December 14, 2024 | Trading Desk Notes for December 14, 2024

What would a turning point in Irrational Exuberance look like?

Well, for a start:

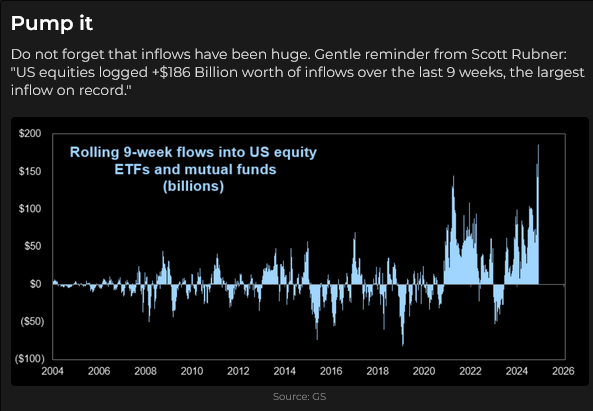

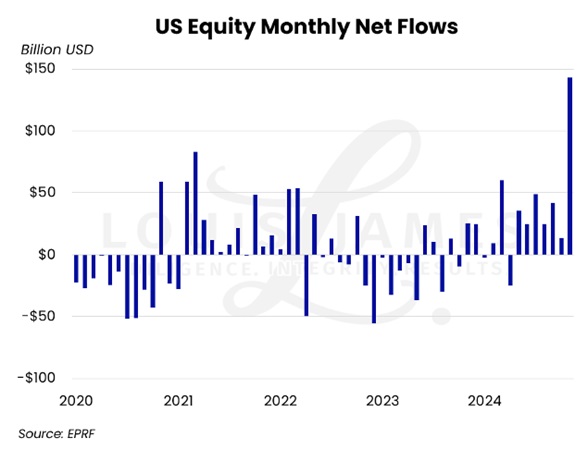

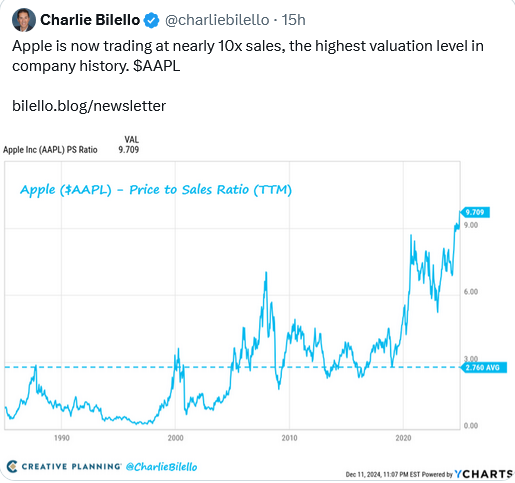

Some analysts say that retail is the most bullish ever. I don’t know how you measure that, but yeah, it feels that way, and retail is gambling on all kinds of crap – exchange-listed or otherwise.

The COT data as of December 10 shows that the combination of large and small specs held their largest net long position in the NAZ since 2017. In the Russell 2000, small specs held their largest ever net long position; in the S&P, small specs held their largest net long position since the covid panic in 2020. They may not be “all-in,” but if not, they’re close.

Is it rotation or something else?

While the NAZ was printing new all-time highs:

Dow futures logged seven consecutive down days.

The Russell 2000 rallied ~8% in November but has slumped in the last two weeks.

The S&P traded higher for 14 straight days (starting November 18) but turned down on Monday, December 9.

The TSE had a classic Key Reversal this week, hitting all-time highs on Monday and closing Friday below the lows of the previous two weeks.

TSLA, which may be THE Trump Bump stock, has rallied nearly 70% since the election and has “taken out” the all-time high made three years ago when it was included in the S&P 500 Index.

The good news for traders and investors who worry that the stock market has gone up too far too fast is that puts are cheap, and buying puts to hedge portfolio risk may be a good idea.

Interest rates

Bond prices fell every day this week; the yield on the 30-year rose from ~4.33% to 4.62%. The market has reversed all the gains made after gaping higher on Monday, November 25, on the news that Scott Bessent was Trump’s pick for Treasury Secretary.

