March 17, 2025 | Understanding Gold

COMMENT: Thank you for your honest analysis of gold. Whenever someone talks about gold and inflation, they are not accurate analysts but mouth the same propaganda that has been prevalent since the fall of Bretton Woods. I discussed this with our economics department, and they said you are correct. The quantity of money theory has become irrelevant. Gold has rallied into March, as Socrates projected.

Well done.

Dirk

REPLY: Yes, I am getting more and more requests from universities around the world that they know what they teach no longer works. It may be easier to explain how things work than it is to get people to disregard what they have been taught. I have proposals now. They want to translate the books I have written into Italian, German, and Spanish, just for starters, to be taught in schools around the world. The gold-only crowd constantly preaches the same thing. Oh, the debt is rising, and the money supply is expanding, so buy gold.

Well, gold reached $875 in 1980, and the National Debt was $1 trillion. If gold responded to debt or inflation, why is it not at $30,000 instead of testing $3,000? When will they start to report the truth behind what gold is all about? They burn so many people because what they put out is a religion, not analysis.

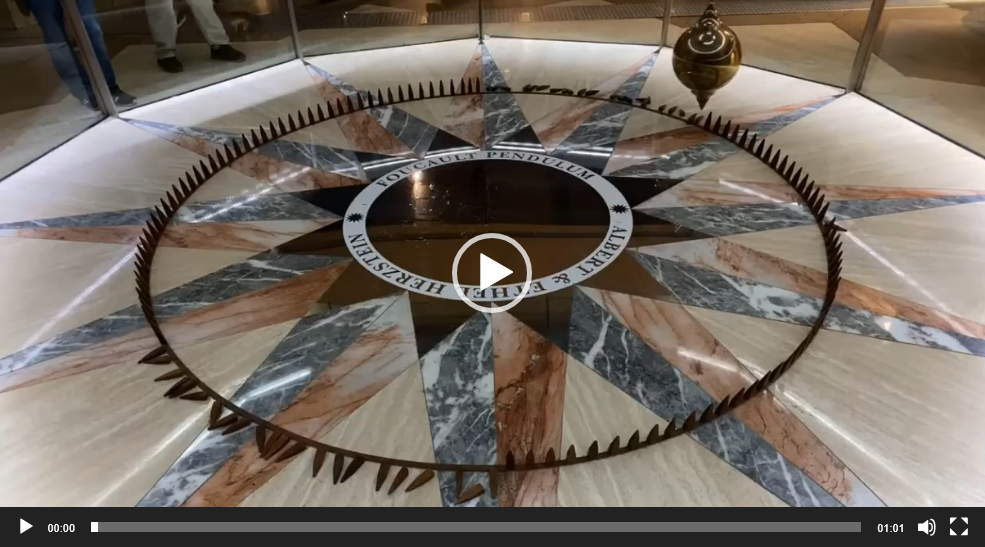

Nothing goes up forever, and nothing goes down forever. There is NO STORE OF VALUE because everything rises and falls. They do not even understand that when gold is money, it too rises and falls because it is on the opposite side of the scale with assets on the other side. All markets move like a pendulum – back and forth. The majority MUST always be wrong at both extremes for that is the energy that propels the make to move in the opposite direction.

Just look at the all the panics during the 19th century. Gold declined in purchasing power into the booms and rose during the declines, just as the dollar does today. We call it cash is king.

Listen to Podcast:

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Martin Armstrong March 17th, 2025

Posted In: Armstrong Economics

Next: Gone Missing »