April 7, 2025 | Asset Bubble Bug Finds Another Windshield

Financial commentators predictably blame the Trump administration for ‘unexpected’ market losses.

Two things about that: the tariff file was not unexpected. Trump has promised to do this for a long time. Secondly, major downdraft cycles are the natural and recurring aftermath of debt abuse and asset bubbles.

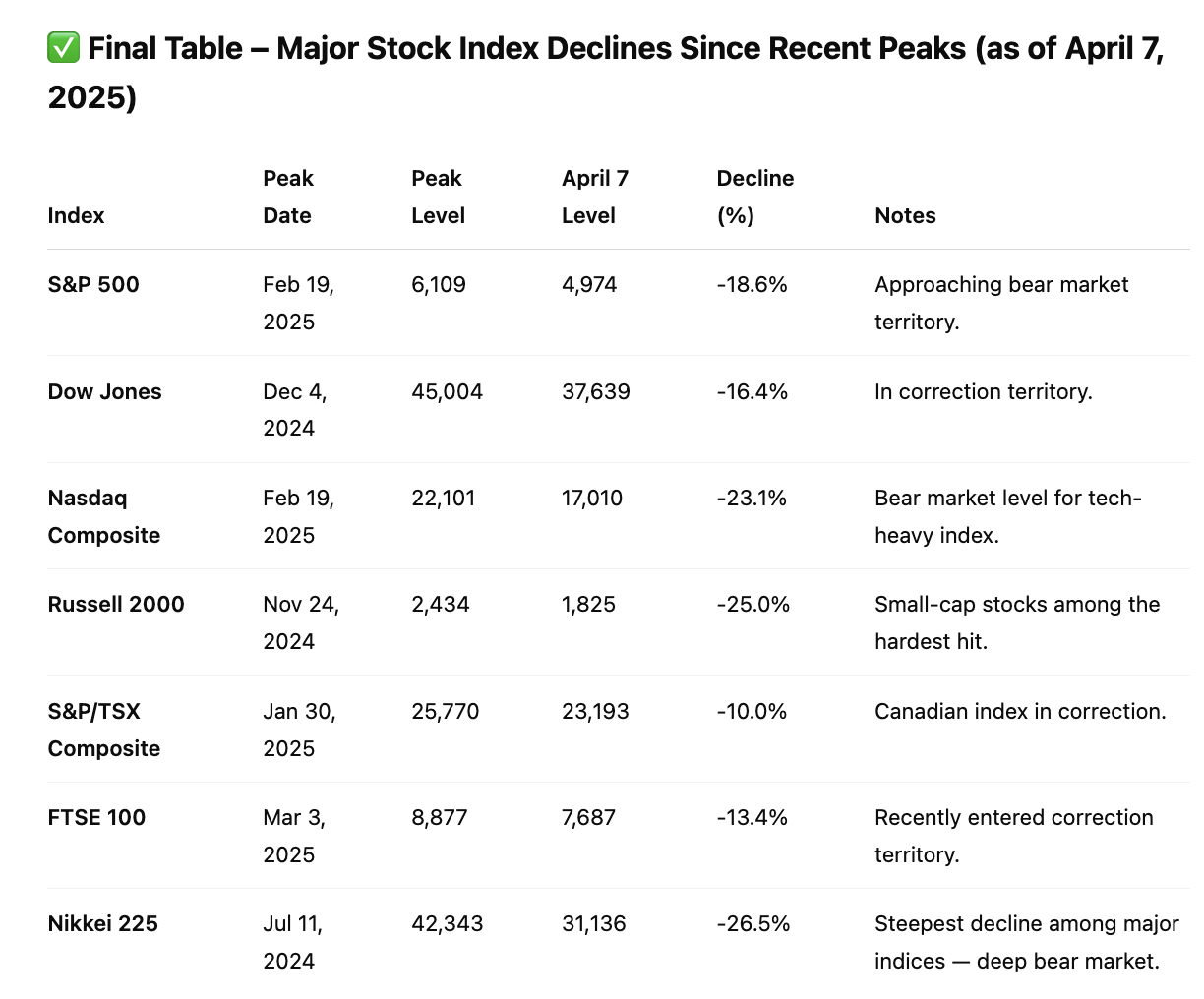

Reckless risk-taking was an international pastime during the years of ‘easy’ money monetary and fiscal policies; it seemed fun while it lasted, but it was always a bug waiting for a windshield—bubbles burst every time—it’s what they do. The progress to date in some widely held benchmarks is summarized below.

The damage has been relatively light so far. As I have repeatedly pointed out, the average stock market decline during past recessions has been 30%, and 34 to 86% when valuations begin from extreme highs, as in 1929, 1973, 1999, 2007, 2019, 2022 and 2024. If prices are halfway through this bear market decline, historically, that would be a fairly mild loss cycle. These are the ladders and snakes of financial mania: Years of apparent progress are deleted in weeks and months. Most are taken by surprise.

The damage has been relatively light so far. As I have repeatedly pointed out, the average stock market decline during past recessions has been 30%, and 34 to 86% when valuations begin from extreme highs, as in 1929, 1973, 1999, 2007, 2019, 2022 and 2024. If prices are halfway through this bear market decline, historically, that would be a fairly mild loss cycle. These are the ladders and snakes of financial mania: Years of apparent progress are deleted in weeks and months. Most are taken by surprise.

The masses have no business gambling with savings they cannot afford or stomach to lose, especially for those at or within a few years of retirement. How long will it take for assets to recover losses this time?

It’s not too late to review risk exposures. It’s also worth repeating that real estate downturns have historically led to the harshest recessions, and that’s happening now.

I’ve diligently measured and mapped this incoming mess; frontline reports now confirm the unwinding. Insolvency trustees have entered their boom time. Hoyes, Mikalos’ consumer solvency counsellor Scott Terrio wrote this on LinkedIn last week:

Many people entered the housing market due to FOMO; many of them had really no business doing so as they couldn’t afford the homes they bought; yet buy them they did – somehow – co-signors, or with many qualifications being very suspect (mortgage-to-income ratios that would make your eyes water). ANYTHING to not miss out. But that kind of thinking can end up backfiring.

In many cases, things would’ve been ok had everything gone ok. But life isn’t like that, very often. The tipping points from doing ok into insolvency (whether legal insolvency or just technical insolvency) are often fine margins. Some of those factors are done by choice, even if never really intentionally.

In matters of personal finance, avoidance is a huge protection, but it takes proactive decision-making and good advice. And there seems to be less and less good advice either on the internet or in terms of peer pressure. Avoidability.

No truer words were ever spoken; none of this was unforeseeable. There was always going to be a catalyst for the delirium to break.

We have another opportunity to review financially destructive behaviours and make wiser choices that can improve health and stability for the rest of our lives. But we have to admit, repent and reform to recover. Repeating the same patterns and expecting different outcomes is just plain painful.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park April 7th, 2025

Posted In: Juggling Dynamite

Next: Part II – Gold Manipulation? »