January 4, 2025 | Trading Desk Notes for January 4, 2025

Will the stock market’s “Trump Bump” be sustained?

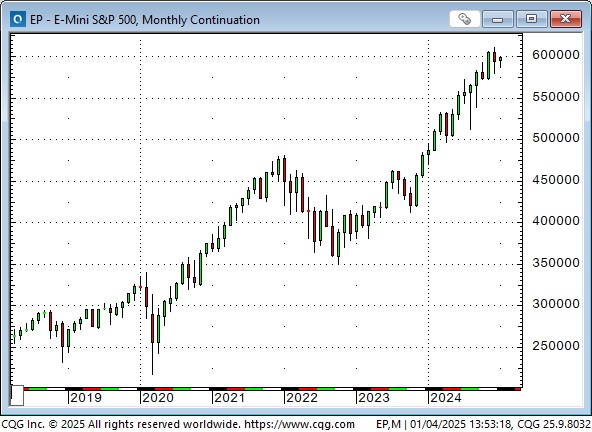

The S&P sold off ahead of the November 5th election, rallied on election day (circle on the chart), gapped sharply higher the day after the election, and then rallied to record highs in early December.

The market drifted sideways near all-time highs for ten trading sessions in early December but broke hard on the 18th (circled) following the Fed’s “hawkish cut.” It bounced back to resistance levels (red line) around Christmas but then reversed back to support levels (blue line) as the new year began.

A decisive break of the resistance or support line will likely signal whether the 2024 bull market continues into early 2025 or enters a correction.

Following Trump’s election victory (and Republican majorities in both the House and the Senate), the market seemed to expect a 180-degree turn in the Federal government’s behaviour. For instance, in energy policy, a switch from restricting the development of fossil fuels (Biden killed the proposed Keystone pipeline on his first day in office) to “drill, baby drill.”

The market also seemed to expect a 180-degree turn in the federal government’s priorities: an America-first foreign policy (which will justify tariffs), substantial deregulation (instead of more regulation), tax cuts instead of tax increases, a business-friendly administration and an end to Woke behaviour.

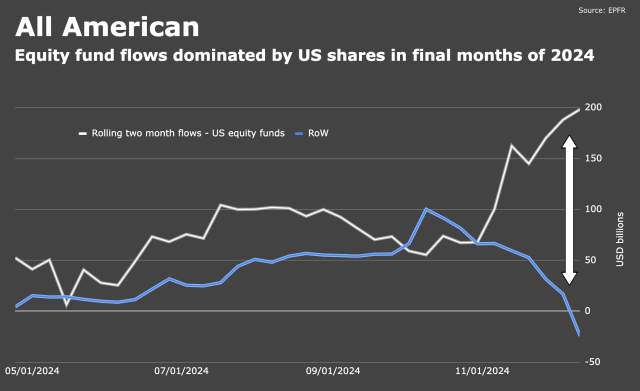

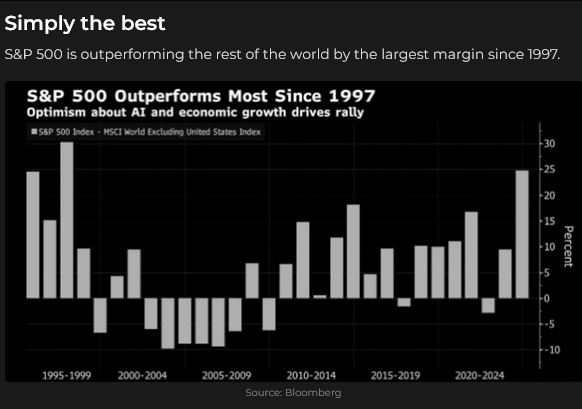

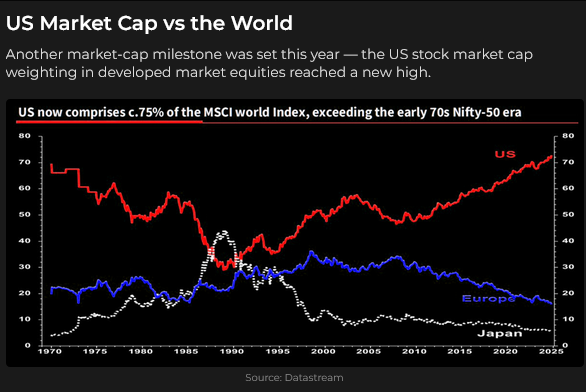

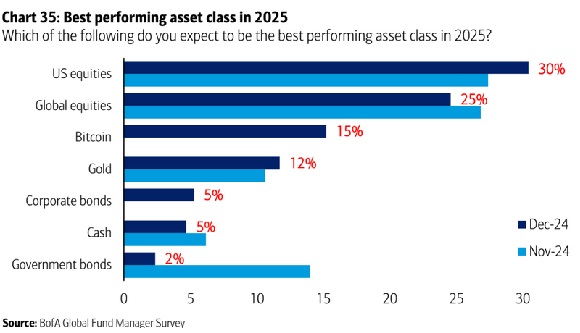

Markets also enthusiastically embraced “American exceptionalism,” with an acceleration of capital flowing to the USA for safety and opportunity. The US dollar extended its rally to a two-year high, and US stocks rallied to record highs, extending their outperformance relative to the rest of the world.

