March 6, 2025 | Germany Chooses Inflation. Bond Investors Say “No Thanks”

Germans are known for their aversion to monetary instability, with good reason. They were victims of an epic hyperinflation in the 1920s, and don’t want to go back there. See: Rhyming History: Weimar Germany’s Hyperinflation.

Now fast forward to the 2010s, when Germany was widely seen as both the best-run major country and the financial bedrock of the European Union and euro common currency. From The Euro is Doomed if Germany Fails:

Since the creation of Europe’s common currency in 1999, Germany has been the key to the whole project. The European Central Bank stood ready to buy up all the (for instance) Italian debt that the markets couldn’t or wouldn’t absorb, and Germany stood ready to back the ECB with its industrial might and financial wealth. So in effect, Italian (and Greek, Spanish, and French) bonds were viewed by the markets as German bonds, super-safe and therefore worth owning even with low yields.

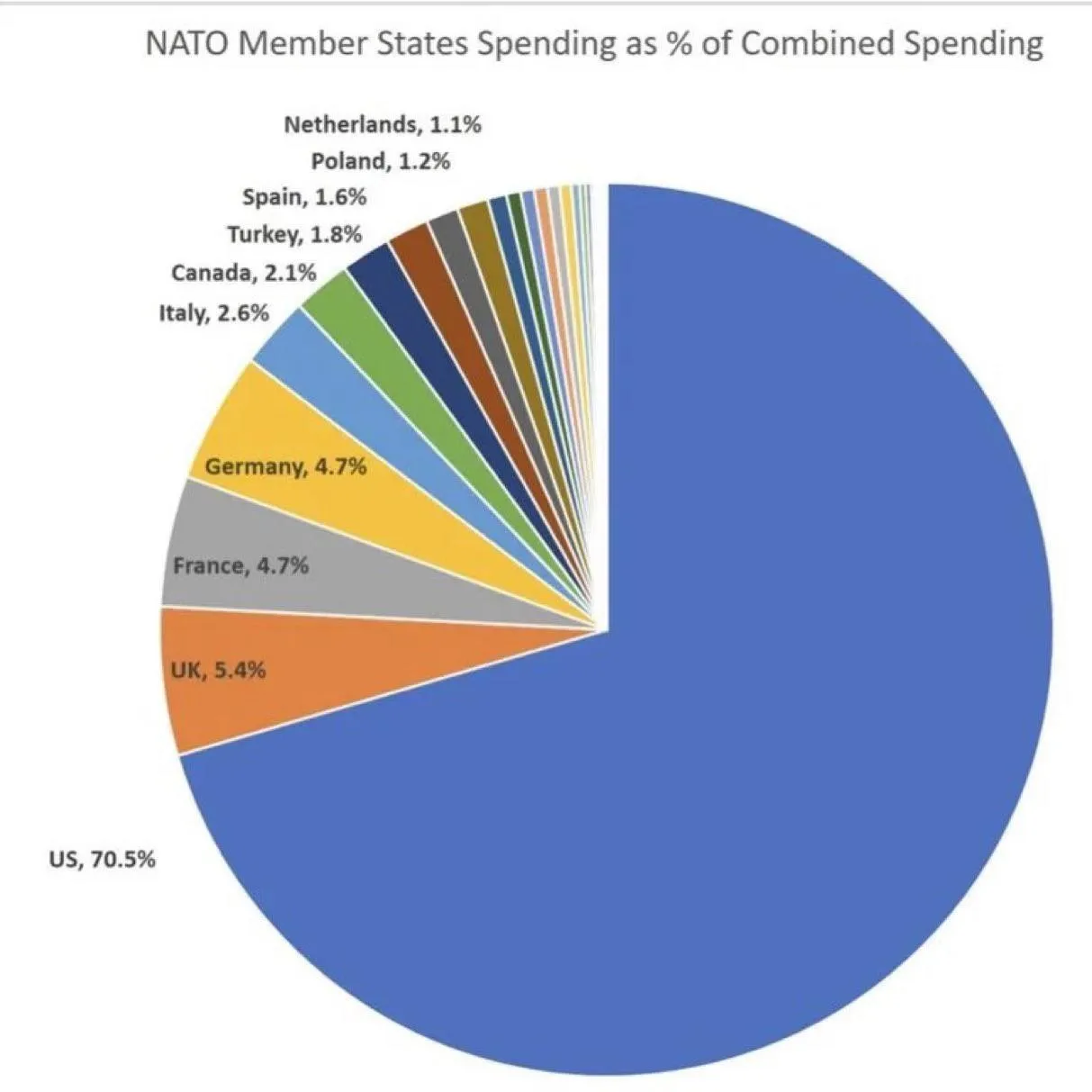

Now fast forward once more to…this week. The US is threatening to leave NATO and abandon the proxy war in Ukraine. And Europe, after decades of sheltering under the umbrella of US military subsidies …

…faces the prospect of providing for its own defense. And instead of scaling back its ambitions — for instance, by working for peace in Ukraine — Europe has decided on a military build-up, debt and inflation be damned:

