January 6, 2025 | Results May Vary

Happy Monday Morning!

Welcome to a New Year. The Real Estate industry remains optimistic that 2025 will finally mark the end of the housing bear market, after what’s been a grueling few years. Are we really turning the corner, or is there more pain to come? Let’s do a deep dive on the Vancouver housing market.

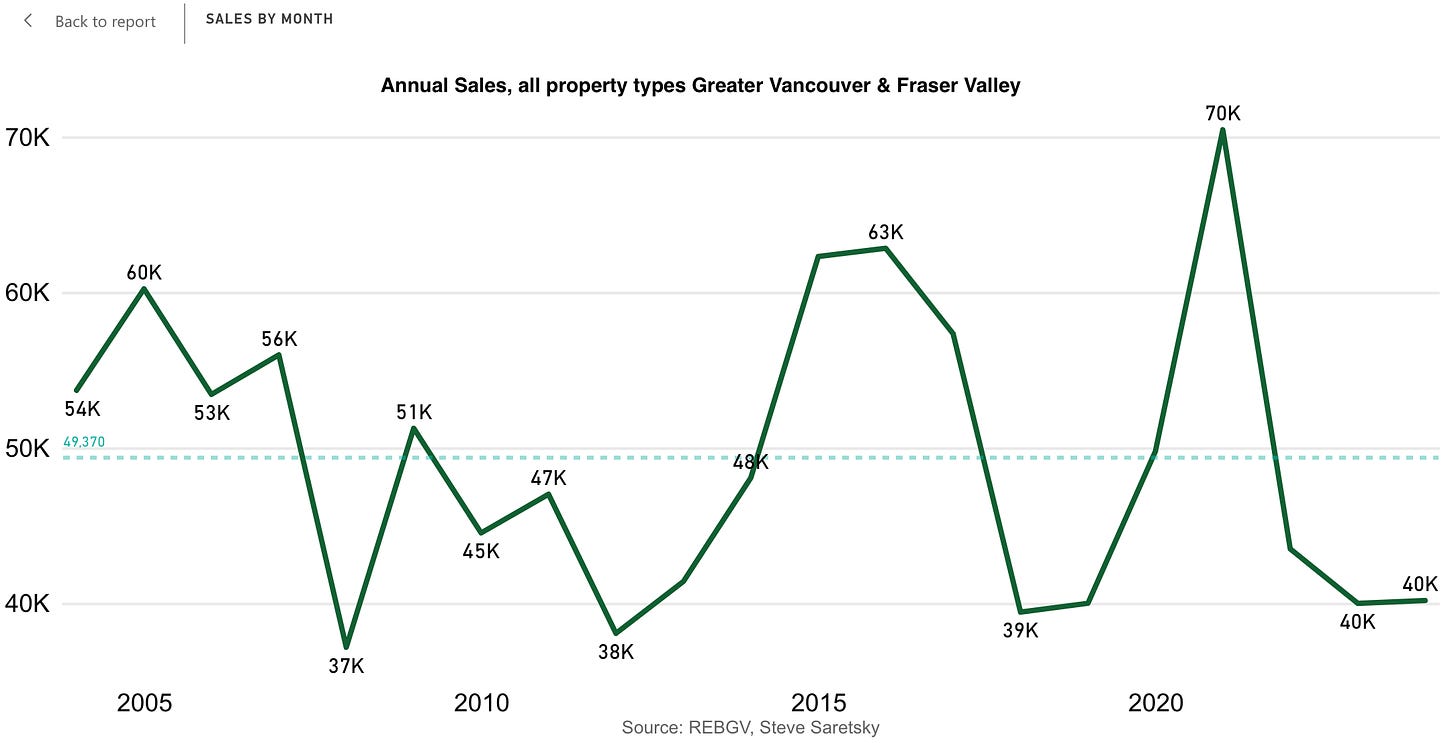

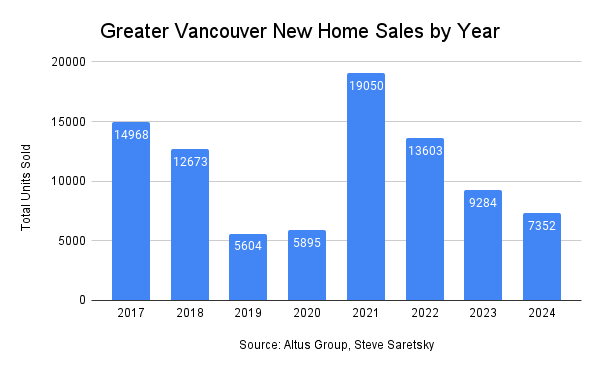

It’s been a difficult adjustment for market participants caught offside when the housing market shifted from a raging bull market to an ice cold bear market the moment the Bank of Canada started jacking rates in March 2022. Home sales went from a record high of 70,000 in 2021 to just 40,000 sales in both 2023 and 2024. It’s been two miserable years for the industry where home sales have been hovering near levels last seen during the 2008 financial crisis.

