April 14, 2025 | Confused? Join the Club: Inflation Plunges While Inflation Expectations Spike

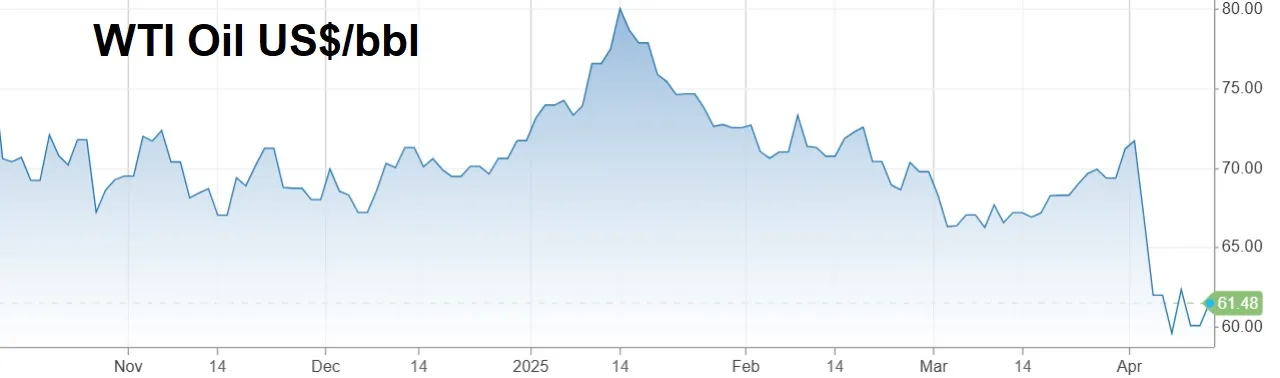

Talk about cross-currents. Oil, which affects the cost of pretty much everything, is down about 15% so far this month. That’s extremely deflationary.

Housing, meanwhile, is right up there with oil for its impact on the cost of living. And home price inflation is rapidly headed for zero overall, with many formerly hot markets already falling at double-digit annual rates.

