February 23, 2025 | Who’s Telling the Truth about DeepSeek?

I’m tracking Nvidia shares closely because they can tell us whether China’s DeepSeek threatens America’s lead in AI development. The Nasdaq-listed stock got pummeled a month ago when the Chinese revealed they were developing an open-source chatbot that can easily compete on performance and price with the most advanced models offered by OpenAI and other U.S. developers, including Elon Musk. Investors who have bet trillions of dollars on relatively costly solutions were so spooked by the news that they batted NVDA down to $113 not long after it had traded as high as $153.

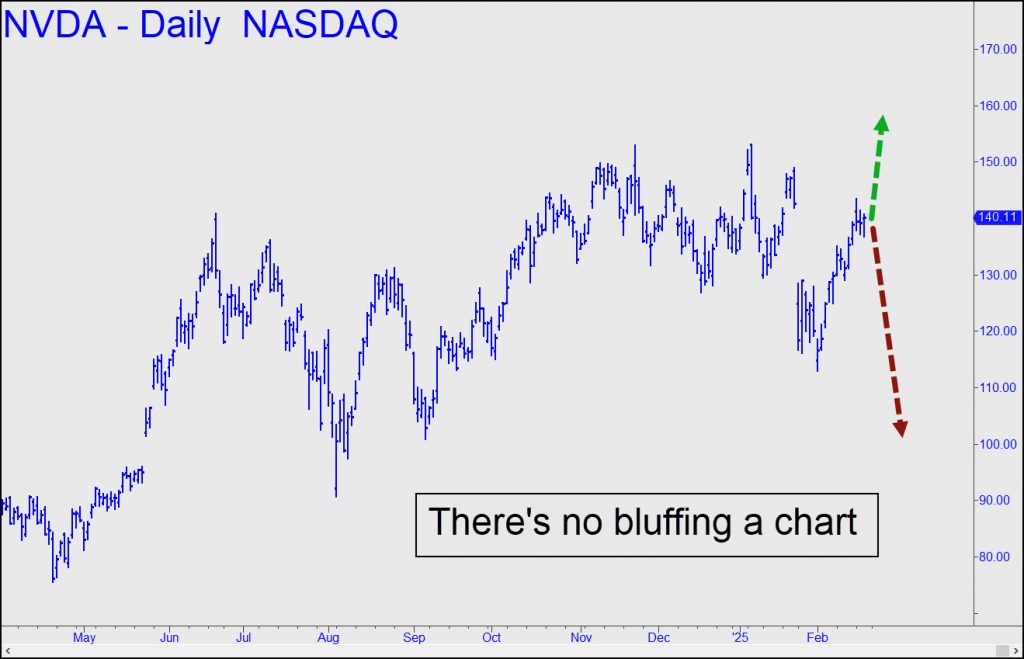

At the time, I said the stock would be an opportune short sale if it bounced from $113 to $140. It did so last week, hitting a recovery high of $143, but I’m no longer so enthusiastic about betting against the stock. It is the chart that has changed my mind, not the aggressive attack on DeepSeek by investors, analysts, pundits and scientists. They said China had spent considerably more developing the technology than they were acknowledging and that its smarts were extracted from Nivida chips the Chinese had purchased despite a U.S. embargo prohibiting them from getting their oft-thieving hands on certain high-tech hardware.

Eating America’s Lunch

So, who’s lying? I doubt we’ll get a straight answer from the news media since they rarely face the challenge of reporting on developments that seem to upset the status quo. The question remains crucially important nonetheless, since there are literally trillions of dollars of bets and side-bets on the relatively capital-intensive, proprietary approach that American-based companies have taken toward AI development. NVDA’s stock chart is probably as good an answer as we’ll get, since a graph cannot lie. In that regard, a move to new all-time highs above $153 would imply that America’s edge in technology is safe, at least for now, along with the trillions of dollars in investment capital the AI story attracted. If the stock instead falls to my original downside target at $103, that would imply even lower prices are coming, presumably as Chinese developers eat America’s lunch with a cheaper, more powerful AI solution.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Rick Ackerman February 23rd, 2025

Posted In: Rick's Picks