March 3, 2025 | Limping Across the Finish Line

Happy Monday Morning!

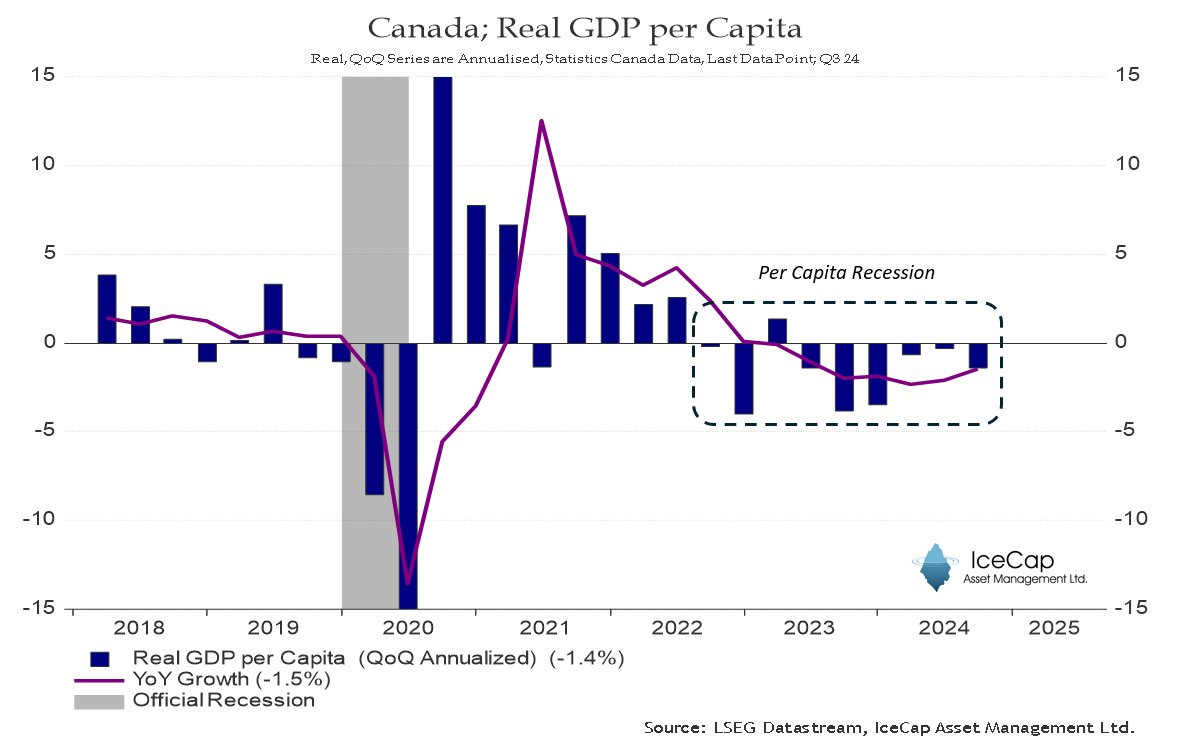

The Canadian economy expanded at a stronger-than-expected 2.6% annualized pace in the fourth quarter, far exceeding the Bank of Canada’s estimate of 1.8% and the 1.7% median estimate from economists in a Bloomberg survey. However, under the hood, the details left more to be desired. According to Statistics Canada, GDP per capita fell 1.4% in 2024, following a 1.3% decline in 2023. Ouch.

