December 23, 2024 | To the Housing Minister

Happy Monday morning!

Chaos in Ottawa. Not a whole lot more to add on the subject that you haven’t already read. Freeland is out, the budget exceeded its fiscal guardrails by more than 50%, and we are likely heading for an early election in the New Year. Until then, the Trudeau government has shuffled the deck chairs on the Titanic.

Former immigration minister, turned housing minister- Sean Fraser, is out. Nathaniel Erskine-Smith will replace Fraser as the new housing minister. He has no experience in housing or Real Estate for that matter, although i’m told that doesn’t matter in the world of politics. Regardless, he’s been handed a hot potato, and while his tenure as housing minister isn’t likely to last long, whoever has the housing file would be wise to take note here. In our final edition of The Saretsky Report we will detail the issues facing the country’s housing markets in the year ahead.

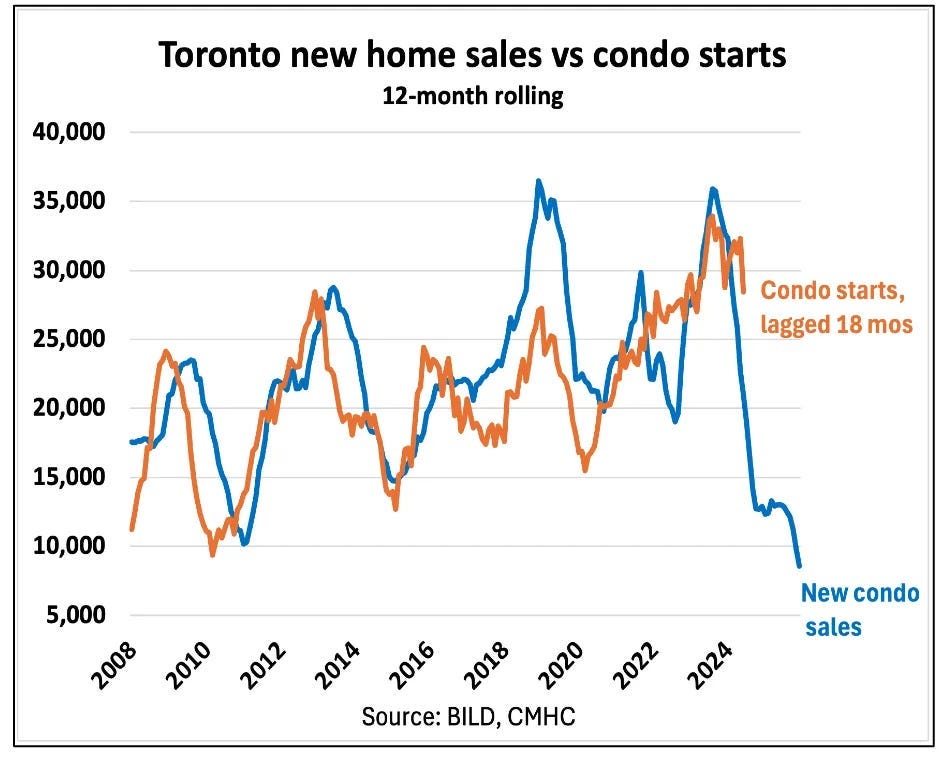

- The pre-sale market is in shambles. The number of condo units pre-sold in the GTA is currently running at 27 year lows. Per Urbanation president Sean Hildebrand, the pre-sale condo market is on track to have its slowest year in almost 30 years, with fewer than 5,000 sales expected by year-end. That figure pales in comparison to the 10-year average of around 22,000 sales. At last count, more than 75 condo projects are currently on hold, and growing. Remember, pre-sales lead housing starts. Housing starts in the GTA are going to look horrible over the next couple of years.

Source: Ben Rabidoux I’m not sure how you turn this around. Sometimes economic gravity just has to play out. The cost of new housing today simply doesn’t make a lot of sense, enticing investors to pay huge premiums for pre-sale is going to be hard to do in a down market where future price appreciation is bleak.

