January 27, 2025 | Poorer Than You Think

Happy Monday Morning!

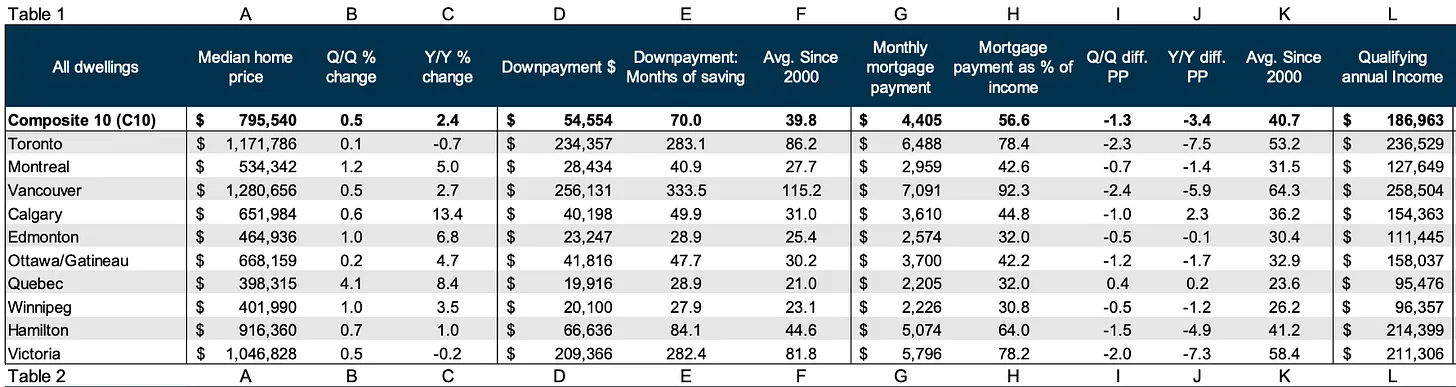

A good reminder from the economics team at National Bank highlights the sobering proposition that a Canadian household would need an annual income of approximately $186,963 to afford a mortgage on a median-priced home in this country, at which point the government thinks you’re rich and taxes you into oblivion.

In places like Toronto and Vancouver the qualifying annual income jumps to $236,529 and $258,504 respectively. Not only does this mean you have to be in the top 5% of income earners just to service the mortgage, but it would also take you 23 years to save for a downpayment in Toronto, and 27 years in Vancouver.

I can tell you from firsthand experience working with home buyers on a regular basis that the biggest barrier to accessing the housing ladder is saving for the downpayment which is incredibly hard to do when you’re paying sky high rents and taxes. This is why parents, who are already on the housing ladder, are gifting large sums of cash to their kids. Call it a front on the inheritance.

It’s also why housing and the social contract are systemically broken in this country. The Feds are trying to lower the barrier to housing by lowering down payment requirements and increase tax payer subsidized loans on purchases up to $1.5M, but all this does is juice demand and supersize leverage.

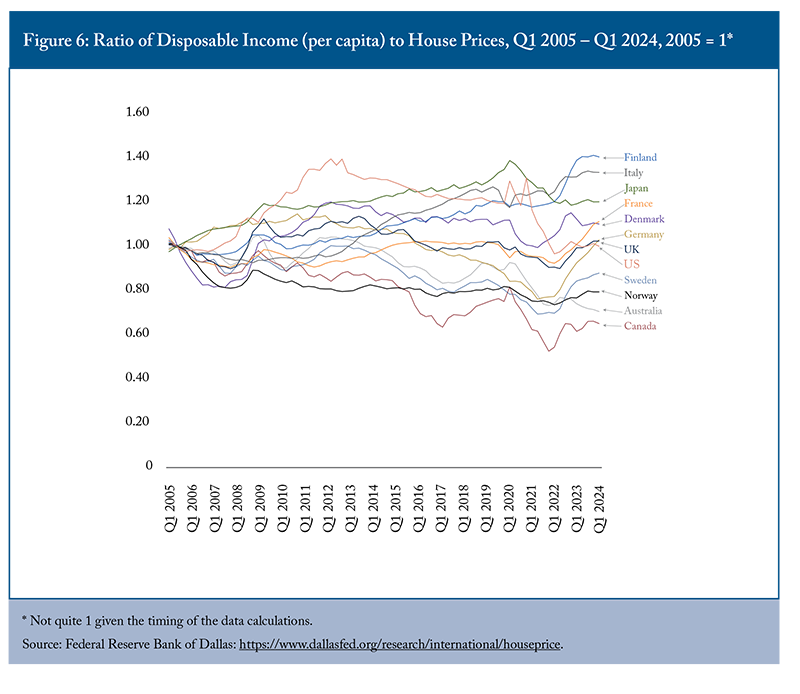

We need to start thinking differently. How can we increase incomes and more importantly increase real after tax takehome pay? Because as it stands right now, Canada has seen the worst deterioration in after-tax income relative to house prices in the world.

