March 29, 2025 | Trading Desk Notes for March 29, 2025

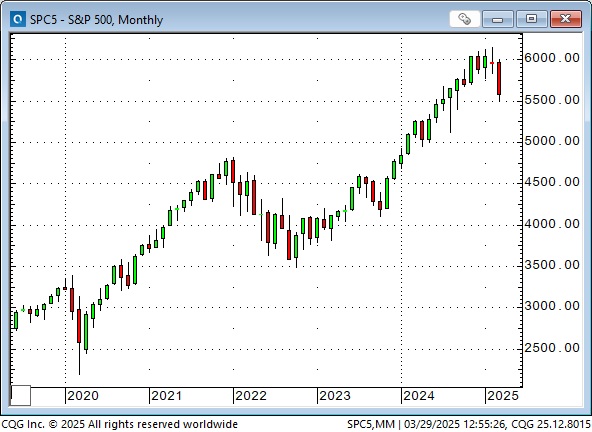

The S&P: lowest weekly close in seven months

The S&P tumbled ~660 points (~11%) from its all-time highs in mid-February to the March 13 lows (pink ellipse), bounced ~275 points (~5%) to this week’s highs, but then dropped ~235 points (~4%) to this week’s close—the lowest weekly close since September 6, 2024 (blue ellipse.)

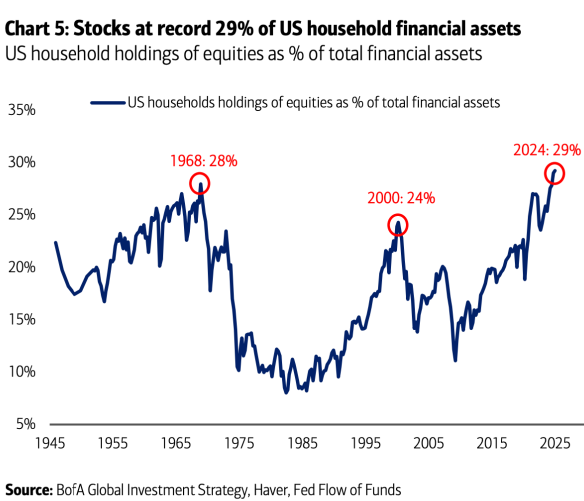

Many analysts blame “uncertainty” over tariffs for the recent weakness in the leading American stock indices. While that may be true, the “precondition” is that the S&P had a massive rally over the past five years (up ~4,000 points or ~180% from the 2020 lows), investors were “all-in” at the highs, and the market was due for a correction.

Gold: an orderly, persistent rally to new record highs

Gold spiked to record highs of ~$2075 following the Russian invasion of Ukraine in February 2022 (blue ellipse) [just like it spiked to record highs of ~$850 in 1980 following the Russian invasion of Afghanistan – see the March 22 TD Notes for details], but then fell ~$450 (22%) over the next eight consecutive months as the Fed aggressively raised short-term interest rates and the US Dollar index soared nearly 20% to 20-year highs.

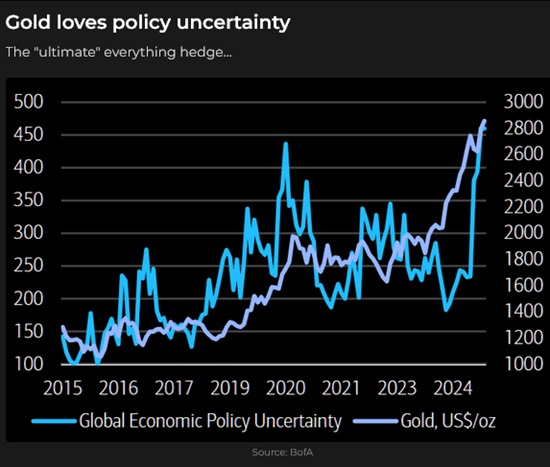

Since the October 2023 lows (blue ellipse), made immediately before the Hamas attack on Israel, gold has rallied ~ $1,300 (~72%) in an orderly, persistent manner, with little regard to its long-standing correlations with interest rates and the USD. “Something else” has driven gold higher, likely a combination of record-sized central bank buying and the private sector “losing confidence” in governments. See the March 22 TD Notes for more details.

