February 17, 2025 | Trading Desk Notes for February 17, 2025

Back in the saddle again

An apology: I have been unable to post the Trading Desk Notes for the past two days due to a frustrating firewall problem. I’m grateful that my tech guys were able to fix it, but it serves as a reminder that things can go haywire in our digital world!

I have done relatively little trading since Trump’s election on November 5, especially since he became President on January 20. I sensed that markets would take a while to “adjust” to the new environment, so I decided to be patient and watch the price action. I make money by managing risks, not by having a great crystal ball, and I had little faith in my ability to predict what Trump would do and how markets would react.

Trump has been a “disruptor” with Gaza, Ukraine, DOGE, tariffs, cabinet nominations, the 51st state, Greenland/Panama and many other issues. Still, I sensed that markets were “getting used to” Trump, so I stepped up my trading last week.

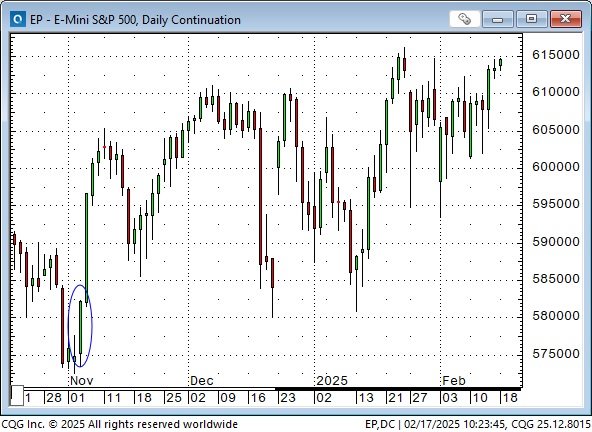

Equities

The S&P has had several dramatic price swings since the election (blue ellipse), but the market has trended higher, with dips seen as buying opportunities. The magnitude of the swings has diminished as prices approach all-time highs (or as the market becomes “used to” Trump).

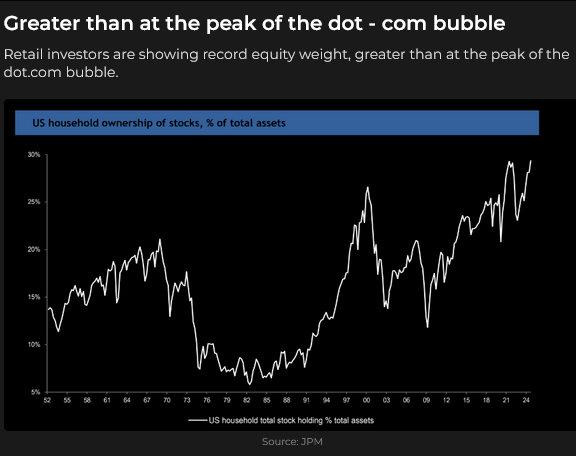

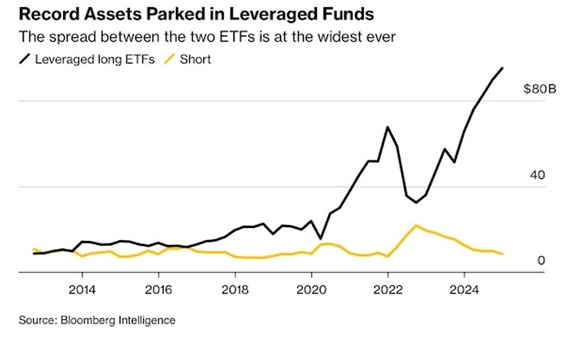

Investors, especially retail investors, appear enthusiastic about the prospects of new highs.

