April 14, 2025 | Bonds!

Happy Monday Morning!

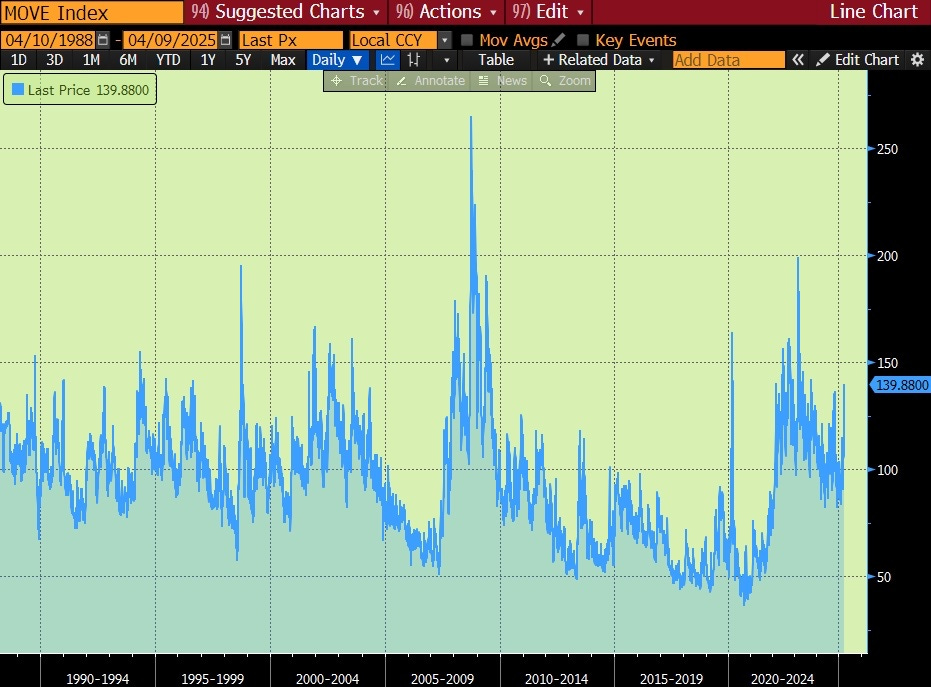

It’s a big week for mortgage shoppers. Fixed rates are on the move higher after unprecedented volatility in the bond market. Bond volatility as measured by the MOVE index touched as high as 172 intraday, levels only seen during times of turmoil (Oct 1998 LTCM collapse, Sep 2008 Lehman collapse, Mar 2023 SVB collapse).

The US 30-year yield rose 46 basis points last week to end at 4.87%. This was the largest weekly rise since April 1987 (38 years ago!).