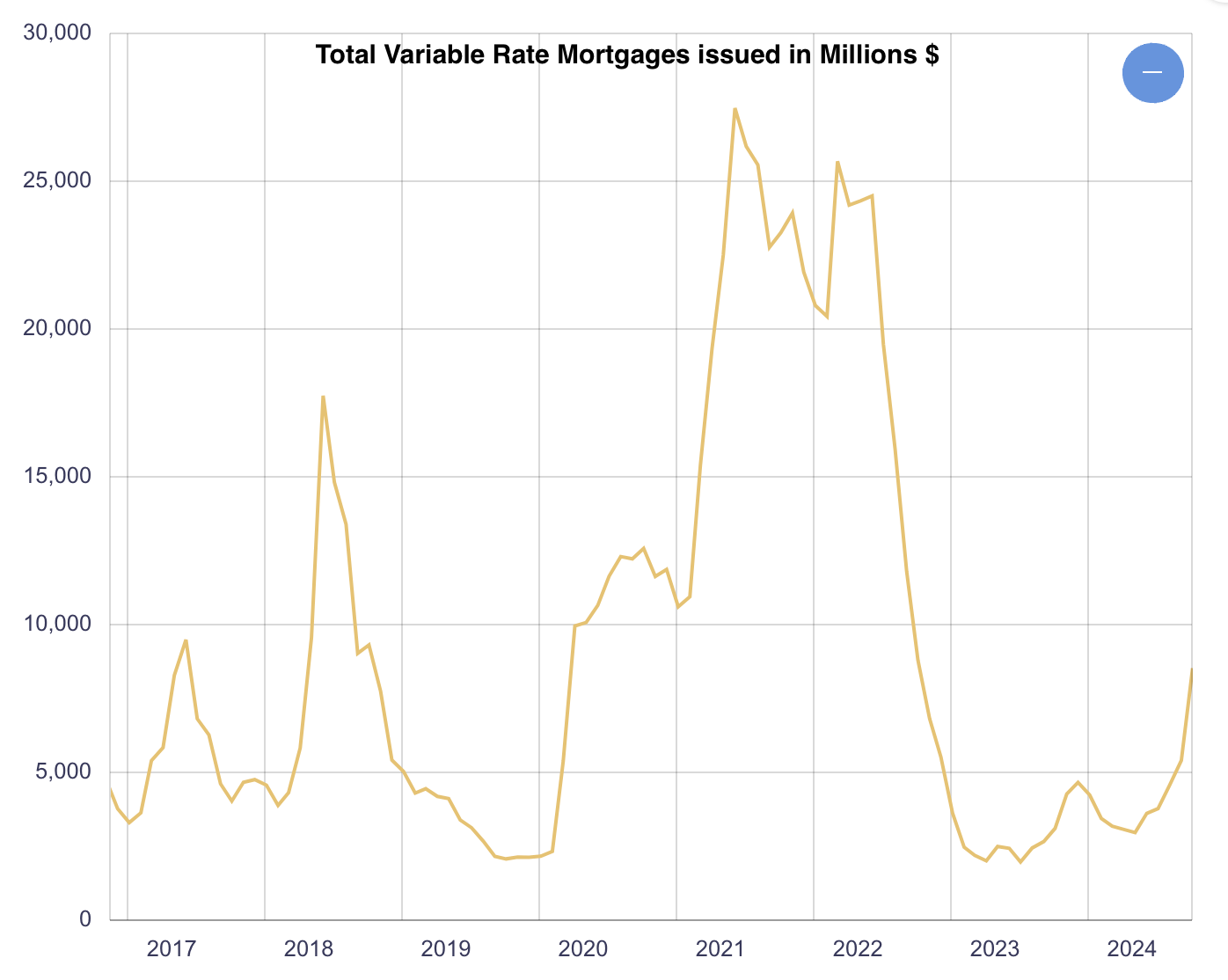

The good news is that sales really can’t get much worse, and from everything we’ve seen, housing activity has been recovering for the past 6 months. This is really not surprising considering variable mortgage rates have plunged 175bps this year and fixed rates have tumbled closed to 100bps. Home buyers purchase payments, and taking mortgage rates from 6% to 4% certainly helps sentiment and the bank account.

So housing activity is recovering but we’re certainly not out of the woods yet. The word for 2025 will be variable. It’s not just variable rate mortgages which are making a recovery, but the market’s behavior will be variable depending on the specific segment.

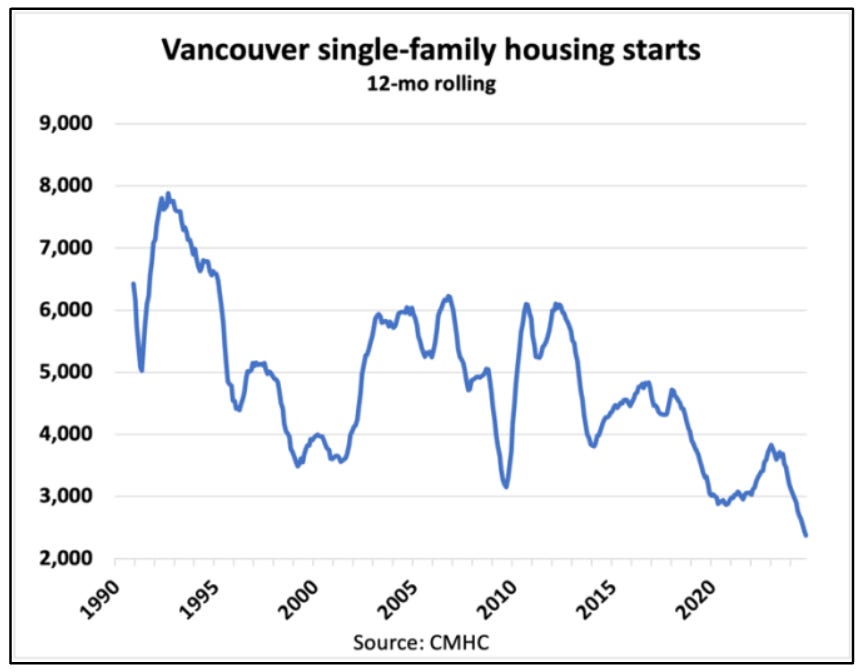

Single family detached houses will bounce back first. In fact, we’re already seeing it. The demand for an entry level house in the lower mainland remains strong. Probably because there are legitimate land constraints and the fact that we no longer build houses in this city. Single family housing starts are at their lowest levels in more than 30 years.

Any new house that is being built today is mostly just an old house being replaced, one for one, with a new custom house. Furthermore, every level of government is encouraging higher density so more and more single family houses are being demolished to make way for duplexes, townhouses and condos. When there’s nowhere to build but up, the slow death of the single family house becomes obvious.