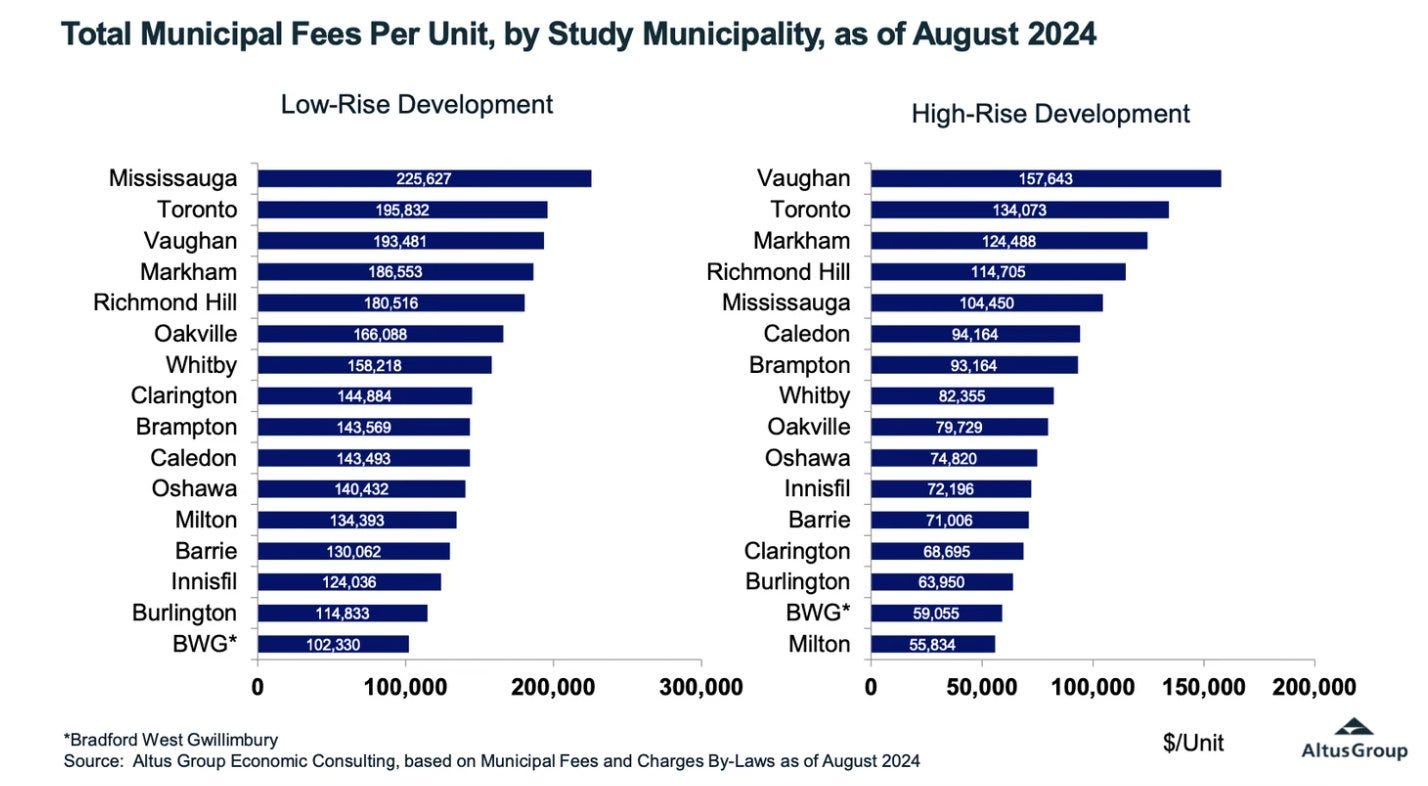

One way policy makers can help offset the crisis brewing in the construction sector is to reduce development fees, at least temporarily. By reducing taxes and fees you can instantly make a few more projects economically viable. In Toronto, municipal fees are reaching nearly $200,000 per door. That is not sustainable.