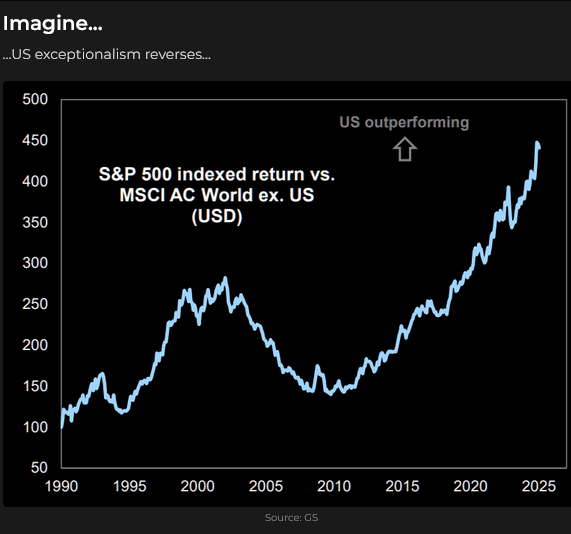

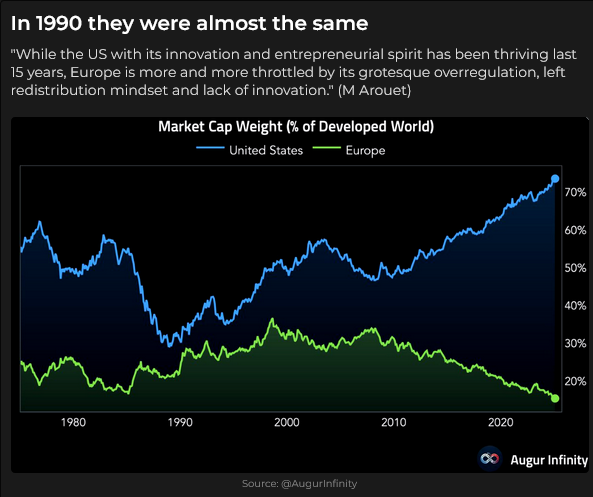

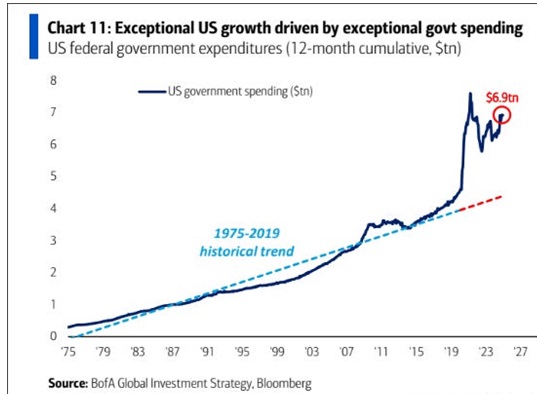

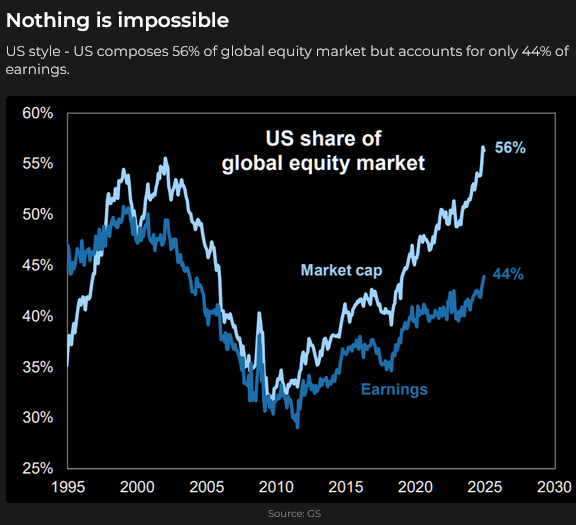

In previous Trading Desk Notes, I’ve illustrated “American exceptionalism,” noting that US equity markets have significantly outperformed the rest of the world and that the US Dollar has soared to (effectively) 23-year highs as capital flows to America for safety and opportunity.

