February 24, 2025 | Shelter Inflation

Happy Monday Morning!

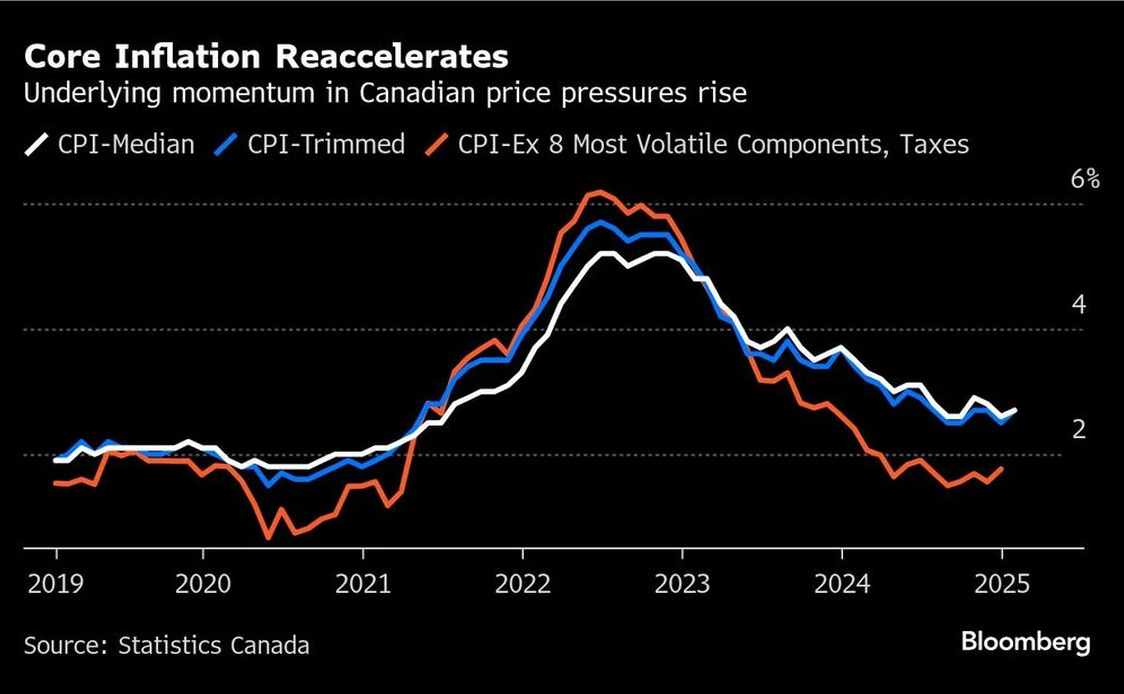

A recent reprieve on tariffs, combined with slightly hotter than expected jobs and inflation data have slowed the odds of a rate cut from the Bank of Canada in March.

The two core inflation measures — so-called trim and median — both jumped to 2.7% in January. These metrics have been stuck close to these levels for months, and Macklem told reporters Friday the central bank is “obviously watching that closely.”

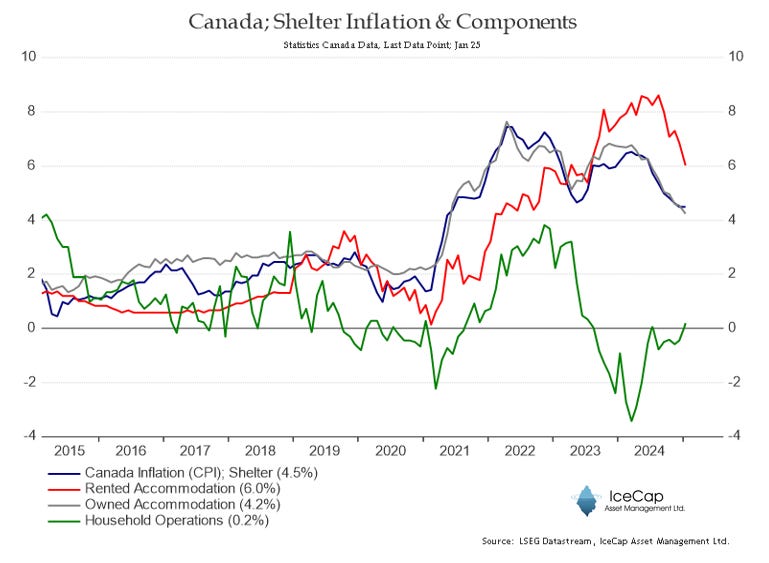

“The fact that we’ve had this sustained pressure in shelter costs, that is having some effect on our core measures,” Macklem said. “We’ll continue to watch them carefully, but there are some technical features of the preferred measures that suggest that might be a little bit overstated.”

