March 1, 2025 | Trading Desk Notes for March 1, 2025

Current positioning:

My short-term trading account began this week long TNotes and Yen, short the S&P. I covered the Notes and S&P for good gains mid-week and was stopped for a slight loss on the Yen. I bought the S&P on Friday and held that into the weekend.

Equities

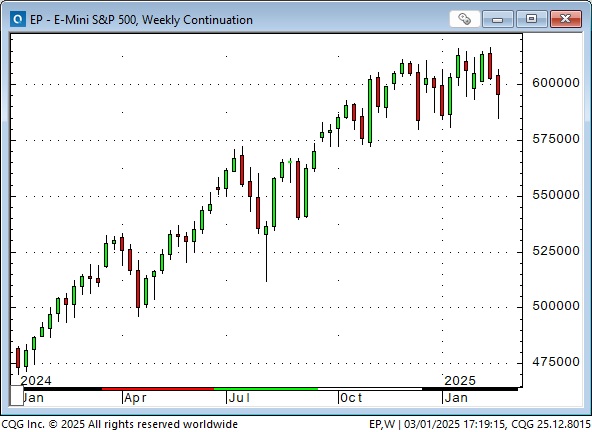

The S&P touched all-time highs on February 19 (blue ellipse), sold off a bit on the 20th, and fell hard on Friday, the 21st. This week, the market opened lower on Monday and remained under pressure until midday Friday. The 7-day drop from all-time highs to Friday’s low was ~5%. (The S&P is up ~75% since October 2022, and has had three corrections of ~10% during that rally.)

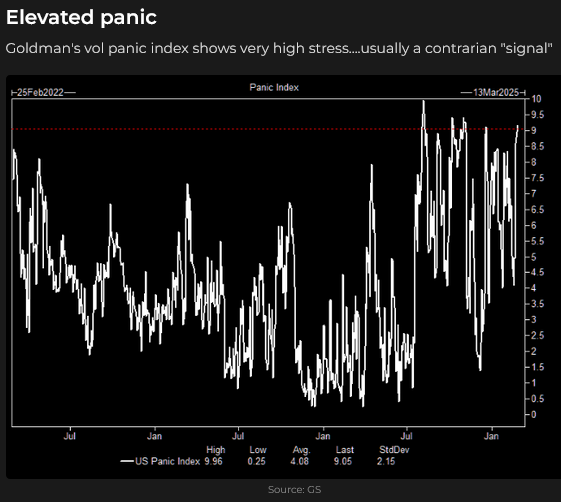

The sell-off on Friday, the 21st, halted around the 6025 level (blue ellipse), which had been a significant support level during the previous two weeks. Once that level was broken on the 23rd, the market remained under pressure until Friday’s lows. (Selling begets selling.) The 120-point rally off this Friday’s low was impressive, given 1) the current bearish sentiment and, 2) it came on massive volume and, 3) marked the close for the week and the month. (I’m “old school” enough to believe that end-of-week and end-of-month prices still have significance.) For the record, Friday’s lows were made as the “Zelenskyy/White House” news hit the market.

The volume in the last ten minutes of Friday’s “floor session” was more than double the opening ten minutes, which is usually the day’s highest, indicating heavy MOC buy orders. Friday’s total daily volume was the highest YTD, adding significance to the rebound from 6-week lows.

I won’t believe the bottom to this 5% decline is “in” until prices get back above, and stay above the 6025 level. (What used to be support becomes resistance once support is broken.) If the S&P turns lower after Friday’s late rally and takes out Friday’s lows, we will see some real fear and ~5750, the lows since September, looks like a target.

NVDA’s quarterly report after the close on Wednesday (blue ellipse) was strong. It opened $3 higher on Thursday but dropped $15 to close on its lows, adding to bearish sentiment.

TSLA may have been the “poster boy” for “Trump bump” stocks, soaring nearly 100% following Trump’s election victory (blue ellipse) but it then gave almost all of that back as Elon Musk “fell out of favor” with many people.

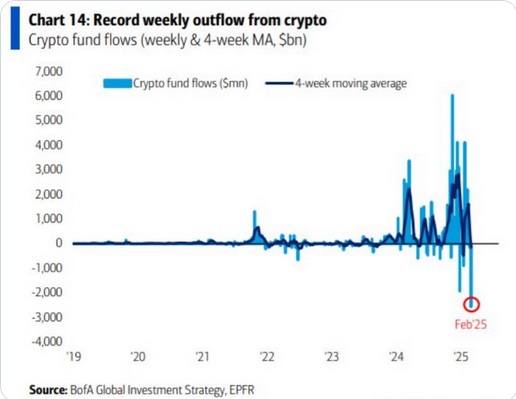

BITCOIN was another bullish sentiment gauge for the “Trump bump,” rallying ~60% following Trump’s election victory (blue ellipse), but it has given most of that back over the last six weeks.