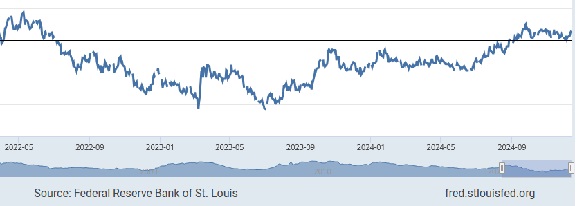

The 2/10-year yield curve ended its inversion in September and ticked steeper this week as long-end yields rose more than short-end yields. Markets are pricing a 25 bps cut from the Fed next week and possibly another one in January.

Currencies

The US Dollar Index traded higher every day this week in step with US interest rates.

The Euro (the Anti-Dollar) fell ~7.5% from September highs to November’s 2-year lows as traders embraced the idea that the soggy Eurozone economy would cause the ECB to lower rates more aggressively than the Fed. COT data as of December 10 revealed that large speculators (who had turned net-short the Euro in September for the first time in two years) held their largest net-short position since the covid panic in 2020.

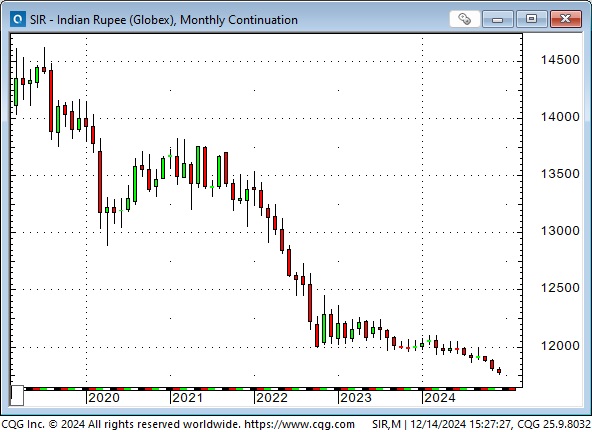

The Indian Rupee and the Brazilian Real fell to all-time lows this week as capital from around the world flows to America for safety and opportunity.

The Canadian Dollar

The CAD remained under pressure this week and closed at a fresh four-and-a-half-year low.

As expected, the BoC cut rates by 50 bps this week, taking short rates down 175 bps in the last six months (from 5% to 3.25%). The market is pricing another 25 bps cut from the BoC in January. Canadian rates are now ~120 bps below US rates across the curve.

One of the best trades I ever made was a Canadian dollar spread in the early 1980s. Fed Chair Volker was raising interest rates (to try to get inflation “under control”), and the Bank of Canada was also raising rates, trying to “keep up” with Volker. At one point, Volker jammed rates higher (I think it was an increase of 200 bps), and the BoC was slow to follow.

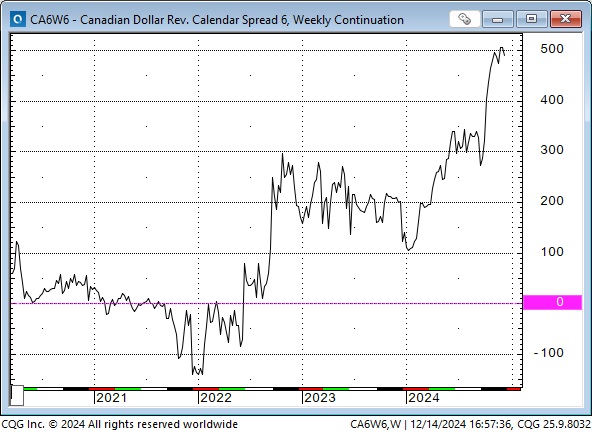

In the FX market, forward prices reflect interest rate differentials between countries. For instance, Canadian rates were usually higher than US rates, which meant that a future price (pick a date) for CAD would be lower than the spot price. (I could write an essay to explain why, but trust me—arbitrageurs keep the spreads honest.)

When Volker jammed US rates higher, and the BoC was slow to follow, forward CAD prices soared relative to spot. I pitched a financial institution on the idea that the interest rate differential had to tighten (the BoC would have to raise rates, or capital would flood out of Canada to earn a much higher interest rate in the US.)

The institutional account liked my idea, so we bought nearby CAD contracts and sold the deferred. In those days, the exchanges (in this case, the IMM) were slow to adjust margin requirements, and we put on the trade with no margin required. (We were long CAD and short CAD – the IMM didn’t see any risk in that!)

