March 15, 2025 | Trading Desk Notes for March 15, 2025

Current positioning:

I’m long S&P futures as of Friday morning. See My short-term trading section below for more detail.

The S&P closed Red for four consecutive weeks

The S&P hit all-time highs on July 16, 2024 (the first ellipse), then tumbled ~10% to August 5 lows on the “Yen-carry” scare. The market recovered, traded above the July 16 highs, fell back a bit, and then soared on the Trump election victory (the second ellipse) and made several new all-time highs on the prospect of a “new golden age” under Trump. The market peaked on February 19 (the third ellipse) and fell ~10% to Thursday’s lows before turning slightly higher on Friday. The market cap of all US listed stocks is estimated to have fallen ~$5 Trillion from the mid-February highs.

The 10% decline over the last four weeks qualifies as a “correction.” The last “bear market” in the S&P happened in 2022 when the market fell ~27% (blue ellipse) following the ~120% rally off the 2020 covid lows. A dramatic increase in interest rates in 2022 accelerated the S&P collapse.

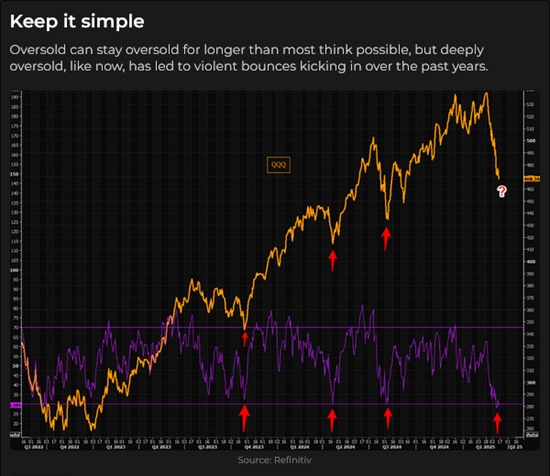

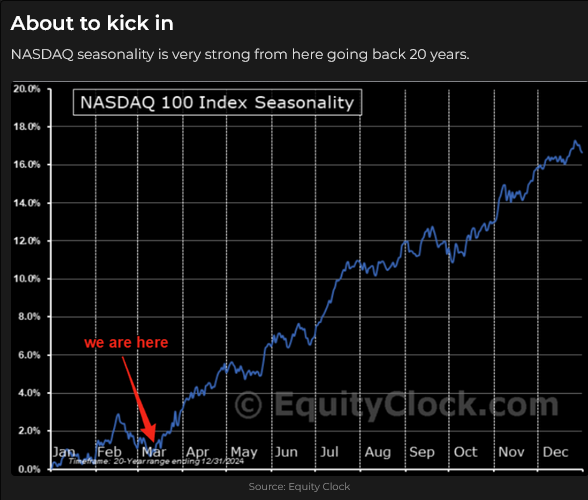

The market is “due for a bounce” on several technical metrics, but to sustain a rally, it will need to clear the 5725 level (first chart above).