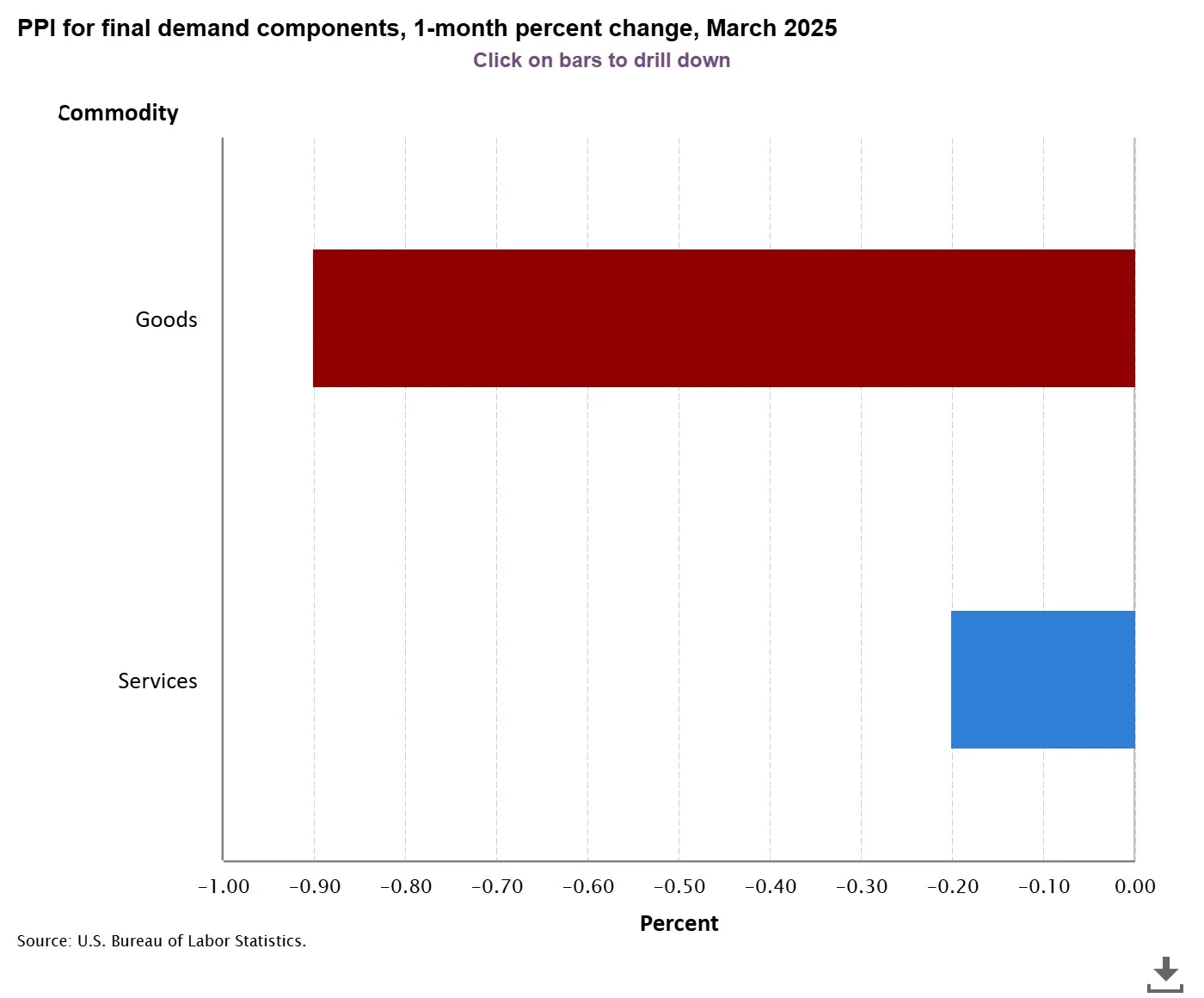

Last but not least, industrial commodities prices declined in March.

Add it all up, and it looks like we’re headed for a deflationary downturn — not surprising after the longest credit expansion/equities bull market on record.

