February 10, 2025 | The Discretionary Bid

Happy Monday Morning!

And just like that, tariffs are off. At least for the next 30 days, or so we are told. In other words, the direction of the Canadian economy really depends on what side of the bed President Trump wakes up on.

Remember, just last week we were facing 25% tariffs across the board, in which BMO suggested would equate to 0% GDP growth in 2025, an 8% unemployment rate, the BoC cutting rates by a quarter-point at every meeting this year, and the Loonie sinking to 64 cents.

So now what? I guess we’ll wait and see. As of right now, OIS traders are pricing in 62% odds that the Bank of Canada will cut rates on March 12th.

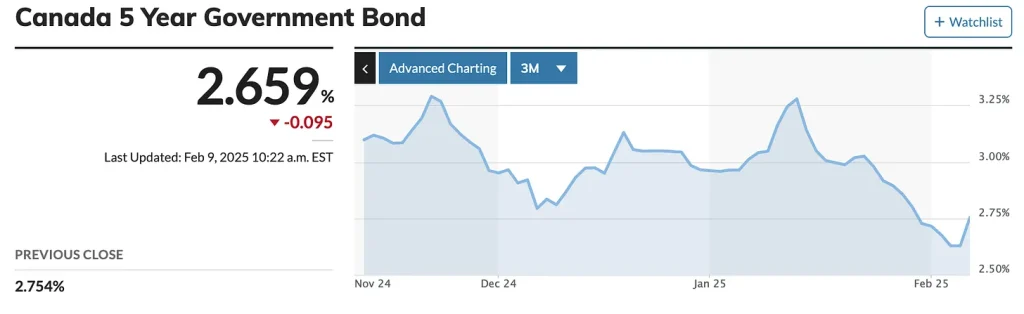

Suffice to say, economic uncertainty remains elevated. Bond yields have been all over the place bouncing up and down 70bps. If you’re one of the 60% of Canadian mortgages up for renewal over the next 24 months-step away from the screen, the volatility could give you a heart attack.

The Canada 5 year bond yield recently touched lows last seen in July 2022. We are hearing that some of the big banks will be hammering their fixed rates lower this week. For the right borrower, a 3 year fixed rate mortgage (uninsured) could be had as low as 3.99%. If you’re actively shopping, you might want to lock that in.

Sure, variable rate mortgages could move lower, but that really depends on a lot of moving pieces. The economic uncertainty is already impairing investment decisions, and keeping policy makers awake at night. Per the BoC’s Macklem this week, “President Donald Trump’s threats of new tariffs are already affecting business and household confidence, particularly in Canada and Mexico. The longer this uncertainty persists, the more it will weigh on economic activity in our countries.”

Further adding, “With a single instrument – our policy interest rate – central banks can’t lean against weaker output and higher inflation at the same time. So we will need to carefully assess the downward pressure on inflation from weaker economic activity, and weigh that against the upward pressures from higher input prices and supply chain disruptions.”

In simpler terms, if we cut too much to offset weaker growth we could push inflation higher and the currency lower, which would create even more problems.

And so the uncertainty is hitting everyone from businesses to rate shoppers, and home buyers. As we noted in last weeks letter, Tariff wars are a significant policy shock. If there’s one thing that buyers hate it’s uncertainty. This will likely push prospective purchasers to the sidelines as they attempt to digest the impacts on housing demand and prices, but also on their employment situation. It’s pretty nervewracking to make a decision on a million dollar purchase if you’re not sure you’ll have a job six months from now.

There’s good reason to believe the recent bounce in housing activity could fade. Don’t get me wrong, people will still move, families need to upsize, boomers need to downsize, but this is another nail in the coffin for the investor bid.

