March 30, 2025 | Seven Charts That Put the Gold Bull Market in Context

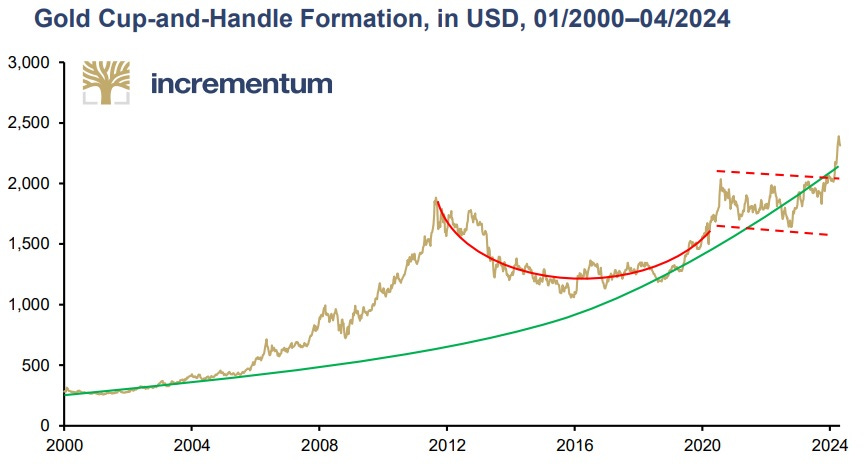

Remember that long, boring stretch where gold couldn’t break resistance at $2,000/oz? Here it is in the context of this century’s bull market — note the definitive breakout in early 2024.

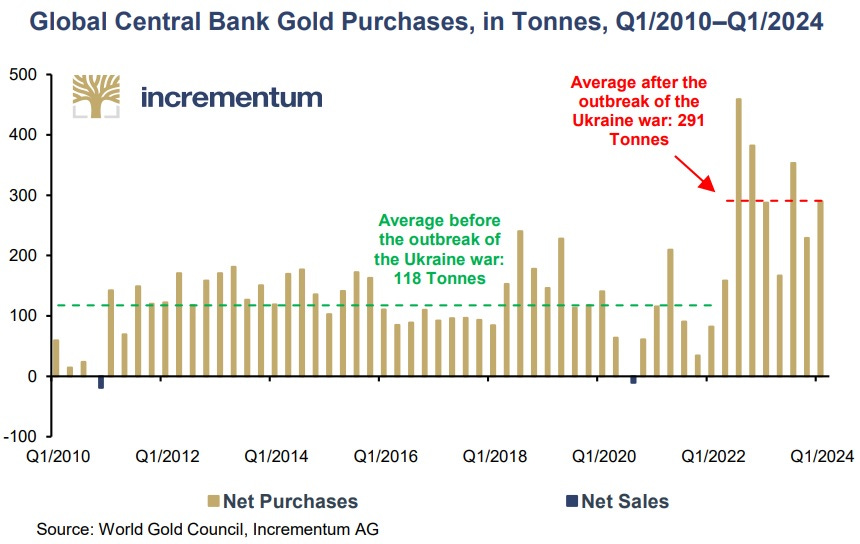

What’s driving the bull market? Central bank buying. And what’s driving that? Geopolitics. Emerging market central banks started planning for a post-dollar world when the Ukraine war broke out:

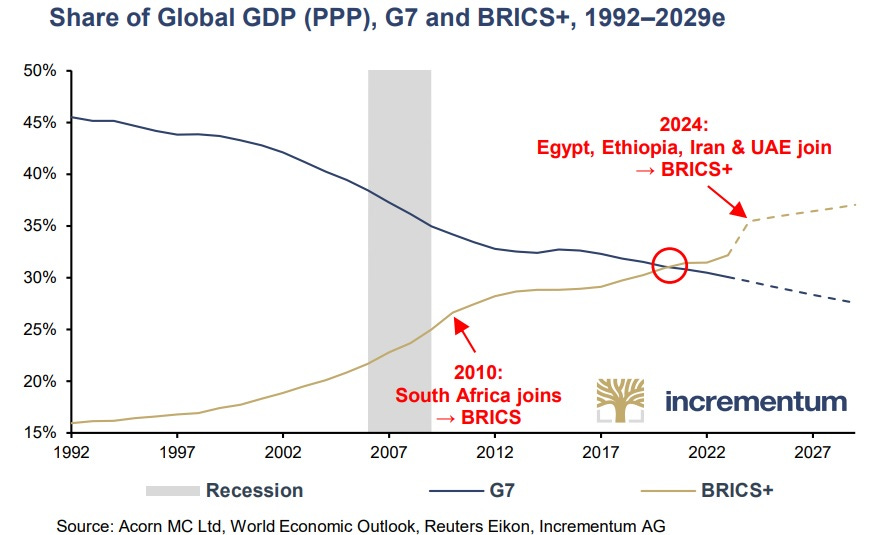

While the above was happening, the BRICS countries’ cumulative GDP surpassed that of the G-7 developed countries. As Incrementum notes:

