Anyone who plays Monopoly can experience how quickly real estate holdings drag once cash in hand proves insufficient.

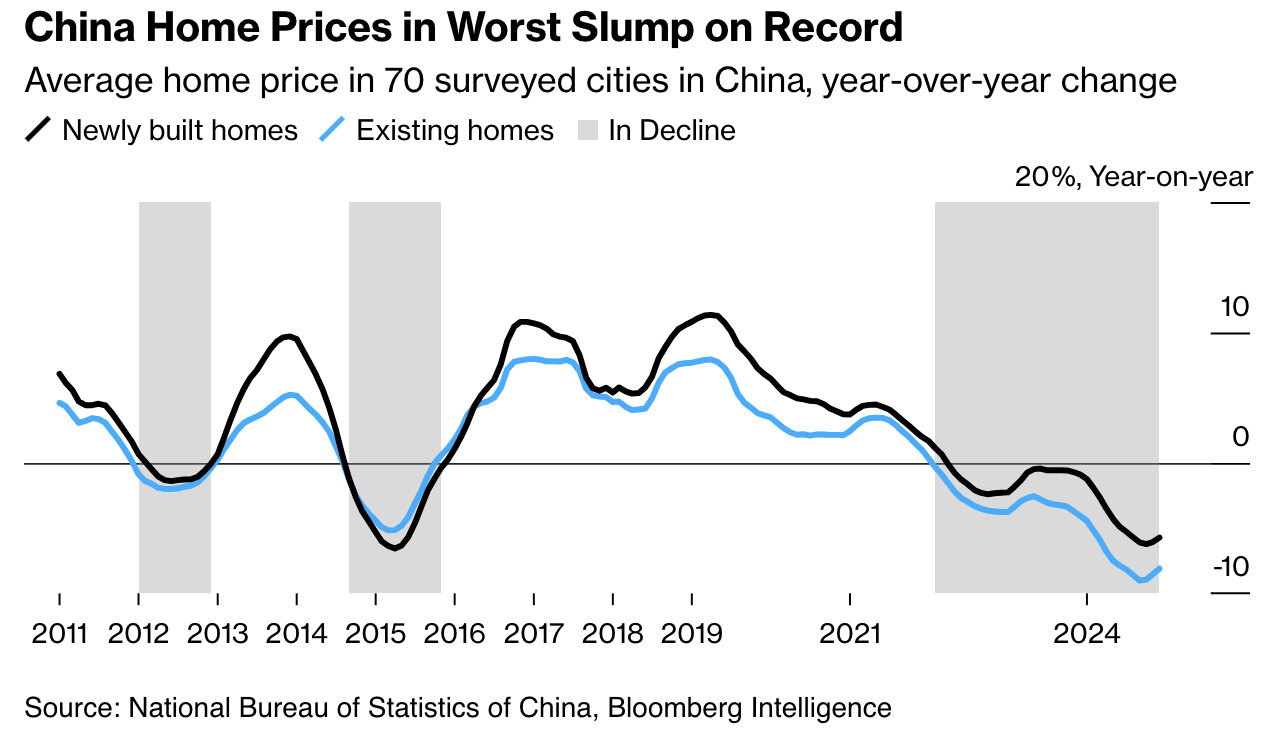

Bubbles may seem fun on the way up, but they’re universally brutal in the inevitable deflation stage. China’s stimulus boom helped inflate global demand and real estate prices after the 2008 recession, but mean reversion has been in motion since 2020 and counting.

Policy interventions to avoid price discovery and arrest market clearing only prolong the pain. This is a heads-up for Canada and other countries where real estate mania was also a national obsession from 2009 to 2022.

As we saw in the ‘lost decades’ following Japan’s property bubble bust in 1989, real estate deflation cycles exert a prolonged, heavy toll in a series of economic dominoes. See China’s Property Crisis Enters a Dangerous New Phase.