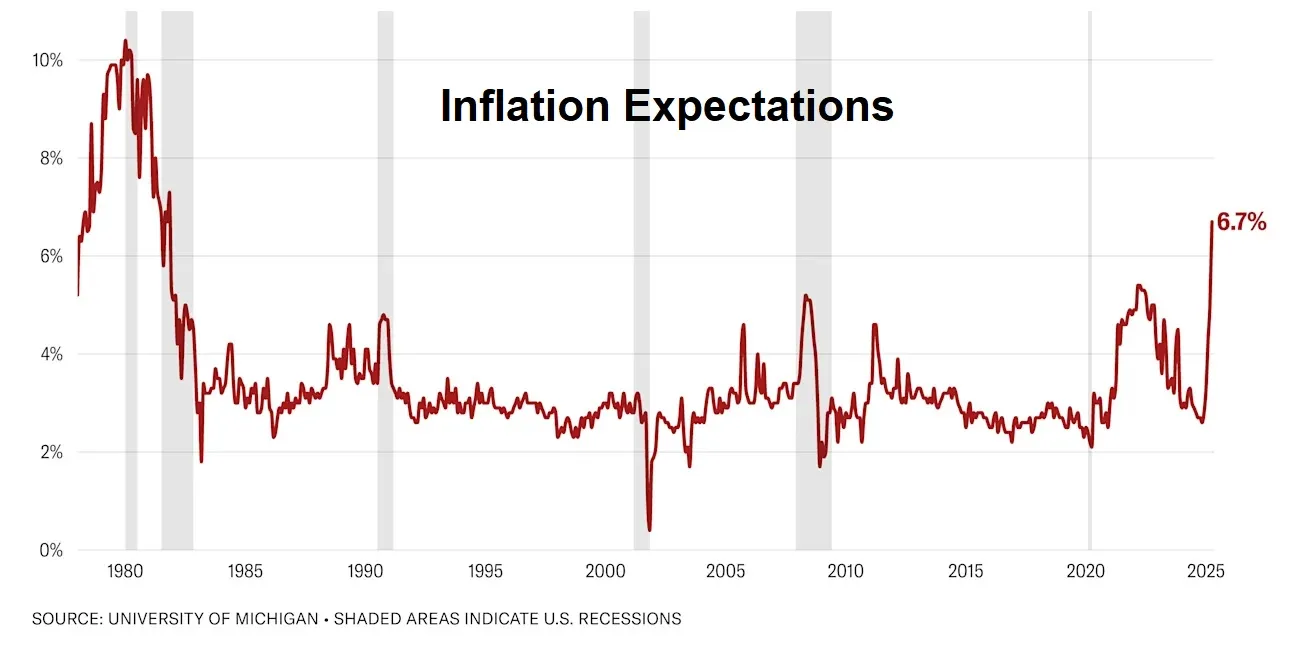

And yet…inflation expectations just spiked

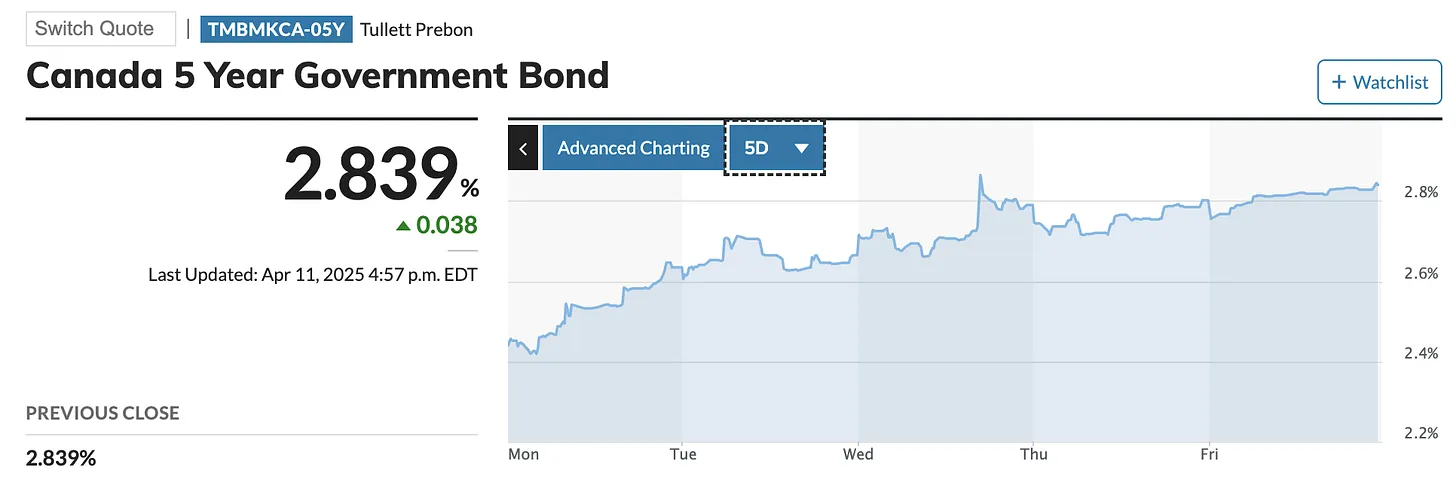

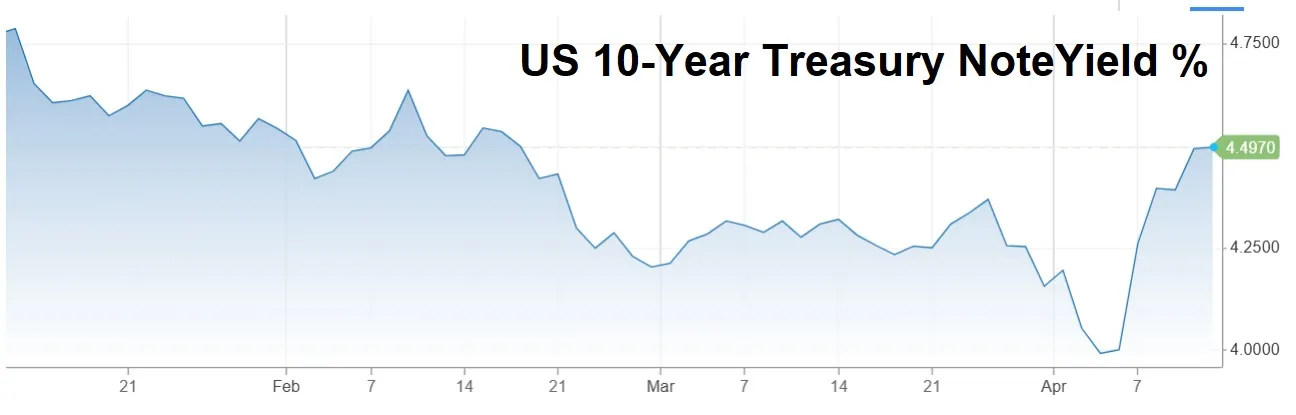

And long-term interest rates, which also measure inflation expectations, are rising. The most important long rate — on 10-year Treasuries — has spiked so far in April.

Obviously, It’s the Tariffs

A trade war is inflationary if it drives up import prices, but deflationary if it slows economic growth. And no one knows which way the current turmoil is going to break.

That’s why gold, which preserves wealth in chaotic times, is way up while oil, which depends on cyclical demand, is down.

How do we play this? As always: cautiously. Even without a trade war, chaotic times were imminent. See the Recession Watch series of the past couple of years. Further out, a currency crisis is virtually guaranteed (hence this newsletter’s focus on safe haven assets like gold and silver).

So, slowly and steadily, continue to add to positions in high-quality precious metals and energy stocks while sprinkling in some short bets as insurance. And let the world go where it goes. Whatever happens this year or next, barring a nuclear war we’re headed for a currency reset that will be bad for financial assets and great for real things.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino April 14th, 2025

Posted In: John Rubino Substack

Next: