March 10, 2025 | Timing

Happy Monday Morning!

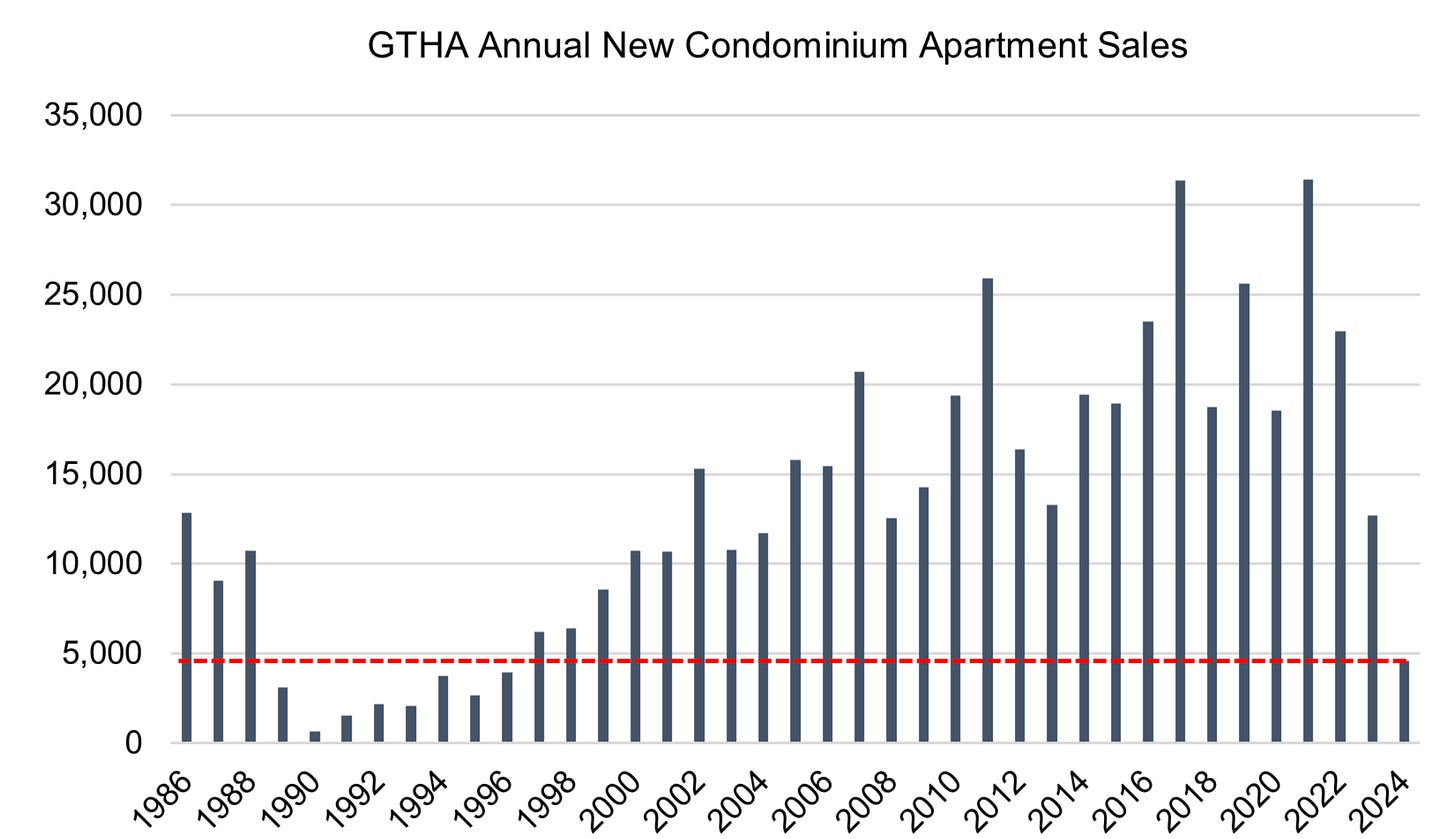

Just last week we highlighted the growing desperation in the new construction market where pre-sales are struggling, and unsold inventory is piling up across the country. This is particularly true in Canada’s two largest major metros of Toronto and Vancouver.

In 2024, Toronto pre-sales hit 30 year lows. A stunningly bad figure when you consider the population has expanded by nearly 2.5 million people since then.

Things aren’t as dire in Vancouver, but pre-sales were still near a 5 year low last year and are down more than 60% since the peak of the bull market of 2021.

The bigger concern here is that pre-sales lead housing starts. There is absolutely nothing that can be done to prevent housing starts from rolling over aggressively when you consider the amount of time, energy, and capital these projects demand. Ultimately, a condo development requires years of planning, and very few developers are actively planning new projects, they’re just trying to salvage the ones that were already in the pipeline.

Even the condo king agrees. In a recent housing panel, Bob Rennie, the condo king noted, “I would tell you by the end of 26, into 27, I feel we’ll begin to get back into absorption. That’s a long time away.”

