March 17, 2025 | Gone Missing

Happy Monday Morning!

Canada has a new Prime Minister. Mark Carney was installed as leader of the country this past week. How long he lasts is anyone’s guess, but if he does eventually survive a federal election he will have some difficult decisions. One of which is housing. Real Estate sales are circling the drain, new construction is on life support, and affordability is still a major problem.

Cue, the Condo King. Prominent BC condo marketer Bob Rennie says he has pitched Carney on encouraging foreign investment back into new development.

Speaking March 4 to a panel of developers, Rennie noted, “I’m working with Carney – surprise – and I’m trying to get a rental program in where people can buy, put it into a 25-year pool, get a preferred rate from CMHC and let’s allow foreign buyers to buy it; they have to rent it out for 25 years and it will show the world we are open for business, because right now all of our governments are not showing that we’re open for business.”

What’s this all mean? In simple terms, Rennie wants to remove the national foreign buyer ban that was introduced by the Trudeau government in 2023. Foreign buyers would be welcomed back with open arms and offered cheap, taxpayer subsidized loans through CMHC, so long as they keep the property as a long term rental. This would likely be enforced by placing a 25 year charge on title preventing resale or conversion to another use.

What’s important here is not whether you agree with the policy, recent polls suggest foreign buyer bans remain politically popular, but rather the signal. Rennie sees exactly what we see, new housing starts are rolling off a cliff, creating a future supply crunch sometime in 2030.

Things are getting so bad in the new construction space that even BC Premier, David Eby, is starting to panic. Just a few weeks ago he amended REDMA (Real Estate Development Marketing Act), giving developers 18 months instead of 12 months to sell enough pre-sales and obtain construction financing. Now, after waging a war against Real Estate “speculators” for the past seven years, he’s desperately trying to entice them back into the pool.

“The shadow side of the work that we’ve done to address investment in housing is a lot of the existing real estate model around pre-sales, and everything else was built around the idea that people were buying pre-sales and flipping them, for example, as well as other kind of links between investors and actually building housing,” Eby told a crowd of Realtors at the BC Real Estate Association in Victoria on Tuesday.

“And so one of the things that we’re looking at is, well, how do we harness that energy around investment — especially at a time when we’re looking for investment in the province, and the interest in investment going into housing and real estate, and do it in a way that facilitates access to more housing for people?”

The premier said he’s actively working on such a program behind-the-scenes, to channel people’s desire to make money buying and selling properties into a more constructive mechanism for government.

In other words, capitalism.

Eby also pledged to the real estate crowd that he would boost protections for landlords.

“I don’t have details I can show you right now, but we’re also looking at, how do we support smaller investors that might buy their own condo and then rent it out as a private landlord, but they’re reluctant because they don’t want the place damaged and what if somebody doesn’t pay the rent, and all these other things.”

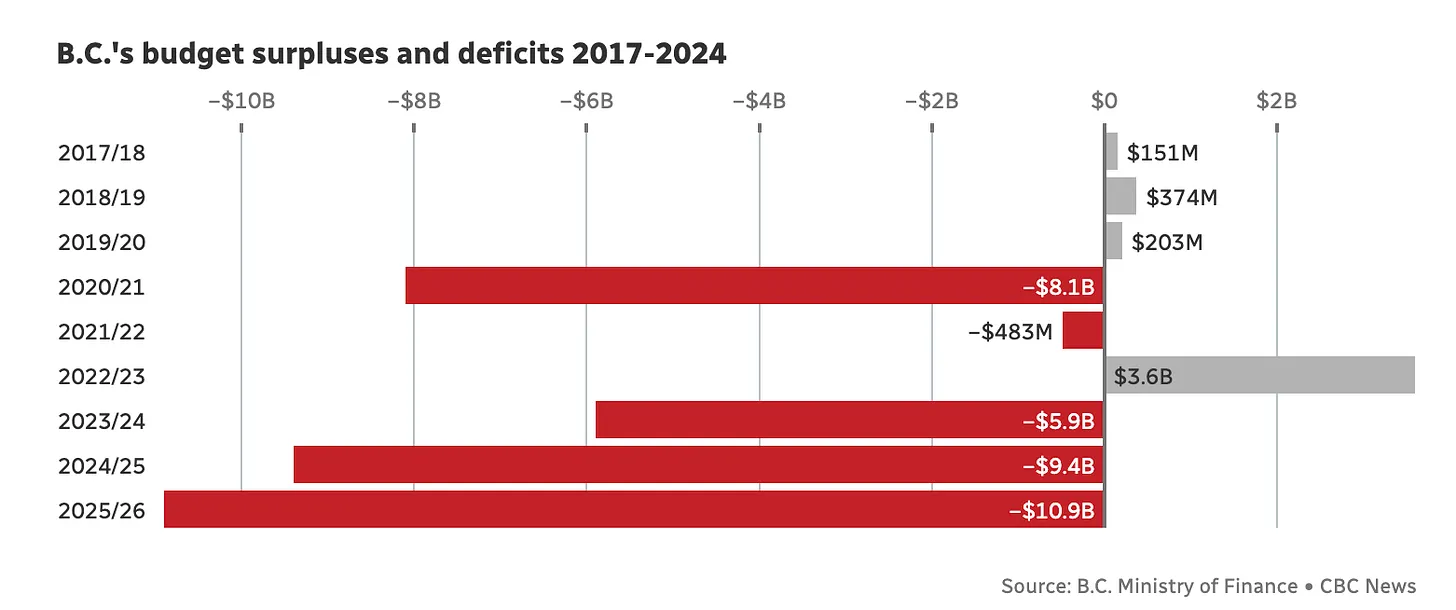

Eby’s sudden change of heart towards speculators comes on the heels of a disastrous budget deficit that is set to exceed $10B next year, a record high.

The prospects of a sharp downturn in the housing sector should only exacerbate these figures.

Unfortunately, there’s not a whole lot Eby can do to prevent economic gravity. At this stage, the train is in motion and nothing can stop it now. Not even Tiff Macklem at the BoC, who slashed rates once again this past week.

The BoC says we’re now in a new crisis and the economic impacts could be severe. Post rate cut, Macklem noted, “We’ve had our trade spats before. This does not look like a trade spat. I worry that this is something more fundamental, more durable, and that that means our standard of living is going to be on a permanently lower path.”

The only benefit here is the rate relief for mortgage borrowers facing renewals. While the prime rate was chopped again, most borrowers are still facing much higher renewals. According to OSFI, as of November 2024, 36% of all outstanding mortgages that have yet to experience a payment increase since origination will be up for renewal by the end of 2026. The number of fixed payment variable mortgages that are in negative amortization, or paying interest only, has decreased by 60% from peak levels in 2023. Encouraging.

However, as OSFI notes, “the condominium market is under pressure due to the 2024 completion of a backlog of condo construction projects leading to oversupply in a soft market. At the same time, there has been a significant drop in demand from investors and owner-occupied borrowers due to negative carrying costs without offsetting capital appreciation as well as economic pressures.”

Sound familiar?

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky March 17th, 2025

Posted In: Steve Saretsky Blog