January 20, 2025 | The Cash Cow

Happy Monday Morning!

Highlighting a good piece from the BMO economics team this past week. Per BMO,

The Canadian housing market should firm modestly this year, but it’s still a long way back to the 2022 highs. Activity and prices have recently improved alongside Bank of Canada rate cuts, and that moderate upward momentum should continue through 2025—but we don’t expect another exuberant takeoff. Nationally, we see sales volumes rising 12% for the calendar year versus depressed prior-year levels. The benchmark home price looks to rise a modest 4%, as still-challenging affordability and investment calculus will keep the rebound in check. Housing starts are poised to soften somewhat alongside weaker presale market conditions and a downturn in population growth, although the level remains robust.

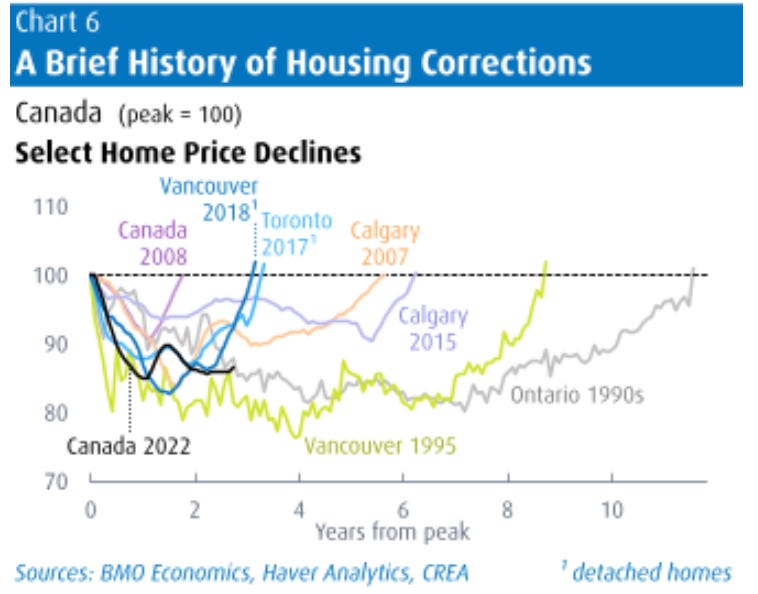

While resale prices have found a floor across most markets, it’s still a long way back to the 2022 highs—as we’ve often said, think years not months. Indeed, even our base-case view, which incorporates a stable economy, steady wage growth and neutral interest rates, home prices don’t push through 2022 levels until about 2029. These are national prices, and regional performance will vary.

They keyword here is regional performance will vary. That is our theme for 2025.

Seven years of dead money says BMO. Imagine the dissapointment for Canadian homeowners and investors who have extrapolated another decade of home price appreciation. A little bit of history suggests home prices don’t grow to the sky, and corrections can be longer than our memory serves.