So we’re building lots of condos. Many of which were designed and pre-sold at the height of a raging bull market. Small condos, marketed and sold to investors. These investors are in trouble.

As it stands today, mortgage rates are still double what they were when these pre-sale contracts were purchased. Meanwhile, rents have been falling for a year now, down nearly 10% from the highs.

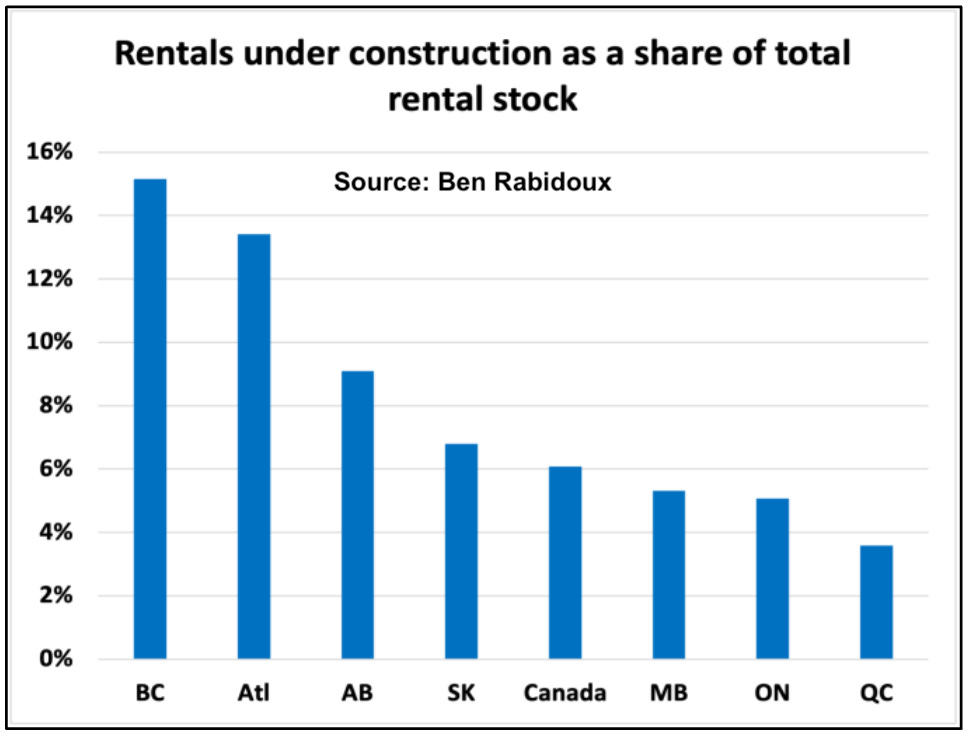

Unfortunately for these investors there’s a record number of new condos in the pipeline currently under construction. The rough math suggests about half of these condo units will end up in the rental pool and they’ll be competing with the growing number of professional corporate landlords building purpose-built rentals. In BC we have the equivalent of 14% of the total existing rental stock currently under construction.

Supply cometh and landlords will be competing for tenants. Remember, the current federal government has promised no NET new population growth over the next two years. Quite simply, the set-up for small and undercapitalized investors is not good. The outlook for both rent growth and price growth over the next year or two is not great. If you’re looking for stress points in 2025 it will be investors, particularly those in the new construction space.

Like we said earlier, the word of the year is variable. Performance will vary depending on what market segment you’re playing in.

Unlike previous years where a rising tide of liquidity lifts all boats, this year will be highly dynamic.

End user demand will continue to recover with investor demand likely to remain weak given the dynamics we highlighted earlier. This will filter though into another tough year for pre-sales.

Stay nimble, my friends. Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky January 6th, 2025

Posted In: Steve Saretsky Blog

Next: Unaffordable Home Prices Weigh »