Source: Storeys We recently learned that Vaughan, the greatest offender of municipal fees, has announced it is cutting fees by nearly half. Progress.

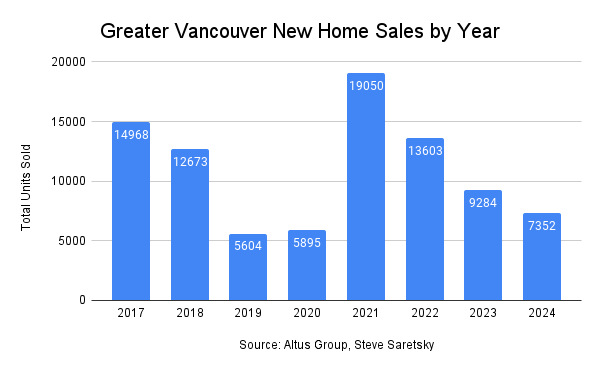

For those following along here in Vancouver, the pre-sale market is also soft, although nowhere near crisis territory. Data is more limited, only going back to 2017. However, Vancouver development is not in great spot.

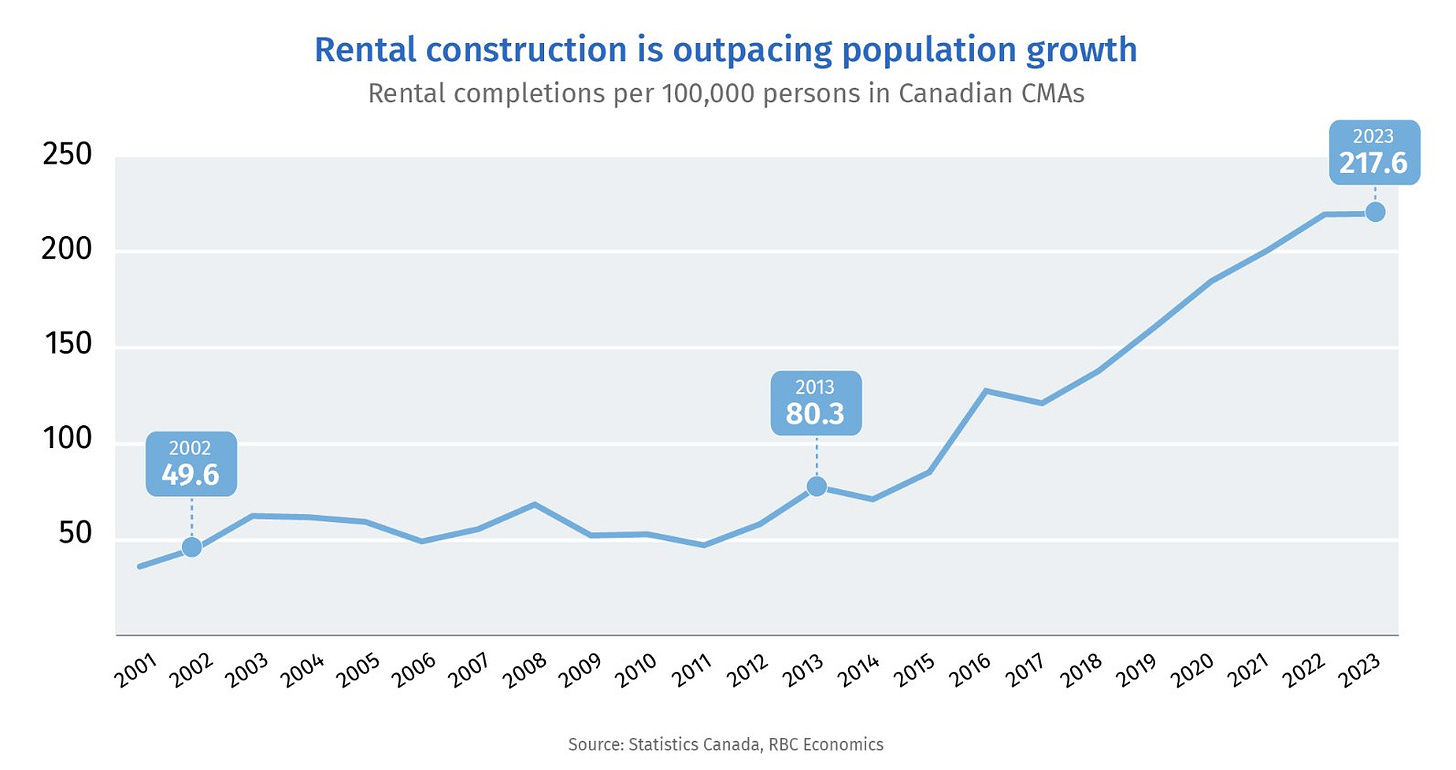

- On the bright side, rental construction is booming, thanks in large part to favourable financing terms from CMHC.

Source: RBC So what’s happening here? Nobody can afford new condos anymore so the market has shifted to rental, supercharged by CMHC’s MLI select program which allows developers to finance up to 95% loan to cost (land plus construction cost) of the development. Upon completion, assuming you meet their easy requirements, you can then get a loan on the completed rental building with a 95% loan to value and a 50 year amortization. Favourable financing terms have allowed rental construction to surge. As these units complete, rents are dropping.

Asking rents for all residential property types in Canada declined to a 15-month low of $2,139 in November, dropping 1.6% on an annual basis. Rents are down double digits in Vancouver and Toronto.

Source: Rentals.ca If you’re rooting for affordability this is good news, although not so good for developers currently building rentals who have penciled higher rents in their proforma. Equally as bad for CMHC and the taxpayers who have committed to financing 95% of the cost. It seems increasingly obvious that CMHC is going to have to temporarily tighten lending requirements to mitigate non performing loans.

Keep in mind rents are already declining and we have a record supply of new housing currently under construction and we’ve been told population growth is heading to ZERO over the next couple of years.