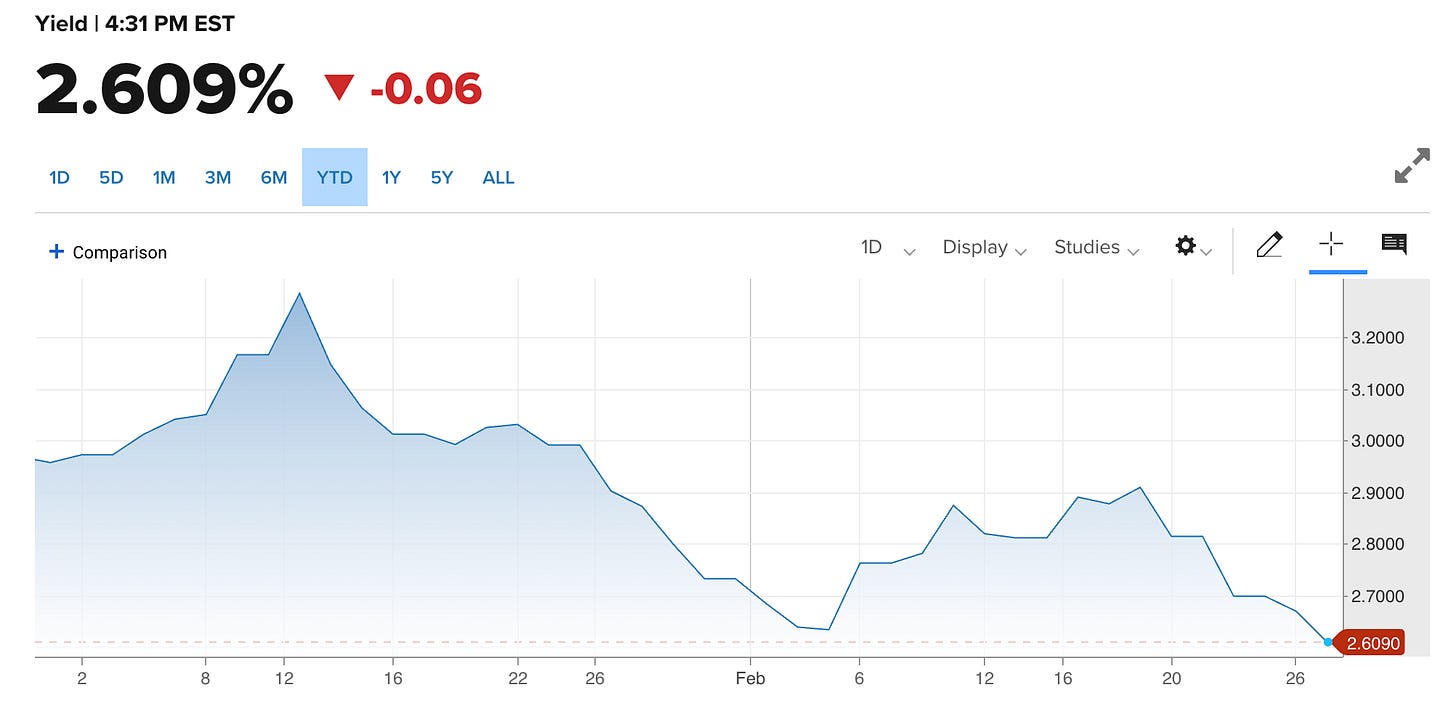

With the Canadian economy facing another round of tariffs this week, any recent bounce in growth is likely to be short-lived, keeping the BoC hovering on the trigger. On the bright side, bond yields continue to tumble, making mortgage rates more appetizing for the 60% of borrowers renewing over the next two years. The 5-year bond yield closed at 2.6% on Friday, its lowest reading this year.

Banks should start cutting rates again next week, just in time for the spring market. Fixed rates below 4% could become the norm in the near term. Under normal circumstances, you’d expect to see a significant boost in purchasing activity, but that has yet to materialize, as buyers remain frozen on the sidelines, worried about a tariff war.

