January 13, 2025 | Big Bank, Big Forecasts

Happy Monday Morning!

Every New Year is marked with forecasts. There’s a natural affinity for making predictions about house prices, particularly in Canada. Most homeowners we chat with today believe two things, interest rates are going lower and house prices should rise in 2025. I have a few thoughts, but first let’s see what the big banks think.

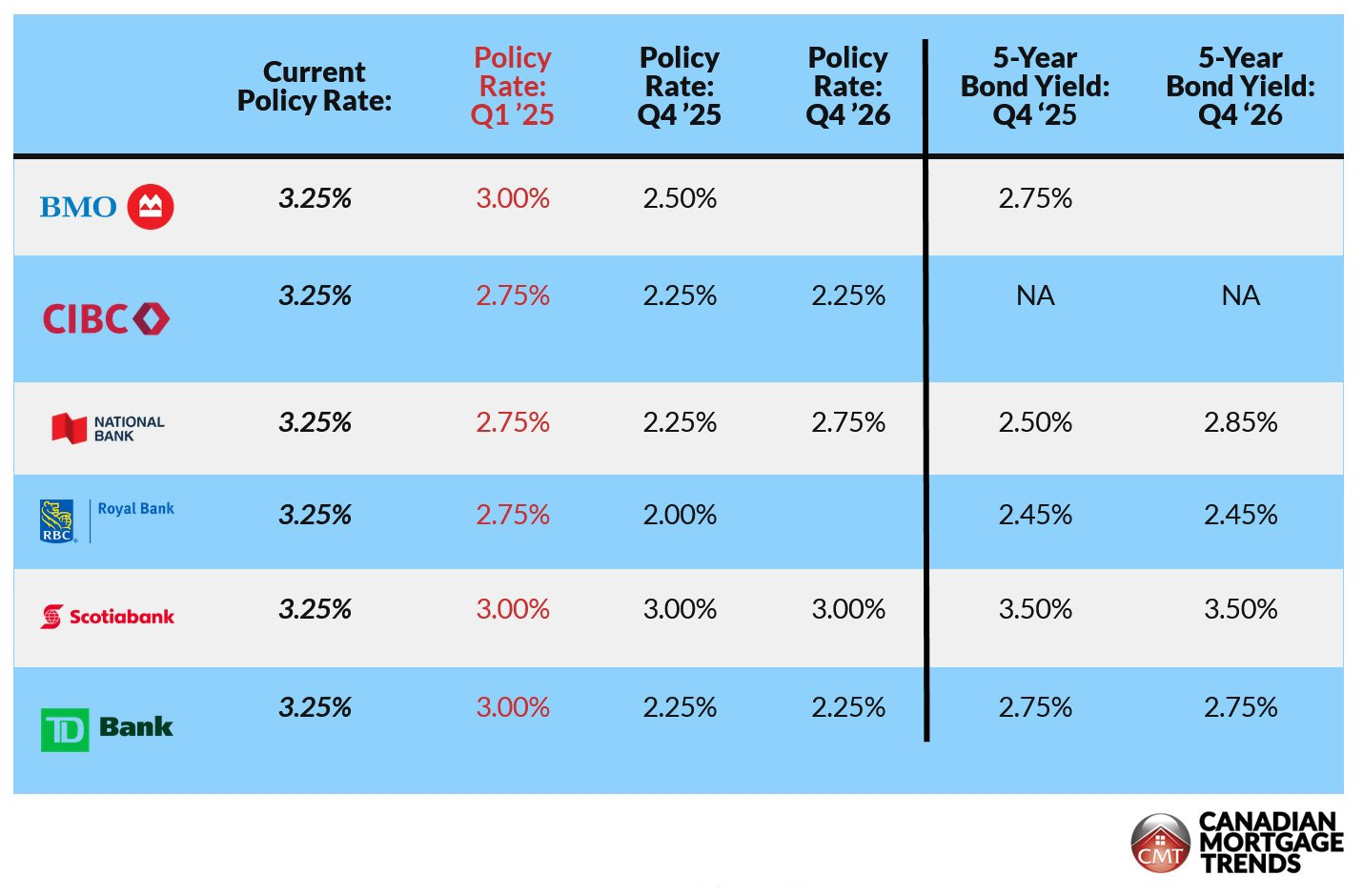

The banks believe the Bank of Canada will keep lowering rates, anywhere from another 25bps to 125bps by the end of the year. That’s a pretty wide range of outcomes. ScotiaBank’s chief economist, Derek Holt, who was spot on back in 2022 when the aggressive rate hiking cycle began, remains the most hawkish, forecasting one more final cut from Tiff Macklem and co. Ouch.

