February 3, 2025 | Tariffs & Housing

Happy Monday Morning!

We are now in the midst of a full blown tariff war. There’s plenty of smart economic commentary out there, so let’s get into it.

According to BMO’s chief economist, Doug Porter,

“Trump’s tariff hammer will come down hard on Canada’s economy. If the announced tariffs remain in place for one year, the economy would face the risk of a modest recession. A couple quarters of contraction are well within the realm of possibility. With little confidence given the lack of historical precedent, we estimate that the tariffs will reduce real GDP growth by about 2 ppts to roughly zero in 2025.”

Assuming all else remains equal (unlikely), BMO’s Porter suggests 0% GDP growth in 2025, an 8% unemployment rate, the BoC cutting rates by a quarter-point at every meeting this year, driving them down to 1.5%, and the Loonie sinking to 64 cents.

Ouch.

Since this is mostly a housing newsletter, let’s turn our attention there.

Tariff wars are a significant policy shock. If there’s one thing that buyers hate it’s uncertainty. This will likely push prospective purchases to the sidelines as they attempt to digest the impacts on housing demand and prices, but also on their employment situation. It’s pretty nervewracking to make a decision on a million dollar purchase if you’re not sure you’ll have a job six months from now.

There’s good reason to believe the recent bounce in housing activity could fade. Don’t get me wrong, people will still move, families need to upsize, boomers need to downsize, but this is another nail in the coffin for the investor bid.

Investors were always the discretionary bid, nobody needs to buy a second condo or another pre-sale, but when rents and prices are rising it’s certainly more appealing. As we’ve highlighted recently, rents are already reversing in many major metros, with new housing completions hitting record highs. Supply is outpacing demand in the rental market, and now you add the likelihood of further job losses on a tenant base that is already feeling the pinch.

Nowhere is this more true than in Ontario where the condo bust is deepening. Rents are falling, condo pre-sales at 28 year lows. It’s a mess, and tariffs won’t help. According to BMO, in Ontario U.S. goods exports top 17% of GDP with a wide range of industries exposed (autos, machinery, metals and consumer goods). The Ontario Finance Ministry forecasts the province could lose nearly 500,000 jobs.

How many of those job losses will hit the construction industry? Housing starts are tumbling as the math on new housing stopped working awhile ago, and the numbers just got worse overnight. Here’s a brief list of construction materials hit by the tariffs:

- Glass Products: Canada imports approximately $3.5 billion USD worth of glass products from the U.S. annually.

- Major Appliances: Over $3 billion USD in appliances are imported from the U.S. each year.

- Hardware: Canada imports about $2 billion USD worth of hardware from the U.S. annually.

- Ceramics: Various ceramic products used in construction are among the top materials imported from the U.S.

- Primary Metals: Including iron, steel, and aluminum, Canada imported more than $14 billion USD worth from the U.S. in 2023.

- Gypsum (Drywall): More than 70% of Canada’s gypsum imports come from the U.S.

- HVAC Systems: In 2023, Canada imported approximately $5.17 billion USD worth of ventilation, heating, air-conditioning, and commercial refrigeration equipment from the U.S.

If there was ever a time for governments to reduce red tape and slash development fees it’s now. After all, a little bit of something (tax revenues) is better than nothing.