Comex gold is up ~$450 YTD, with speculators maintaining their record-sized net long position.

Copper

Copper soared over $3 per pound (from ~$1.25 to ~ $4.45) in the 2009/2011 commodity bull market. It fell to ~$2 per pound when covid hit global markets in Q1 2020 but soared to nearly $5 by early 2022 as “the electrification of everything” story was widely embraced.

Copper prices surged higher from March to May 2024 (from ~$3.80 to $5.20) as speculators once again bought copper “in size” on the “electrification” story. Three months later, however, copper had fallen back to ~$4, and speculators bailed out.

Copper has had another bull run over the past three months, with prices running from ~$4 in early January to new record highs of ~$5.25 this week. This time, however, the (COMEX) speculators have been cautious – their net long positioning as of March 25 is less than half of what it was in May 2024.

The Copper Miners ETF (COPX) hit record highs at the end of the 2009/11 bull market at ~$60 and surged from ~$34 to ~$52 in last year’s bull run. However, despite the sharp rise in copper prices over the past three months, it has been “subdued” YTD and dropped sharply this week (perhaps in sympathy with the broad market).

While the COPX has not run higher with the YTD surge in copper prices, the gold miners ETF (GDX) has surged to 12-year highs as gold prices have rallied to record highs.

I won’t pretend to know “what’s driving” the YTD surge in copper prices, but the lack of “confirmation” from the copper miners certainly makes me reluctant to buy copper here. Over the years, I’ve often wondered, “What are we buying?” when we buy COMEX copper. Are we buying 25,000 pounds of red metal or some form of over-hypothecated Chinese financial instrument? I’m sure all the serious players in the copper market know about the “electrification of everything” story. That’s old news. People talk about metal being moved ahead of possible tariffs on copper, like steel and aluminum, but I’ve never heard a whisper about that from anyone in the Trump administration. China has been the world’s largest consumer of copper (~55-60% of total world demand), and, from my perspective, China is in a balance sheet recession and may now need substantially less copper.

Currencies and correlations

I’ve learned to pay attention to correlations between markets, particularly when long-established correlations break down. For instance, gold historically had a strong negative correlation with the USD; when that correlation broke down, it signalled that “something else” was driving the gold price.

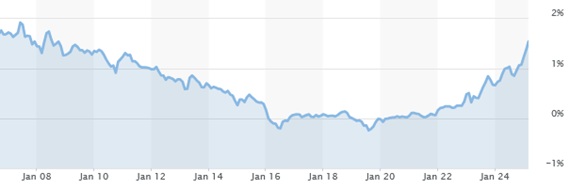

The price trends of the Japanese Yen and the US long bond have had a strong positive correlation over the last 18 months.

From a risk management perspective, this strong correlation means that if I own bonds and buy the Yen, I’m doubling up on the same trade.

The Japanese 10-year yield, at 1.55%, is now at a 17-year high.

With the S&P’s pronounced weakness on Friday, both US bonds and the Yen rallied—and may continue to rally if the S&P continues to fall.

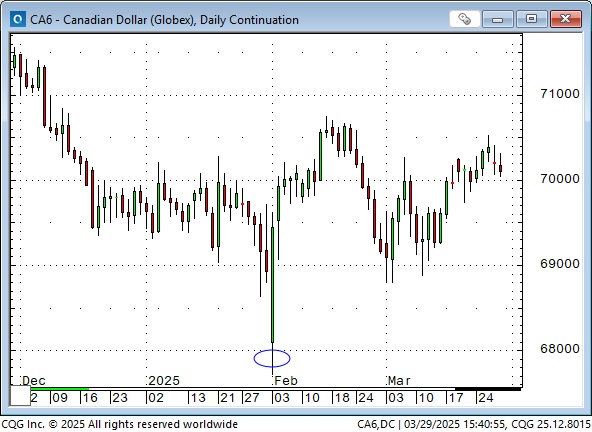

The Canadian dollar

Speculators aggressively ramped their net short CAD positions to record highs from March through August 2024 as the CAD fell from ~74 to ~72 cents (blue rectangle.) They pared back their short positions when the CAD rallied (pink rectangle) but took their net short positions to new record highs as the CAD fell to ~69 cents (black rectangle.)

