December 16, 2024 | Whispers of the Bond Market

Happy Monday morning!

Homeowners, rejoice! As expected, The Bank of Canada followed through with another jumbo rate cut, slashing the overnight rate by another 50bps, and signalled more to come, albeit at a slower pace.

“It has been a tumultuous four-and-a-half years for Canadians, for the Canadian economy. I’m very pleased we’ve got inflation back to 2 per cent. Price stability is low, stable inflation. We’ve got it back to low. We need to deliver on stable,” noted BoC’s Macklem.

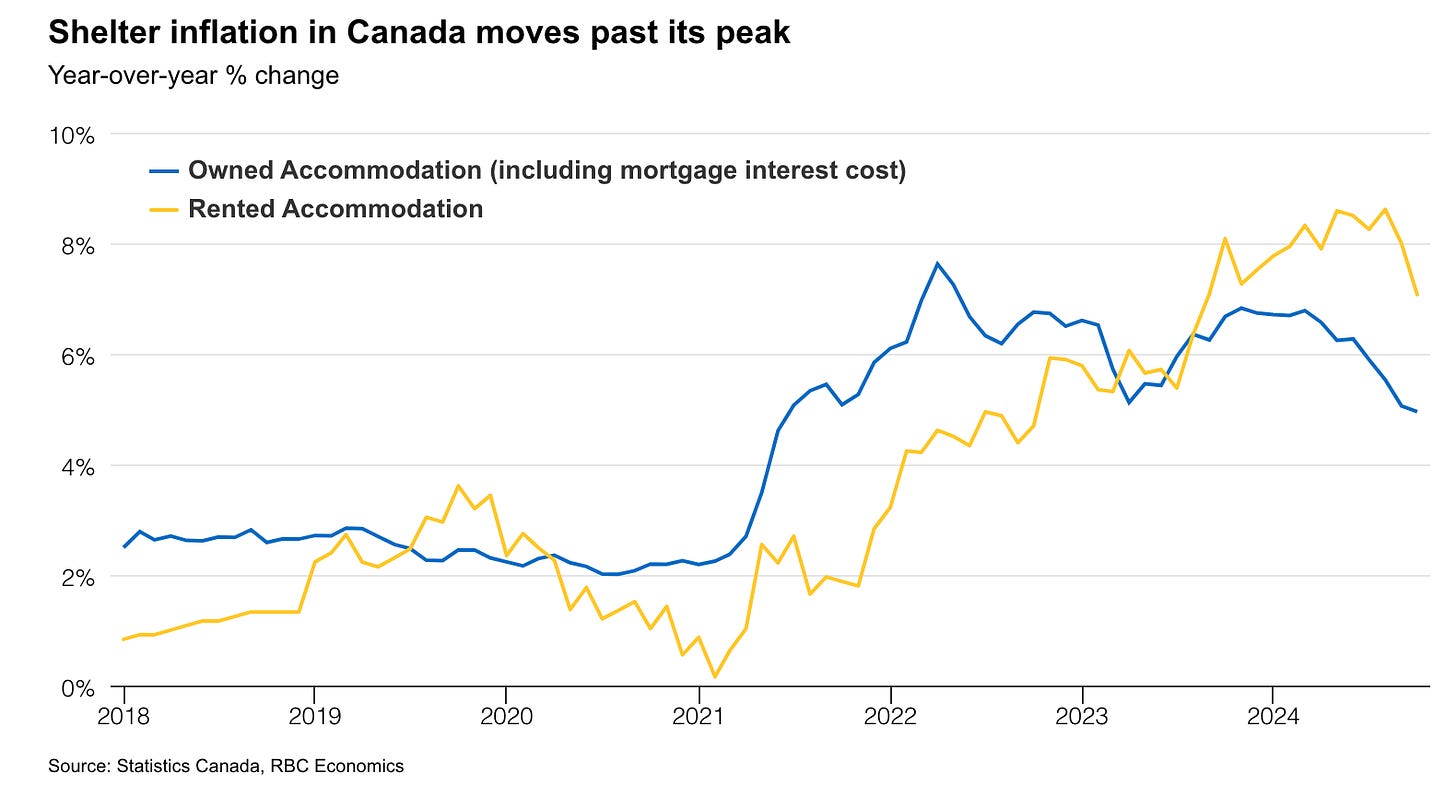

It’s true, inflation in Canada is in the rearview and it seems reasonable to think that will continue in the months ahead considering the weakness in the labour market, the exodus of non-permanent residents, and shelter inflation rolling over in real time.

According to recent data from Rentals.ca, asking rents for all residential property types in Canada declined to a 15-month low of $2,139 in November. Rents fell 1.6% on an annual basis in November. In Vancouver and Toronto, asking rents are down a whopping 10% year-over-year.

Pretty significant when you consider that the BoC’s models are suggesting rent prices are still running hot at +7% year-over-year.

Make no mistake, we believe the BoC is aware the rental market is softening in real time, and gives them the green light to continue easing monetary policy.

