January 25, 2025 | Trump’s Biggest Policy Change Is Great For Gold

The president has definitely hit the ground running. But his most impactful policy move isn’t an executive order or cabinet appointment. It’s this:

President Trump says he’ll ‘demand that interest rates drop immediately’

(CNBC) – President Donald Trump lobbed his first volley at the Federal Reserve, saying Thursday that he will apply pressure to bring down interest rates.

Speaking via video to an assembly of global leaders at the World Economic Forum in Davos, Switzerland, the new president in a wide-ranging policy speech did not mention the Fed by name but made clear he would seek lower rates.

“I’ll demand that interest rates drop immediately,” Trump said. “And likewise, they should be dropping all over the world. Interest rates should follow us all over.”

The comments represented an initial strike at Fed officials, with whom he had a highly contentious relationship during his first term in office. He frequently criticized Chair Jerome Powell, who Trump appointed, on occasion calling policymakers “boneheads” and comparing Powell to a golfer who can’t putt.

Speaking later in the day to reporters, Trump said he expects the Fed to listen to him and plans to speak to Powell “at the right time.”

Trump’s comments come less than a week before the Fed holds its two-day policy meeting that will conclude Wednesday.

Markets are assigning virtually no chance that the Fed will lower further its benchmark borrowing rate, which currently is targeted in a range between 4.25%-4.5% following a full percentage point of cuts in the last four months of 2024. Traders are pricing in a first rate reduction likely coming in June and about a 50-50 probability of another move before the end of the year, according to CME Group data.

Elect a Real Estate Guy…

Trump’s talk about buying Greenland and making Canada the 51st state is of a piece with his interest rate statements.

This is not surprising. For the first 60 years of his life, he was a real estate developer, for whom buying undervalued properties is a Pavlovian reflex. And real estate guys absolutely love low interest rates.

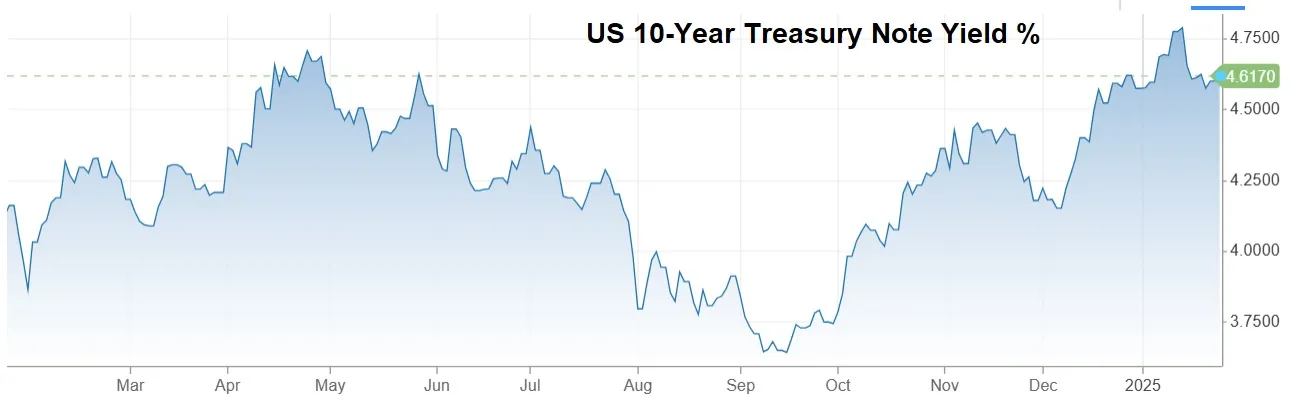

But what might come as a surprise (at least to the real estate world) is that cutting short-term interest rates with stocks, homes, cryptos, and a bunch of other consequential things at record highs while inflation is above target could spook the bond markets into raising long-term rates. That’s already been happening, as the 10-year Treasury yield has increased by about 100 basis points since the Fed’s September rate cut.

To sum up, throwing even easier money at the Everything Bubble would take us into uncharted territory. Gold and silver are must-haves while we run the experiment.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino January 25th, 2025

Posted In: John Rubino Substack