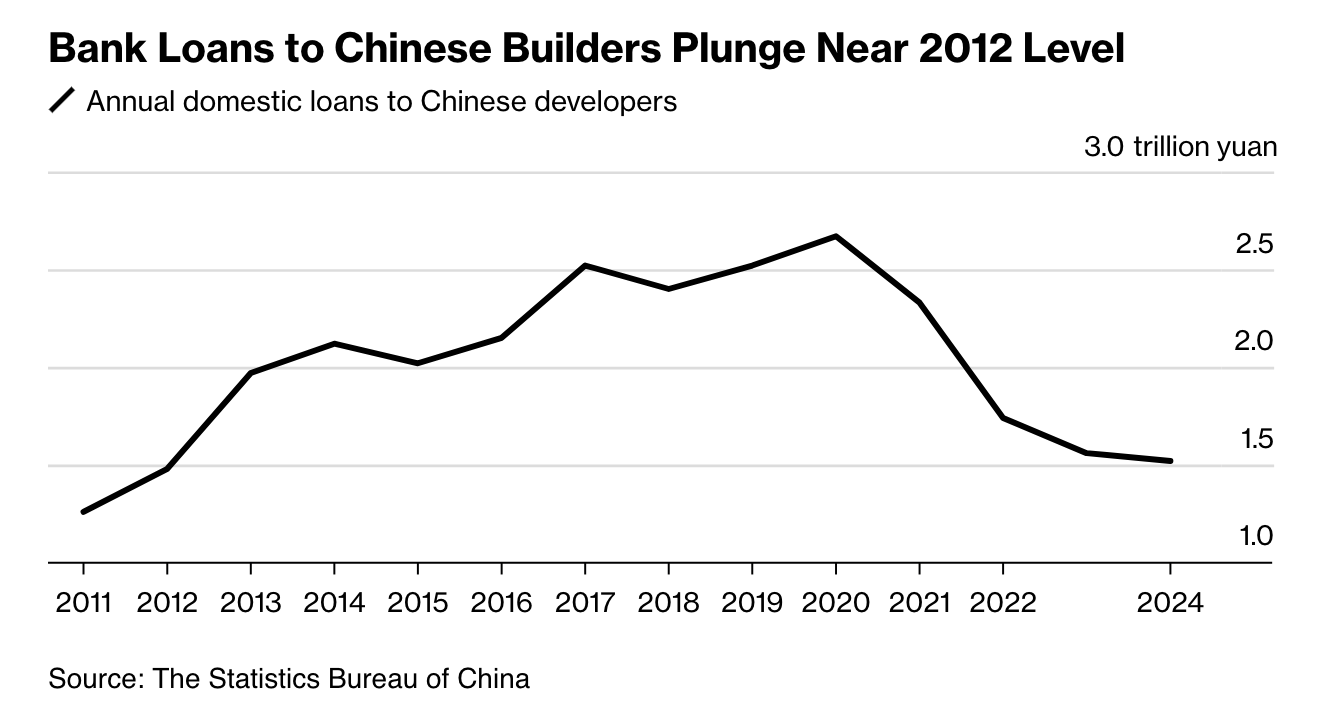

Signs of trouble are now popping up everywhere. A brief revival in home sales has fizzled despite multiple rounds of stimulus from President Xi Jinping’s government. Chinese bankers have mostly stopped lending to real-estate projects outside major cities such as Shanghai, according to people familiar with the matter. And international creditors are losing patience: More debt restructuring deals are unraveling and at least a dozen developers face petitions to liquidate, including once-storied names like Country Garden Holdings Co.

The pain is also spreading to Hong Kong as Chinese homebuyers and tourists pull back. New World Development Co., a real-estate giant controlled by one of the financial hub’s richest families, is racing to sell assets and mortgage some of its marquee properties as losses mount.

Similar problems in many highly indebted developed economies now simultaneously challenge domestic growth at a time when tariff wars are poised to hurt exports.