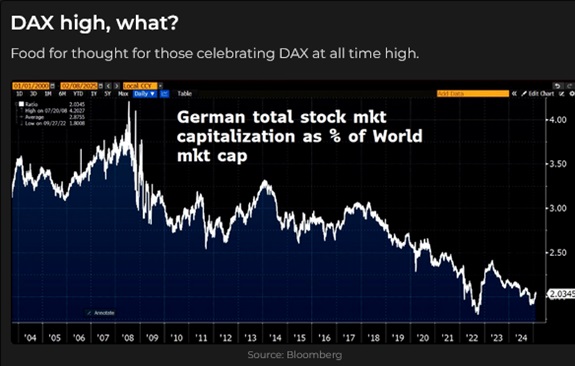

Some analysts believe that “American exceptionalism” will continue and accelerate now that Trump is President. However, YTD, European stock indices (led by defence stocks) have outperformed the S&P, with the Pan-European Euro Stoxx 50 index soaring to record highs (while the mainstream media continues to paint the Eurozone as an economic and political basketcase.)

Higher earnings multiples enhance the American outperformance in terms of global market cap.

The German DAX hit record highs this week, but the DAX barely registers as a percentage of the world’s total market cap.

Chinese tech stocks have soared since DeepSeek shocked the AI world.

But from a 5-year perspective, American exceptionalism is clear. (NAZ is purple; the Hang Sang Tech index is gold.)

Currencies

The US Dollar Index (outside of a few weeks in late 2022) hit 23-year highs in January but has fallen ~3% since then.

The Euro (the Anti-dollar) hit 23-year lows in January (outside of a dozen weeks in late 2022), with the net speculative short position across the currency futures market at a 10-year high – speculators were extremely negative foreign currencies against the USD. There is an important Federal election scheduled for February 23 in Germany.

The Canadian Dollar briefly spiked to a 23-year low (~6770) on Monday, February 3, following Trump’s weekend announcement of 25% tariffs against Canada and Mexico. The CAD rallied from those lows as Trump “paused” the tariffs on Monday following negotiations about border security with Canada and Mexico.

Currency futures speculators built a historically massive net short position against the CAD since September and (as of February 11 COT data) have reduced that position by ~15% as the CAD rallied back from the “worst possible” tariff news. The subsequent Trump tariffs on aluminum and steel imports had minimal impact on the CAD. The ~3-cent month-to-date rally in the CAD is the biggest monthly rally in eight years. Will the CAD shorts start to throw in the towel? If the USD weakens against most currencies, the CAD will rally. Markets are pricing a 50/50 possibility of a cut by the Bank of Canada at their March 12 meeting. At the 2-year tenor, Canadian rates are ~150 bps below US rates.

Gold

Comex gold futures hit all-time highs last week (with April at ~$2,968) and have closed higher for seven consecutive weeks, up ~$300 (11%) since the end of 2024. Some analysts expect the US Treasury to “revalue” its gold holdings from the 1973 level of ~$42 per ounce to enhance the asset side of its balance sheet. There is also speculation that the DOGE may “audit” American gold holdings. The last comprehensive audit appears to have been in 1953.

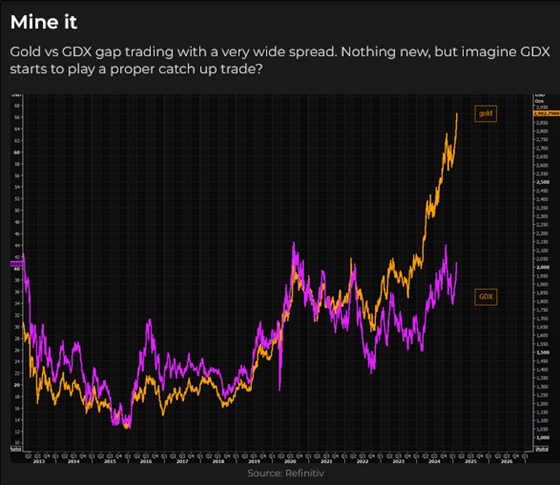

Shares of gold mining companies continue to lag behind bullion gains, but gold producers’ profit margins are rising as gold prices rise faster than operating costs.