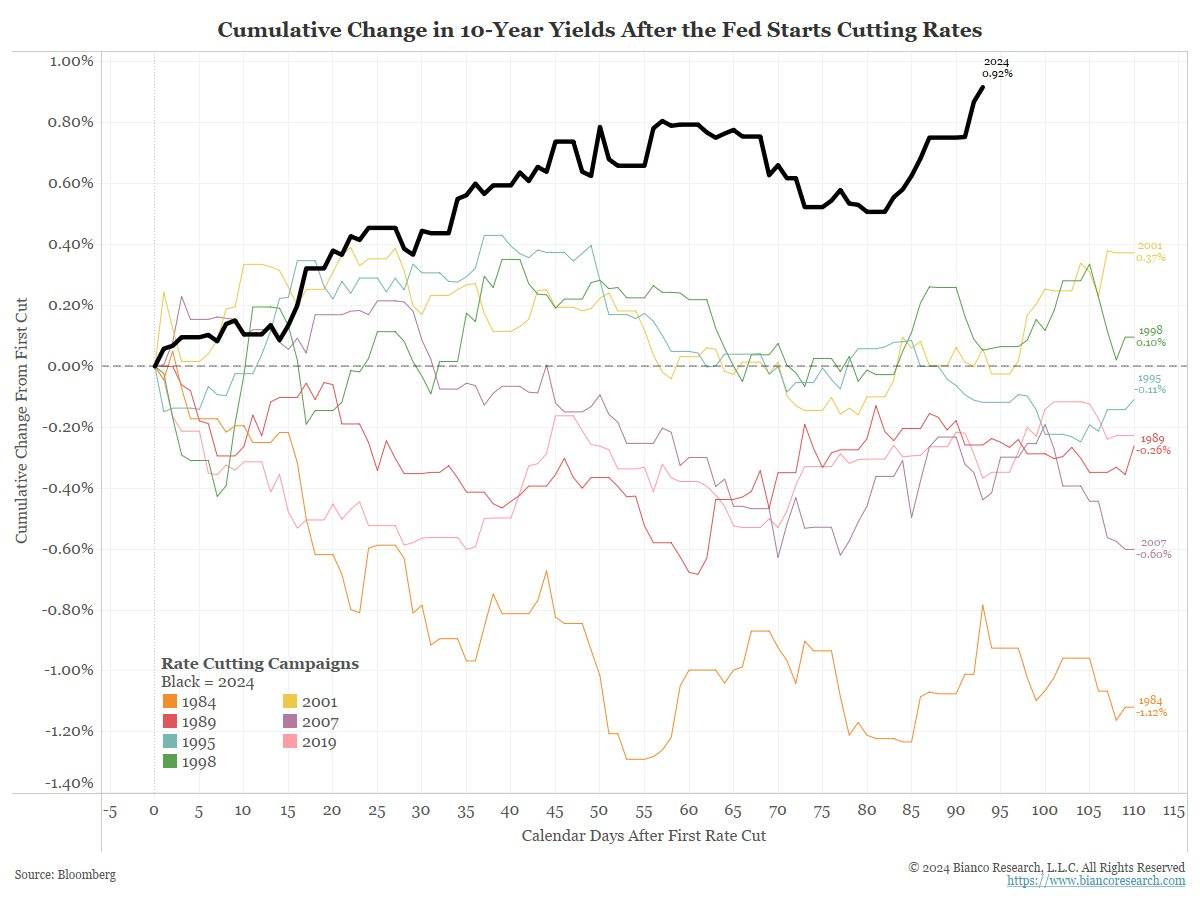

- There was a lot of concern about the mortgage renewal cliff. That is now looking like the mortgage renewal hill. About 1.2 million mortgages need to be renewed next year. As CIBC notes, about 40% of mortgages renewing next year will see lower monthly payments. About 10% of them will see an increase of less than 10%. That leaves the remaining 50% of renewals next year facing an average 20% payment shock, but that doesn’t look so scary if you consider the fact that over the past 5 years, both wages and home prices have risen by more than 30%. Overall, CIBC estimates that the total payment shock in 2025 will average just 2.5%. Manageable, we are told.However, what if rates don’t fall further from here? Sure the Bank of Canada is still slashing rates but most borrowers are on fixed rate mortgages, influenced almost exclusively by the bond market.The bond market is still worried about inflation, particularly in the US. Since the Fed started cutting rates we’ve seen yields rising, yields are up the most in a cutting cycle in at least 40 years.

Source: Jim Bianco Canadian bond yields are being brought along for the ride. The Bank of Canada has slashed rates by 175bps this year, yet the Canada 5 year bond is down a meager 10bps. That’s not exactly the rate relief most Canadians had in mind.