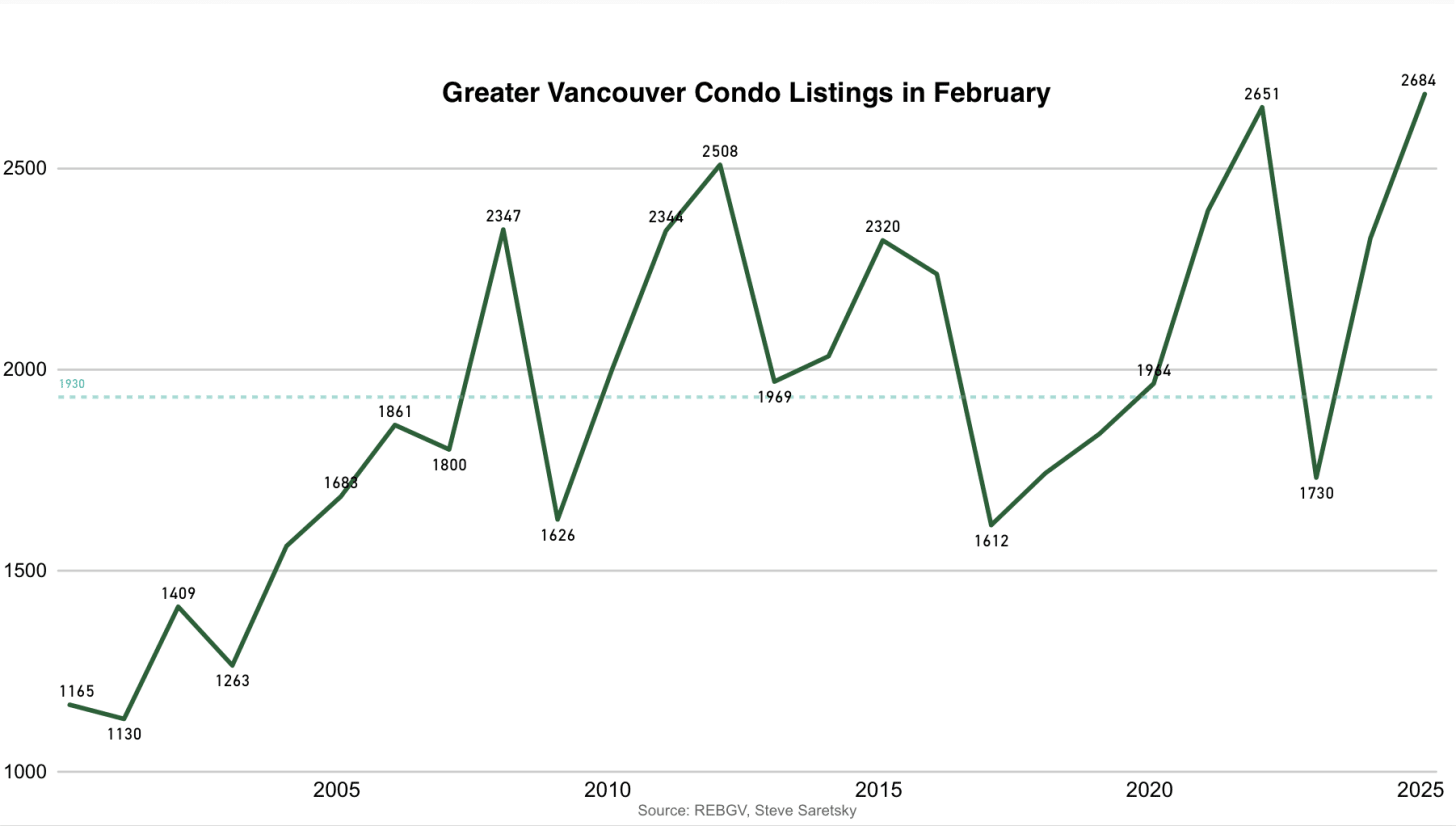

Nowhere is this more evident than in February’s housing data. Greater Vancouver home sales fell 11% year-over-year, and outside of February 2009 and 2019, this was the lowest February sales total in 25 years. Fewer sales, more inventory—new listings jumped 11%, and total inventory grew 28%.

Things get particularly interesting in the condo market. New condo listings hit a record high in February, with over 2,600 new listings piling on to the MLS, following another record high in January.

