December 7, 2024 | Trading Desk Notes for December 7, 2024

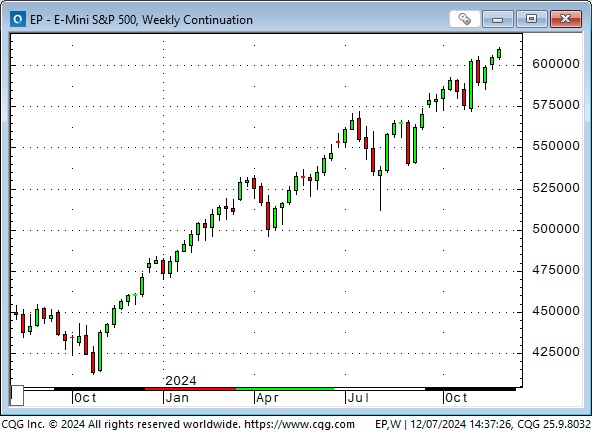

Tech stocks led the indices higher this week.

AAPL hit new record highs, up ~11% in a month and ~50% in eight months.

TSLA had another good week, up ~56% since the election and 2.8X in the last eight months.

AMZN is at record highs, up ~15% since the election and ~50% in the last four months.

The S&P closed this week at record highs, up ~7% since the election and nearly 50% since the October 2023 lows.

WMT looks like a tech stock, up ~16% since the election and over 90% since the October 2023 lows.

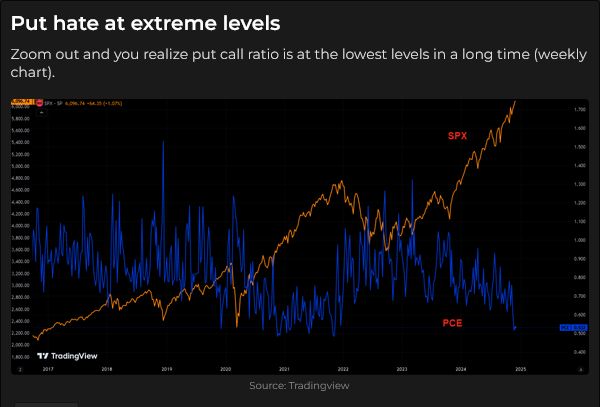

A torrent of capital flows into American stocks driven by TINA and FOMO.

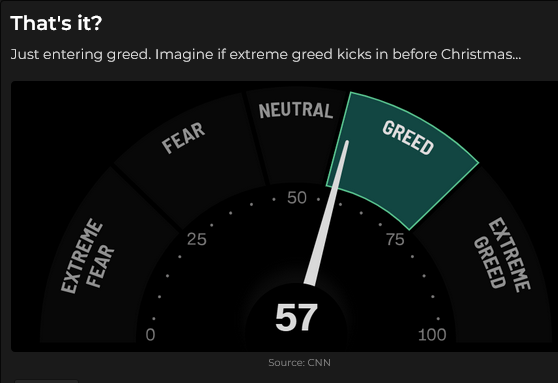

Imagine what these charts will look like if market sentiment gets to Extreme Greed!

Volatility has collapsed.

Bitcoin closed above $100,000 for a “market cap” of ~$2 Trillion.

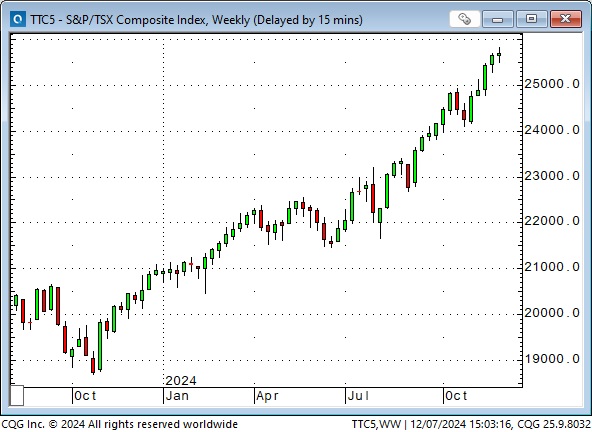

The Toronto Composite closed at record highs, up ~6% since the election and ~39% above the October 2023 lows. In November, the Composite had its best month in four years.

Currencies

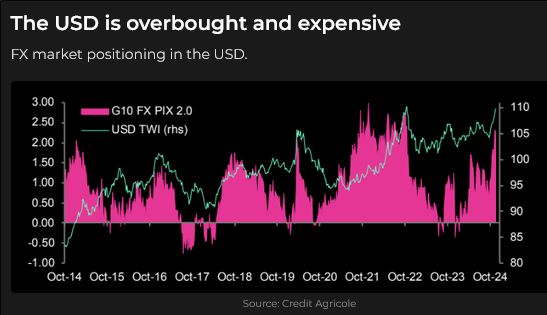

The US Dollar Index broke out to 2-year highs following the election but has been unable to sustain all those gains.

