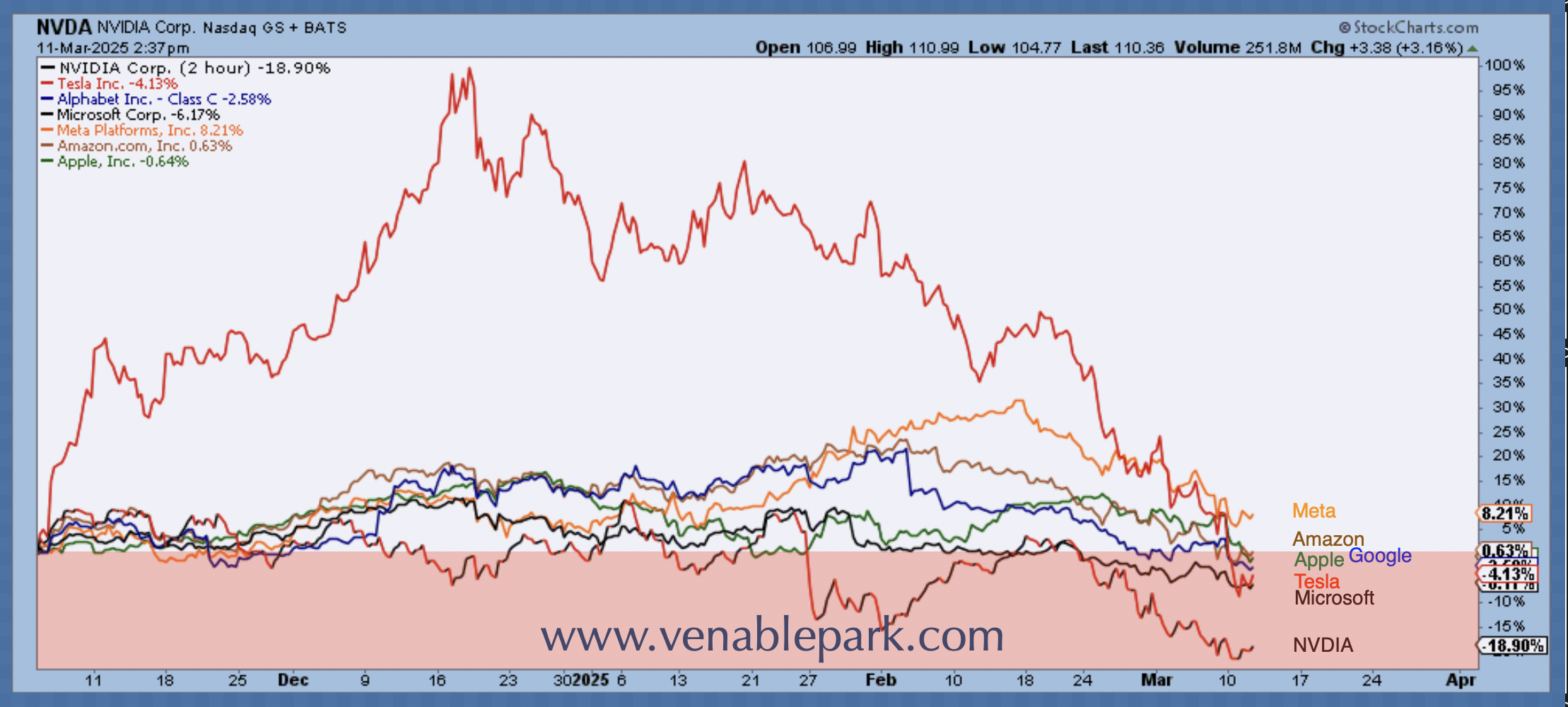

And, it’s gone…the widely owned Magnificient 7 stocks (Apple, Microsoft, Nvidia, Amazon, Meta, Alphabet A, and Alphabet C), down a collective 20% from recent highs, have given back their Trumphoria election gains (see pink bank below, courtesy of my partner Cory Venable).

The downdraft to date is Apple -15%, Microsoft -19%, Nvidia -27%, Amazon -20%, Meta -19.6%, and Alphabet -20%. Tesla, down 53% since December 18, has retreated to the 12th most expensive S&P 500 constituent.

So far, the group still accounts for an oversized 28.9% of the S&P 500’s market capitalization, and there’s a lot of downside room before prices retest the late 2022 cycle low (see red band below). This is especially true for A.I. mania leaders, Nvidia (in black) and Meta (in orange).

The U.S. dollar index has also round-tripped, with the DXY index returning to the same level as before Trump’s election.

The Euro has rebounded 5.5% against the greenback, while the commodity and recession-sensitive Canadian dollar has dropped 7.2% since last September.

Promising prosperity is easier than delivering it, and pain has not been restricted to tech shares alone. Most risk assets have slumped along with Trump’s approval rating.

The economically sensitive Russell 2000 index of small-cap companies -17% since November—is back to the same price level as December 2020, more than four years ago.

As usual, dividend-paying stocks and corporate debt are proving to be poor bear market shelters, with prices falling broadly. Cash and Treasuries have gained, while gold prices have flatlined so far.

This is not the change that bag-holders most would-be investors had in mind. The latest AAII sentiment survey found that 60% of respondents feel suddenly bearish. Small business sentiment soared into December but has been retreating since.

Extremes have a way of cutting both ways; it’s called mean reversion. Nothing moves in straight lines, but the spectacular speculative episode of the 2020-2024 period has a lot of giveback yet to go.