February 22, 2025 | Trading Desk Notes for February 22, 2025

Current positioning:

My short-term trading account is short the S&P, long T-Notes, and long Yen.

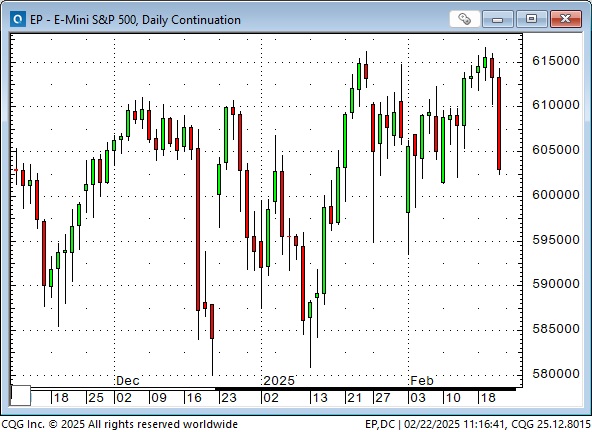

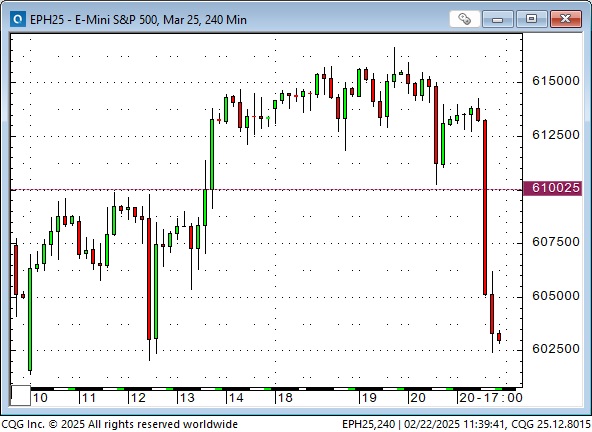

S&P futures traded at record highs on Wednesday but fell ~2.25% to Friday’s lows

Friday’s break was the most significant drop since December 18, when the Fed cut 25 bps but hinted it was unlikely to cut again soon. Since then, “Buy The Dip” has been a profitable strategy – until now.

The S&P drifted sideways to slightly higher from February 14 to February 20 but broke hard on the February 20 opening. Support levels at ~6100 held, and the market returned to the sideways range. However, prices broke again on the February 21 opening, and once the 6100 support level cracked, the market fell hard and closed this week on the lows.

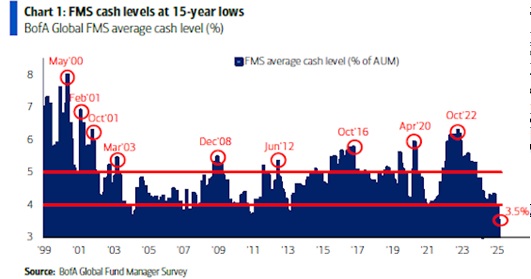

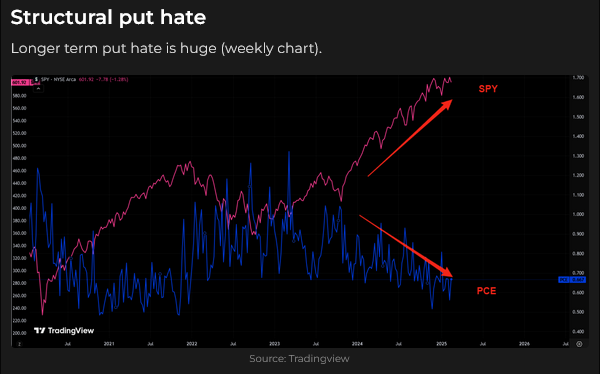

Equity market sentiment and positioning have become very bullish since Trump’s election, but the market is overdue for a correction. US stocks have trended higher since the election – the S&P rose ~ 7% to all-time highs in mid-February but have declined recently due to uncertainty around Trump’s dramatic policy changes. Budget debates ahead of the mid-March debt ceiling may add to uncertainty.

Some popular “high-flying” markets fell away from their highs mid-week, perhaps setting the stage for the S&P’s tumble on Friday.

European stocks have been “sizzling” YTD but broke hard on Wednesday.

CAT has had a “recessionary vibe” since January.