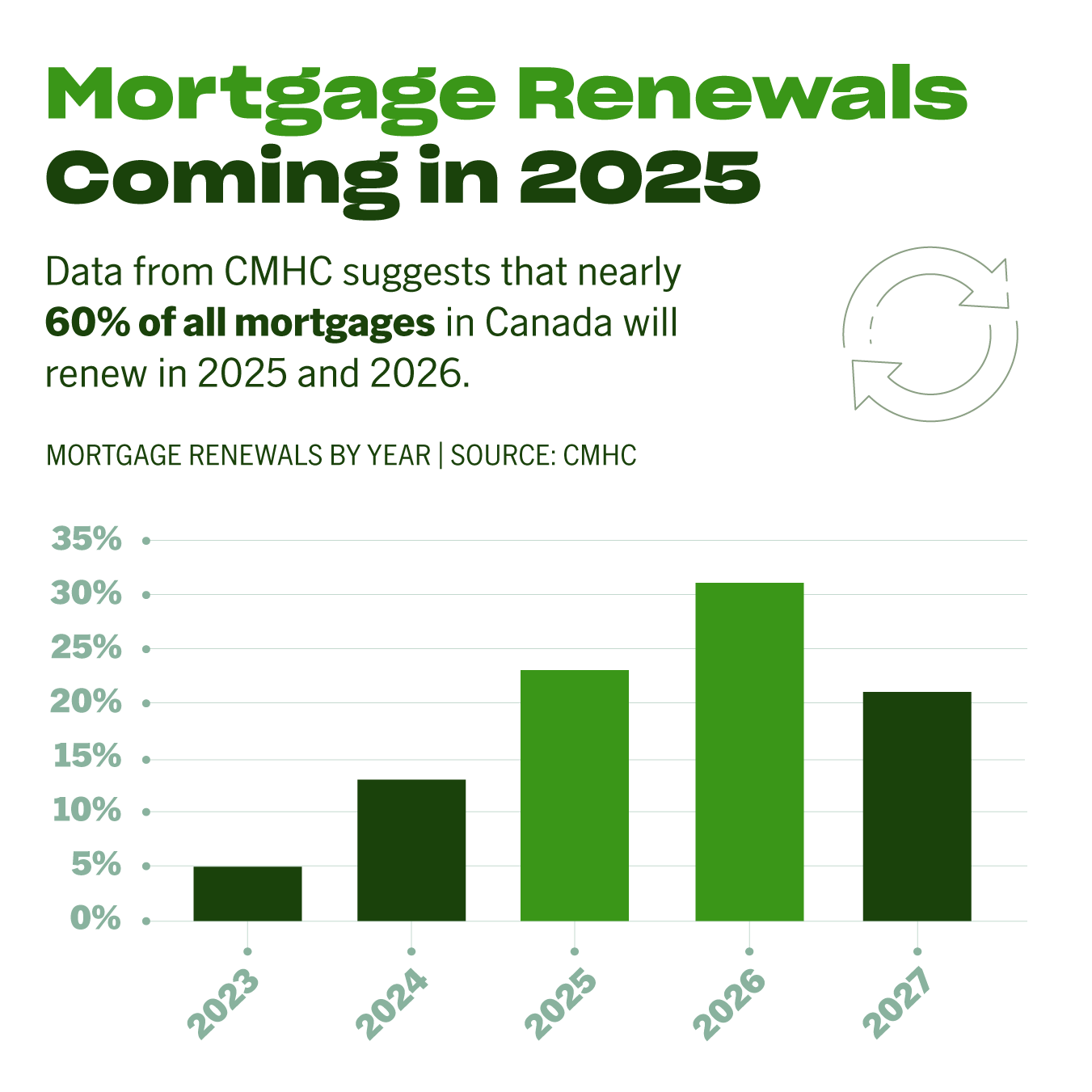

On the bright side, carrying costs are bound to move lower. If BMO is anywhere close to being right, variable rate mortgages will settle in the low 3’s. That’s good news for the 60% of mortgages coming up for renewal over the next 24 months.

It’s no wonder some of the big banks are reporting that nearly 50% of all new purchasers are going variable. Fixed rates are breaking lower too, with the Canada 5 year bond plunging nearly 50bps in the past few weeks.

Trade wars will be hard on just about everyone. If there ever was a silver lining that’s the best we can offer at this time.

Stay nimble out there.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky February 3rd, 2025

Posted In: Steve Saretsky Blog

Big error in your reasoning. Trump tariffs are on Canadian exports to the U.S. and those tariffs are paid by Americans not Canadians. Canada does not have to place tariffs on imports from the U.S. if it doesn’t want to. Canadian imports can still come in tariff-free.