February 28, 2025 | Trump is Wrong To Impose Tariffs on Canada

Tiff Macklem, Governor of the Bank of Canada, outlined the likely economic impact of new U.S. tariffs on Canadian exports announced by President Trump. These 25 percent tariffs on most Canadian goods are expected on March 4. Canadian energy and electricity would incur tariffs of 10 percent.

How much economic degradation is coming? Is Trump wrong to believe in tariffs?

Macklem said, “If US tariffs play out as threatened, the economic impact would be severe. A protracted trade conflict would sharply reduce exports and investment. It will cost jobs and boost inflation in the next few years and lower our standard of living in the long run.”

Tariffs, structural change and monetary policy – Bank of Canada.

Demand for Canadian goods in the U.S. would drop as they would be more expensive to the U.S. consumer. Layoffs in Canadian export industries would be widespread and household incomes would drop. The Canadian dollar would decline, making imported goods more expensive and elevating inflation. This makes it difficult for the Bank of Canada to lower interest rates when there is a recession.

Macklem continued, “Central banks don’t have much leverage during a trade war and monetary policy can’t respond to both lower growth and higher inflation at the same time.”

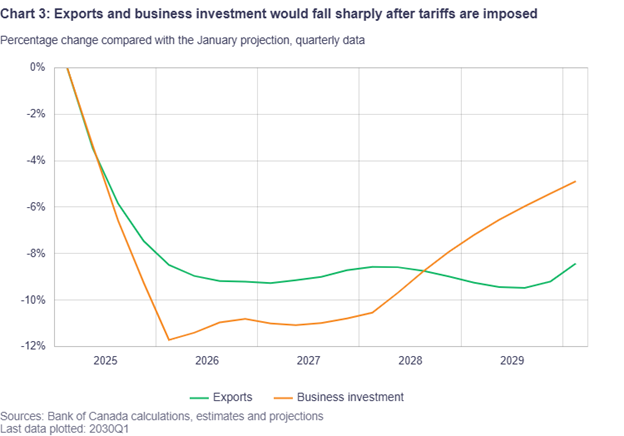

Here is one Bank of Canada projection for the impact of tariffs:

So, a trade war with the U.S. will be a substantial hit to the Canadian economy for the next several years and perhaps longer.

But President Trump’s view is that tariffs can generate massive new revenues for the U.S. government and that revenue could eventually replace income tax.

To bolster this view, President Trump has cited Republican Wiliam McKinley (U.S. President 1897-1901). Trump said that “McKinley made this country rich”. In McKinley’s time tariffs accounted for about ½ of the government’s revenue as there was no income tax then. But McKinley backed away from tariffs shortly before he was shot by an anarchist, saying “Commercial wars are unprofitable.” McKinley came to realize that all nations must prosper from trade, not just the U.S.

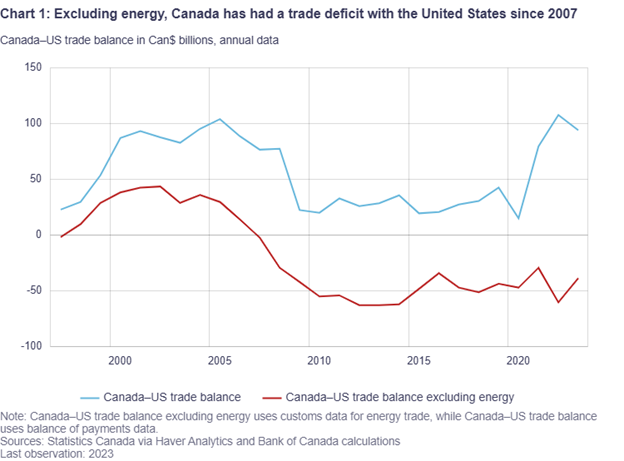

Trump’s most serious criticism about Canada centres on U.S. trade deficits. But this complaint is unjustified when all the facts are reviewed carefully.

Only the export of 4.2 million barrels a day of crude oil to U.S. refineries puts the U.S. into a trade deficit. For more than fifteen years, excluding oil exports, the U.S. has enjoyed a trade surplus with Canada.

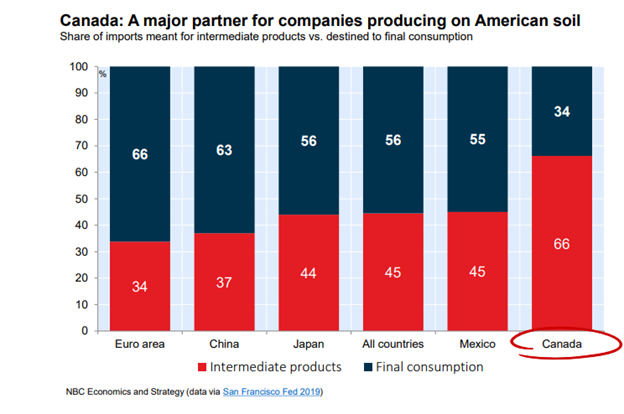

About 66 percent of Canada’s exports to the U.S. are intermediate goods which are used to bolster the sales of U.S. companies. This makes most Canadian exporters partners with these U.S. manufacturers:

The U.S. refiners and manufacturers that benefit from these imports must be telling Trump about the nuances of trade. But he isn’t listening.

Trump is wrong to say that the U.S. is subsidizing Canada by running a trade deficit. Trade benefits both countries.

Unfortunately, facts might not deter Trump from imposing tariffs that will cause significant pain to Canadians.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth February 28th, 2025

Posted In: Hilliard's Weekend Notebook