January 24, 2025 | Canada Should Use The Nuclear Option Against Trump

As soon as February 1, the U.S. might impose a 25 percent tariff on all imports from Canada. Crude oil is one of the biggest Canadian exports to the U.S.

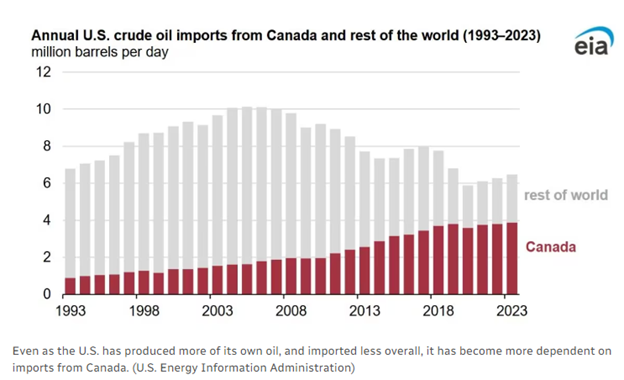

One possibility for retaliation, termed the “nuclear option”, is to cut off all crude oil exports to the U.S. Currently Canada supplies about 2/3 of U.S. oil imports.

Should Canada go with the nuclear option if tariffs are imposed?

This extreme action could be an export tax on Canadian crude, a complete withholding of crude going to the U.S., or a reduction in the amount of crude allowed to flow south.

Canada has been a very important supplier of crude to the U.S., providing about 4 million barrels per day. In approximate numbers the U.S. produces 13 million and consumes about 20 million, so the shortfall of 7 million barrels per day is covered by Canadian imports to an important extent – about 60 percent.

Source: U.S. Energy Information Administration

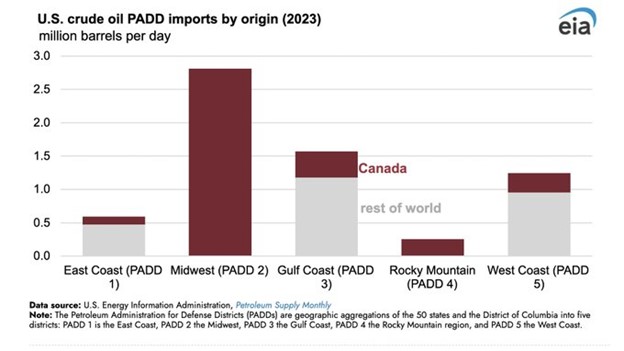

Most of the Canadian crude entering the U.S. is a heavy blend, requiring a complex refining process. Most of the refineries that can handle that — 22 in total — are located in the Midwest, part of the PADD 2 (Petroleum Administration for Defense). All of the oil going to PADD 2 is from Canada, and also for PADD 4 (Rocky Mountain):

Source: U.S. Energy Information Administration

One of the most important refineries is the Pine Bend refinery in Minnesota. Koch Industries runs this refinery, which is fed by Canadian heavy crude. Charlies Koch is very wealthy, at more than $50 billion net worth, and much of that came from refining Canadian heavy oil bought at a discount. He is a major financial backer of the GOP and other right-wing groups. A complete blockage of Canadian oil exports would hit Koch hard. President Trump would hear about the problem immediately.

So, if Canada exports are blocked to the refineries in the Midwest, they would be unable to make gasoline and, in a month or two, there would be shortages of gasoline and diesel.

How much of the negative impact would hit Canada?

Trevor Tombe, economist from the University of Calgary, says that the 25 percent tariffs starting February 1 will be very expensive for Canada, causing a deep recession. He estimates that the GDP impact would be about -1.8 percent, or about $1,300 per person. And an oil curtailment would add to the trouble and would be very difficult financially for Alberta. In the long term the U.S. might reduce its imports from Alberta.

The oilsands would feel the most pain, with the “nuclear option” of complete stoppage of crude exports.

Premier Danielle Smith argues against the “nuclear option” and wishes to negotiate with President Trump.

But how do Canadian negotiators get President Trump’s attention?

Nothing short of the “nuclear option” would put much political pressure on Trump. It might be worth a try. If nothing else, it would be interesting to see how Trump reacts when someone calls his bluff.

A bully like Trump needs to be confronted.

Hilliard MacBeth

The pinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth January 24th, 2025

Posted In: Hilliard's Weekend Notebook