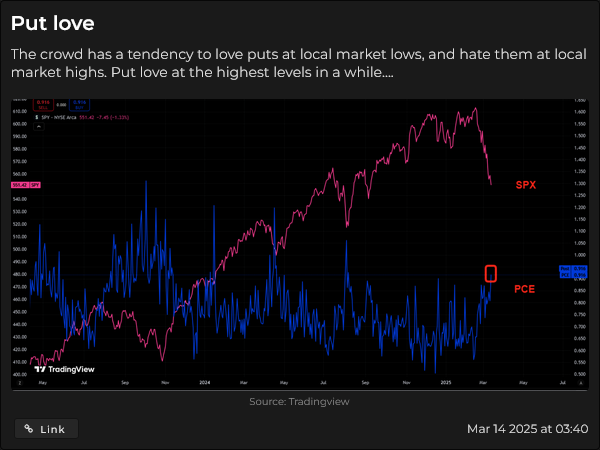

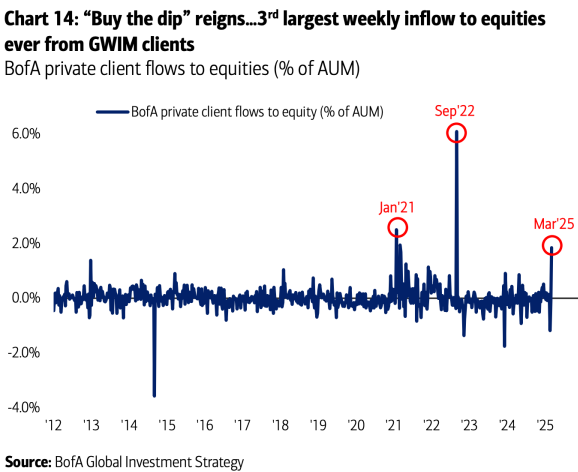

Some investors have been “buying the dip” while systematic accounts (and others) have been selling.

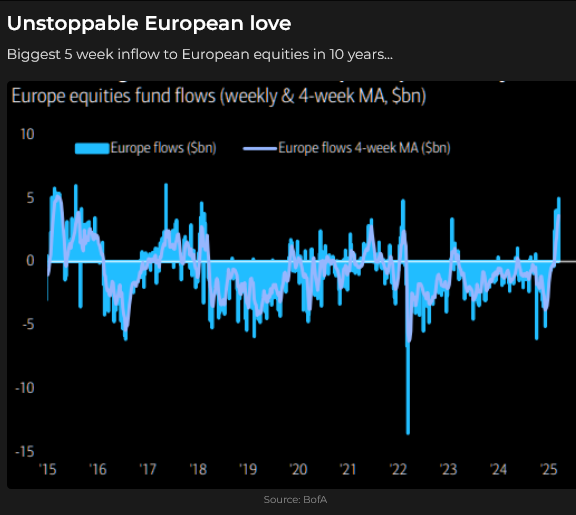

North American stock markets have seen de-risking, leverage reduction and sector rotation. There has also been a “step back” from “American Exceptionalism.” European and Chinese markets have risen in anticipation of significant local government stimulus.

Interest rates

The 10% decline in the S&P since mid-February has occurred while US short-term interest rates have gone from pricing “maybe” one 25bps cut later this year to “likely” three cuts as uncertainty about Trump’s tariff policies has increased the odds of a recession. (This chart is the December 2025 Secured Overnight Financing Rate (SOFR) which, like a T-Bill, trades at a discount to par (100) with par being a zero interest rate. 9650 implies ~3.5% interest rate.)

Ten-year T-note prices tumbled last fall (yields soared) as the market feared endless government deficits. The January and February rally may have been spurred by thoughts that the Trump administration would “balance the budget,” short-covering, concerns over stock market weakness, and concerns about a looming recession. The weakness over the past two weeks may be linked to thoughts that the Fed would start to cut “too early” and that uncertainty over Trump’s policies/actions would lead to a recession and thus continuing deficits and possible Treasury sales by foreigners.

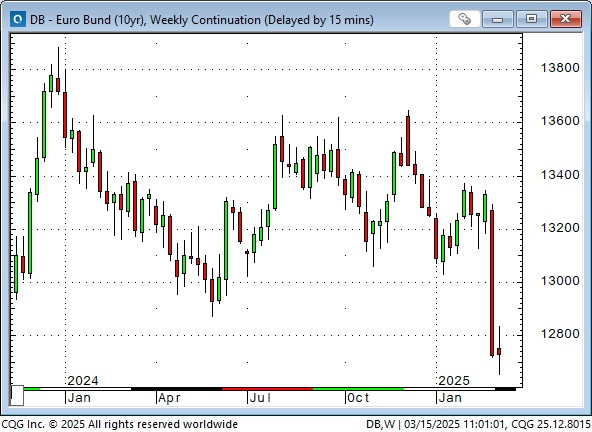

The dramatic recent tumble in German Bund prices, in reaction to proposed massive fiscal deficits to pay for defense and infrastructure, may also have weighed on US Treasury prices.