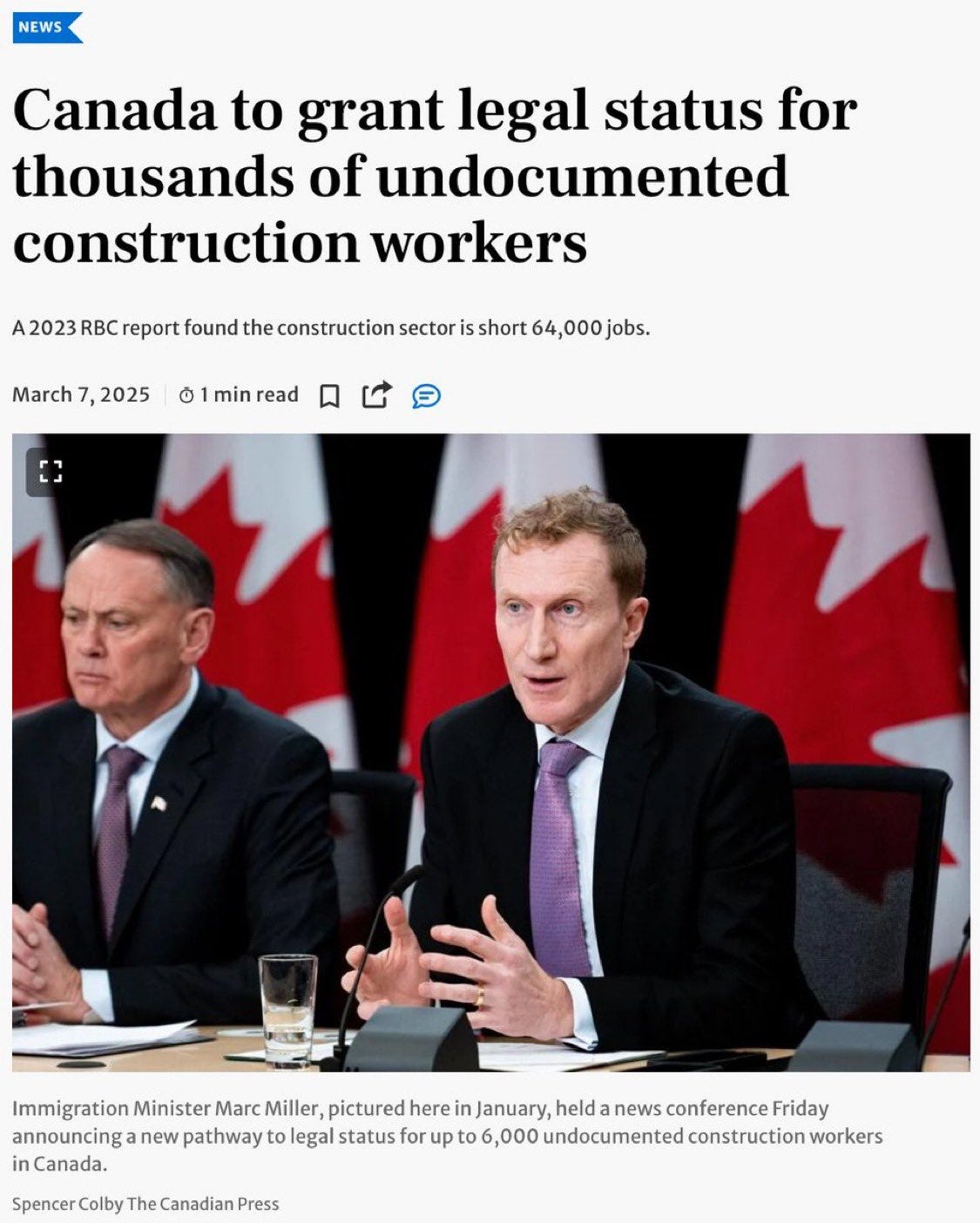

Given all the issues we just highlighted, we found this piece in the Toronto Star rather interesting.

Up to 6,000 undocumented construction workers will be given a pathway to gain legal status in Canada, Immigration Minister Marc Miller said Friday in a news conference.

“These undocumented migrants are already living and working in Canada, and are contributing to the sector,” Immigration, Refugees and Citizenship Canada said in a statement.

“This pathway will keep them here legally so that they can continue to build the homes our economy and communities need with the proper protections.”

This certainly made sense a few years ago when housing starts were hitting record highs and we genuinely had a labour shortage. Does it make sense today when construction work is drying up?

Make no mistake, we are not arguing against more construction workers, we just find the timing of the policy rather interesting.

From a long term structural perspective we need more construction workers. According to BuildForce Canada, the industry could face a recruiting gap of more than 85,000 workers by 2033.

What we are saying is that in the very near term, as highlighted by current market conditions, we don’t need more housing and we don’t need more construction workers. In the medium term we will absolutely need more of both.

However, right here, right now, there is a glut.