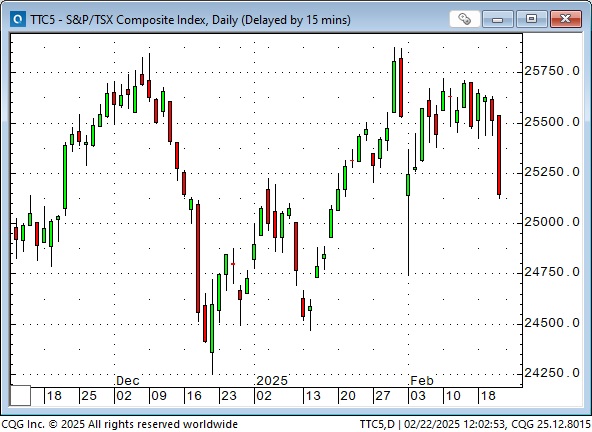

The Toronto Composite reached record highs at the end of January, broke hard on the February 3 tariff news, and then rallied back to make “lower highs” last week but broke hard on Friday.

Chinese stocks, particularly Chinese tech, are dancing to a different drummer.

The Russell 2000 index hit record highs in late November on the “Trump Bump,” but this week’s close looks ominous.

The Big Question is, “What happens on Monday?”

Sentiment and positioning seem to imply that traders/investors are “all in” on bets that “stocks only go up” and “dips” are buying opportunities. (If massive government spending under Biden contributed to the stock market rally, will massive cuts in government spending under Trump lead to a weaker stock market?) As noted above, I’m short the S&P, and if the market opens weak on Monday, especially if it breaks below 6000, I expect to see more selling. If the market rallies through 6100, I’ll cover my shorts.

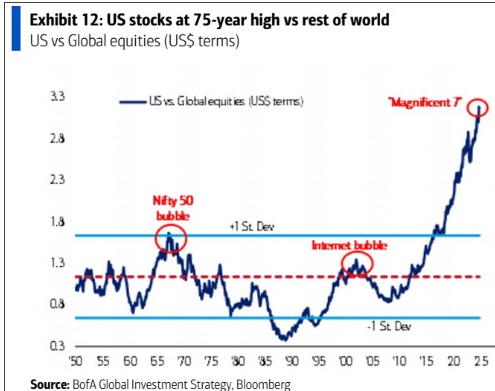

Is American exceptionalism peaking – after a multi-year run?

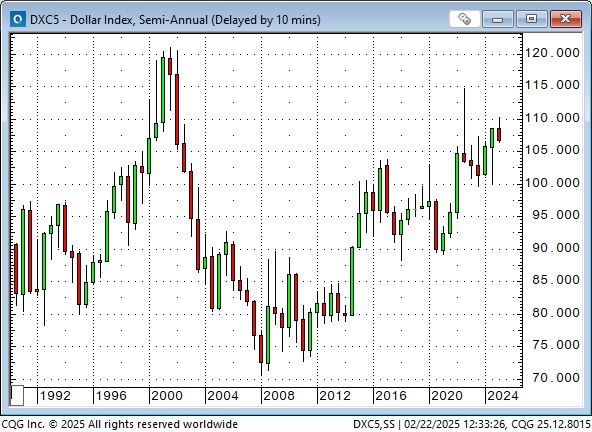

My Macro view is that (years of) capital flowing to the USA for safety and opportunity helped create American Exceptionalism – which meant a strong US Dollar and US stock markets outperforming the Rest Of The World. American Exceptionalism may have peaked in January (along with Trump’s approval rating and ability to get what he wants) as the US Dollar Index (aside from a few weeks in 2022) hit 23-year highs and reversed lower.

The (DXY) US Dollar index is heavily weighted with European currencies and is down ~4% from its 23-year high in January.

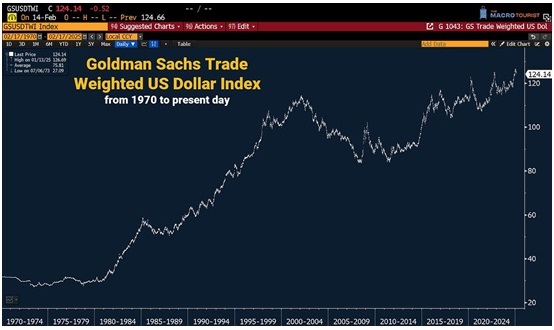

This chart shows the Goldman Sachs trade-weighted US Dollar Index at all-time highs from 1970 to 2025. (Asian currencies are more heavily weighted in this index and have been grossly undervalued due to mercantilist trade policies.)

The Japanese Yen

The Yen hit record highs in 2012, and President Abe instituted his “Three Arrows” program to revive the weak Japanese economy. By July 2024, the Yen had fallen ~50% to 35-year lows. To stay competitive with Japan, other Asian currencies trended lower with the Yen.

