February 21, 2025 | Wild Times in Precious Metals

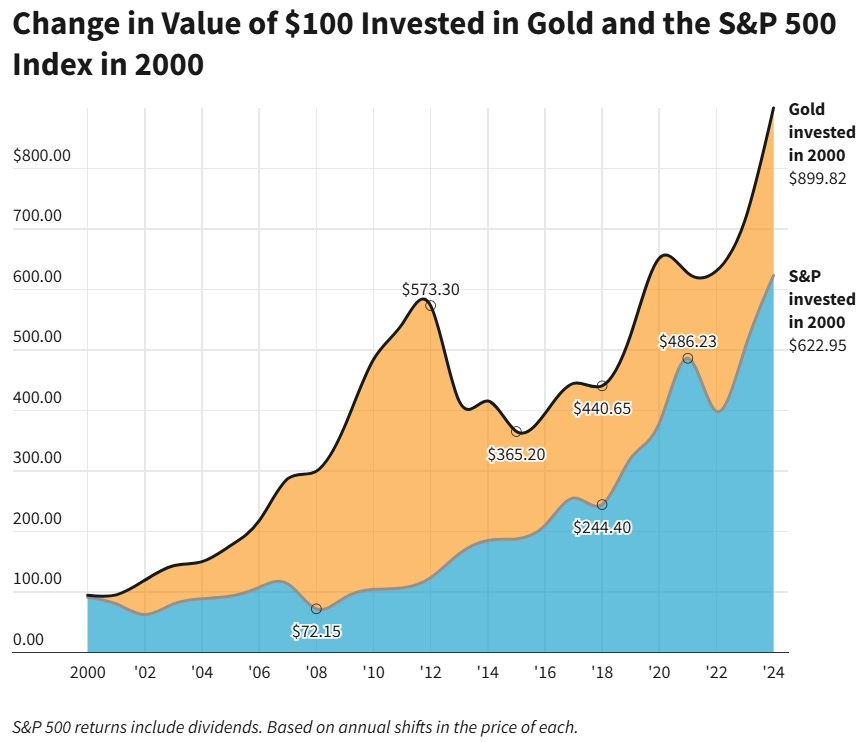

Since the start of this century, gold has outperformed stocks — despite stocks being in an epic bull market:

You’d think that gold would have gotten more attention after such an impressive run. But until recently, this has remained a largely neglected asset class.

But Now…Damn

In just the past few weeks, the news surrounding gold has gotten both strange and frantic. Here are a few of the events/trends that are making gold interesting for the generalist investor masses.

Gold’s market cap hits $20 trillion

This year alone, it’s up by $5 trillion, or five times the entire market cap of bitcoin.

Gold pours out of London, into New York

From Mining.com: The amount of gold stored in London vaults fell by 4.9 million troy ounces in January, the largest monthly decline since records began in 2016, as traders rushed to ship the precious metal to the US to avoid tariff risks and capture premium prices.

From CNN: All existing slots at the Bank of England to withdraw gold bars are booked up as market players race to ship the metal to the United States to take advantage of a surge in gold prices there, an official has said. Gold has become more valuable in the US than in other parts of the world as traders worry supply will plunge if Trump’s across-the-board tariffs, both announced and planned, make imports of the metal costlier.

Mints start adding surcharges

On February 20, major mint Argor-Heraeus imposed a “temporary extra fee” on minted gold and silver. The surcharge is USD 3.50/oz for minted gold and a massive USD 3/oz or 9.23% for minted silver. According to BullionStar, “This is on the wholesale level and is on top of normal premiums and minting charges. The LBMA spot price can no longer be said to represent the price of physical metal.”

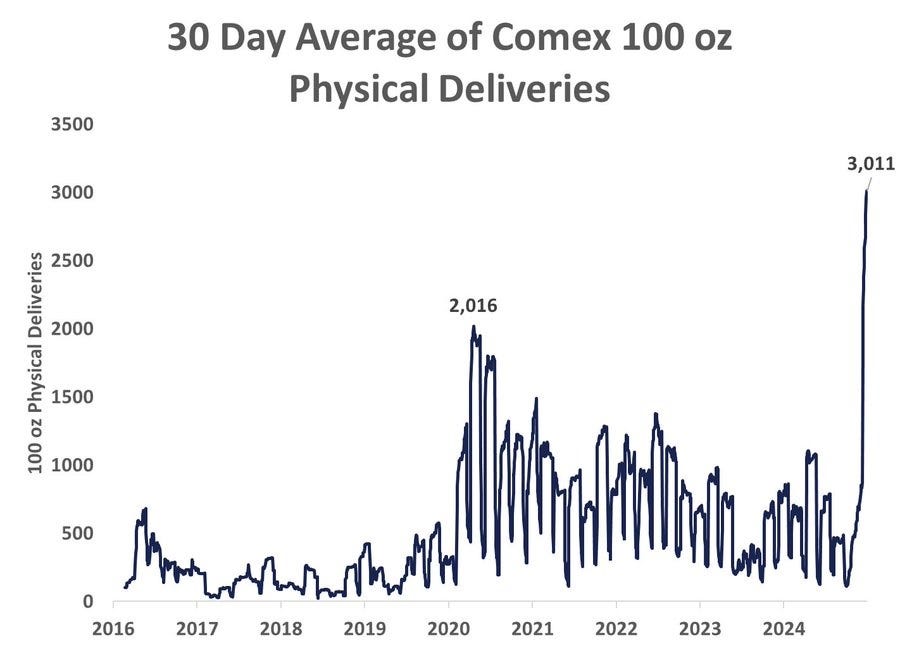

Comex gold deliveries spike, as futures contract holders demand physical metal:

The US discusses “gold revaluation”

The US claims to have a lot of gold, which it values at $42/oz. Now, Trump administration officials are floating the idea of marking this gold to market, in theory strengthening the government’s balance sheet and enabling it to borrow more money.

Doge to audit Ft. Knox

From Forbes Magazine: “Elon Musk, the world’s richest man and head of the powerful Department of Government Efficiency (DOGE), and President Donald Trump elevated decades-old conspiracies about the state of the U.S. government’s gold reserve at Fort Knox this week, as Trump vowed to take a rare look inside the tightly guarded facility.”

US considers backing Treasury bonds with gold

From USA Gold: One of the key proposals discussed is the issuance of 50-year treasuries backed by gold, an idea championed by economist Judy Shelton, a prominent Trump supporter. Shelton has suggested the possibility of issuing these treasuries on July 4, 2026, the 250th anniversary of the United States. “This could be a way to incentivize demand for our treasury market, which has been waning,” he noted.

Conclusion

Some of the above is important and some isn’t. Right now it’s hard to say which is which. But what definitely matters is the amount of gold-related news that’s being generated. Lots of people suddenly care about this metal for lots of different reasons. The more they care, the more they learn. And the more they learn, the more sound money they’ll want to own.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino February 21st, 2025

Posted In: John Rubino Substack

Next: DOGE vs Corrupt Media »