January 29, 2025 | Recession Watch: Did the Everything Bubble Just Pop?

Real estate, being expensive to finance and highly volatile at market peaks, is frequently a catalyst for recessions. And as Wolf Street’s Wolf Richter reports, housing is sending “peak cycle” signals.

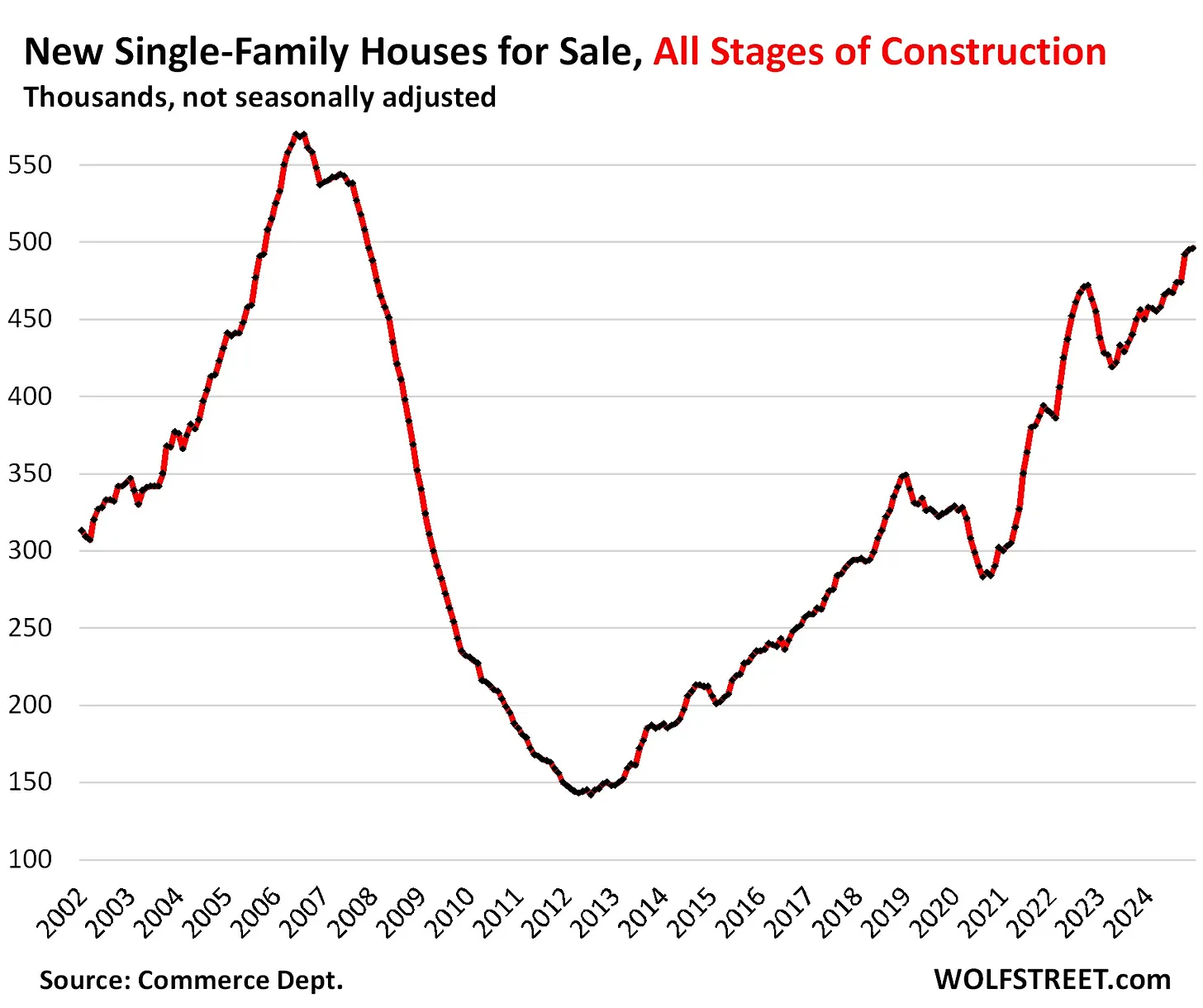

The supply of new houses for sale is spiking to previous bubble levels:

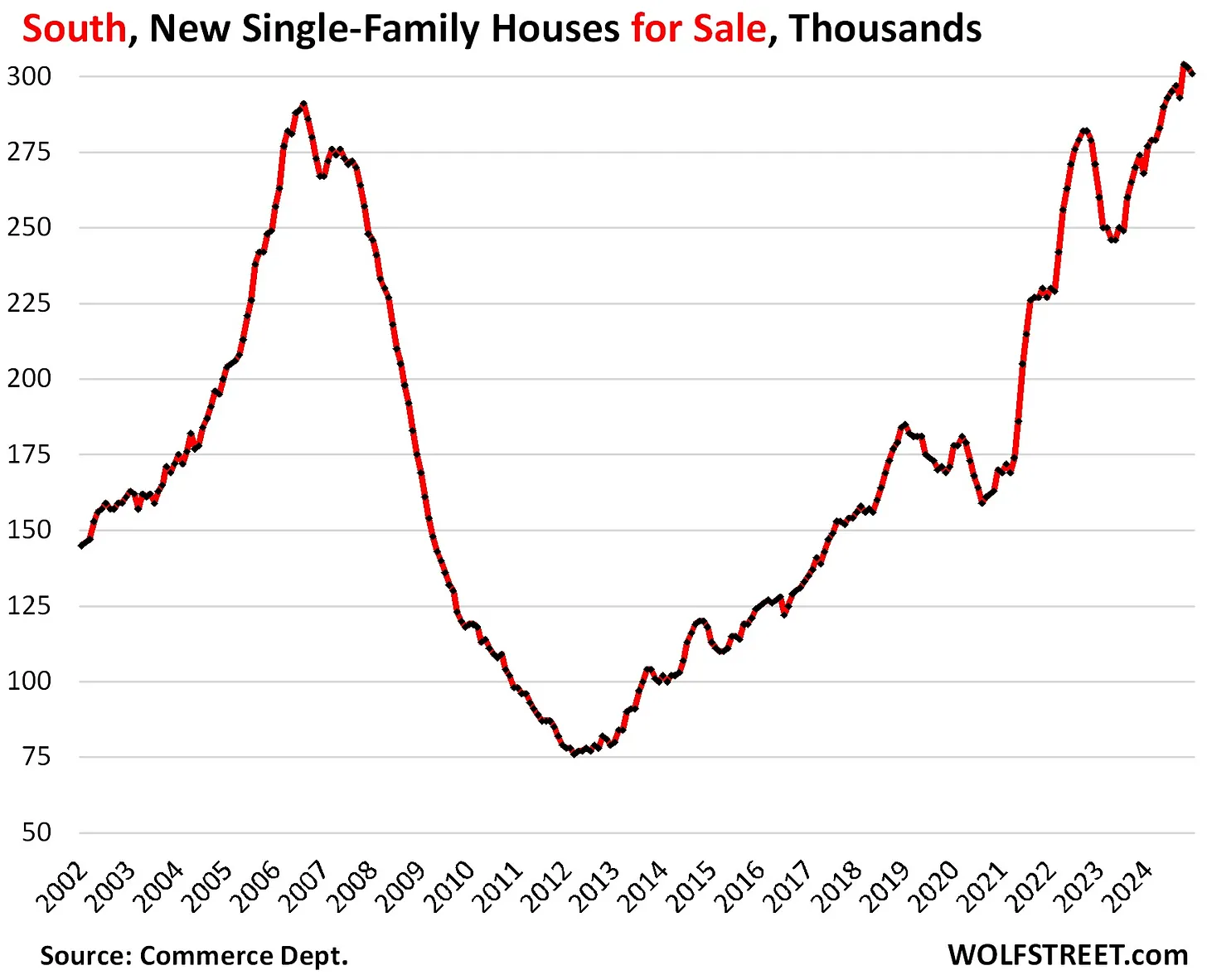

In some formerly hot markets, it’s even worse:

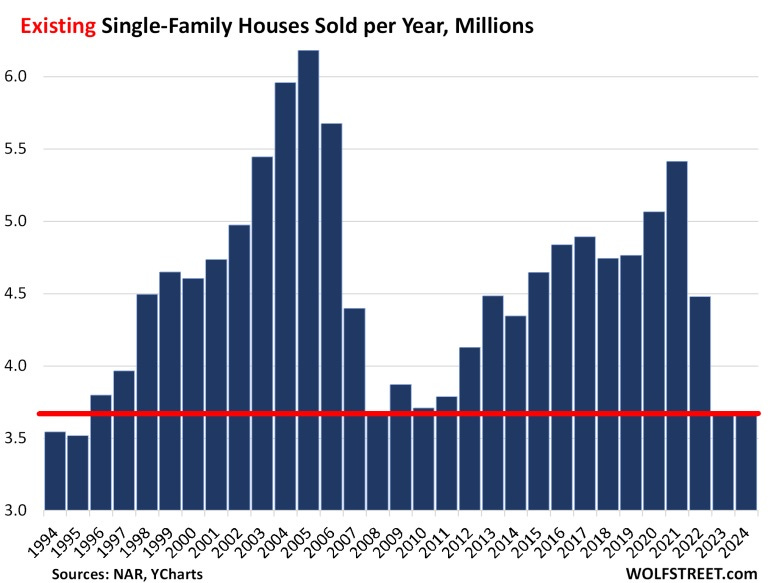

Houses aren’t selling at today’s price/mortgage rate levels:

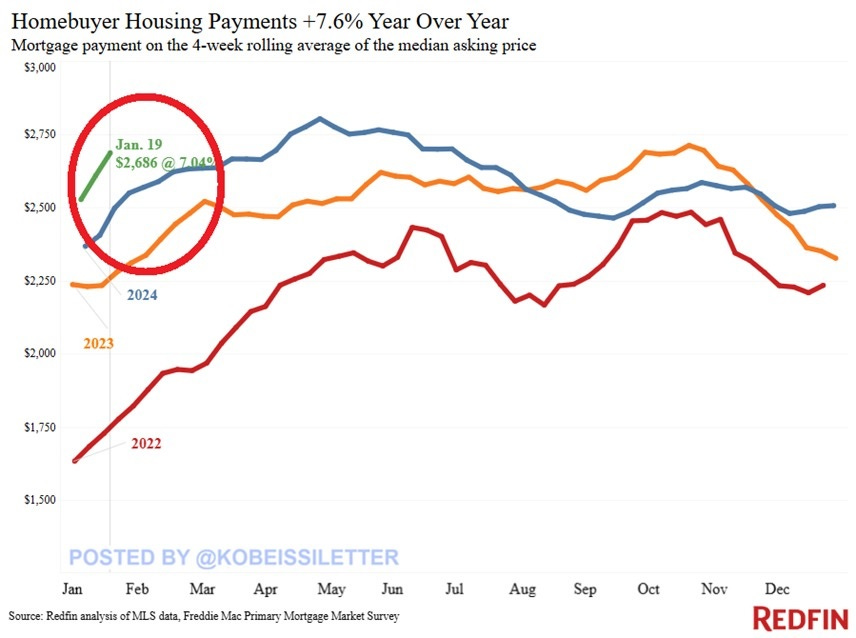

Meanwhile, the cost of homeownership (mortgage, insurance, taxes) keeps rising. In other words, there’s no relief in sight:

Watch those homebuilder stocks. When they roll over, home prices will follow.