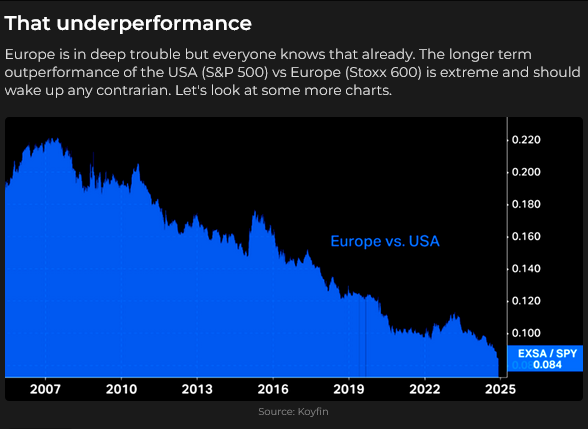

The Euro hit 2-year lows following the election but has rallied despite extreme negative sentiment and positioning.

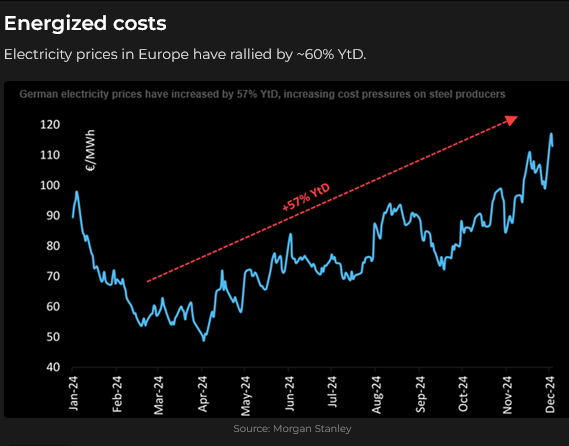

One of the reasons the market is negative on Europe.

The Canadian Dollar has been under relentless pressure since the end of September and closed this week at 4-year lows. The BoC will likely cut rates by 50 bps on Wednesday.

Since September, the USDX has been up ~6%, and the CAD has been down ~5%. Canada has its problems, but ALL other actively traded currencies have fallen as much or more than the CAD. (The AUD is down ~9%, NZD ~8%, and BRL 10%.) The big story in the currency market over the past three months is that the USD is rising against ALL other currencies.

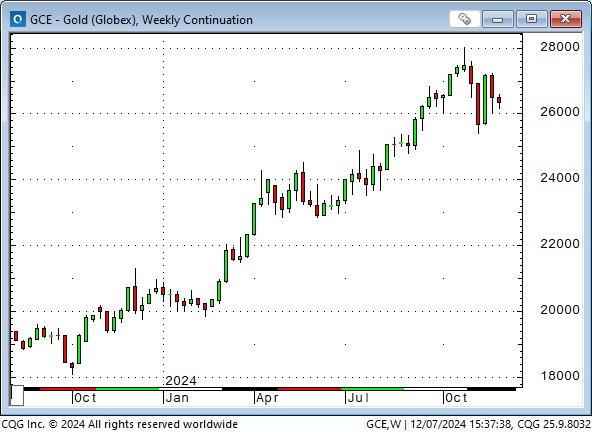

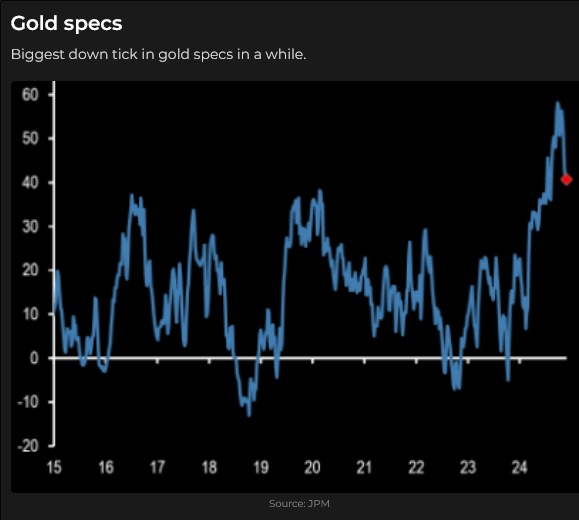

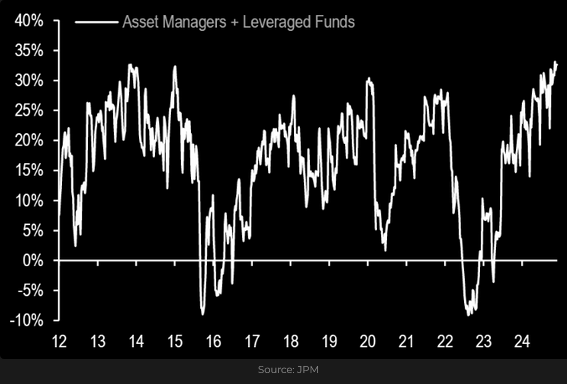

Gold

Gold rose ~75% from October 2022 to October 2024 but has fallen back ~$175 (~6%) since late October. Comex gold open interest has declined ~20% during this correction.

Energy

Cameco is my favourite uranium barometer, and it closed this week at new record highs, up ~70% from the September lows.