It’s the strongest signal yet that the central bank may be starting to move away from the two measures as key guideposts for setting interest rates.

In other words, Macklem knows the housing market is in much worse shape than Stats Canada suggests. Official data suggests shelter inflation is still running hot at 4.5%, and rents are churning at 6% year-over-year.

Yet regular readers here know we’ve been tracking the housing market in real time. House prices are still under pressure and rents are plunging, down as much as 10% across many major metros, with nothing to suggest the downwards pressure is going to relent anytime soon.

Here’s the latest from CREA on national housing trends,

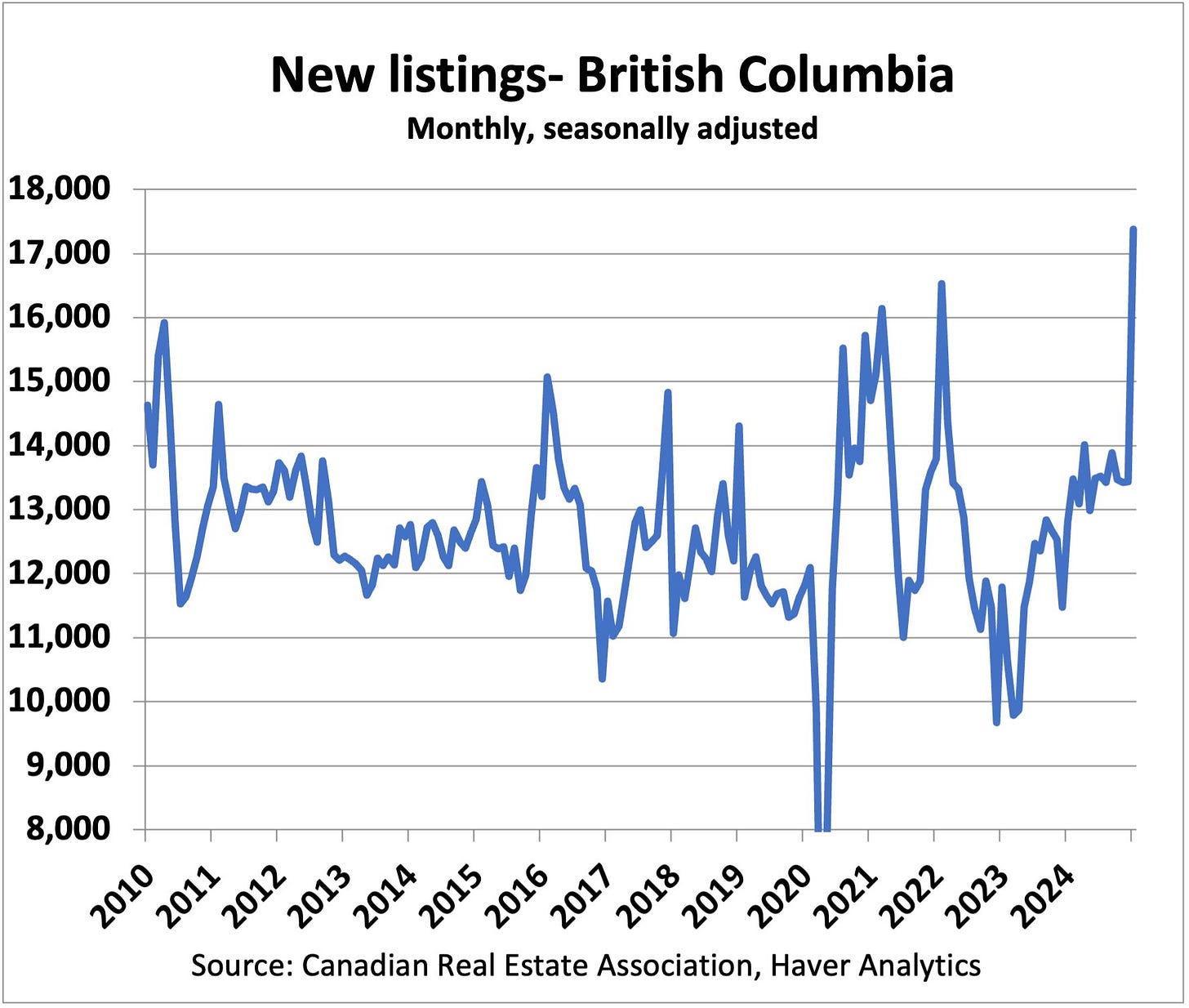

“The standout trends to begin the year were a big jump in new supply at an uncommon time of year, as well as a weakening in sales which only showed up around the last week of January,” said Shaun Cathcart, CREA’s Senior Economist. “The timing of that change in demand leaves little doubt as to the cause – uncertainty around tariffs. Together with higher supply, this means markets that had been steadily tightening up since last fall are now suddenly in a softer pricing situation again, particularly in British Columbia and Ontario.”

Aside from some of the wild swings seen during the pandemic, this was the largest seasonally adjusted monthly increase in new supply on record going back to the late 1980s.

