March 17, 2025 | The MSM Discovers Copper

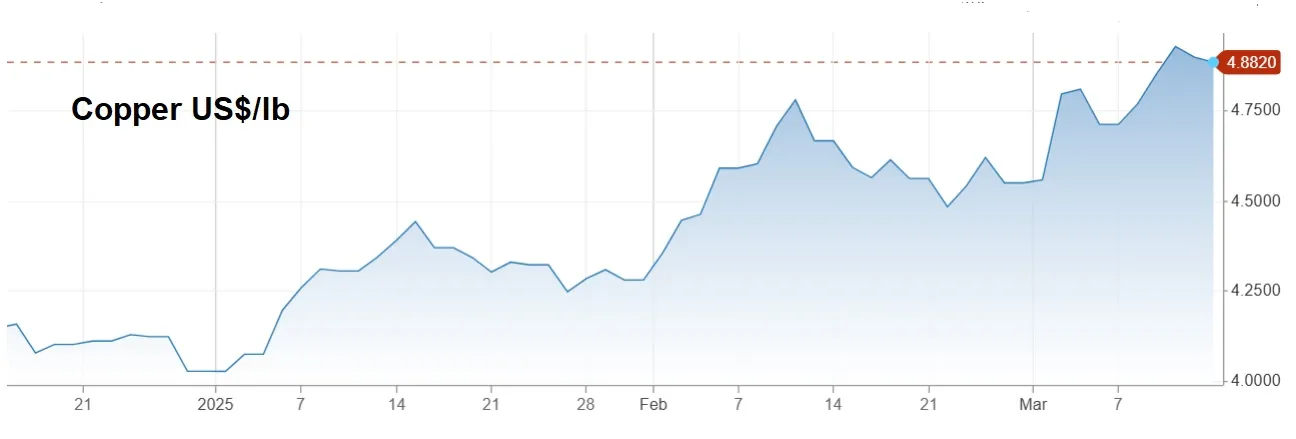

Copper has had a quietly impressive run so far in 2025.

But much more is coming as mainstream investors tune into the story. Consider this, from NPR of all places:

Forget about rare earth minerals. We need more copper

(NPR) – In recent weeks, you’ve likely heard a lot about rare-earth substances, thanks to President Trump’s stalled efforts to secure a minerals deal with Ukraine and his talk of annexing Greenland. These vital substances fuel the growing renewables and electric-vehicle industries. However, many experts warn that the shortage of another crucial metal, used in electronics, wiring and even plumbing could be just as concerning.

It’s a problem that will only get worse. A report last year by S&P Global blamed the shortfall on a number of problems, including underinvestment in new exploration and mines due to the industry’s focus on short-term returns.

BHP, a Melbourne, Australia-based multinational mining and metals company says that existing mines will produce around 15% less copper in 2035 than in 2024. The average grade of ore has also diminished by around 40% since 1991, BHP says.

“Most of the high-grade stuff’s already been mined,” says Mike McKibben, an associate professor emeritus of geology at University of California, Riverside. “So, we have to go after increasingly lower grade material” that cost more to mine and process, he says.

That’s a recipe for higher prices and unmet demand, says Shon Hiatt, a business professor at the University of Southern California. “It’s projected that in the next 20 years, we will need as much copper as all the copper that has ever been produced up to this date,” he says.

Copper’s ability to be recycled plays a significant role in easing some supply challenges, but it’s far from sufficient. Only around one-third of the copper supply in the U.S. comes from recycled material.

The U.S. already imports half of the copper it consumes from countries including Canada and Mexico. Like aluminum and steel, copper is poised to be swept up in the White House trade war. Last month, the president ordered an investigation into copper imports from Canada, and U.S. Commerce Secretary Howard Lutnick has confirmed that Trump will add copper to the 25% tariffs on Canadian steel and aluminum.

Stuart Burgess, chairman and co-founder of Sandy, Utah-based Burgex Mining Consultants, says his team is the “boots on the ground” that physically stakes new mining claims for companies. “We’re seeing a lot of interest in copper, particularly here in the United States,” he says.

He notes that it takes four times as much copper to make an electric vehicle as a gas-powered one and that charging all those EVs will require massive upgrades to the power grid, further straining the demand-side of the copper equation. “If we take all the known deposits in the world that are proven … it would probably meet half that demand by 2050,” he says.

There are ways to squeeze out efficiencies, but only at the margins, Burgess says. “Everybody looks for that magic black box where you can put one copper element in and get two out. It doesn’t exist,” he says.

However, it can take a decade or more to develop new sources of copper into productive mines, Jowitt says. Even then, there are no guarantees. Take for example the planned Resolution Copper Mine in Arizona, which has been caught up in a more than decade-long legal and political battle that has drawn in three presidents over concerns voiced by the state’s Native American tribes. Another planned copper mine in Arizona and two in Minnesota have run into significant delays.

Read the rest here.

The Best Copper Miners Are Just Getting Started

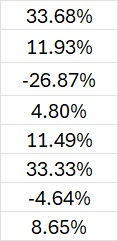

Of the eight copper stocks in our Portfolio, six are up since inclusion. If growing MSM interest attracts generalist money, they have a lot further to run.

Portfolio Copper Stocks Gain/Loss

Subscribe to John

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino March 17th, 2025

Posted In: John Rubino Substack

Next: Understanding Gold »