February 20, 2025 | Why Timing Matters For Short Selling

Betting against overvalued stocks can be insanely profitable — if you use put options and get the timing right. But those are big “ifs”. Here’s a cautionary tale.

Back in May of 2023, when this newsletter was new and its recommended Portfolios needed fleshing out, I named the homebuilder stocks as excellent short candidates. Home prices were too high, mortgage interest rates were rising, and the overall stock market looked ready to hit a wall. So housing was a dead business walking.

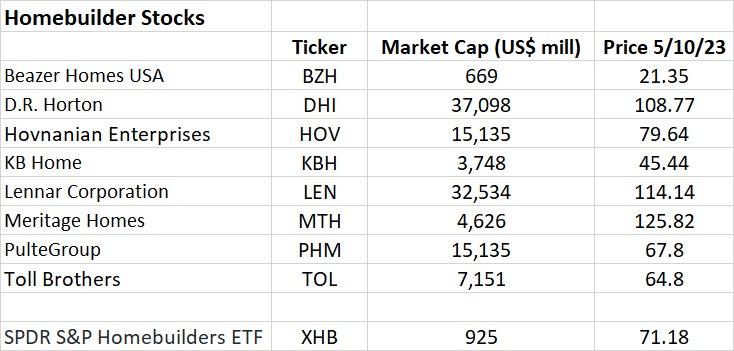

I provided the following list of homebuilder stocks, along with a sector ETF, and said that betting against some or all of them with long-dated put options might pay off in the ensuing couple of years.

Good Idea, Unfortunate Timing

Sadly, the housing market — and markets in general — were a little more resilient than they seemed. New home sales held up, homebuilder profits remained robust, and their stocks marched higher for the next 18 months. Below is Lennar, a big homebuilder with a representative stock from the May 10, 2023 recommendation date (at $114 per share) until I capitulated and removed the short recommendation at around $170.

Then — almost immediately — the short thesis started to work. The incentives homebuilders had to offer to induce people to buy their ridiculously unaffordable houses started eating into profits, and their stocks started falling. Lennar is down by about 40 points since I threw in the towel.

The Lesson?

Shorting, especially with put options that eventually expire worthless if not sold, requires the short seller to be both right and timely. This is vastly harder than it looks.

But…it’s still worth doing. Put options have two functions: First, they provide a cheap way to bet on an expected outcome, and, depending on the option strike price’s relation to the underlying shares, can return big multiples of the purchase price when those shares fall. Second, they’re relatively cheap insurance against your long positions going down instead of up. Put those two benefits together, and a case can be made for always allocating 5%-or-10% of one’s capital to long-dated puts on either broad market averages or objectively overvalued stocks.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino February 20th, 2025

Posted In: John Rubino Substack