On the flip side you have RBC which is calling for a whopping 125bps in additional rate cuts this year, far exceeding market expectations. In other words, RBC thinks the wheels are about to fall off the Canadian economy. Just this past week we heard from RBC’s CEO Dave McKay who noted “Every 25 bps of BoC rate cuts releases roughly $7 billion of cash flow into the Canadian economy. You can see why the Bank of Canada wants to get rates down…”

What’s perhaps most enlightening about these big bank forecasts is that despite the hundreds of highly educated economists on the payroll there is no consensus on interest rates, or bond yields. A perhaps unsettling reality for many Canadian borrowers.

Things get even more interesting in the bond market. RBC and National Bank have bond yields drifting modestly lower this year, while Scotia has bond yields ripping to 3.5% by year end. If ScotiaBank is right that would push most 5 year fixed rate mortgages back into the high 4’s.

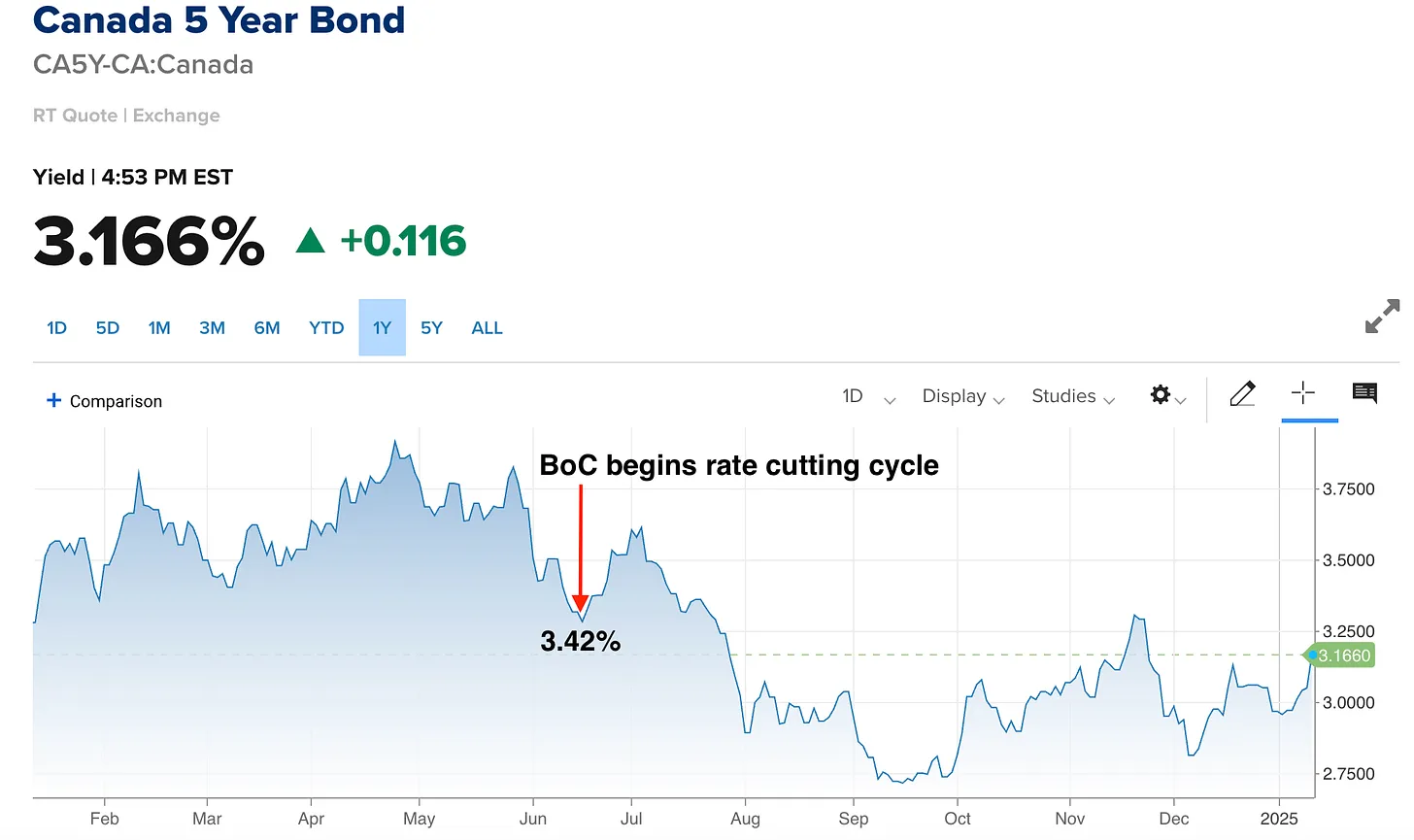

I’m not sure if ScotiaBanks Derek Holt is right, but I think he is presenting a plausible scenario that we have also cautioned in this newsletter. Bond yields and fixed rate mortgage rates probably won’t come down as much as many Canadians thought they would. Since the BoC started chopping rates in June, the 5 year bond yield has dropped a mere 25bps. So the BoC has cut by 125bps but the 5 year is down just 25bps. The bond market is not playing ball.