Front-month Nymex WTI closed this week at ~$67, near 3-year lows.

Interest rates

US short and long rates rose sharply from the end of September to mid-November (with a high correlation to the rise in the USD). In mid-November, Trump’s nomination of Bressent (circled) turned the market (especially the long end).

Thoughts on trading

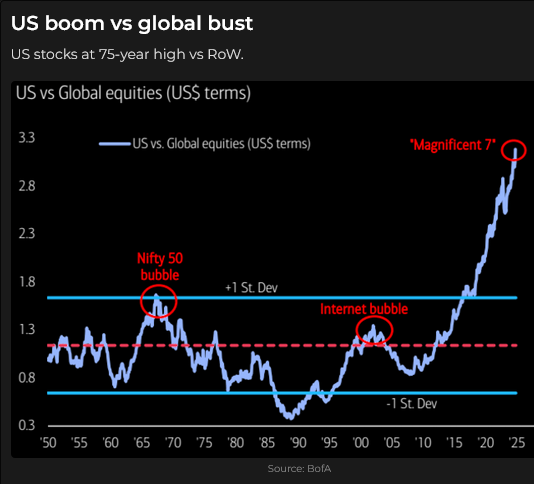

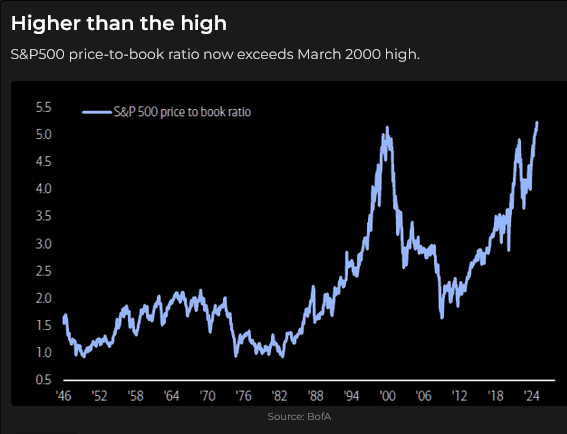

Price action in the currency and equity markets seems to imply that “American Exceptionalism” will become even greater under a second Trump presidency. I’m skeptical and see the raging TINA, FOMO, and ultra-low VOL readings as signs of an all-in top, but I’ll wait for a turn rather than trying to top-pick a surging market.

Here’s a link to an article in the FT by Ruchir Sharma, which claims that “America is over-owned, overvalued and overhyped to a degree never seen before.”

The growth of US money market funds to nearly $7 Trillion reinforces my skepticism. Some market commentators think of that money as “dry powder” that will eventually capitulate and FOMO into the equity market, driving it to new record highs. I see cash flow to money market funds as a sign that “veteran campaigners” are taking some money off the table and putting it into safe alternatives.

Quote of the week

Due to substitution effects and relentless technological advancement, commodity shortages are always temporary. Higher commodity prices are the cure for high commodity prices as supply and demand adjust almost instantly. In stocks, higher prices do not increase supply, and they often increase demand. Brent Donnelly

My short-term trading

I was away from my trading desk on a four-day road trip to attend a family funeral this week and didn’t do any trading.

On my radar

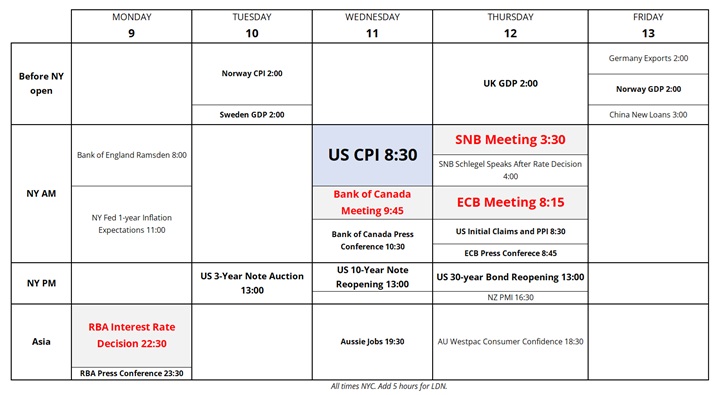

Here’s an excellent calendar for next week from Brent Donnelly.

The Fed meets the following week, and a 25 bps cut is expected. The BoJ also meets the following week.

The Barney report

I was away from home for four days this week, driving in the snowy mountains, and Barney was delighted to see me when I got home. He was keen to show me that he could hold a stick and a ball in his mouth at the same time.

Listen to two interviews I did this morning.

I talked with Mike Campbell on the Moneytalks show about the surging stock market, the Canadian dollar and gold. You can listen to the entire show here. My spot with Mike starts around the 60-minute mark.

I did my 30-minute monthly interview with Jim Goddard this morning on the This Week In Money show. We discussed American exceptionalism, stocks, currencies, interest rates, gold, and the energy markets. You can listen to the entire show here. My spot with Jim starts around the 11-minute mark.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair December 7th, 2024

Posted In: Victor Adair Blog