Stock market Bulls Vs. Bears

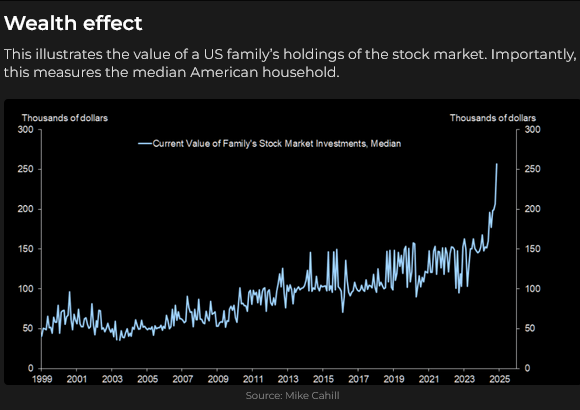

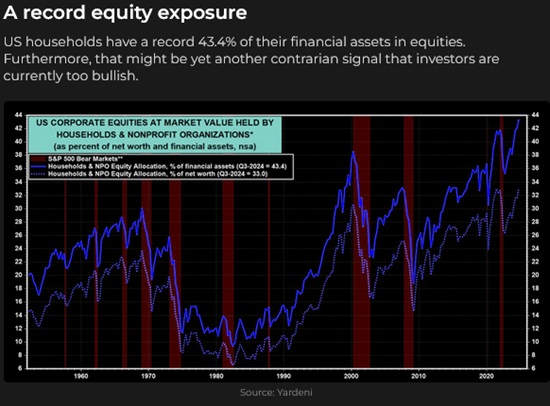

The Bulls: Stocks have been in a powerful uptrend since the covid panic of early 2020 (with a brief setback during 2022 when the Fed raised rates to “fight inflation.”) The momentum of that trend will be maintained with bullish Trump policies and dramatic technological progress. Corporate buybacks are estimated to be over $1Trillion in 2025, and people will keep buying stocks because of FOMO and TINA.

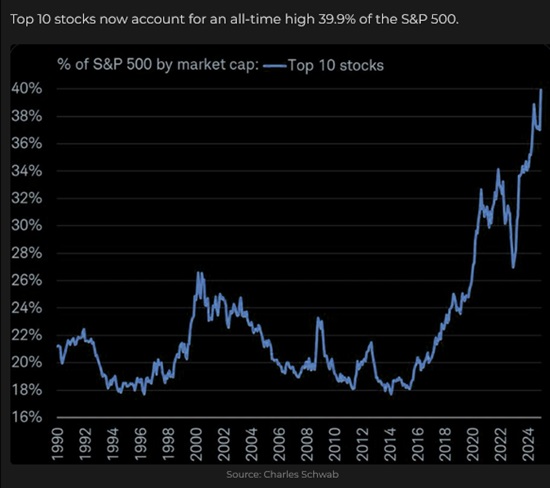

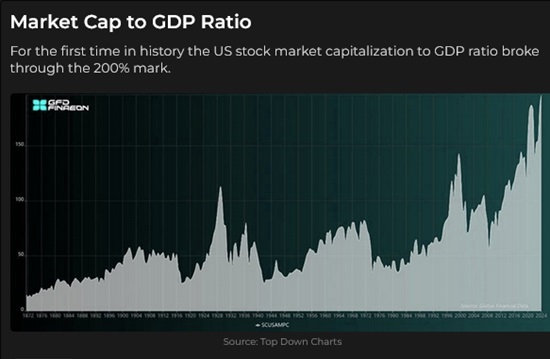

The Bears: The market has gone parabolic and is priced for perfection. It has gone up too far, too fast and is overdue for a correction, if not worse. The thin Republican majorities in the House and the Senate do not guarantee that Trump’s policies will get congressional approval. The fact that the top ten stocks in the S&P account for nearly 40% of the index’s market cap and that US stocks account for ~75% of the MSCI world index is a sign of dangerous concentration, likely heralding a nasty correction. People use WAY too much leverage in the stock market (i.e. ODTE options now represent over 50% of total options trading volume.) People treat the stock market like a casino.

Currencies

The US Dollar Index hit a 14-month low following the Fed’s “hawkish cut” in mid-September but began to rally shortly thereafter on expectations that the Fed would cut rates less aggressively than other central banks. The rally accelerated on Trump’s election victory (circled), and by year-end, the USDX was at 26-month highs.