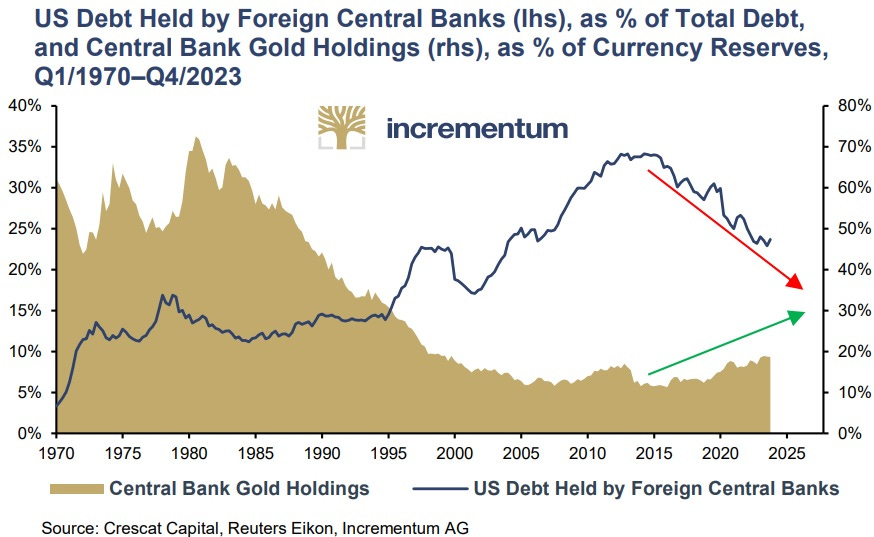

For years, the BRICS+ countries have had a considerable trade and current account surplus with the West. A steadily increasing share of gold in the currency reserves of emerging economies is the manifestation of this development. This is similar to the situation after the Second World War, when Europe, especially Germany and France, successively increased their gold reserves as a result of high current account surpluses. In contrast, US gold reserves fell to almost one quarter, or just over 8,000 tonnes, as a result of the gold drain. While the US experienced a gold drain in the 1960s, there are currently signs of a gold gain in the emerging markets.

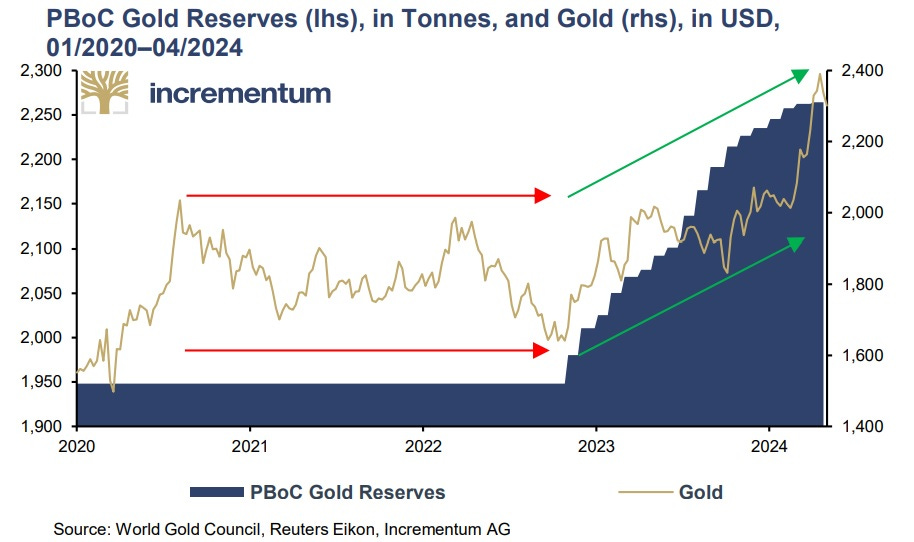

Not surprisingly, China, with its persistent trade surplus, has been a leading buyer of gold.