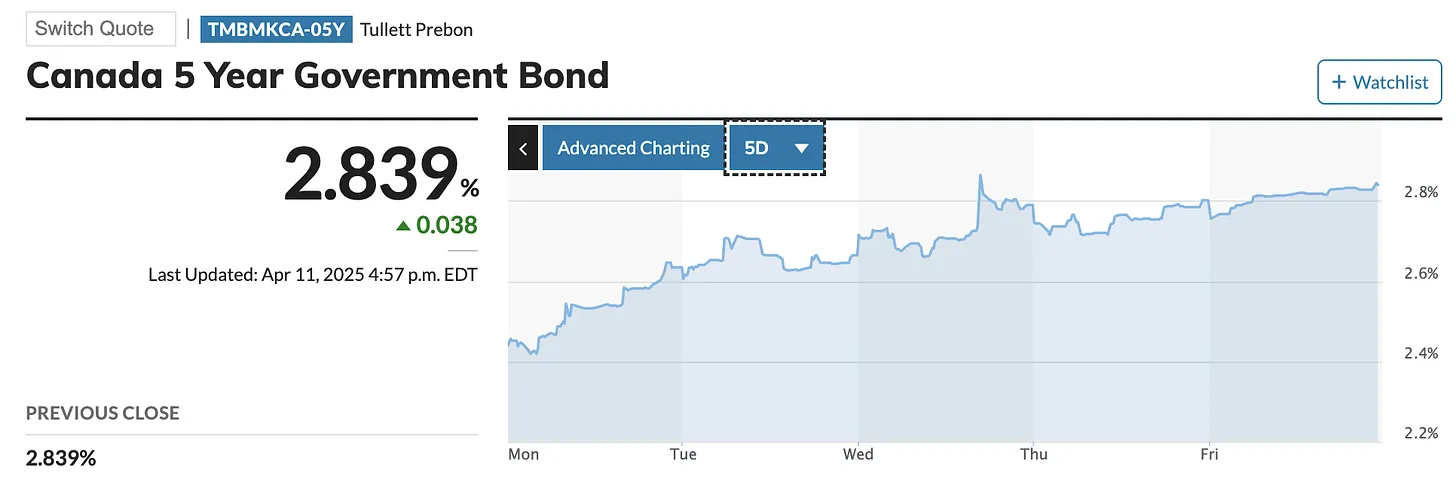

Coincidentally, this sent Canada’s 5 year bond yield ripping higher, up about 40bps on the week. We expect most lenders to raise fixed mortgage rates this week as a result. If you’re looking for peace of mind with your mortgage payment you might want to lock in. Fixed mortgage rates under 4% are likely gone in the near term.

It’ll be another volatile week ahead for the bond market. Adding to the mix of uncertainty is Canada’s CPI inflation data which is set to drop on Tuesday. Economists polled by Reuters expect annual inflation to come in at 2.6% in March, matching February’s reading.

All eyes are on the Bank of Canada this week who are set to meet on Wednesday. Rate cut odds are approximately a coin-toss. Per RBC,

Wednesday’s interest rate decision for the Bank of Canada will be another close call for policymakers, but we expect they will ultimately opt to add another “insurance” 25 basis point cut in the face of escalating U.S. tariff risks. Minutes from the last BoC meeting largely confirmed that the central bank would have foregone a cut to the overnight rate in March if not for heightened trade risks.

Let’s watch.

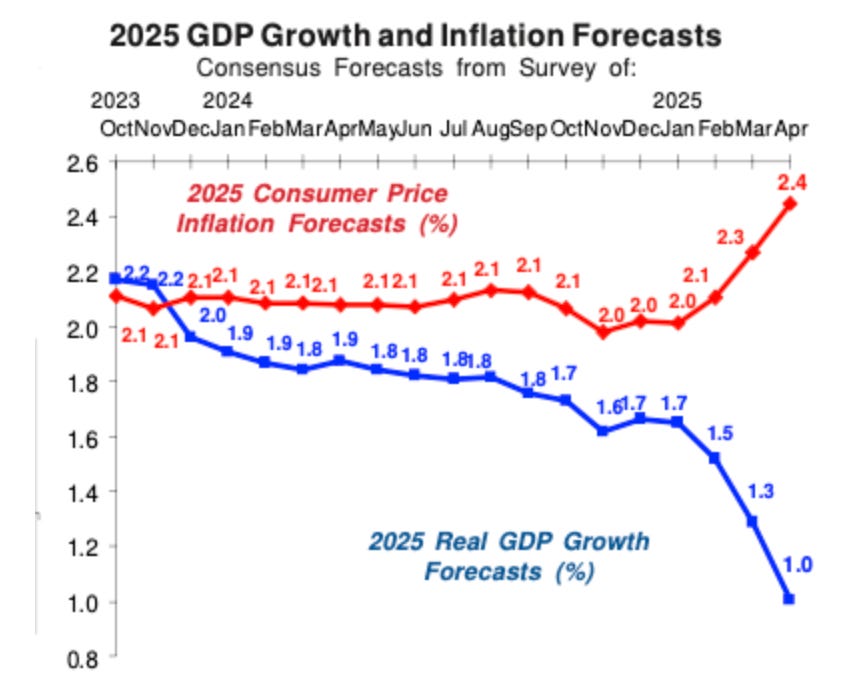

The possibility of higher inflation and weaker growth could put the BoC’s Macklem through the spin cycle. Consensus amongst Bay Street forecasters suggests 2.4% inflation this year, and 1% growth.

Although let’s be honest, accurately forecasting in this environment is about as likely as the Leafs winning the Stanley cup.