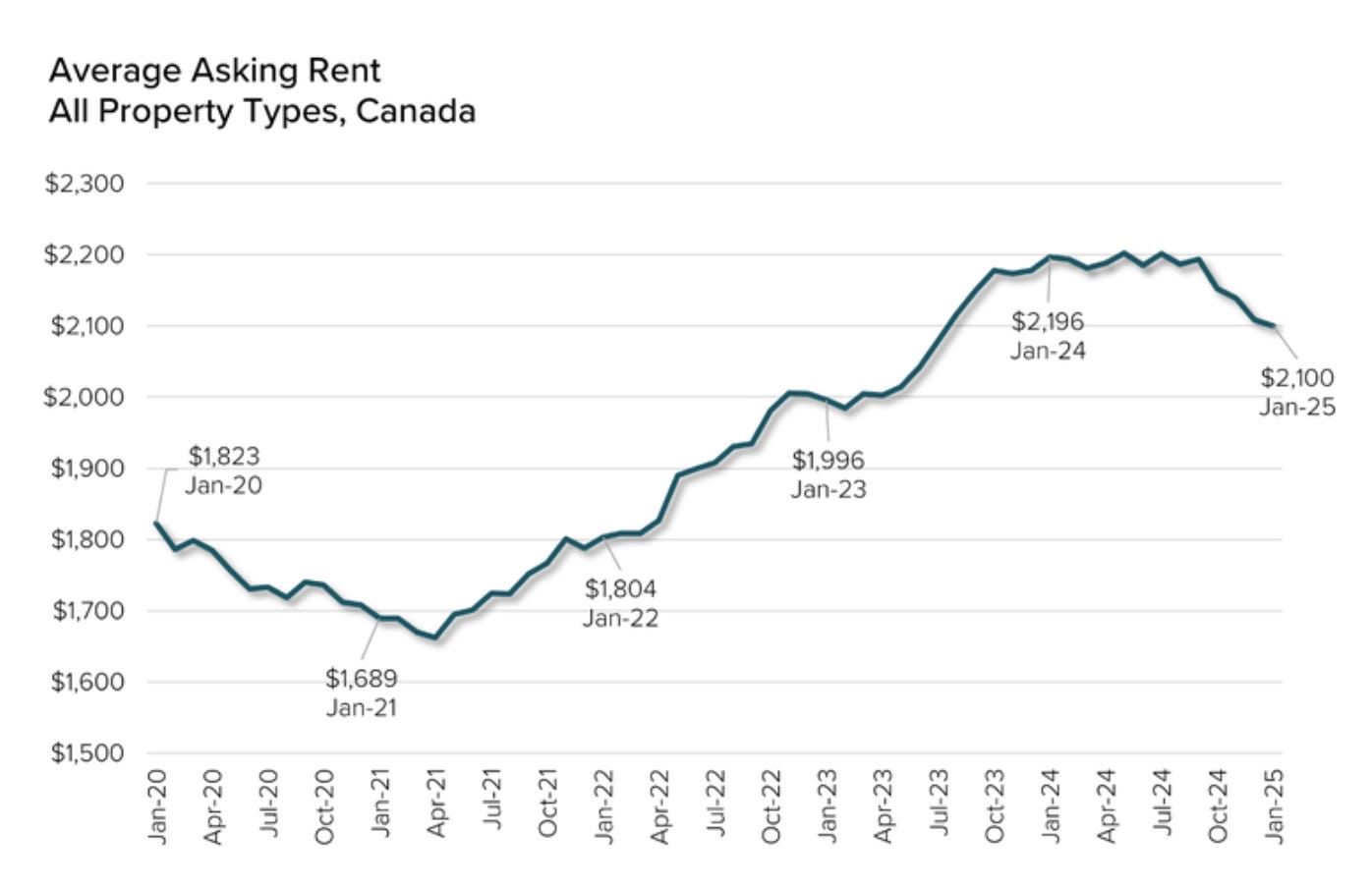

Investors were always the discretionary bid, nobody needs to buy a second condo or another pre-sale, but when rents and prices are rising it’s certainly more appealing. As we’ve highlighted recently, rents are already reversing in many major metros, with new housing completions hitting record highs. Supply is outpacing demand in the rental market.

Just this week Rentals.ca reported the average asking rent for all residential properties in Canada was $2,100 in January, declining 4.4% compared to a year ago, falling to an 18-month low.

The slump is predominately concentrated in Vancouver and Toronto where rents have fallen 5% and 8% respectively. It goes without saying that residential rents rarely fall outside of a recession.

This is uncharted territory for many investors. Falling rents, falling prices, and higher mortgage rates. I’ll be honest, I don’t know what’s going to happen with the tariff wars or interest rates, but I’m confident in suggesting the investor market will continue to struggle in 2025.