Things are particularly concerning in BC, where new listings have exploded higher.

As we’ve highlighted before, this is largely a story of the condo investor heading for the exits, not the end user market. It’s been nearly three years since interest rates began their ascent, and while mortgage rates have chopped around, they’re still nearly double what most investors have become accustomed and this is making a mess of investor balance sheets.

Many cash flow negative investors will hold on for awhile and ride out the storm, after all, most housing corrections are often short lived in places like Vancouver and Toronto. However, we’re now in year three of a flat to declining market, and revenues (rents) are now declining, offsetting any reprieve from lower mortgage rates. Higher vacancy rates are also adding pressure. A three month vacancy for a small landlord could amount to $10,000 of lost revenue, and that’s enough to entice some to sell.

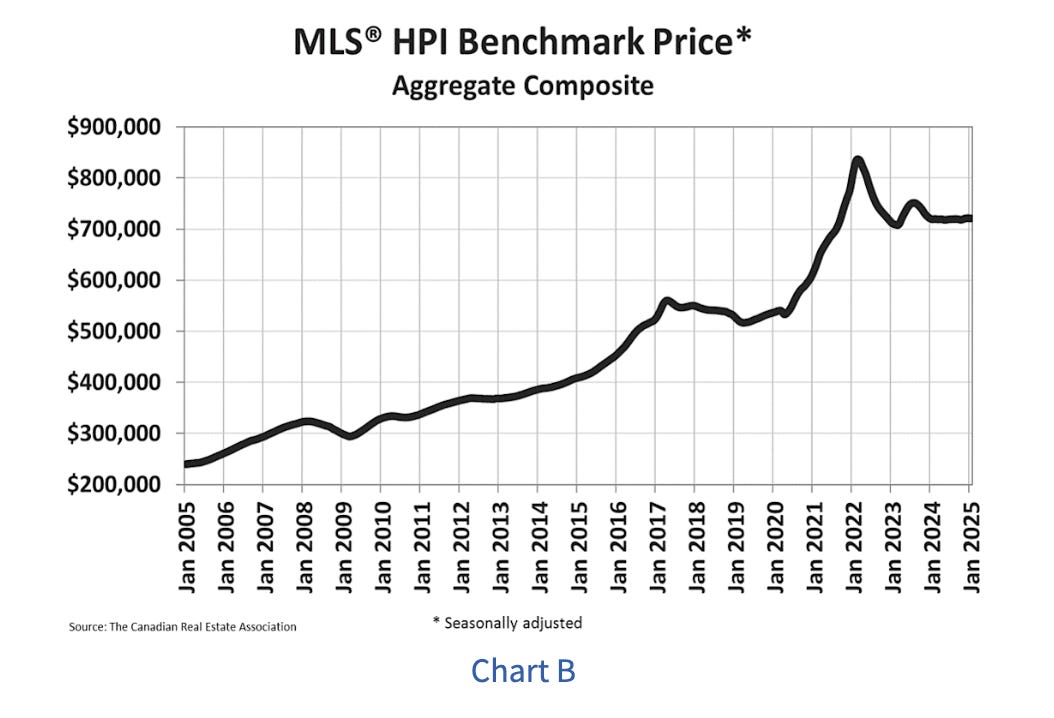

What’s most surprising is just how well home prices have held up so far. Per the national home price index, prices were unchanged over the past year. Flat as a pancake.

Yet given the trend in new listings there’s more reason to believe prices will move lower, not higher. So perhaps Macklem and the BoC are right, stubborn shelter inflation is likely more noise than reality

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky February 24th, 2025

Posted In: Steve Saretsky Blog

Next: Revenue Thoughts »