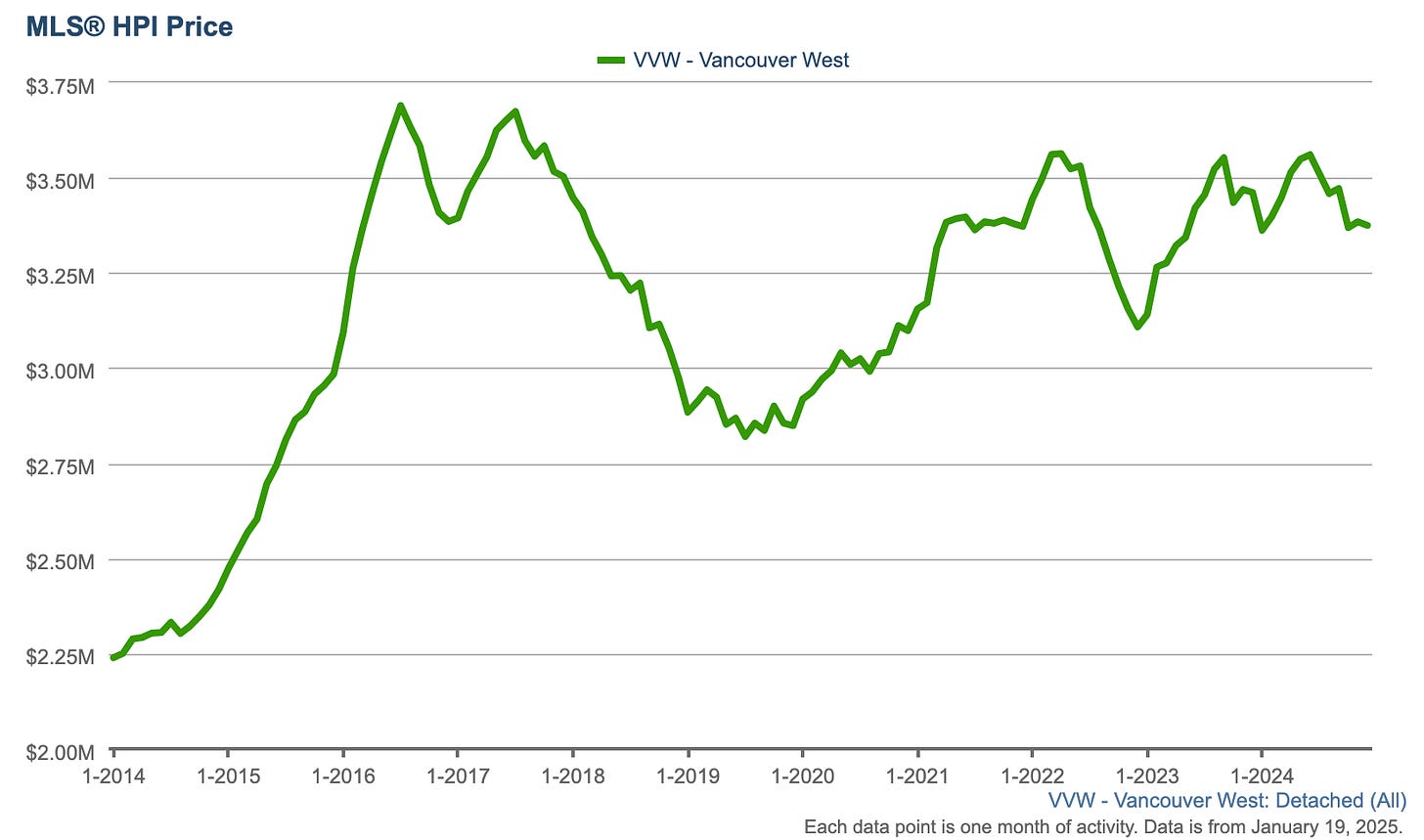

In fact, the correction has already been playing out across highly desirable locations throughout Vancouver. Detached homes on the west side peaked in 2016, and have gone nowhere for eight years.

Meanwhile, condos in downtown Vancouver have been on life support since 2018.

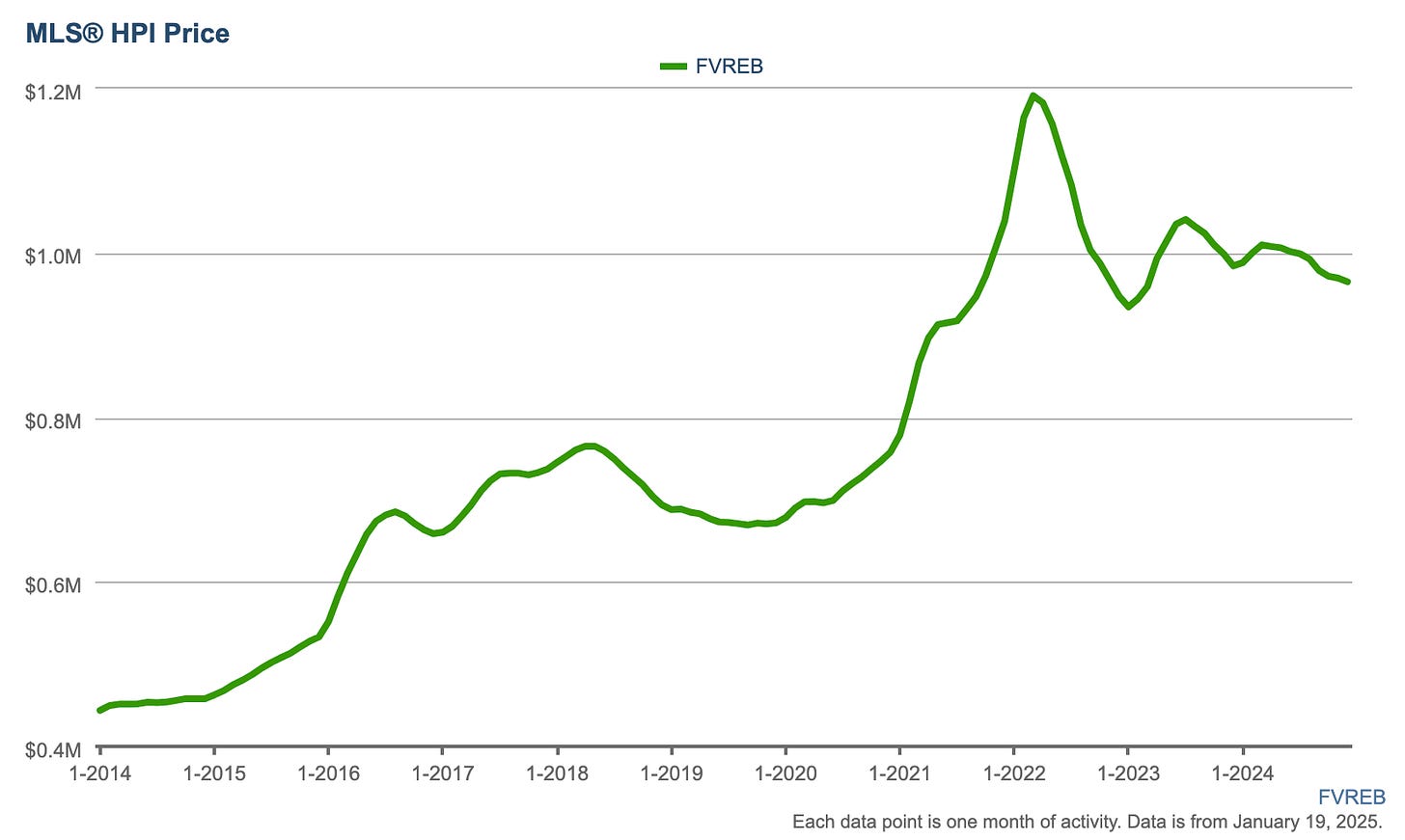

However, in places like the suburbs, where affordability once reigned supreme, home prices in the Fraser Valley have more than doubled over the past decade.

