January 14, 2025 | Surprise: Financial Conditions Tightening into 2025

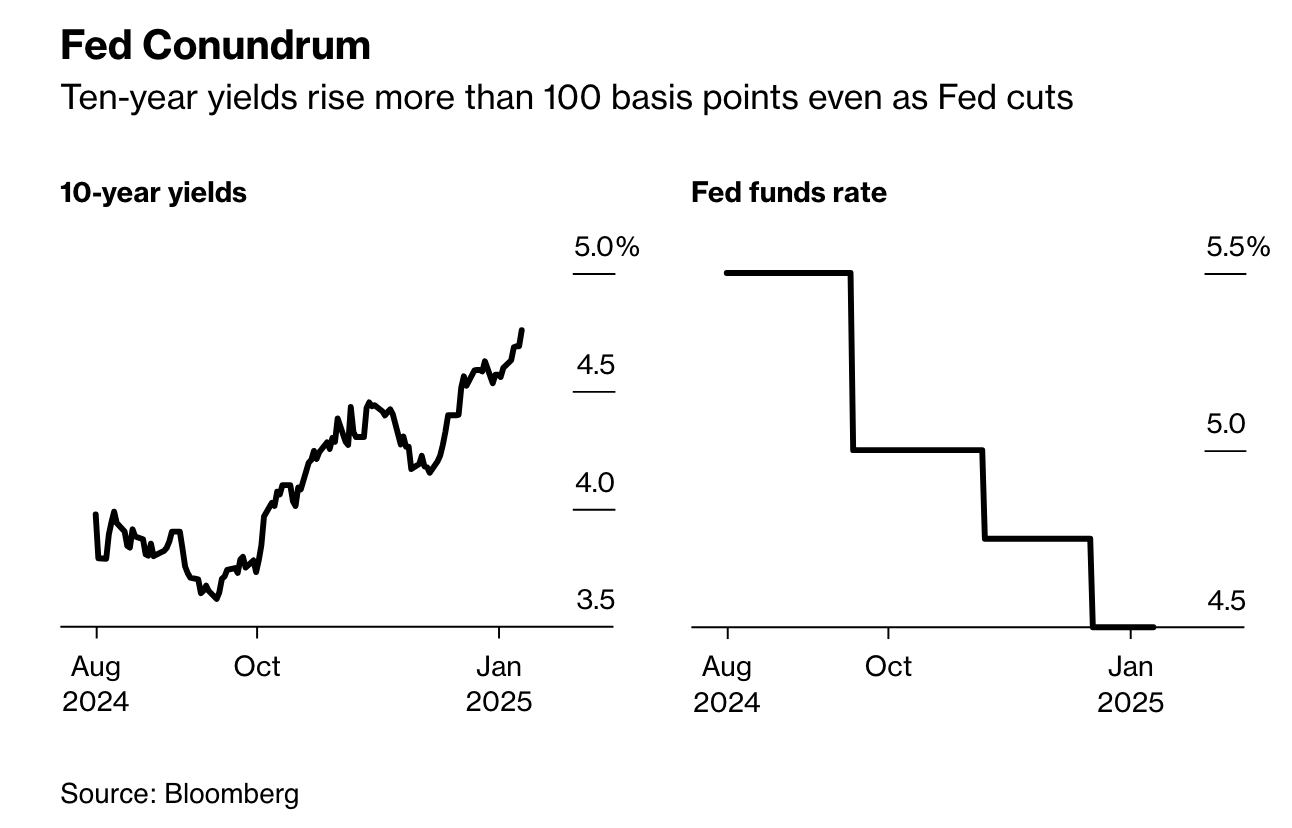

While the U.S. Federal Reserve cut overnight rates by 125 basis points since November 2023 (below on the lower right), the U.S. 10-year Treasury yield has risen more than a percentage point, touching 4.8% for the first time since October 2023 (on the lower left) and April 2007 before that. Higher rates are the opposite of what financial markets had been expecting.