The trade worked like a hot damn. The BoC raised rates (I think they “saw” Volker and raised him), and the forward premium collapsed. My client made a terrific profit and sent me a lot of business over the next couple of years.

This chart shows the price changes in a 6-month CAD calendar spread over the last five years. The pink zero line means that both legs of the spread are the same price; there is zero difference between the nearby leg and the deferred.

Right now, with Canadian short rates ~120 bps below US rates, the 6-month forward CAD contract is ~50 bps premium to the nearly, which is at least a 16-year high.

If a trader thought the spread between US and Canadian short rates would narrow, he might buy nearby CAD and sell the deferred. This kind of trade can be done with a LOT of leverage in the futures market. This is not investment advice; it could be a very volatile and risky trade.

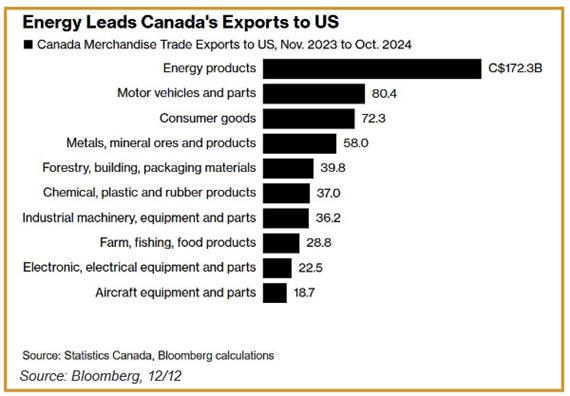

The 25% tariff

The Big Question hanging over the CAD is whether or not Trump will hit Canadian exports with a tariff. He said he will levy a 25% tariff (on Day One of his Presidency) on all Canadian exports IF Canada doesn’t block the flow of illegal migrants and dangerous drugs into the USA.

Politicians, businesspeople, and economists on both sides of the border have offered opinions on why 25% tariffs are a terrible idea. The market seems to believe that “cooler heads” will prevail, but Trump has a history of mercurial behaviour.

I say “seems to believe” because while the CAD is down ~5% since the end of September, that “fits” with the USD being up against all currencies during that time (the AUD is down ~9%, the Euro ~7.5%, the Swiss 6%, the Yen ~9%, the GBP ~6%). There has not been any “additional weakness” in the CAD to compensate for the tariff risk.

Gold

Gold rallied ~$100 Monday to Wednesday (perhaps spurred by reports of Chinese central bank buying) but gave nearly all those gains back on Thursday and Friday. The February futures chart shows serious resistance around $2,750.

Energy

The Financial Times had a terrific article on the LNG market today. It noted that freight rates for LNG shipping have fallen sharply because there are now more ships available to transport LNG than there is LNG available from export terminals.

My short-term trading

I shorted the S&P on Monday as it broke below Friday’s lows. I added to the trade on Friday and kept those positions into the weekend.

I missed shorting bonds on Monday and could not bring myself to get short as they fell every day this week. This was a case of “it hurts more to miss making a trade than it does to lose money on a trade.”

The Barney report

Barney and I have been home alone this week with my wife visiting friends in Vancouver. For a change of venue, I took the Barns to the trails near the Englishman River. He rolled in a dead fish (probably a spawning salmon) and got “mucho stinky.” Thankfully, I had a big dog towel in my car to save the upholstery, but it took two shampoos in the shower to get the stink out of him. There will be no more off-leash runs at the river until the spawning season is well and truly over!

Listen to Mike Campbell and I discuss markets.

On the Moneytalks podcast this morning, Mike and I discussed the Canadian Dollar, the “toppy” stock market, and rising bond yields. My 8-minute spot with Mike starts around the 1 hour and 5-minute mark.

The Archive

Readers can access weekly Trading Desk Notes from the past seven years by clicking the Good Old Stuff-Archive button on the right side of this page.

Subscribe: You have free access to everything on this site. Subscribers receive an email alert when I post something new, usually four to six times a month.

Victor Adair retired from the Canadian brokerage business in 2020 after 44 years and is no longer licensed to provide investment advice. Nothing on this website is investment advice for anyone.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Victor Adair December 14th, 2024

Posted In: Victor Adair Blog