February 2, 2025 | Mainstream Media Muffle China’s Breakthrough

Bloggers were revved up when last week began, trumpeting a warning that China’s DeepSeek R1 threatened to crush America’s capital-intensive effort to lead the world in AI development. ZeroHedge was among the first to jump on the story. “The future of humanity is being decided as we speak,” wrote Mark Whitney. “This is a full-blown, scorched-earth free-for-all that has already racked up a number of casualties, though you wouldn’t know it from reading headlines that typically ignore recent ‘cataclysmic’ developments.”

What had the Chinese done to upend the status quo? Mark Button, a technology expert quoted in the article, describes the situation: “Imagine we’re back in 2017 and the iPhone X was just released. It was selling for $999 and Apple was crushing sales and building a wide moat around its ecosystem. Now imagine, just days later, another company introduced a phone and platform that was equal in every way, if not better, and the price was just $30. That’s what unfolded in the AI space today. China’s DeepSeek released an open-source model that works on par with OpenAI’s latest models but costs a tiny fraction to operate. Moreover, you can even download it and run it free (or the cost of your electricity) for yourself.”

An Ostentatious Yawn

Predictably, the mainstream media threw everything they had at DeepSeek in the days that followed. The Wall Street Journal led the charge with an ostentatious yawn and a list of bullet points intended to suggest that China’s supposedly killer solution was about as impressive as a set of Lincoln Logs assembled into a working toaster oven. By week’s end, Wired chimed in with a pantywaist report that university researchers had baited DeepSeek with 50 malicious prompts, and that it failed to block even a single one. If this story had broken a year ago, the old Zuckerberg would have ordered up grief counseling for Facebook’s stasi.

Why did the news media go on the attack? Although we tend to assume they are just shilling for OpenAI, Nvidia and other companies with trillions of dollars sunk into the artificial intelligence story, it is simpler than that. For in fact, journalists are too timid and too lazy to rock the boat with a story that is difficult to nail down. To be sure, it is not easy to measure DeepSeek’s achievement, whatever its nature against Open AI’s stated goal of “build[ing] computers smart enough and safe enough to end history, thrusting humanity into an era of unimaginable bounty.” Only time will tell whether the Chinese have defeated the pay-to-play model advanced by Nvidia and other big players with an open-source solution that will cost users a relative pittance.

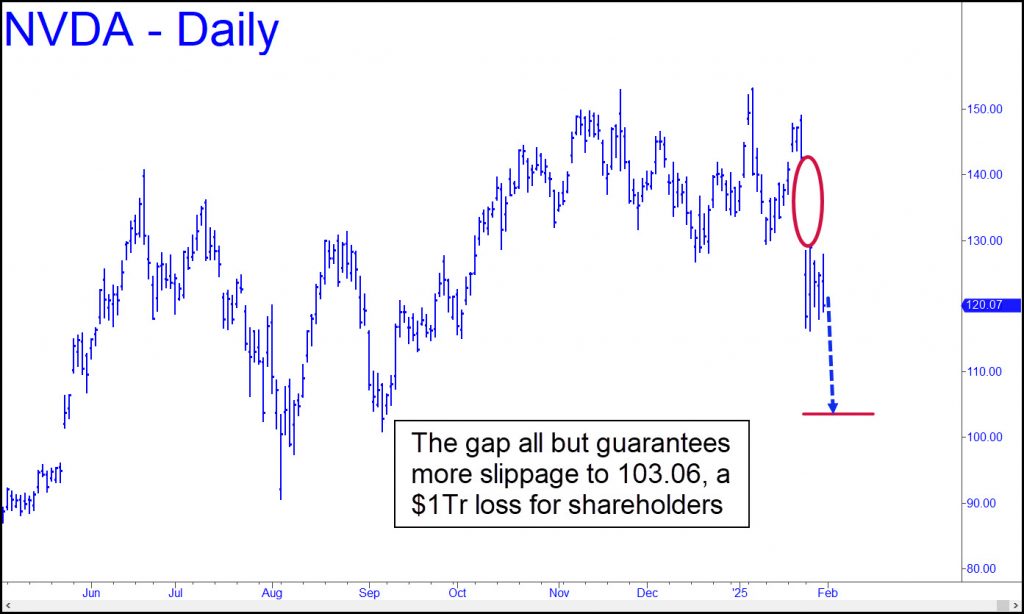

Whatever happens, the news has already deflated stock market valuations, reversing the global “wealth effect” by trillions of dollars. A measurable trillion of the loss will be in Nvidia shares alone. The company was worth about $3 trillion when it peaked in early January at $153, but my technical forecast says NVDA is all but certain to continue falling down to $103 before it finds traction. Although no one knows whether the DeepSeek story will prove to be as earth-shaking as some AI skeptics believe, price action in NVDA cannot but give us a precise answer. If the stock sinks to $50 after an obligatory, oversold bounce from $103, that would validate the naysayers’ arguments that the AI story was mostly hubris, fated from the start to disappoint.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Rick Ackerman February 2nd, 2025

Posted In: Rick's Picks