Reporting that the USDX is at a 26-month high diminishes how strong the US Dollar truly is from a historical perspective. Outside of the September to November period in 2022 (following aggressive interest rate increases from the Fed), the USDX is now at 23-year highs. It has rallied ~55% from the January 2008 lows, its lowest level since the leading currencies began to “freely float” in the late 1970s. Futures market speculators hold a historically massive net short position in the leading currencies – they are, therefore, massively net long the USD.

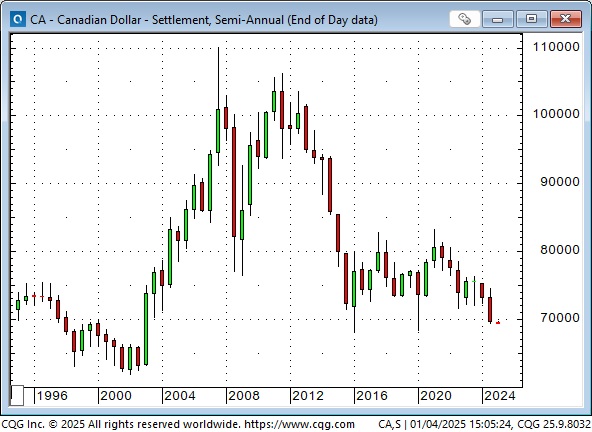

Since late September, the Canadian Dollar has fallen nearly five cents (~7%) to five-year lows as the USD has soared against all other actively traded currencies.

Reporting that the CAD is at five-year lows diminishes its historical weakness. Outside of brief spike lows in 2016 and 2020, the CAD is at 22-year lows, down ~36% from the record highs (1.10) made in November 2007. Futures market speculators hold a historically massive net short position on the CAD.

Interest rates

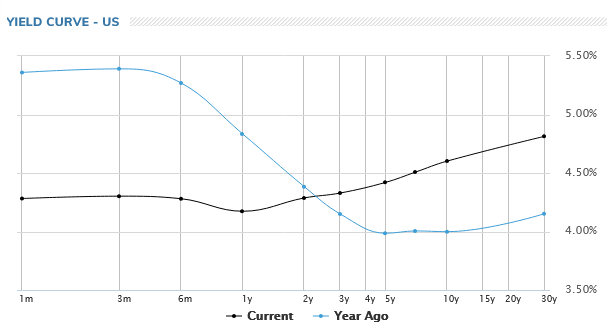

Since September, the Fed has cut short-term interest rates by 100 bps, and during that same period, the yield on the 10-year Treasury bond has risen ~100 bps (from 3.63 to 4.62%). Bond prices have fallen sharply since September, with the “term premium” rising as bond buyers believe that more and more bonds will have to be issued to fund the growing government debt and deficits.

With short rates falling and long rates rising, the yield curve has become increasingly “uninverted.”

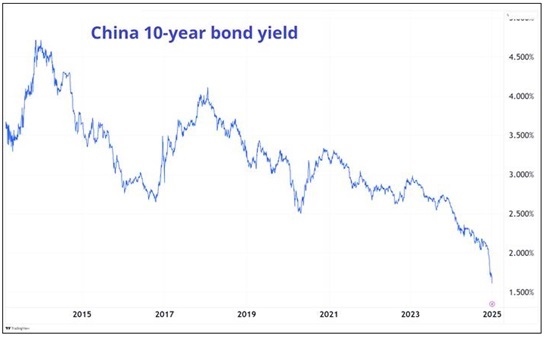

While bond yields have been rising in “Western” markets, they have fallen like a stone in China. I’ve previously written that China looks to be in a balance sheet recession and may follow the path (with a 35-year delay) that Japan has been on since 1989.

Gold

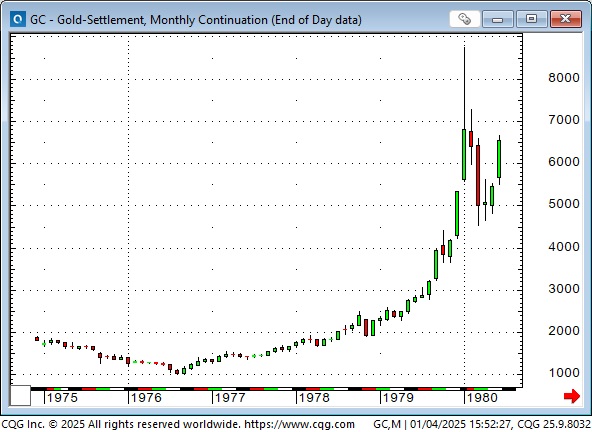

Fifty years ago this week, in January 1975, the US federal government allowed Americans to legally own gold after 41 years (from 1933 to 1975) when it was against the law for citizens to own gold.

