February 14, 2025 | Higher Inflation Could End Rate Cuts For This Year

Higher inflation returned this week. The numbers for January CPI inflation came in hotter than expected. A significant upturn in Core CPI on a monthly and annual basis raised eyebrows, although the markets were not rattled for long.

Is this the end of rate cuts? Will rate hikes be next?

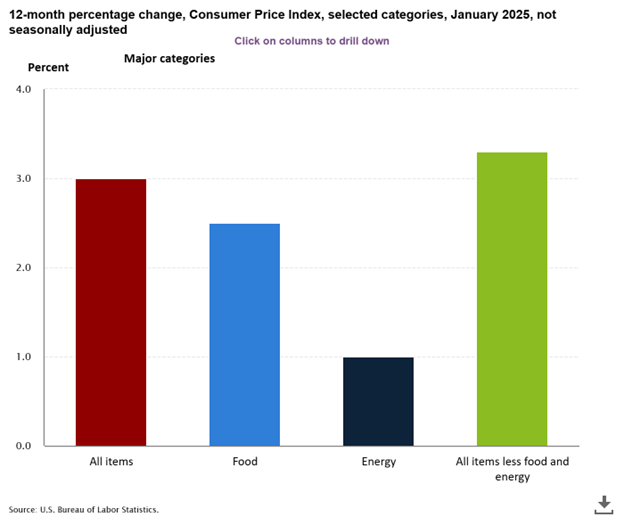

The U.S. CPI released on Wednesday indicated higher headline inflation at 3 percent, driven mostly by service costs, which include shelter. The graph below shows Core CPI, which strips out energy and food, with growth of 3.3% over the last 12-months. If this is the start of a new trend consumers and market traders would be very discouraged as they were expecting rates to fall to the 3 percent level this year.

And this jump in inflation comes before the Trump tariffs hit. The 30-day reprieve for Canada and Mexico is due to end soon, while new tariffs announced on Thursday would be reciprocal on a country-by-country basis and also are delayed.

Tariffs are inflationary. The cost of the tariff is added to the price of an item for sale and the vendor tries to pass on the cost of the tariff to the consumer. Sometimes, if the tariff is small, the vendor can convince the provider of the product to lower the price by the amount of the tariff. But if the tariffs are high, say 25 percent, the item can no longer be imported.

Then the domestic price of a comparable product becomes the new price. For almost all products that come from China or Vietnam or similar countries, the U.S. equivalent product, if it exists, will be priced higher, perhaps much higher. Trump says the tariffs are designed to encourage domestic manufacturers to expand, but in the short term the U.S.-based seller will not be able to match the price of the product coming from China where costs are much lower. So, Americans are stuck with a higher-priced USA-made product which may be inferior in quality to what they could have bought from China before the tariff.

Tariffs like that are inflationary in the short term and perhaps even the long term. In past instances of tariff wars, some domestic manufacturers stay complacent and continue to supply a higher-priced product.

Higher inflation leads to higher interest rates. The 10-yr government bond yield moved up above 4.6 percent after the CPI release. This is the highest coupon on that bond since 2007. It is hard for the Fed to cut rates with government bond rates at such high levels. While expectations for rate cuts to the 3 percent range were prevalent in mid-2024, expectations will go up substantially after this report. Rate hikes are back on the table.

The Fed will not start hiking rates after one just bad report. The PCE Price index is out February 28 and that will affect the Fed’s view. But rate cuts are on pause for now, and perhaps for the rest of 2025.

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth February 14th, 2025

Posted In: Hilliard's Weekend Notebook