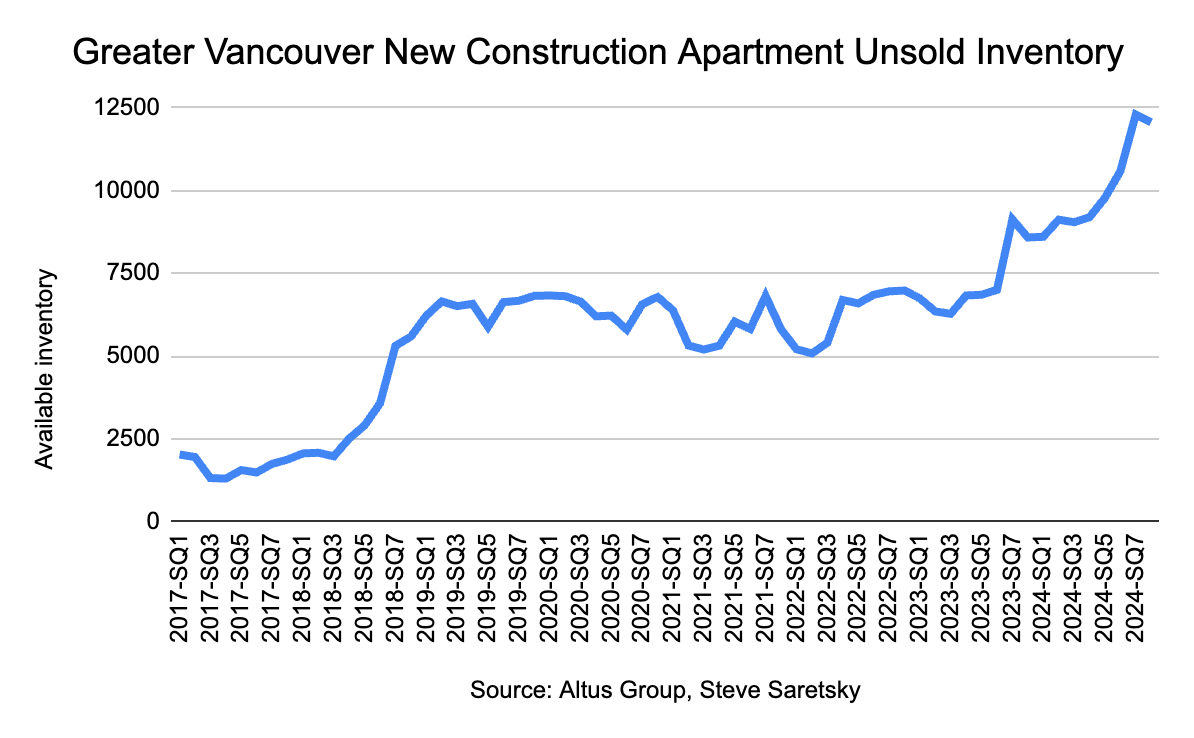

Back-to-back months with record-high new listings while sales remain well below long-term averages—quite simply, lower rates have not enticed investors to wade back into the pool. Investors have become net sellers rather than buyers. As we’ve highlighted before, this is putting pressure not only on the resale market but especially on the pre-sale market. Investors dominate the pre-sale market for several reasons—most end-users don’t want to wait 4-5 years to move in, and many aren’t comfortable purchasing what is essentially a futures contract.

And so, the number of unsold units sitting on developer balance sheets has ballooned to levels not seen in at least eight years.

Developers and policymakers alike are scrambling for solutions. One of those solutions? More time to sell units.

Under current REDMA (Real Estate Development Marketing Act) guidelines, developers had 12 months to obtain construction financing after filing their Disclosure Statement. In other words, they had one year to sell enough pre-sales (typically 60% of the building) to satisfy the banks and secure financing. The purpose of this rule is to protect buyers from projects that might not proceed due to financial instability.

The BC government has just extended that rule from 12 months to 18 months.

This tells you just about everything you need to know about the current state of the pre-sale and investor market.

Remember: Pre-sales lead housing starts.

The REDMA extension might help a few projects limp across the finish line, but for many others, the extra six months only delays the inevitable. After all, you can’t suspend economic gravity.