Japanese 10-year yields hit 17-year highs this week. (Chart from: www.Marketwatch.com

Currencies

The US dollar index soared last fall as US interest rates rose relative to rates in other countries. Trump’s election victory (blue ellipse) accelerated the rally and took the index to what was effectively (outside of a few weeks in late 2022) a 23-year high. The USD was truly King Dollar at the beginning of 2025. and “American Exceptionalism” was at its peak. Commitments of Traders (COT) data showed that speculators in the currency futures market held their largest pro-USD net position in years.

Long-time readers of these Notes may remember that I’ve occasionally mentioned that currency market trends often go WAY further than seems to “make any sense” and then they turn on a dime and go the other way. Interestingly, many significant reversals over the years happen around the turn of the year.

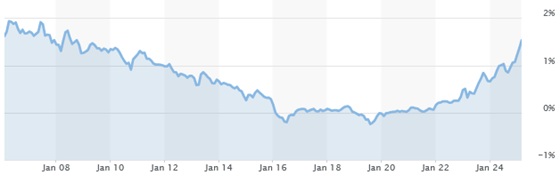

The USDX is down ~6% from its highs YTD, with about half of those losses happening last week when the Euro surged as the US/German interest rate differential dramatically narrowed (US short rates softened and German rates soared on the prospect of massive government deficits.)

The Canadian dollar tumbled last fall as the USDX soared, but it has traded mostly between 69 and 70 cents for the past three months despite the tariff-related drama between Canada and the US. The big green spike (blue ellipse) to multi-year lows on February 3 resulted from Trump announcing 25% across-the-board tariffs on Canada and then pausing those tariffs later that day. My guess is that the FX market is expecting a “moderation” in the tariff-related drama, perhaps with a renegotiation of the USMCA agreement. COT data shows that the net short speculative position against the CAD is ~20% smaller than in December.

Gold traded above $3,000 this week

Comex April gold rallied ~$135 from Tuesday’s lows to Friday’s all-time high of ~$3,017, an increase of ~50% from the February 2024 lows. Interestingly, this week’s rally happened against a background of a possible cease-fire agreement between Russia and Ukraine. COT data as of Tuesday, March 11, shows that the historically huge speculative net long gold position has shrunk ~20% over the last six weeks.

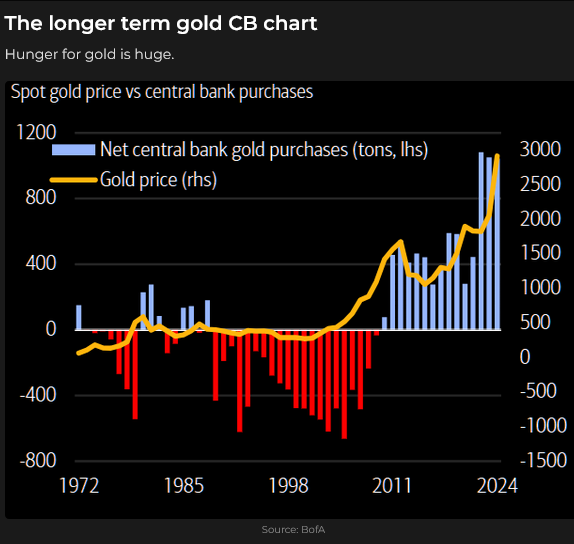

This chart from BoA research shows that central banks have been substantial net buyers of gold (the blue bars) over the last 15 years (especially in the previous three years—since the Russian invasion of Ukraine and the subsequent sanctions applied against Russia). The red bars represent central banks’ net selling.

This chart and comments are from Martin Murenbeeld’s March 14, 2025 Gold Monitor (click here for a free sample).

Energy

Front-month NYMEX WTI briefly traded above $80 in January, but fell to ~$65 (down ~19%) this week and last.

$65 is the lowest price for front-month WTI over the last five years.

