January 29, 2025 | Pent-up Listings Hope for Spring Demand

The Bank of Canada (BoC) cut interest rates by 25 bps this morning, bringing the overnight rate to 3%, 200 bps lower than when the central bank started easing in June 2024. Moreover, the BoC announced it would restart quantitative easing (Treasury buying) in March to reduce longer-term yields/interest rates and increase liquidity in the financial system.

Treasury prices are rallying, with the 5-year Canadian yield at 2.85%, down 106 basis points since last June.

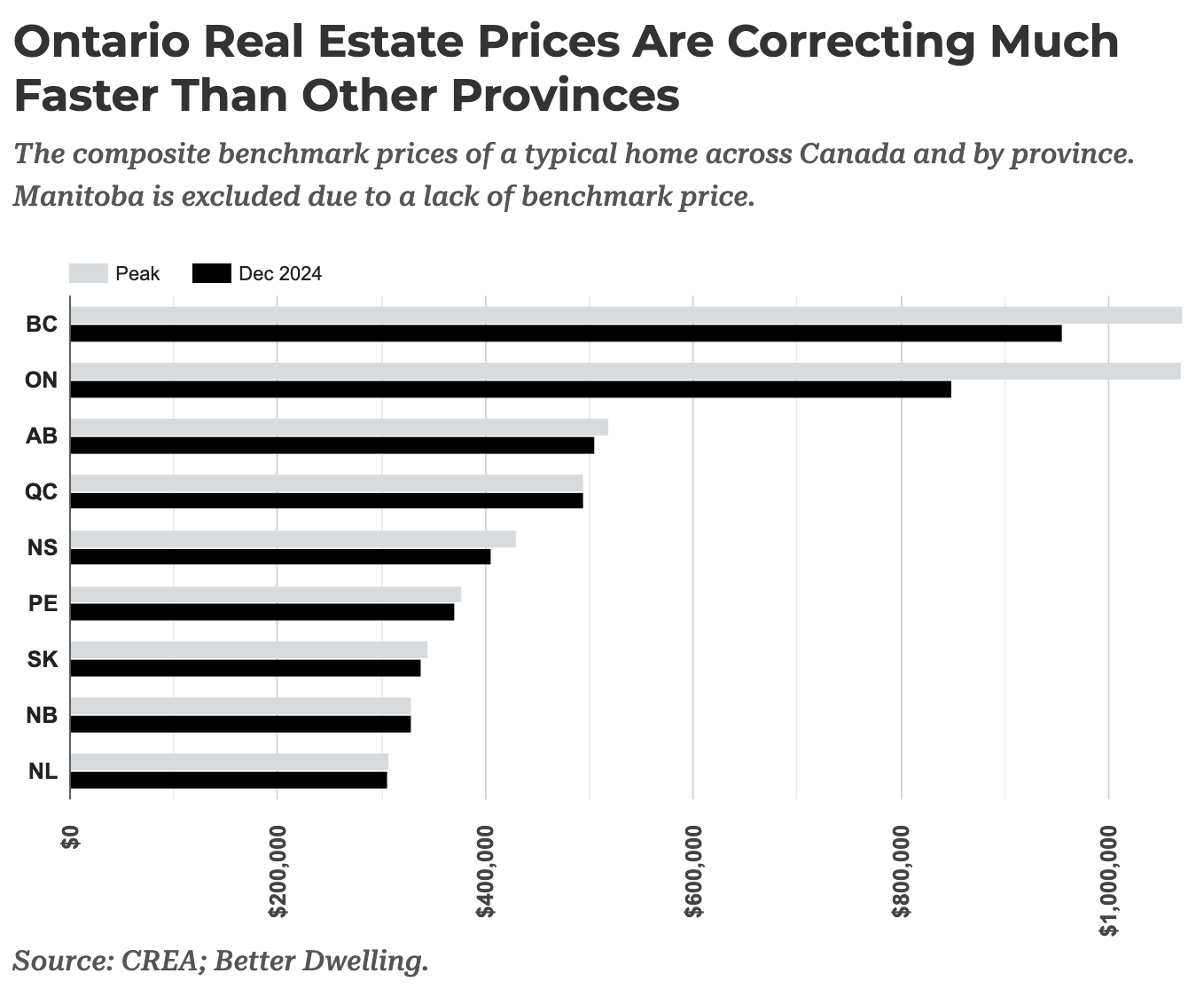

Bank of Canada rate cuts were widely expected to raise Canadian real estate demand and prices. That hasn’t happened. Ongoing weakness is particularly evident in the most populous provinces of Ontario and BC. See Canadian real estate slips; Ontario sees the sharpest correction by far.

As per CREA data, Ontario’s benchmark average sale price fell to $859,600 in December and remains 20.6% (-$220,800) below the March 2022 high. BC is in second place for the biggest drop, with the benchmark at $955,500, down 10.9% (-$116,100) from its 2022 high.

For-sale inventory has risen more than sales, even as frustrated sellers cancelled 1 in 5 listings (20%) without a sale in December. Many plan to relist properties in March, but those banking on strong spring demand may be disappointed.

Canadian mortgage rates are in the 4% to 6% range, depending on terms. This remains more than double the rates at the pandemic-era lows of 2020-2022 when many Canadians borrowed record amounts that come up for refinancing in 2025-2026.

Property prices remain too high unless rates fall near all-time lows or incomes jump significantly.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park January 29th, 2025

Posted In: Juggling Dynamite

This market is going to crash worse then 2008