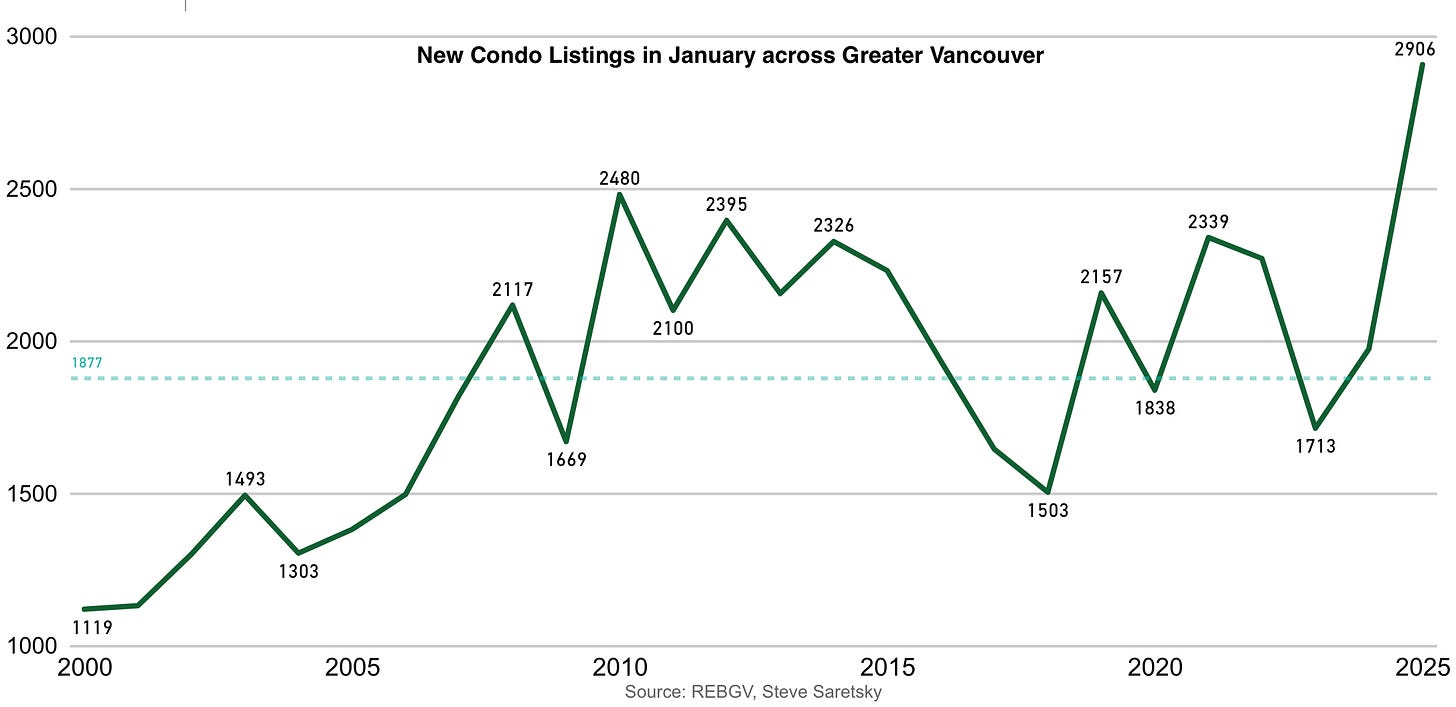

Here’s a look at the number of new condo listings in Greater Vancouver for the month of January. All-time highs to start the year.

New listings are way up for several reasons. Sellers who tried to sell last year but didn’t get their price. People who thought about selling last year but saw the weak resale conditions and decided to rent instead. They figured 2025 would be better, but so far it’s not looking that way. And lastly, record new condo completions, many of which can’t be carried as long term rentals due to negative cash flow issues.

It should be noted that the end user market, particularly entry level single family houses are performing just fine. The issues are really in the investor condo market and that isn’t going to change if we get a fentanyl Czar or tariff reprieve.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky February 10th, 2025

Posted In: Steve Saretsky Blog