March 21, 2025 | Chinese Automaker BYD is Taking Over Tesla

Chinese automaker BYD is flooding the world outside of North America with new, inexpensive models both hybrid and all-electric.

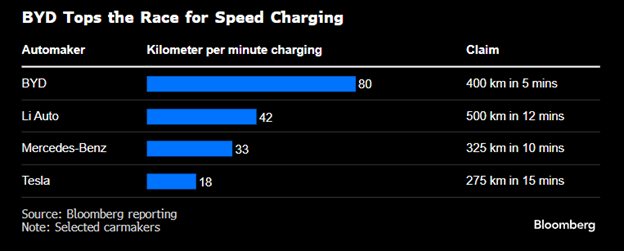

And the latest announcement from BYD of an all-electric vehicle that can add 400 kilometers of range in five minutes is sending shock waves throughout the automotive world.

Will these new models allow BYD to take over the number one position from Tesla?

Tesla is the undisputed leader in the world in all-electric vehicles, but that lead might be erased soon. And the competition will come from China, not Detroit.

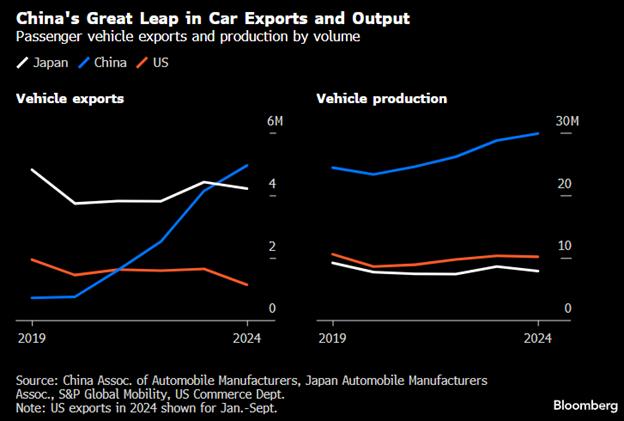

China’s total production will reach 30 million vehicles this year, with about 5 million exported. About 50 percent of the value of these exports is electric.

It is becoming clear that the future of car production is electric, and the Chinese automakers are in second place after Tesla and gaining rapidly.

BYD leads outside of North America and Europe, surpassing Tesla although BYD’s total includes hybrids while Tesla sells only all-electric vehicles. Both companies produced 1.8 million vehicles with electric drive in 2024.

But the race has become even more interesting. BYD announced a breakthrough in rapid charging, with two models that can take on 400 kms of range in just five minutes.

The fastest charge that Tesla can do currently is about 250km in fifteen minutes, but only some of their terminals and models can do that. Tesla has a much larger charging system with 65,000 terminals and 7,000 stations worldwide. There are 2,800 stations in each of North America and Asia-Pacific, and 1,300 in Europe. Tesla plans to increase charging power to 500 kW soon at most of these stations.

Electric vehicle competition in China is fierce, and Tesla’s share was slipping there as newer and cheaper Chinese models appeared, even before BYD’s announcement.

BYD’s new system, called Super e-Platform, features flash charging batteries, a 30,000 RPM motor and new silicon carbide power chips. Initially the system will only be available in China on two models, the Han L and Tang L, beginning in April. The cost of these new models is about 270,000-280,000 yuan or about US$37,000.

These charging speeds are impressive:

A limitation on fast charging is heat management. As the battery charges heat is created and the charging rate must slow to allow heat to dissipate. BYD claims to have a new “liquid-cooled megawatt flash charging terminal system”.

BYD is building 4,000 charging stations in China that can charge at this fast rate. But the new BYD models will not sell well until an extensive fast charging network is built as they are more expensive. BYD’s share price soared on this announcement, lifting its market value to $162 billion, more than Ford, GM and Volkswagen combined.

Tesla shares continued to slide, due to this news and the anti-Elon Musk sentiment that is growing steadily. Tesla is down 44 percent year-to-date (and about 50 percent from last year’s peak) although its market cap still exceeds US$700 billion.

Musk owns 13 percent of Tesla.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth March 21st, 2025

Posted In: Hilliard's Weekend Notebook