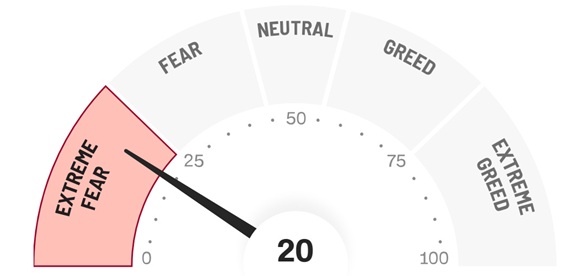

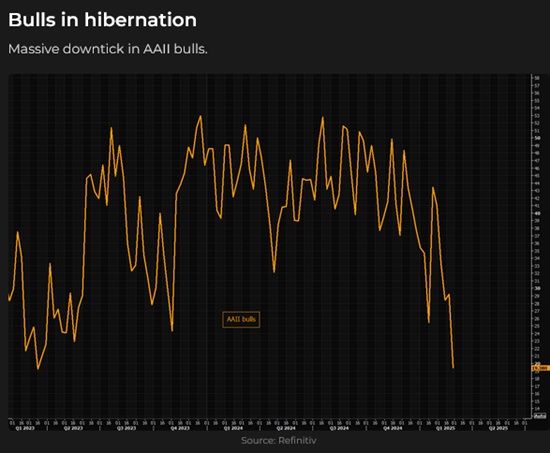

AAII (American Association of Individual Investors) bullish sentiment fell to 2-year lows this week.

Equity market volatility (VIX) jumped to 7-month highs this week.

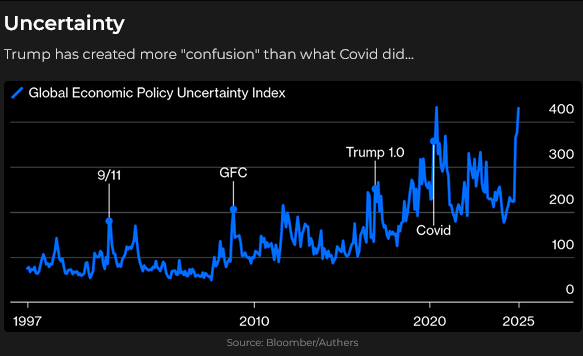

The post-election bullish sentiment came from the Trump-inspired “new golden age” of tax cuts and a booming domestic economy. The current bearish sentiment comes from uncertainty over tariffs, plunging consumer confidence, and falling asset prices. The Atlanta Fed GDPNow forecast for Q1-2025 is negative 1.5%, down from positive 2.3% last week.

Interest rates

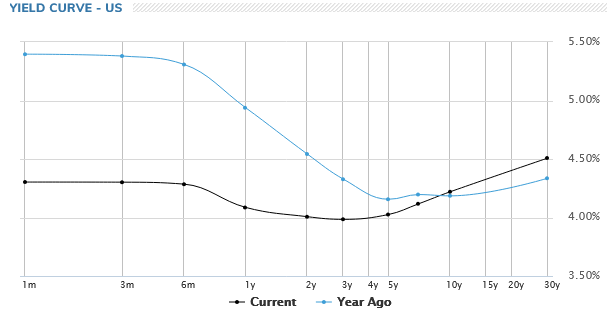

10-year T-Note futures have rallied for seven consecutive weeks since early January, with yields falling from ~4.75% to ~4.25%. Prices have closed higher for 10 of the last 11 days as the rally accelerated.

Bond prices fell last fall, even as the Fed cut short rates, as investors demanded a “risk premium” in compensation for fears of inflation remaining above target and “never-ending” government deficits. The rally from the January lows may be driven by 1) short-covering, as 2) investors believe that this year’s deficit will be lower than previously expected because of congressional pressure and DOGE, and 3) the increasing possibility of a “recession” and 4) the Treasury is focused on getting bond yields lower, and 5) capital flowing from equities into bonds on fears of an “over-valued” stock market.

COT data as of February 25 shows that net long speculative positioning in 30-year T-Bond futures is at a 10-year high, with most of those positions held by small speculators.

SOFR (Secured Overnight Financing Rate) futures have rallied sharply the last three weeks and are now pricing in 2 X 25 bps Fed cuts before yearend. Those rate cut expectations are driven by softening consumer metrics, not by fears that Trump will force Powell to cut rates.

Currencies

The US Dollar Index rallied ~10% last fall with more than half of those gains coming after Trump’s election victory (blue ellipse.) The highs around 110 were effectively 23-year highs (outside of a few weeks in late 2022) as the US Dollar soared against all actively traded currencies.