The Yen rallied ~15% from the July 2024 lows following massive FX intervention by the Japanese authorities (which triggered the covering of massive speculative short Yen positions.)

The Yen fell from September 2024 to the end of the year as the US Dollar soared against all currencies, with about half of that USD rally coming after Trump’s election victory (blue ellipse.) As the US Dollar Index fell back from its January highs, the Yen rallied ~5% against the USD and also ~5% against the Euro.

The Yen has been the strongest of the leading currencies YTD, with traders perhaps expecting Trump to attack the Asian mercantilist trade policies that have created massive trade surpluses with the USA. American trade deficits are an unintended consequence of the strong US Dollar.

COT data as of February 18 show that speculators are net long the Yen, but their position size is a fraction of the net short position size they maintained in the spring/summer of 2024 when the Yen was plumbing multi-year lows.)

The Japanese 10-year bond yield is at 15-year highs.

Bonds

US 10-year TNotes have rallied YTD (closing higher for six consecutive weeks) in harmony with the rising Yen and in contrast to the falling USD. (Note that the USD soared as bond yields soared from September to December 2024.)

Bonds were bid the last three days on softer economic data but also as US stocks were weaker. The Big Story last fall that drove bond prices down was the expectation that never-ending record government deficits would mean a tsunami of Treasury paper. Is the market now starting to believe that those fears were overdone and that the Trump administration will reduce government deficits? I bought TNotes last week, hedged the trade after the Notes rallied by writing OTC calls, covered the trade for good gains on Monday and put it back on Thursday.

Gold

Comex gold futures have closed higher for eight consecutive weeks, rising ~$340 (~13%) to a record high (basis April) weekly close of ~$2,950. Gold is up ~$ 900 (~45%) from year-ago levels. It continues to outperform gold stocks and silver. Central banks have been the big gold buyers, and they want physical bullion, not stocks, not silver. Gold is at record highs against all major currencies.

The last time gold significantly declined (~$250) from record highs was from the end of October to mid-November 2024. The GDX foreshadowed that decline by about a week. Are the weak recent GDX prices foreshadowing another correction in the gold market?

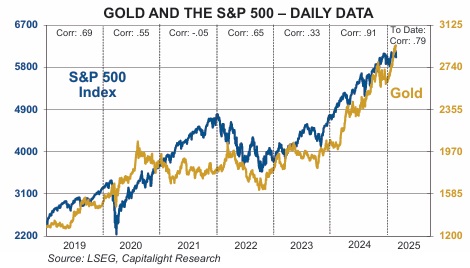

Gold and the S&P have had a tight correlation. If the S&P has a correction from its recent highs, I suspect that could lead to a correction in gold. Central banks have been the big gold buyers, and they have a very long time horizon, but speculators who have been “piggybacking” on the central bank buying have a shorter time horizon and may be quick to take profits if gold turns lower. I have no position in gold (I shorted it a couple of times last week but was quickly stopped), but I could easily get short again if I sense speculators are bailing out. (The decline in gold open interest the last four weeks may also foreshadow a turn.) This chart is courtesy of the Gold Monitor.

On my radar

Stock indices had a pretty hard down day on Friday and closed on their lows for the week. That could set up more selling on Monday, and if Monday is a down day, that could draw in more sellers. But the trend has been higher for months, and dip buyers have been rewarded, so if the market rallies on Monday, the shorts will have to scramble. NVDA reports on February 26.

Federal election in Germany Sunday, February 23.

There is a possibility that stagflation is ahead, and stocks don’t like stagflation.

Trump has been on a roll so far, but that may change at some point, and the debt limit debate may lead to a US Government shutdown after mid-March.

Quote of the week

“They say that patriotism is the last refuge to which a scoundrel clings. Steal a little, and they put you in jail. Steal a lot, and they make you King.” From Bob Dylan’s song Sweetheart Like You, on the 1983 Infidels album.

The Barney report

Barney always gets some toast when I’m having coffee and toast in the morning. I decided we needed a container of dog treats on the desk, and I found this unique pottery bowl with a lid. Barney knows precisely what’s in there and is not shy about telling me when he’s dying of starvation. I now have claw marks on my trading desk.

Listen to Mike Campbell and me discussing markets on the weekly Moneytalks show

On this morning’s show, Mike and I discussed what I think might be a significant turn—a mean reversion—in the US Dollar and the US stock market as the multi-year era of American Exceptionalism ends. We discussed how I develop a macro view of markets but use charts for market timing. We also talked about gold. You can listen to the entire show here. My 8-minute spot with Mike starts around the 56.5-minute mark.

The Archive

Readers can access weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything!

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair February 22nd, 2025

Posted In: Victor Adair Blog