January 3, 2025 | A Very Reliable Recession Indicator is Flashing Red

Among the several U.S. recession indicators warning of trouble to come, this might be the best one to watch.

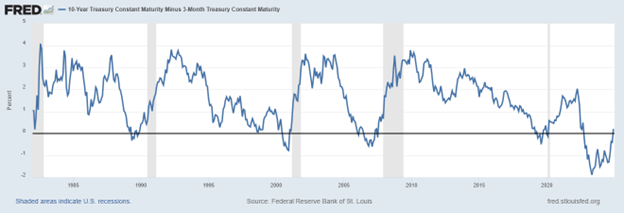

Yield curve inversion sounds a bit wonky, but it is straightforward. The yield curve on government bonds is derived from the different interest rates on the short, medium and long-term maturities plotted on a graph. The curve usually indicates that long-term maturities yield a higher interest rate than short-term bonds. That is considered a positive slope to the yield curve.

But when the interest rate on short-term notes, like 3 months, exceeds the rate on a longer term bond, such as the 10-yr US Treasury note, the yield curve becomes inverted, and it is plotted on the graph as a negative number. This is unusual.

The reason that this negative state is considered abnormal is that most investors would prefer to keep their money liquid and avoid the risk of capital losses when interest rates rise. So, the risk of investing for ten years is usually rewarded by earning a higher return than investing for 3 months. Investors have to be lured by higher rates to take on a longer-term bond.

The chart confirms that the normal relationship is positive, meaning the line is above zero on the graph almost all of the time back to 1980 at least. There are five brief episodes since 1980 when the ratio has dipped into negative territory before eventually rebounding to the normal range. The vertical gray bars indicate a recession, so four times out of five when the ratio went negative as in 1989. 2000, 2006 and 2019 there’s been a recession that started soon after, within a year for two.

Source: FRED – St. Louis Fed.

The yield curve inverted (went negative) recently, for the fifth time, starting in October 2022. This time the ratio went much deeper into negative territory than previously, reaching -1.8 percent. And this episode of inverted yield curve has longer in the negative, as it has been more than two years since turning negative.

There is another phenomenon that shows up on this chart that many investment people have noticed. Every time the yield curve inversion turns back to a positive number there has been a recession shortly after. And the latest inversion has de-inverted, moving into positive territory in December 2024.

In 2022-25 investors were doubting the validity of this recession barometer. But it is a good bet that this time we’ll see a recession too. This is partly because there is always another recession coming and it has been a long time since the last one, if you don’t count the 2020 recession. The global financial crisis ended in 2009 or 2010, so we are now starting the fifteenth year after that severe recession.

And huge government deficits have been stimulating the economy, perhaps delaying the start of a recession. But if the Musk-Trump team is serious about making spending cuts to reduce the deficit, that will push the economy into recession.

Short-term pain for long-term gain!

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth January 3rd, 2025

Posted In: Hilliard's Weekend Notebook