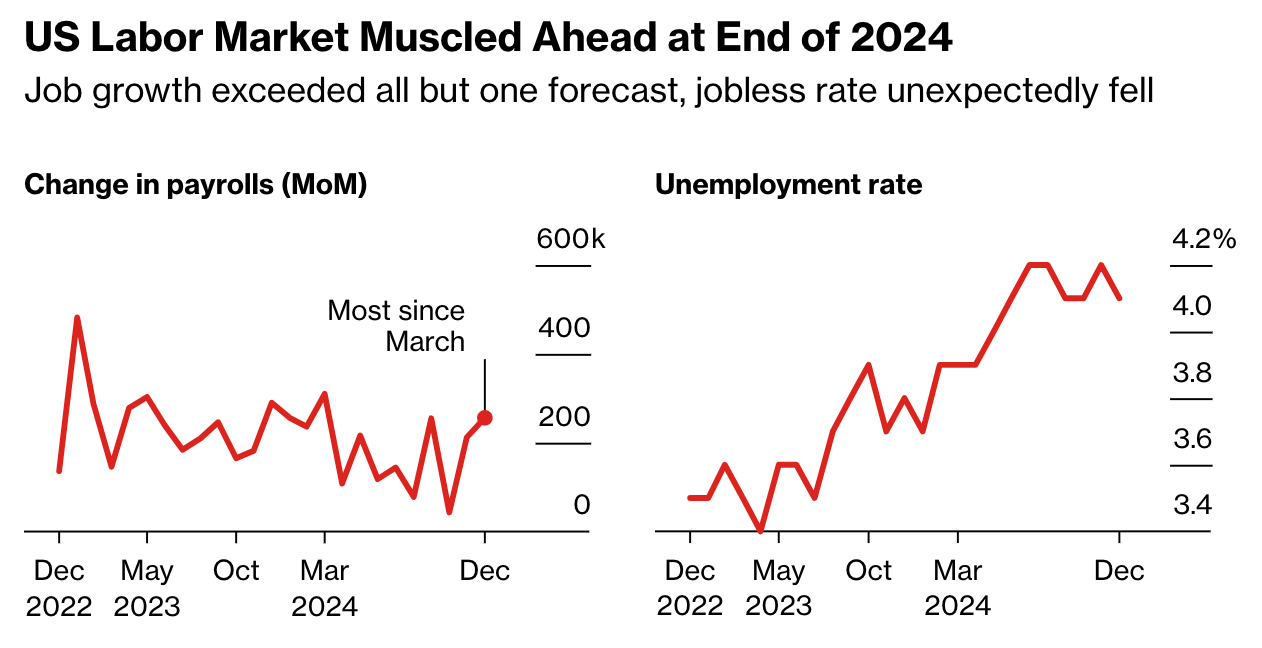

This has little to do with the strength of the Canadian economy, but rather a string of stronger than expected economic data in the US that is driving domestic bond yields higher. Just this past week the US added 256,000 jobs in December, the most since March — exceeding all but one forecast in a Bloomberg survey of economists. The unemployment rate unexpectedly fell to 4.1%.

None of this suggests more rate cuts are warranted in the US, and the bond market agrees. The 10-year yield is now up 104 basis points since the Fed started cutting rates in September. In many cases, financial conditions are getting tighter, not looser.

So what does this all mean for Canadian Real Estate?

More uncertainty.

Now add in looming trade tariffs with the US that threaten to tip the economy into recession combined with the political chaos in Ottawa and things get really interesting.

There’s a wide range of possible outcomes here, not just for the bond market, but housing too. If there’s one thing potential house buyers hate it’s uncertainty. Nothing delays the purchase of a big ticket item like the threat of losing your job.

The reality is most of these bank forecasts will be wrong, predicting markets is hard.

So far here’s what we know for sure. Mortgage rates have come down from their highs of 6%. Sentiment has improved from the depths of the rate hiking cycle. Sales are normalizing but there’s also a record number of units under construction and immigration is going to slow to a trickle.

Good luck with your forecasts. Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky January 13th, 2025

Posted In: Steve Saretsky Blog