The CAD spiked to 22-year lows on February 3 (blue ellipse on the chart below) when Trump announced 25% tariffs on imports from Canada. Later, on the same day, it had its biggest one-day rally in years when those tariffs were “paused.” Since then, speculators have gradually reduced the size of their net short positions back to levels of October 2024 despite continuing/mounting tensions between Trump and Canada. I think speculators have decided that there isn’t much “meat left on the bone,” being short CAD, and they are taking profits and looking for “greened pastures” elsewhere.

How my macro view impacts the way I trade

I’ve been trading for over 50 years, and I’ve seen a lot of wild price action in response to events that markets had not anticipated. I believe that markets are now underpricing not only how much the world as we know it will change but also how fast it will change. As Papa Hemingway wrote in The Sun Also Rises, “slowly at first, and then suddenly.”

We have an angry man determined to make significant changes in the world, and his favourite tool is a blunt instrument. There will be unintended consequences, misunderstandings and “collateral damage.”

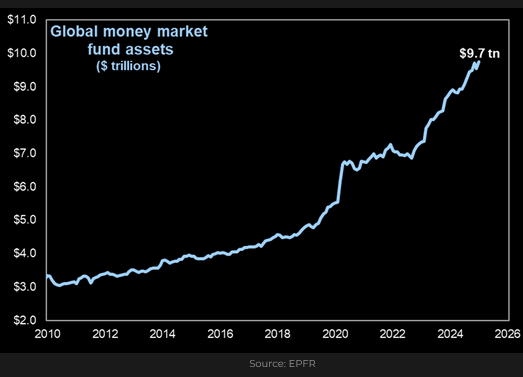

There is a lot of leverage in our financial world, and I expect people will discover that leverage is a double-edged sword.

Where there’s risk, there’s opportunity, but the old saying is that everybody loses in a bear market.

I will look for trading opportunities in liquid markets, keep my size modest, and take losses quickly. As Sergeant Esterhaus used to say, “Be careful out there.”

My short-term trading

S&P: I started this week with a long S&P position I bought on Friday, March 21. On Tuesday, I covered that for a gain of ~135 points. I reversed to shorting the market as it fell back from Tuesday’s highs, making ~65 points on my first trade and losing ~20 points on the next. I lost another 30 points buying the S&P on Thursday and did nothing on Friday’s big down day.

YEN: I shorted the Yen on Thursday, March 20. As the market sold off I trailed a buy stop lower. It was elected on Tuesday for a 30-point gain.

Gold: I shorted a small position of gold on Monday and was stopped for a $21oz loss on Thursday.

WTI: I shorted WTI on Tuesday and held that position into the weekend.

CAD: I shorted OTM puts on Thursday and held that into the weekend.

The Barney report

I keep a bowl of dog biscuits on my desk. Barney knows that. Occasionally, he will stand beside my office chair and whimper. I’ll turn to him, and he will put his paws up on my knees, look over at the bowl of biscuits and then give me this “sad-eye” look. It works nearly every time.

Listen to the March 29 Moneytalks show

Mike Campbell, his wife, and his son are in Europe for a bicycling vacation, so I hosted the show this week. Ryan Irving of Keystone Financial was my first guest, with three value-oriented small-cap picks. Ozzy Jurock was my second guest, and he explained why he thinks the Canadian real estate market is now a buyer’s market. (Ozzy called the top back in 2022.) My third guest was Robert Levy, and we discussed gold, stocks, and currencies. Grant Longhurst provided a dynamite Shocking Stat and Quote Of The Week. You can listen to the show here.

This morning, I also did my monthly 30-minute interview with Jim Goddard on the This Week In Money show. Jim and I discussed my macro views on gold, the S&P, copper, the US Dollar, the Canadian Dollar, and Trump’s tariffs. You can listen to the entire show here.

The Archive

Readers can access weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything!

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair March 29th, 2025

Posted In: Victor Adair Blog