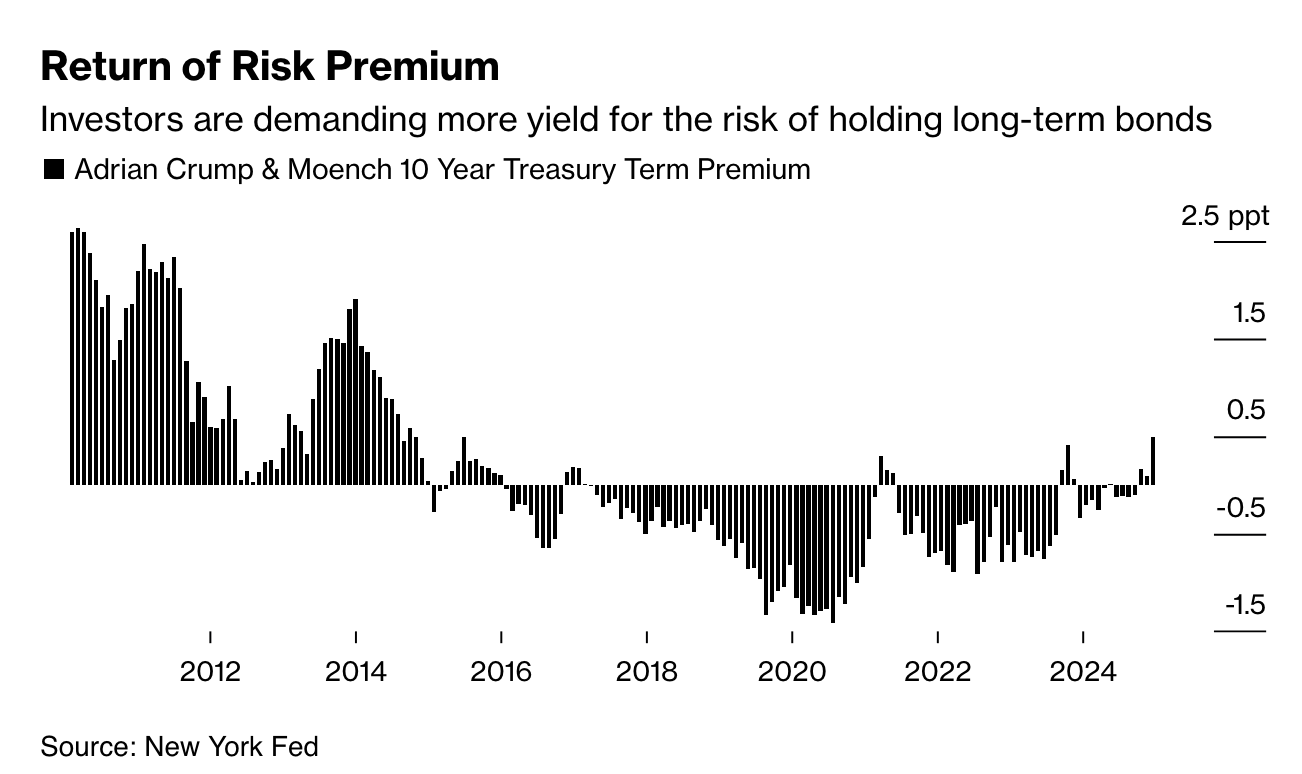

Treasury investors are demanding more yield compensation in the face of incoming trade tariffs, rising debt levels, and galloping interest payments globally, and fair enough. See Global Bond Tantrum is a Wrenching and Worrisome Start to the New Year.

After a record 793 days of inversion from July 2022 through September 2024, an upward-sloping yield curve means that longer-dated bonds finally yield more than short (shown below since 2010). That makes sense.

Since 1955, every U.S. recession has been preceded by an inverted yield curve, followed by re-steepening before the recession fully materialized within 6 to 18 months. So far, no recession has been declared four months after the U.S. 10-2 curve normalized.

Furthermore, when the Fed cuts its policy rate, the U.S. dollar typically weakens, lowering borrowing costs for international USD debtors and boosting U.S. exports. The opposite has happened this time, with the U.S. dollar index (DXY) surging 10% against major trading partners since July 2023.

Magnifying the downside risk of highly inflated stock prices, 30% of S&P 500 company revenues are generated in deflating non-USD currencies and closer to 60% for the “Mag 7” companies (31% of the S&P 500 market capitalization).

Higher yields are better for savers but hard on debtors and are much less ‘stimulative’ to credit growth and stock markets than the zero-bound rates maintained for nine years, 2008-2015 and 2020-22. Investors would be wise to take note.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park January 14th, 2025

Posted In: Juggling Dynamite