The USDX fell ~4% from the January highs to this week’s lows but rallied ~150 bps from Wednesday to Friday, perhaps reflecting “risk-off” sentiment in capital markets and “evening up” into month-end.

COT data as of February 25 shows that net speculative short positioning in all currencies against the USD fell to its lowest level since November, after reaching a 10-year high in mid-January when the USD was hitting multi-year highs.

The Japanese Yen hit 35-year lows last July and then had a spectacular rally, rising nearly 15% in three months, as massive intervention by Japanese authorities ignited the covering of enormous speculative short positions.

The Yen fell from September to January as the USD rallied against all currencies, but it turned higher in January on a combination of 1) expectations of higher Japanese interest rates, 2) concerns that Trump would pressure Asian countries to revalue their currencies to reduce their trade surpluses with the USA and, 3) concerns of Japanese capital repaitration. (The US trade deficit with all countries hit a record $153 Billion in January, perhaps as people try to get goods into the US before tariffs hit.)

COT data as of February 25 shows net long speculative positioning in the Yen is at a multi-year high – higher than in September 2024 when the Yen was much higher, around 72 cents. While the size of the long positions currently held by speculators is substantially smaller than the speculative short positions held before the intervention last July, the market is presently “crowded” long. (Remember that the Yen fell by ~50% from 2012 to 2024 – giving speculators little “reason” to be long Yen!) Open interest in the Yen is up ~50% YTD, supporting the “crowded” idea.

The Canadian Dollar plunged to 20-year lows (6775) on the February 3 announcement of 25% tariffs, rallied back to ~7075 last week and fell to ~6925 this week as Trump said he would hit Canada with 25% tariffs next week. The Bank of Canada meets March 12 and may cut rates again, especially if Trump hits Canada with 25% tariffs.

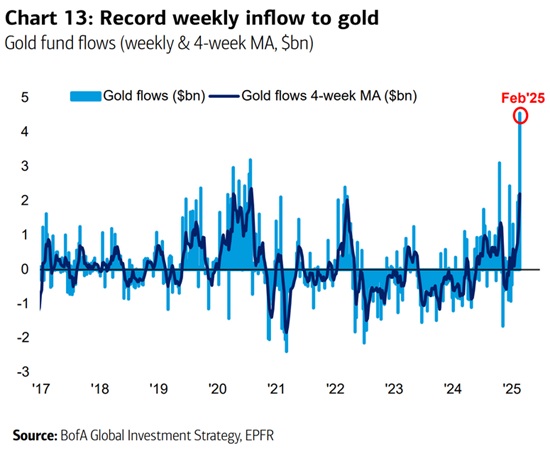

Gold

Comex gold rallied ~$350 (~13%) from December lows to this week’s highs of ~$2974 as people aggressively bid a rising market higher, then fell ~$130 to this week’s lows, creating a weekly key reversal on the charts. Open interest has fallen ~20% since January 24 as prices rallied ~$200.

This chart courtesy of the Gold Monitor.

On my radar

Employment reports. Will the loss of government jobs show up? Will we get a negative number? Will a government shutdown occur if Congress can’t agree on a budget? Tariffs.

Quotes of the week

“The previous administration’s over-reliance on excessive government spending and overbearing regulation left us with an economy that may have exhibited some reasonable metrics but ultimately was brittle underneath and heading for an unstable equilibrium.” Scott Bessent, Treasury Secretary February, 2025.

“Capitalism is about taking money away from bad ideas and giving it to good ideas. Passive investing is everybody gets money, whether you mismanage your company or you don’t mismanage your company.” Jim Bianco February, 2025

Link of the week

Check out Maggie Lake on Substack. She does video interviews with some of the best people in finance.

The Barney report

The snow is gone, and spring is starting in the Pacific Northwest Rainforest. Barney and I were out yesterday on a logging road under a blue sky, for a change, with the temperature around 14 degrees Celsius. In a month from now, all the rough-looking bush will be green with lots of wild flowers showing. But Barney won’t care if he can run with a big stick!

Listen to Mike Campbell and me talk about markets.

On this morning’s Moneytalks show, Mike and I discussed the dramatic swings in investor sentiment across markets as Trump creates uncertainty regarding tariffs and geopolitical issues. You can listen to the entire show here. Be sure to listen to Robert Bryce on the devastation caused by “net zero” policies. My spot with Mike starts around the 53-minute mark.

Listen to my monthly interview with Jim Goddard

This morning, I did my monthly 30-minute interview with Jim Goddard on the This Week In Money show. We discussed the rapidly changing macro environment and zeroed in on stocks, currencies, interest rates, and gold. You can listen to the whole show here. My spot with Jim starts around the 32-minute mark.

The Archive

Readers can access weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything!

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair March 1st, 2025

Posted In: Victor Adair Blog