April 10, 2025 | Gold Miners: Great Q1 Earnings Coming

We’re heading into another earnings season, and with gold outperforming pretty much everything else, this one is looking even better for the miners than Q4.

For context, here’s the XAU gold/silver miners index for the past six months. Note the nice run that started when excellent Q4 miner earnings combined with a rising gold price:

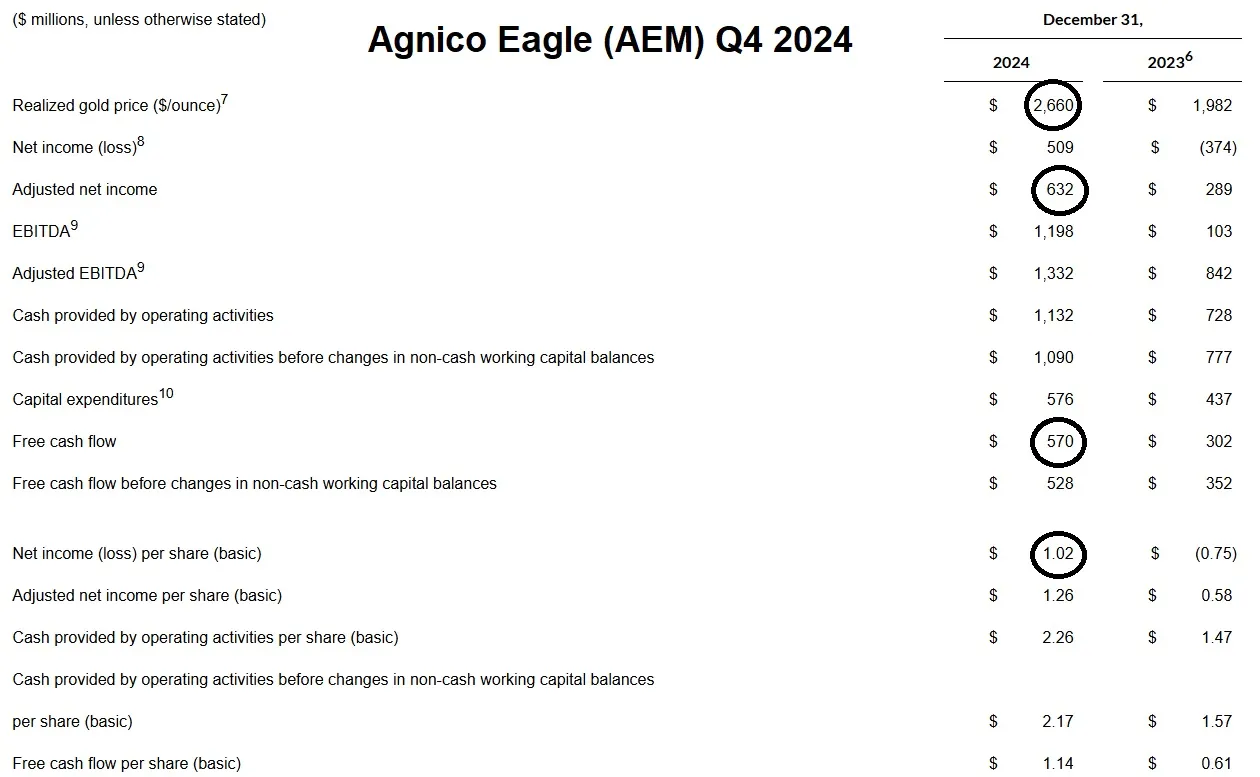

And for a sense of what a higher gold price means for a well-run miner, here are Agnico Eagle’s Q4 results. Note that the average gold price rose from $1,982/oz in Q4 2023 to $2,660/oz in Q4 2024, while Agnico’s net income and free cash flow rose by much more in percentage terms. That’s the kind of operating leverage that makes miners fun to own in bull markets.

In 2025’s Q1 (which ended on March 31), gold averaged nearly $3,000/oz, which means another big operating leverage pop for the miners. So prepare for some blow-out reports in the coming month. Here are three earnings release dates to put on the calendar:

Newmont 4/23

Agnico Eagle 4/25

Franco-Nevada 5/7

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino April 10th, 2025

Posted In: John Rubino Substack