Like BMO said, regional differences matter. The suburbs may have outperformed in the most recent bull market but they’re now leading the charge on the way down. For starters, most of the home building and immigration has flooded into the suburbs in recent years, so when we talk about declining rents, rising mortgage rates, and outflows of non permanent residents that really hurts the suburbs a lot more than the capital rich inner city markets.

While BMO notes regional differences, they should also consider product differences too. When we talk about the Canadian housing bubble bursting, we’re really talking about the GTA, and more specifically in the new condo market.

GTA pre-sale condos finished the year at a 28 year low.

The Bank of Canada raised rates, and suddenly the music stopped. Home prices stopped rising and everyone scrambled for the exits. Now we’re left trying to figure out who’s holding the bag. It’s turns out it’s a lot more than just a few speculators. Yes there’s a record 80,000 units under construction (which excludes purpose built rentals). So not only are the investors going to be on the hook but if a whole bunch of buyers don’t close it becomes a problem for the developer and the banks.

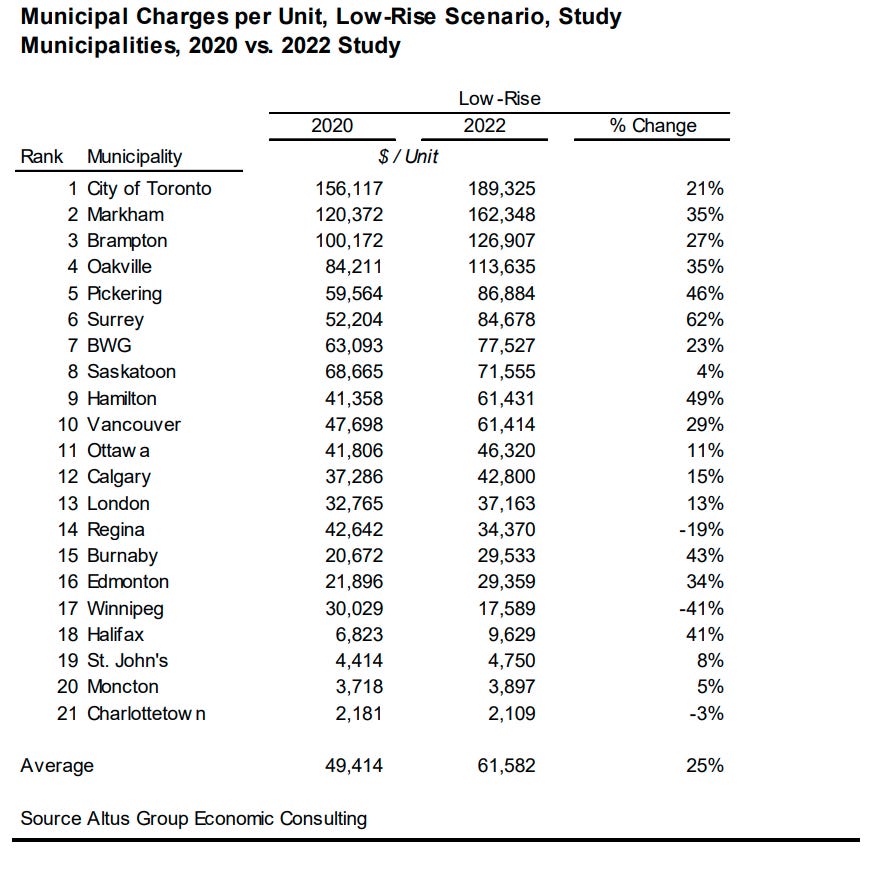

It’s also a problem for the city, and the taxpayers. We just found out the city of Toronto is raising property taxes this year by 6.9%. That follows a 7% increase in 2023, and 9.5% last year. In other words, property taxes have increased by a whopping 24% over the past three years!

So despite one of the most impressive housing booms in modern history, the city is still scrambling for tax revenues. Make no mistake, the housing boom has been very good for government coffers.

For every low rise unit that gets built the city pulls in $189,000. The highest development charges in the country.

So what happens now that pre-sales have crashed to a 28 year low… the cash cow has been taken to the wood shed.

If BMO is right, and we think they are, this housing bear market is not over and the correction will last years, even if prices just go sideways from here. A period of stagnation, not just for home prices, but for home building too.

Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky January 20th, 2025

Posted In: Steve Saretsky Blog