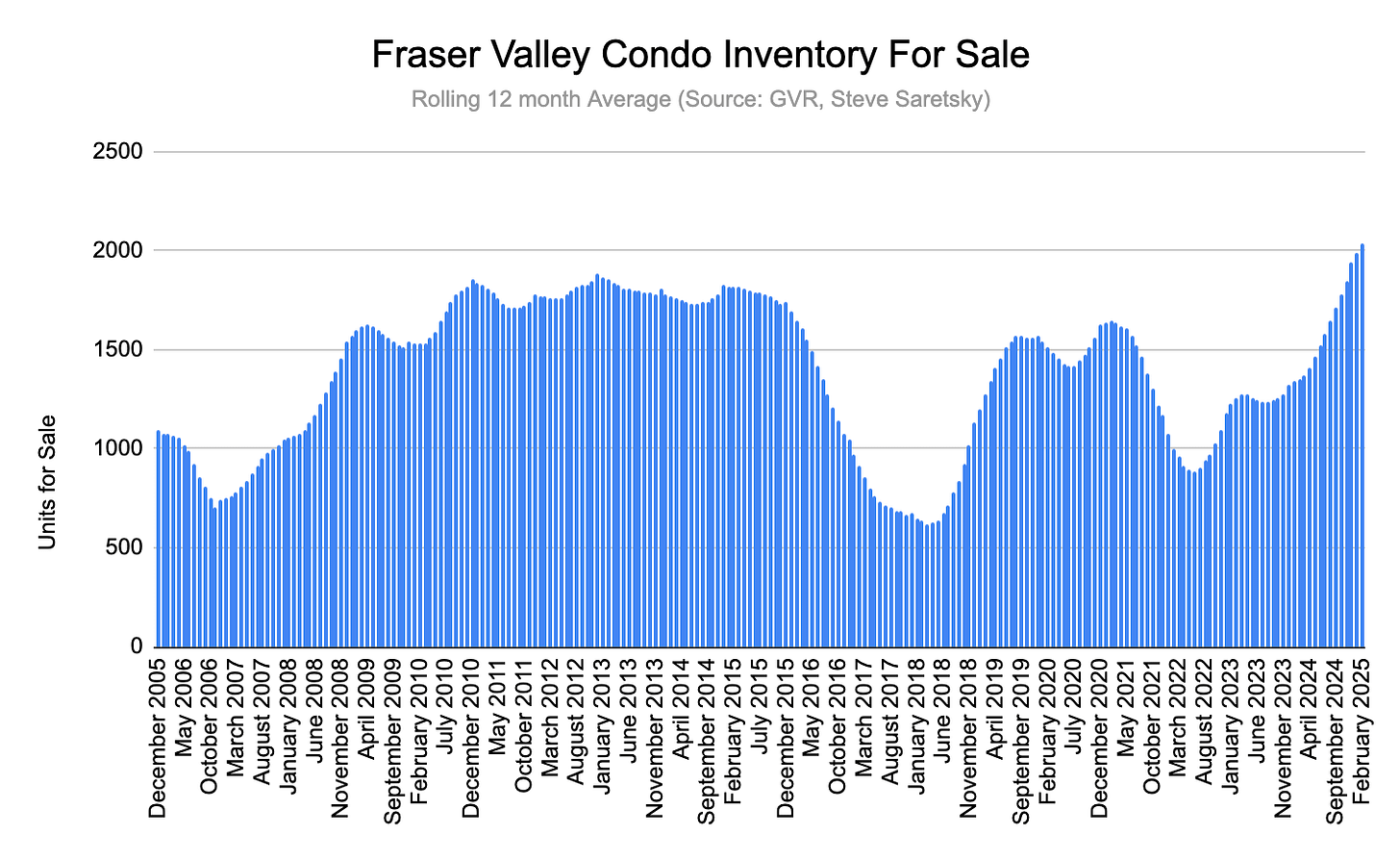

Unsold inventory on developer balance sheets is at record highs, coinciding with record condo inventory for sale on the resale market.

Where speculation was hot and heavy, the bubble has burst. Condo inventory for sale in the suburbs is at record highs.

It’s also where developers have been building the most, so more is coming. Units that pre-sold at $1150/sqft in areas like Surrey and Coquitlam have comparable resale units transacting at $1000/sqft, creating appraisal concerns for units that are nearing completion.

The banks who were often behind the construction financing of the development are, in some cases, dishing out 100% LTV mortgages to buyers through a clever program called ‘blanket appraisals’. From the banks perspective its better to stroke the loan at 100% LTV and kick the can down the road then have a whole bunch of units not close, and jeopardize the entire financial viability of the building.

Eventually this shall pass, but as the condo king noted, probably not for a few years still.

The tariff news cycle isn’t helping either. The index of consumer confidence as tracked by the Conference board of Canada now sits at levels last seen during the depths of the pandemic and the financial crisis. When people are worried they don’t transact.

Maybe lower rates will eventually get them off the sidelines. Market odds are now 80% chance of another 25bps rate cut from the BoC this Wednesday. Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky March 10th, 2025

Posted In: Steve Saretsky Blog

Next: Interview with Maxime Bernier »