For excellent daily insights into the New York metals and energy markets I highly recommend “Market Vibes” on Substack. I’m a paid subscriber and read JJ’s comments daily. Check out this recent interview with JJ on The Market Huddle. (JJ and I worked for ContiCommodity in the late 1970s/early 1980s. He was on the floor in New York and I worked in Vancouver and San Diego so we never met, but we’ve become “pals” lately thanks to mutual friends.)

My short-term trading

I started this week long the S&P, short the Yen, gold and calls on the 10-year Note. All positions were established on Friday, March 7.

I had bought the S&P as it rallied back from below 5700 on March 7 and was +50 points ahead on the trade at the close. The market opened lower Sunday afternoon and kept falling. I covered the trade for a modest gain.

The Yen closed near its lows for the day on Friday and I was slightly ahead on the trade, but it opened higher on Sunday and kept climbing. I was stopped for a slight loss.

Gold was weaker Sunday and Monday, and at Monday’s close, I was ~$25 ahead on the trade. The market rallied on Tuesday and Wednesday, and I was stopped for a slight loss. (I’m glad I was stopped; the market rallied over $100 from Wednesday’s low to Friday’s high.)

My short T-Note calls looked good going into Friday’s close, but the market rallied Monday as stocks fell and popped a little higher early Wednesday and I was stopped for another slight loss.

After being stopped on my short Yen Sunday night, I shorted it again on Monday but was stopped for a slight loss at the overnight highs and missed the 100+ tick tumble to Wednesday’s lows. (I think I’ve had five consecutive small losses on the Yen in the past couple of weeks – from both the short and the long side. I’ve had the direction right, but my stops have been too tight!)

From Tuesday to Friday, I bought the S&P nine times (trying to pick a bottom) and broke even on my closed trades. I’m slightly ahead on the last buy I held into the weekend.

Thoughts on trading

My trading this week was a classic case of “trading is not a game of perfect!” Market sentiment is stressed and short-term price action has been wickedly choppy. I do not attempt to guess when the next tape bomb from the Trump administration will hit the market, but I acknowledge the risks by keeping my trade size small.

This week was another example of how hard it is to do a 180. I had gone short gold last week because I thought the rally was tired, open interest was down, and COT spec long positioning was down. The bullish story was well known. The market inched in my favor on Monday, trading lower than the lows of the previous four days, and my confidence in being short increased.

When the gold market rallied and stopped me out on Wednesday, I believe that if I had a “clear mind,” I would have seen that the market had had a great chance to break down, but it hadn’t, and it was therefore a “buy.” I didn’t see the “buy opportunity” because I was in an “it’s a short” frame of mind.

The Trump administration is roiling the market. (Trump: “There will be a little disruption…I’m not ruling out a recession…I’ll shut down Canadian auto production.” Bessent: “There’s going to be a detox period…for markets that have become hooked on excessive government spending.”

I don’t make a trade because I think Trump is right or wrong. He impacts markets (some more than others), but I trade the market, not Trump. For instance, I think the S&P’s 10% decline since mid-February is primarily a result of Trump & Co. saying things the market didn’t like. (I also think the S&P was egregiously over-bought in February and was vulnerable to any “bad news.”) So the market was “impacted” and fell; now, it is ~5600 instead of ~6100. Do I want to be a buyer or a seller?

The Barney report

I love to take Barney to places where he can run and explore to his heart’s content, so one of our favourite spots is an area of forest logged about twenty years ago. There are rough roads, lots of trails, and lots of ditches, which fill up with rainwater this time of year. That boy loves to wade in ditches!

Listen to Mike Campbell and me discuss markets on the Moneytalks show

On this morning’s show, Mike and I discussed the 10% drop in the S&P in the last four weeks, various inflation reports, gold over $3,000, copper up 22% YTD and Trump’s impact on the markets. You can listen to the entire show here. Don’t miss Mike’s discussion with Louis Vincent Gave. My 10-minute spot starts around the 54-minute mark.

The Archive

Readers can access weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything!

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair March 15th, 2025

Posted In: Victor Adair Blog