Energy

WTI rallied ~$10 from late December to mid-January but gave back all those gains over the next four weeks. If the Ukraine war ends, will energy prices fall if the “friction” (Doomberg’s term) of moving crude from supply points to demand points is reduced, thus lowering the price? OPEC+ has kept production off the market to keep prices higher—will they start selling more? Saudi Arabia needs more money to maintain “social harmony.” Will Trump sanction Iran and Venezuela?

I recommend that readers interested in the energy markets subscribe to Joseph Schachter’s free weekly Eye on Energy report.

My short-term trading

As noted above, I did relatively little trading in the last six weeks of 2024 and January 2025 as I “tried to get a read” on how the market reacted to Trump.

I caught two good breakdowns in the S&P in December and gave most of those gains back when my CAD calls expired worthless in early February.

I had a good short S&P trade at the end of January and frittered half of those gains away in early February.

I lost a little money shorting gold over the last two weeks, trying to catch the $70 break that happened on Friday.

Last Wednesday, after stocks, bonds, and currencies fell following the stronger-than-expected CPI, I bought the S&P, the 10-year Note, the Euro, and the CAD. On Friday, I covered the S&P, the Euro, and the CAD for good gains and hedged the gains on the TNotes by writing short-dated OTM calls. I held that spread into the weekend. My P+L had its best week since November.

I feel like I’m back in the saddle.

On my radar

The US and Russia will negotiate a possible end to the Ukraine war behind closed doors in Saudi Arabia. No Europeans have been invited to join the negotiations. Historic changes are underway on several fronts. I’ll be watching market price action for trading clues rather than following “expert advice” about what will happen. Greg Vallerie writes that Trump could get the Nobel Peace Prize if he ends the Ukraine war.

Quote of the week

“The tape is all; the macro is nothing.” Jason Shapiro 2025

Thoughts on trading

I’ve read over 100 market books and subscribed to many market commentaries, podcasts, and videos. I’m not looking for buy/sell recommendations—I’m looking for ideas that I may be able to apply to the markets I trade. I’ve done that forever.

The “accepted wisdom” in the commodity market is that ~5% of all futures traders make money over the long term. As Peter Brandt likes to say, “It’s easy to make money trading futures, but it’s hard to keep it.”

One thing that long-term successful traders seem to have in common is that they have learned (the hard way) how to keep their winnings. They don’t blow up from overtrading, and they don’t fritter their capital away on dumb trades and flashy lifestyles. I call that risk management.

If you want to survive as a trader, I highly recommend watching this 30-minute video with Jason Shapiro and Anthony Crudele. I have massive respect for these guys. They are both successful veteran traders who have lived through wild financial and lifestyle ups and downs.

Jack Schwager published his first Market Wizards book in 1989. One of the best interviews in that book was with Bruce Kovner (you may know his famous quote: “What I am really looking for is a consensus the market is not confirming. I like to know that there are a lot of people who are going to be wrong.” All successful traders have a style of trading that suits them, and Bruce’s idea about a consensus the market is not confirming rang a bell for me. If you want a 6-minute read about Bruce Kovener, click here.

Another successful trader is Adam Mancini. He only trades the S&P; his trading is entirely technical/chart-based. Here’s a recent comment by Adam: There are no bulls and bears. There are winners and losers.

Maggie Lake does good market interviews on Substack.

The Barney report

Barney loves snow. He never looks happier than when running at full speed through it. He also loves to roll around in it and pounce on it as though he has found a prize. He’s a snow dog.

Listen to Victor talk markets with Mike Campbell

On the Saturday morning Moneytalks podcast, Mike and I discussed how markets have changed since Trump became President. I pointed out that American Exceptionalism may have peaked as European stock markets rallied on expectations of a coming resolution to the Ukraine war. This meant a lower USD and cheaper energy costs in Europe. You can listen to the show here. My 10-minute spot with Mike starts around the 48-minute mark.

The Archive

Readers can access weekly Trading Desk Notes from the past eight years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone about anything!

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair February 17th, 2025

Posted In: Victor Adair Blog