Market consensus pegs a 58% probability that the Bank of Canada will hold its overnight rate at 2.75% tomorrow, with a 42% chance of a 25-bp cut to 2.50%.

This morning’s milder-than-expected Canadian inflation news, CPI of 2.3% year-over-year in March, was welcome. Canada’s consumer carbon tax ends in April, and oil (WTIC) around $61 is the lowest since March 2021, but that’s about where the disinflationary news ends. Tariffs are set to increase the price of goods and accelerate unemployment.

Adding insult to injury, financial conditions have tightened over the past month as the Canadian dollar rose 3% against our largest trading partner, alongside rebounding interest rates and falling equity markets.

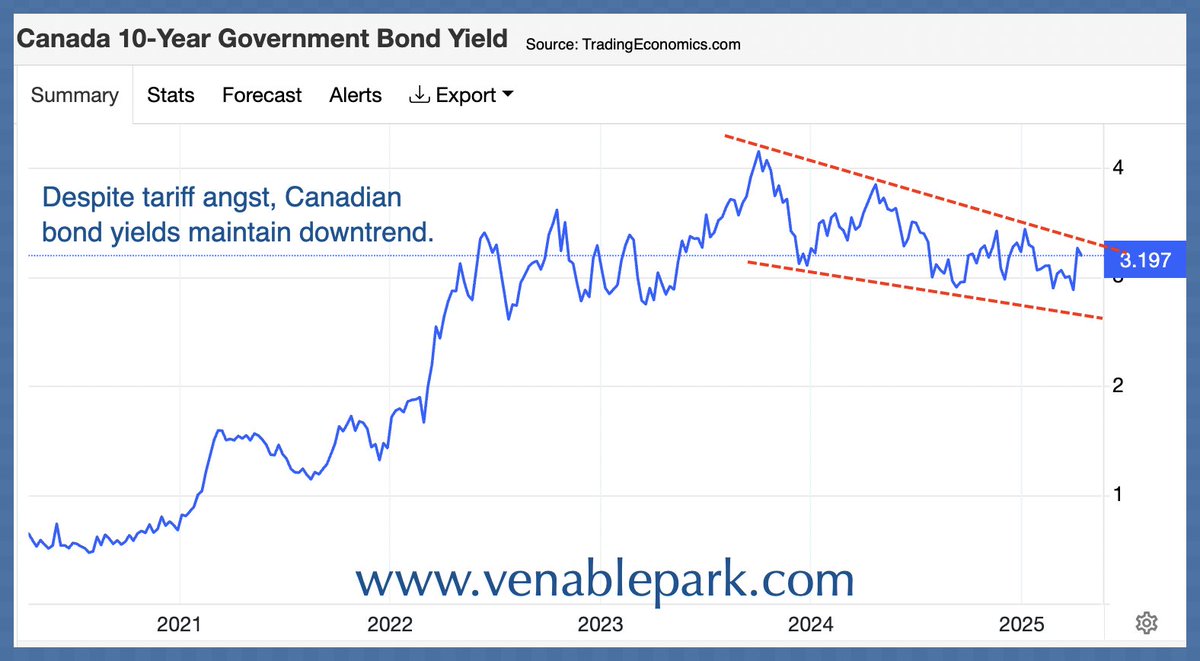

So far, the Canadian treasury yield rebound from April 3 through 10 is mild and well within a downtrend that’s persisted since October 2023 (see red lines around the Canadian 10-year yield below, courtesy of my partner Cory Venable). The difficulty is that interest rates have fallen much slower than many had imagined, and 60% of all Canadian mortgages are up for renewal this year and next (Bank of Canada); the majority are facing a 2x rate increase from the loan inception in 2020-21.

The difficulty is that interest rates have fallen much slower than many had imagined, and 60% of all Canadian mortgages are up for renewal this year and next (Bank of Canada); the majority are facing a 2x rate increase from the loan inception in 2020-21.

Unsurprisingly, the much-hoped-for housing rebound continues to disappoint.

The Canadian Real Estate Association (CREA) reported today that home sales fell 9.3% year-over-year in March and are down 20% nationally compared with November 2024.

The national average home price in Canada was $678,331 in March 2025, down 3.7% from March 2024 and 17% since February 2022.

CREA now expects 482,673 homes to be sold in 2025, a decline of 0.2% from 2024, and much weaker than the 8.6% increase in sales it had previously projected. See: Tariff Turmoil means Canada’s housing market is ‘treading water at best’:

“Up until this point, declining home sales have mostly been about tariff uncertainty. Going forward, the Canadian housing space will also have to contend with the actual economic fallout,” CREA senior economist Shaun Cathcart said.

The last time Canada experienced a national home price decline lasting more than two years was during the early 1990s housing correction, which spanned approximately from 1990 to 1996. During that period, average home prices in many regions, particularly Ontario and British Columbia, declined or stagnated amid higher interest rates, economic recession, and an overhang of overinvestment from the late 1980s.

From 1990 to 1995, Canada’s 5-year fixed mortgage rate fell from around 13% to 9%, yet home prices continued to mean-revert from the mania of the 1980s.

Today, interest rates are about half as high as in the early 1990s. But, the rate of change, doubling over the last 5 years, is a major shock, especially after the irrational price appreciation and over-investment of 2017-2024.

Bubbles always end in painful giveback periods, but this one is particularly inopportune for Canada.