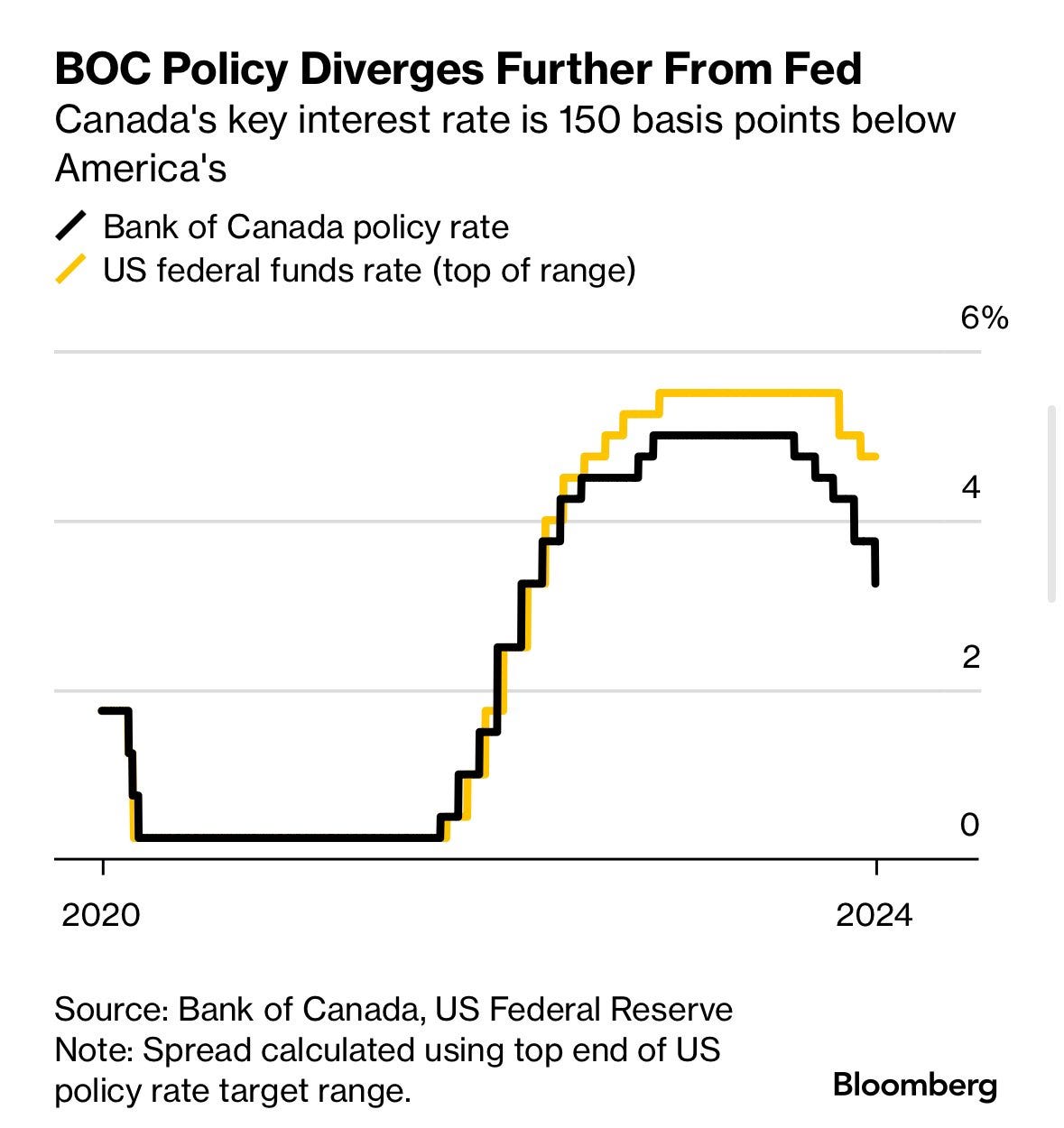

Unfortunately, there’s no such thing as a free lunch. While the BoC continues to chop rates, our neighbours to the south look like they might be done. Markets are pricing in a 25 bps reduction at the Dec. 17 policy meeting, and nothing after that.

The interest rate differential between Canada and the US is now at its widest levels since 1997.

This is putting significant pressure on the Canadian dollar which has tumbled to its lowest levels in nearly five years.

In a recent interview with the Globe & Mail, Macklem suggested he isn’t worried just yet, but perhaps he should be.

“We are starting to see a bit more of a depreciation of the Canadian dollar. How much of that is related to the interest-rate spread I think is an open question, because much of the depreciation of the Canadian dollar vis-à-vis the U.S. dollar really is more reflective of U.S. dollar strength.”

For now policy makers are celebrating the achievement of aggressive rate cuts domestically.

There’s just one problem, markets aren’t playing ball. Yes, mortgages cost less, but only if you’re on a variable rate mortgage. The 50bps cut from Macklem and Co means an adjustable-rate mortgage will see payments drop by about $30/month for every $100,000 owing.

Fixed rates, however, did not get any cheaper this week, in fact they went up!

The Canada 5 year bond yield, which is an excellent bellwether for 5 year fixed rate mortgages finished the week up 15bps.

Remember, about 1.2 million mortgages need to be renewed next year, the majority of which are fixed rates, not variable rates. In other words, the bond market is more important to Canadians and the housing market than the prime rate.

If you’re trying to figure out where rates and housing are going once has to shift their attention back down south where 10 year treasury yields and inflation are accelerating higher.

We continue to believe too many Canadian homeowners are focused on Tiff Macklem and the Bank of Canada cutting the overnight rate, and not enough appreciation is being given to the strength of the US economy and the whispers of the bond market.

If the Fed is really done cutting rates this month we’ll have more confirmation that the Bank of Canada is stuck between a rock and a hard place- cutting rates into a falling Loonie as bond yields push higher, and with that, higher fixed rate mortgages.

Let’s watch.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky December 16th, 2024

Posted In: Steve Saretsky Blog

Next: Food Inflation on the Rise »