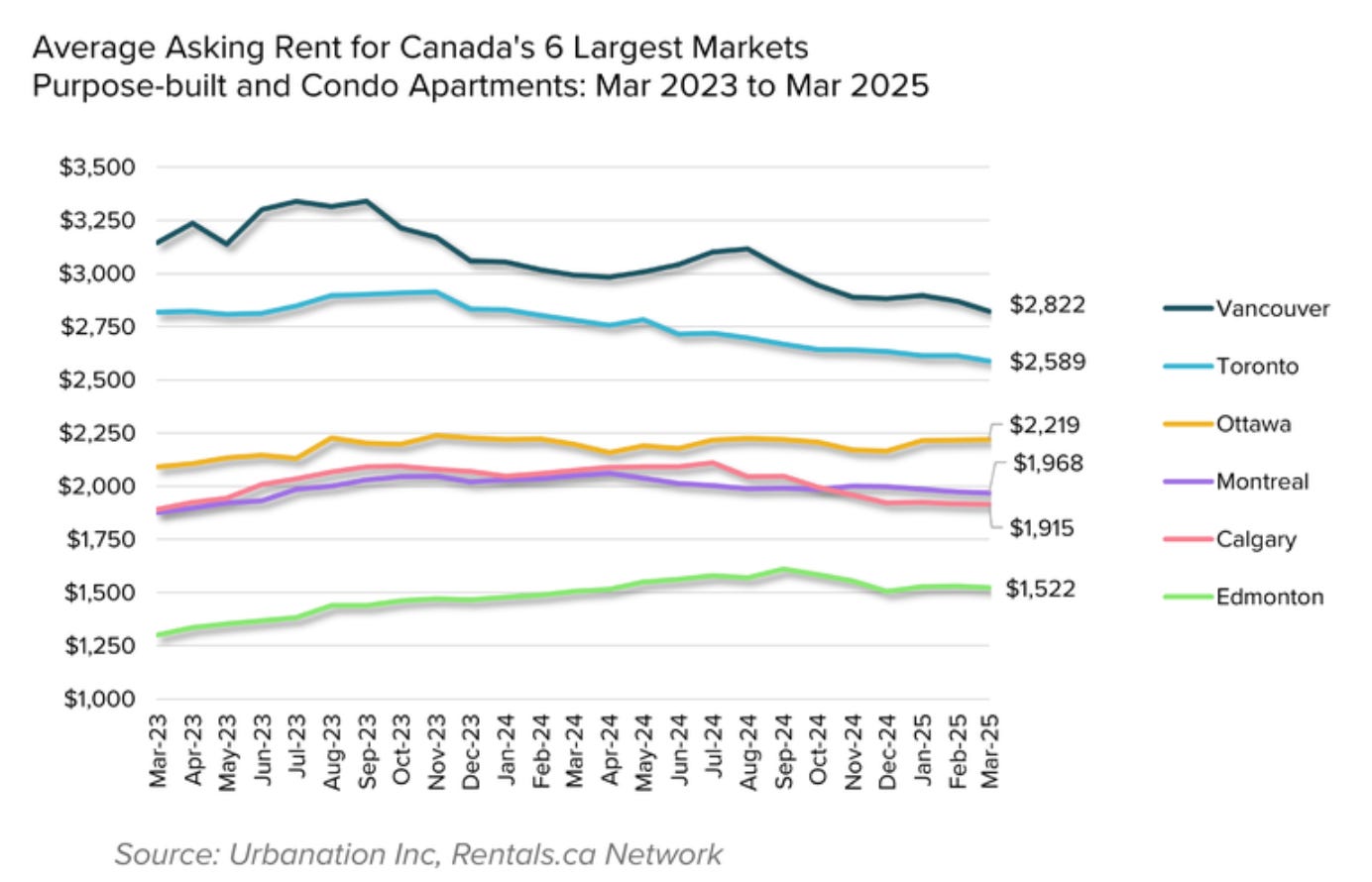

One thing the BoC doesn’t have to worry about is shelter inflation. The housing market is flat on its back, with a plethora of condo inventory pushing resale prices lower. This is also putting further pressure on rents, which continue to decline across most major metros.

Per Rentals.ca,

Rents fell the most in Calgary last month, with a 7.8% annual decline to an average of $1,915, a two-year low. The 6.9% year-over-year decrease in apartment rents in Toronto marked the 14th consecutive month of annual declines, pushing average rents down to a 32-month low of $2,589. Apartment rents fell on an annual basis for the 16th straight month in Vancouver, declining 5.7% to a 35-month low of $2,822. Montreal saw apartment rents fall for the eighth month in a row, with a 4.0% year-over-year decrease to an average of $1,968.

Considering shelter accounts for approximately 29% of Canada’s Consumer Price Index, persistent weakness in the housing market should help keep a lid on CPI.

Stay nimble out there.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky April 14th, 2025

Posted In: Steve Saretsky Blog

Next: Rough Ride Exacting a Toll »