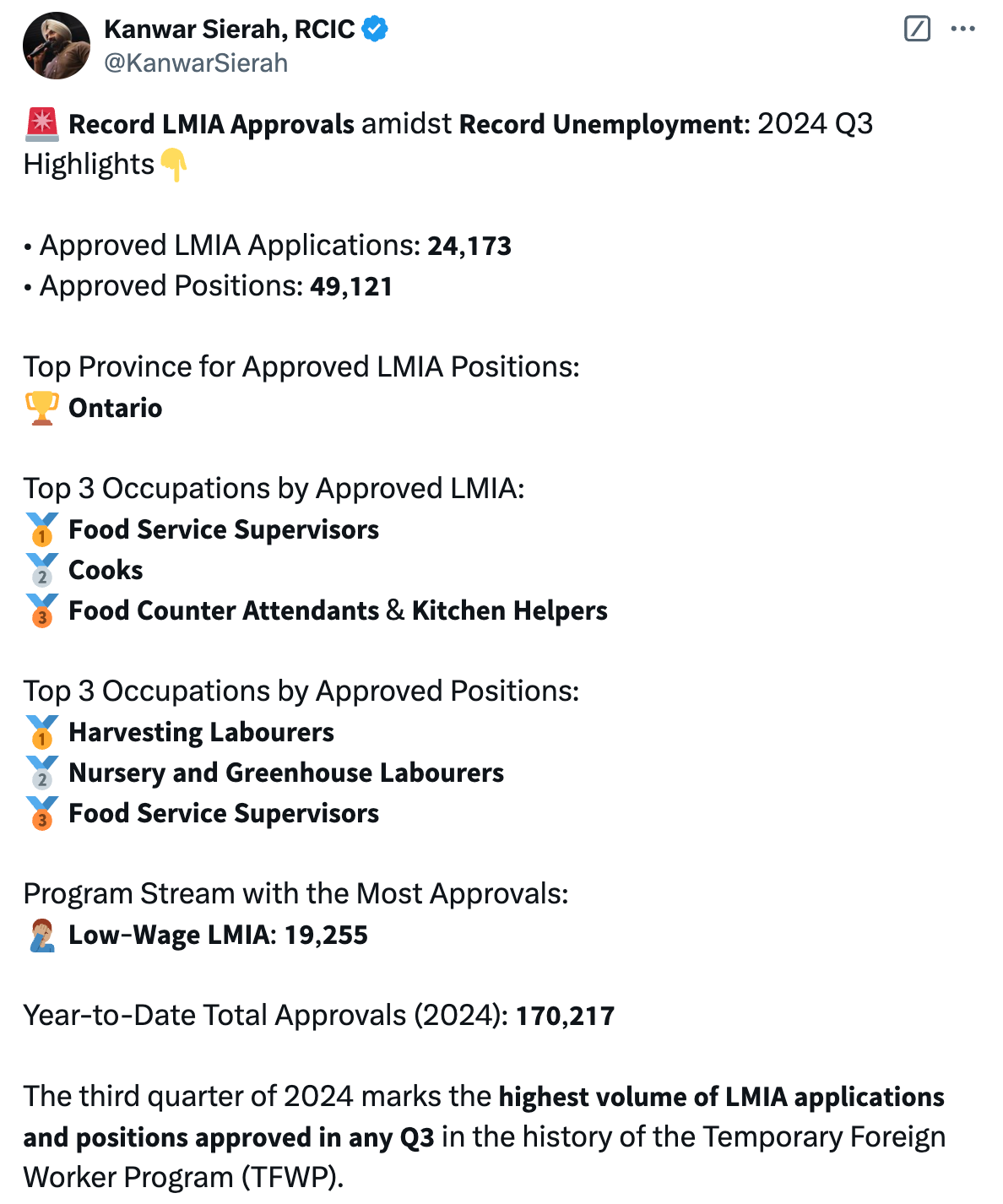

Now add a softening labour market that is still adding a record number of temporary workers through the LMIA program and things could get tricky.

Everyone has been so focused on the Bank of Canada but it should really be on the bond market and the labour market when it comes to judging the size and ramifications of the mortgage renewal cliff/ hill.

Suffice to say, we will be bracing for another volatile year ahead, regardless of who’s in power. No predictions here, just observations.

Regardless of who’s playing the role of housing minister we’ll continue to fade the noise and focus on the metrics that matter. Thank you for following along this year, and see you in the New Year.

Merry Christmas & Happy Holidays,

Steve

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky December 23rd, 2024

Posted In: Steve Saretsky Blog

Next: Grantham on the Baby Bust »