In 1974, world gold prices rose from ~$100 to ~$200 (a record high) as the market expected Americans to buy gold aggressively once prohibition was lifted. However, Americans showed little interest in buying gold, and from early 1975 to mid-1976, the gold price fell back to ~$100.

But inflation rose as the 1970s progressed, and the gold price started rising from the mid-1976 lows, went parabolic in 1979 and spiked to ~$850 in January 1980.

Silver rose from ~$4 in 1976 to ~$50 in January 1980. I was a commodity broker with ContiCommodity (one of the largest US commodity brokerage firms) during that time. I remember the silver market crashed ~$13 the day the exchange issued “liquidation only” orders for non-commercial accounts.

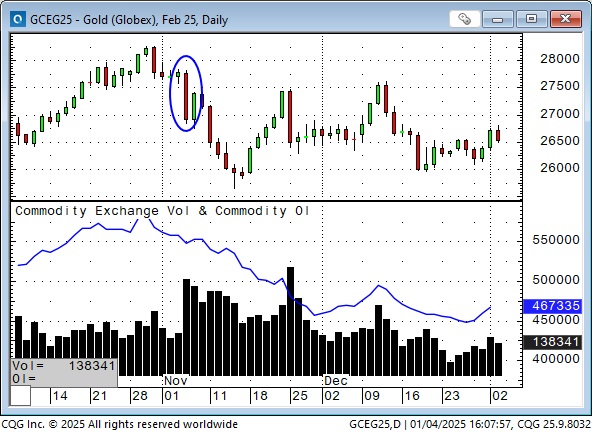

Gold briefly traded above $2,800 in late October 2024 but dropped sharply following Trump’s election victory (circled) and has trended sideways to lower since then with declining open interest (the blue line.)

Gold shares have underperformed gold bullion for years. The gold shares ETF, GDX, hit a 4-year high in October as gold traded above $2,800 but has dropped ~20% since then (gold is down only ~5% from the October highs.)

There are many theories about why gold shares have underperformed gold bullion (the traditional thinking was that gold shares would rise faster than a rising gold price because the shares were a “levered” play on the metal if gold prices rose faster than mining company operating costs.) I think the current “best answer” is that gold shares are not gold, and (by far) the biggest buyers in the gold market over the past two years have been central banks (or sovereign wealth funds), and they want gold, not gold shares. There’s more to it than that, of course, and if I ever find the time, I’ll try to write more about this conundrum.

This chart from Martin Murenbeeld’s Gold Monitor (click here to get a free trial of his excellent service) shows a close correlation between gold and the S&P for the past several years, particularly since the Fed stopped raising interest rates in 2022. I’ve read the Gold Monitor every week for the past 33 years and recommend it to readers who want good information on the gold market.

My short-term trading

I was short the S&P for its big break on the Fed’s “hawkish cut” on December 18, and I did relatively little trading in the second half of December.

I lost a little money bottom fishing in the Yen, and I still own some February OTM calls on the CAD (bottom fishing again) that have lost about half their value.

After the New Year’s break, I traded the S&P from the long side, looking for a bounce, resulting in a tiny net loss.

Going into the weekend, I’m long the Yen and OTM CAD calls. I will probably start trading more next week.

On my radar

Tariffs. Will the Trump bump be maintained? Will Trump push Japan and other Asian exporters to boost their currencies? Will China devalue its currency (currently near all-time lows)? What will markets do if the Ukraine war stops? What happens if the people of Iran revolt against the theocracy? (Will oil prices fall if Iran is less of a threat?) Will the growing electricity demand be met by using natural gas for power generation while we wait for the nuclear rollout? Will data centers be built in the Permian or the Montney (The Montney basin has lots of natgas; it’s colder, and there is lots of water around.) What will the growing slowdown in China mean for markets? What is Trump going to do?

The Barney report

My wife’s daughter and husband-to-be came for a three-day visit after Christmas and brought their dog, Joey. (My future son-in-law is an Aussie.) Barney and Joey got along very well and basically turned the house upside down.

If you want to know what I really think about the markets, listen to these podcasts.

Listen to Mike Campbell and me discuss whether or not the stock market “Trump Bump” will be sustained in 2025. We also discussed the soaring USD, the plummeting CAD, and interest rates. You can listen to the entire show here; my 10-minute spot with Mike starts around the 50-minute mark.

I also did my monthly 30-minute interview with Jim Goddard on the This Week In Money podcast. We discussed the high-flying stock market, the soaring USD, the tumbling CAD, why bond yields are rising while the Fed is cutting short rates, the gold market, why I think the slowdown in China is super-important and the short list of things that are on my radar as we start 2025. You can listen to the podcast here. My spot with Jim begins around the 37-minute mark.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair January 4th, 2025

Posted In: Victor Adair Blog

Next: Mexico 2025 »