January 10, 2025 | A Credit Crunch Coming Soon

Hints of an imminent credit crunch in the U.S. and Canada are piling up.

Too much debt in commercial real estate, residential real estate, credit card balances, personal loans, mortgages, builders’ construction loans and even governments could trigger a crisis of failure to repay debts.

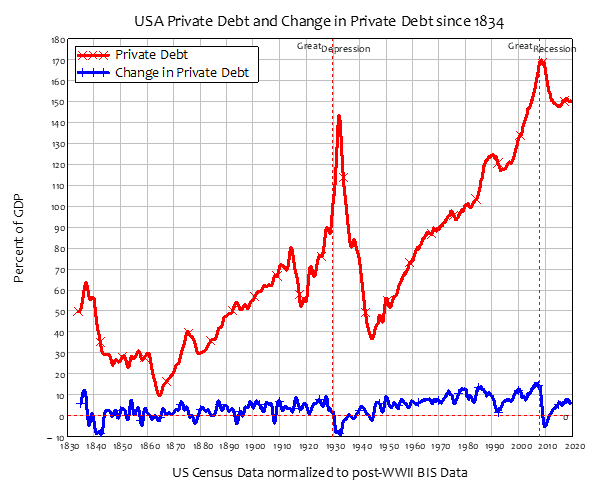

This chart shows U.S. private sector debt since 1834 and it’s obvious that we are in unusual times. The current private sector debt as a percentage of GDP is higher than immediately before the start of the Great Depression in 1930!

The years since 1950 include many observations where private sector debt grew faster than GDP by more than 10 percent. This steady and rapid buildup of debt has fueled the economy for many decades.

Source: Steve Keen

In Canada, private sector debt to GDP is much higher than in the U.S.

Source: FRED – St. Louis Fed

Canada is at 220 percent of GDP, while the U.S. peaked at 170 percent and is now at 150 percent. Canada has been one of the world’s leaders on this metric for more than a decade, fueled by a booming real estate market. Speculators, builders, homeowners, and foreign investors all became convinced that residential real estate would always rise in value, so they borrowed all they were allowed and dove in. For a time that worked quite well.

When March 2020 hit governments all around the world flooded the private sector with new loans and gifts to allow them to survive the crisis. We can guess that people used that money to lever up their loans and buy more real estate, because GTA house prices peaked in early 2022.

But now we have home prices dropping by up to 20 percent or more in some areas, especially in the outskirts around the Toronto centre. Condos are struggling and even Calgary is seeing some price declines.

It might be that this debt accumulation has finally caught up with the capacity of households to support the interest payments, especially after a bout of inflation raised prices substantially. One of the signals that could be the canary in the coal mine is widespread failure to pay off credit card balances monthly:

Source: FRED – St. Louis Fed

We can see the rapid decline in credit card balances after the deluge of money arrived in 2020, and then an almost vertical rise since 2021, when balances increased by almost 50 percent. This is more remarkable when we remember that the average interest rate on credit card balances is 23 percent.

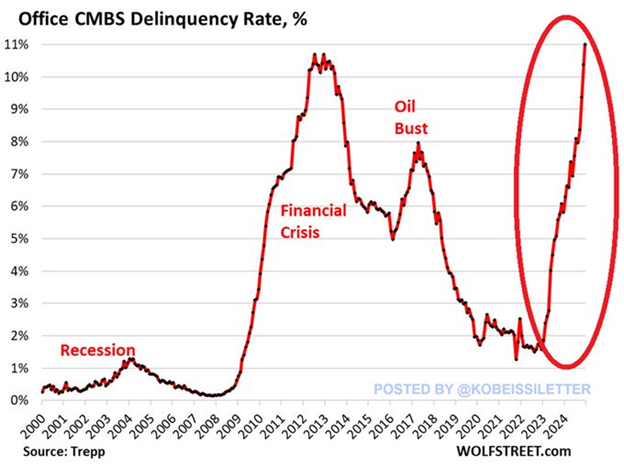

And it’s not just households with mortgages, HELOCs and credit cards. There is a surge in business loan defaults also, especially in commercial real estate. The office sector is the worst category for payment delinquency.

Most governments in developed countries are not in a position to bail out heavily indebted businesses and households right now. Canada’s federal government just announced a CAD$61 billion deficit and the U.S. is heading for a $2 trillion shortfall.

Will governments try to avoid a severe credit crunch by inflating the economy once again?

Hilliard MacBeth

The opinions expressed in this report are the opinions of the author and readers should not assume they reflect the opinions or recommendations of Richardson Wealth or its affiliates. Assumptions, opinions and estimates constitute the author’s judgment as of the date of this material and are subject to change without notice. We do not warrant the completeness or accuracy of this material, and it should not be relied upon as such. Before acting on any recommendation, you should consider whether it is suitable for your particular circumstances and, if necessary, seek professional advice. Past performance is not indicative of future results. The comments contained herein are general in nature and are not intended to be, nor should be construed to be, legal or tax advice to any particular individual. Accordingly, individuals should consult their own legal or tax advisors for advice with respect to the tax consequences to them, having regard to their own particular circumstances.. Richardson Wealth is a member of Canadian Investor Protection Fund. Richardson Wealth is a trademark by its respective owners used under license by Richardson Wealth.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Hilliard MacBeth January 10th, 2025

Posted In: Hilliard's Weekend Notebook

Next: The UK’s Strange Collapse »