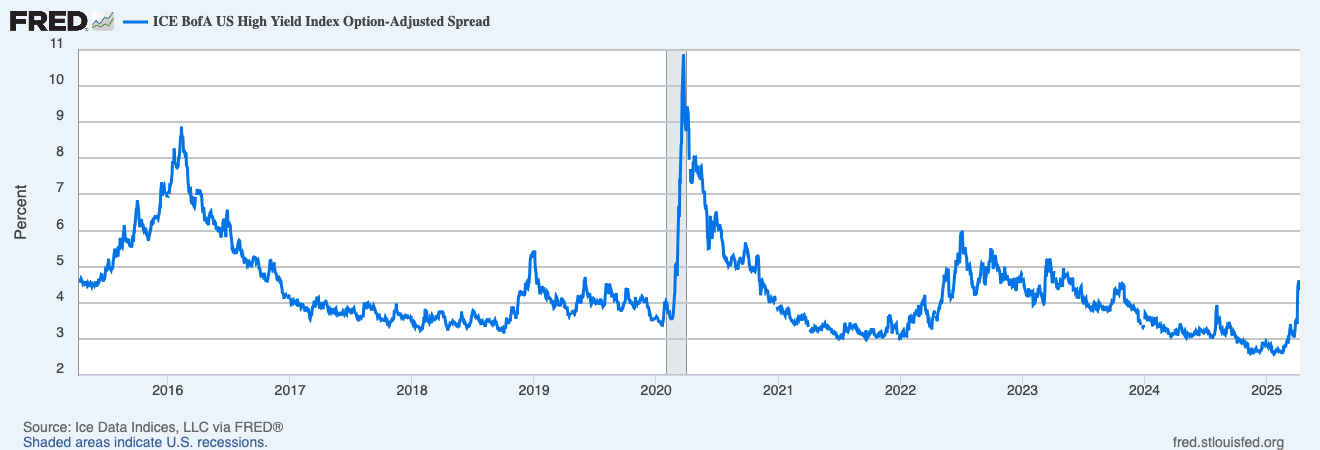

Companies borrow at a premium or spread rate above similar-dated Treasury bonds. Last week, high-yield spreads (companies with BB+ and worse credit ratings) rose to 461 bps, the highest since the March 2023 regional banking crisis (below since 2015).

So far, the Treasury market has been more attentive than the equity market. The last time corporate borrowing costs were this high, the S&P 500 was at 3800, some 29% lower than last week’s close.

So far, the Treasury market has been more attentive than the equity market. The last time corporate borrowing costs were this high, the S&P 500 was at 3800, some 29% lower than last week’s close.

With the US economy in decline, the Fed is expected to cut interest rates more in 2025, and both of those factors tend to weaken the greenback. Year to date, the US dollar has weakened sharply against major trading partners.

At the same time, as the US buys fewer goods from foreign countries, those countries receive fewer greenbacks and need to raise cash from other places to pay their bills. They have less to recycle into longer-duration financial assets, like stocks, corporate debt, precious metals, cryptocurrencies and treasuries. See The Dollar and the Bond Market’s Ominous Message for Donald Trump.

This is where liquidity needs can accelerate into a financial crisis. Some aggressively levered funds were forced to liquidate holdings after their positions went against them last week. And there will likely be more of that to come.

This is where liquidity needs can accelerate into a financial crisis. Some aggressively levered funds were forced to liquidate holdings after their positions went against them last week. And there will likely be more of that to come.

As asset prices fall, credit conditions tighten, just as fears about tariff inflation could dampen central banks’ reaction functions.

New Treasury Secretary Scott Bessent has said his office is focused on extending the term of the Federal debt to lower interest costs and extend payback periods. For that to happen, America needs the bond market to believe that inflation is under control and that lower interest rates are sufficient compensation for lenders.

As yields leapt into last Wednesday, President Trump announced a 90-day pause on additional tariffs, explaining that “People were getting a little queasy.” Queasy is an understatement.

Once entrenched, history warns that such negative financial momentum is difficult to reverse.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park April 14th, 2025

Posted In: Juggling Dynamite