Lowering income taxes seems like the obvious solution, but don’t hold your breath. House prices and taxes are inflating at a rate far exceeding incomes and we need to reverse course immediately.

The public sector is essentially cannibalizing the economy. From 2019 to 2023, public sector employment increased by 13.3%, compared to just 3.6% in the private sector (including self-employment). As of September 2024, public sector employees totaled 4.4 million, representing 21% of the total workforce. It costs tax payer dollars to keep feeding the machine, and many of those dollars are being derived from the housing sector.

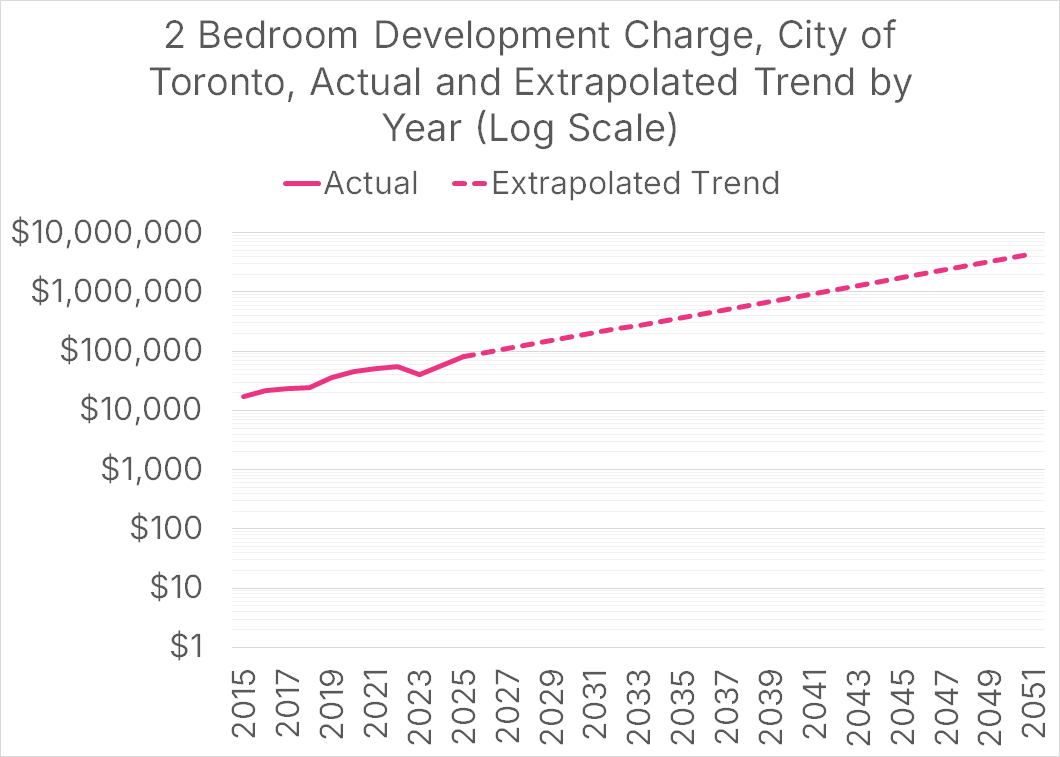

Remember, about 30% of the cost of new housing today is just government fees and taxes. That which is unsustainable can not continue. For example, Toronto’s development charges on a 2-bedroom apartment unit have risen by an average of over 17% a year for a decade. At this rate DCs will exceed $4 million by the end of Toronto’s planning horizon (2051).

If you want to improve housing affordability over time you have to reduce taxes not just on the development side, but on the personal income side as well. Because, as we highlighted at the beginning of this note, $186,963 doesn’t buy you what it used to.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky January 27th, 2025

Posted In: Steve Saretsky Blog