Or Maybe Tech Will Do It

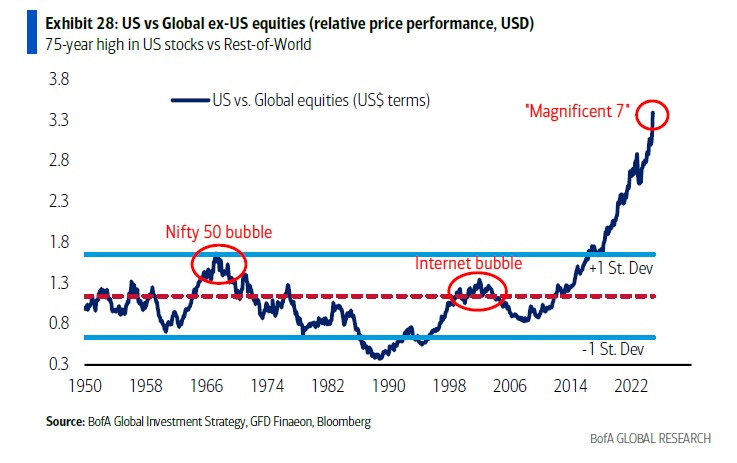

Sometimes, when you’re in the middle of something, it’s hard to see it clearly. For many investors, that’s the case with US equities, which are now more expensive relative to the rest of the world than ever before — by a wide margin. This is an epic imbalance.

The Pin That Pops the Bubble?

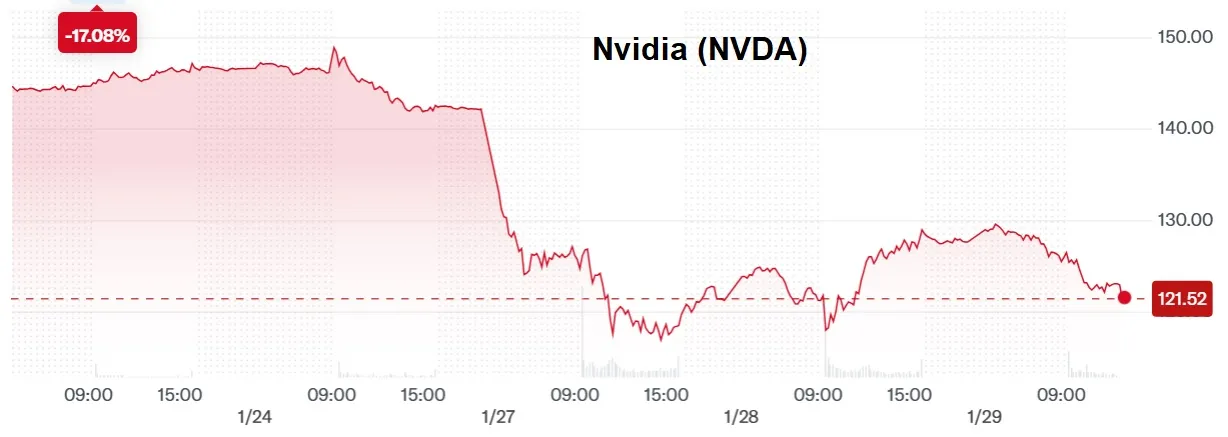

If US stocks are historically overvalued, and AI (led by Nvidia) is what’s elevating this market, did China’s DeepSeek breakthrough just pop the bubble? Nvidia, the dominant AI chipmaker, has shed 17% (or half a trillion dollars of market cap) in the last five days. And it’s still the most richly-priced stock ever:

History teaches that the biggest imbalances are resolved in the most violent ways. If trillions of real estate and AI spending turn out to be “malinvestment,” the ride down to intrinsic value will be epic.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

John Rubino January 29th, 2025

Posted In: John Rubino Substack