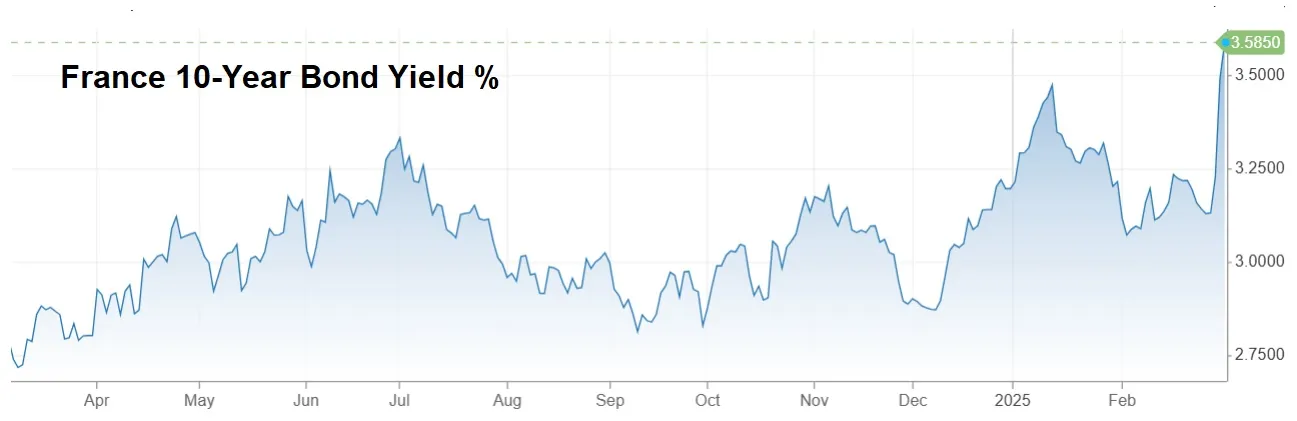

French economy minister floats taxing the rich to fund military buildup

Germany needs military service to deter Russia, top general insists

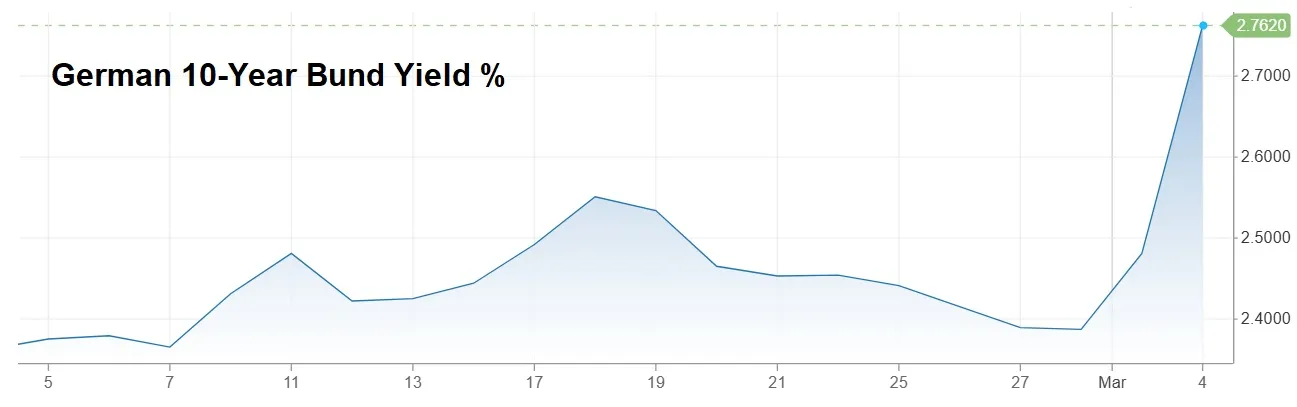

Germany moves to overhaul debt rules to unleash major defense spending

Just One Problem

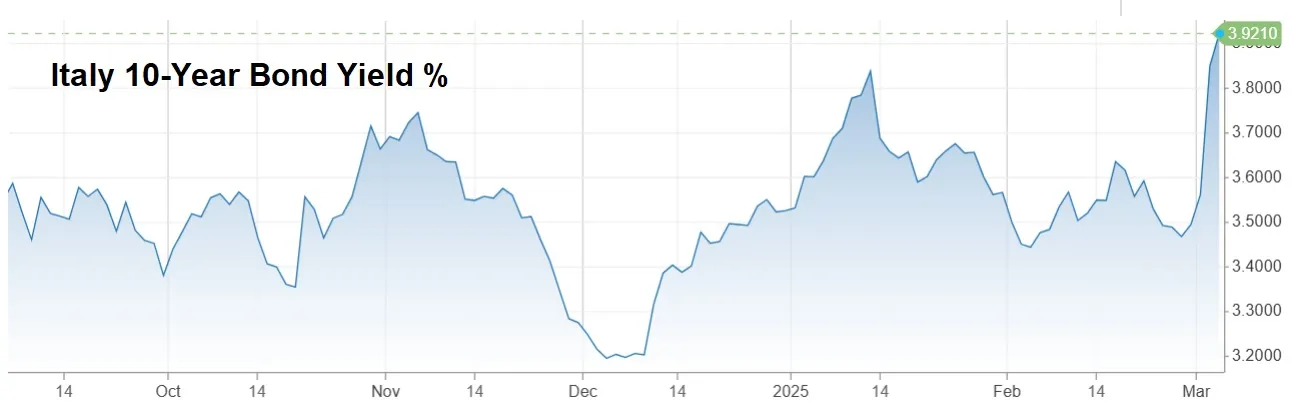

If Germany is both deindustrializing and militarizing, it will be spending wealth it isn’t creating, and will have to borrow a growing part of future budgets. Not only will its bonds no longer be rock-solid triple-A paper, but Italian and Greek bonds will be, gasp, obligations of Italy and Greece. Rational investors understand the implications of this change, and are demanding higher interest rates, not just from Germany…

…but also France and Italy:

Is The Euro Doomed?

Combine widening fiscal deficits with rising bond yields, and eurozone countries will (like the US) face soaring interest costs, which they have to borrow to cover. That’s another way of saying the euro enters the death spiral that is the fate of all fiat currencies.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino March 6th, 2025

Posted In: John Rubino Substack

Next: The JFK Files Released »