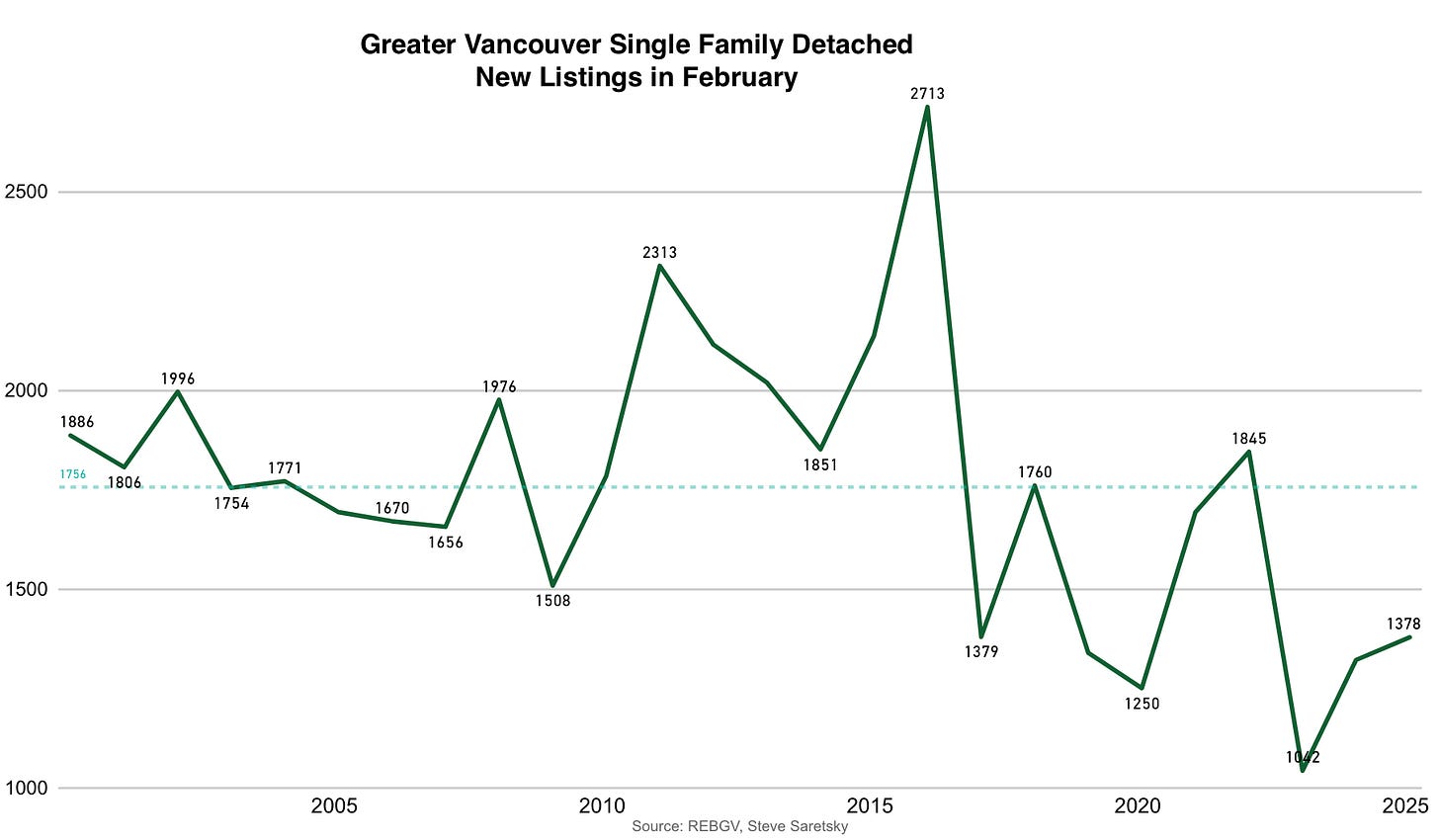

What’s happening in the investor market is an entirely different ballgame than what we are seeing in the end user market, particularly for single family homes. While condo inventory has swelled to new highs, the number of new listings in the detached market hovers near all-time lows.

Our housing woes are almost exclusively concentrated in the investor market. Perhaps that will spill over at some point, but not today.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky March 3rd, 2025

Posted In: Steve Saretsky Blog