As they accumulate gold, foreign central banks are dumping U.S. dollar-denominated debt.

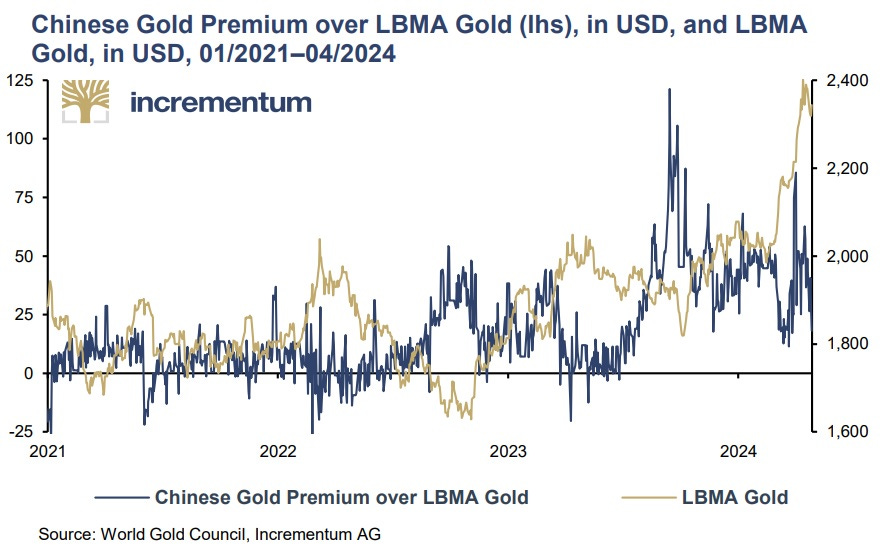

China is also encouraging its citizens to own gold. The resulting strong domestic demand is driving gold prices to a premium on the Shanghai Gold Exchange. This, in turn, is increasing the flow of gold from West to East. From Incrementum:

The enormous Chinese appetite for gold can be seen in the premium for Chinese gold compared to LBMA prices. The high domestic demand in China is also being fueled by China’s youth, who have recently discovered gold beans as an investment opportunity. In addition, import restrictions or tariffs on gold imports could keep prices in China artificially high. Another reason is likely to be China’s withdrawal from the LBMA gold auctions last year, which may have restricted the volume of gold flowing into China.

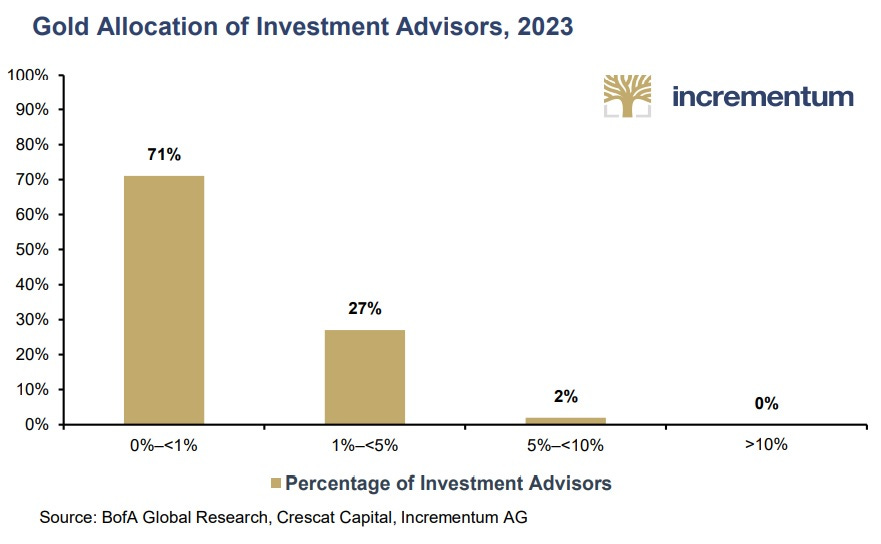

Western investment advisors have yet to recognize the above dynamic. In 2023, 71% of their clients have virtually no exposure to gold, and that number has barely risen since then.

Download the latest Incrementum charts here.

A Bull Market With Legs

The trends driving the gold bull market — de-dollarization, inflation, and a looming currency reset — accelerated in the past year and have much further to go. Combined with the apparent cluelessness of Western investors, the result should be higher gold demand and rising prices in the coming decade. Keep stacking!

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino March 30th, 2025

Posted In: John Rubino Substack