December 3, 2024 | The Unbearable Weight of Home Prices

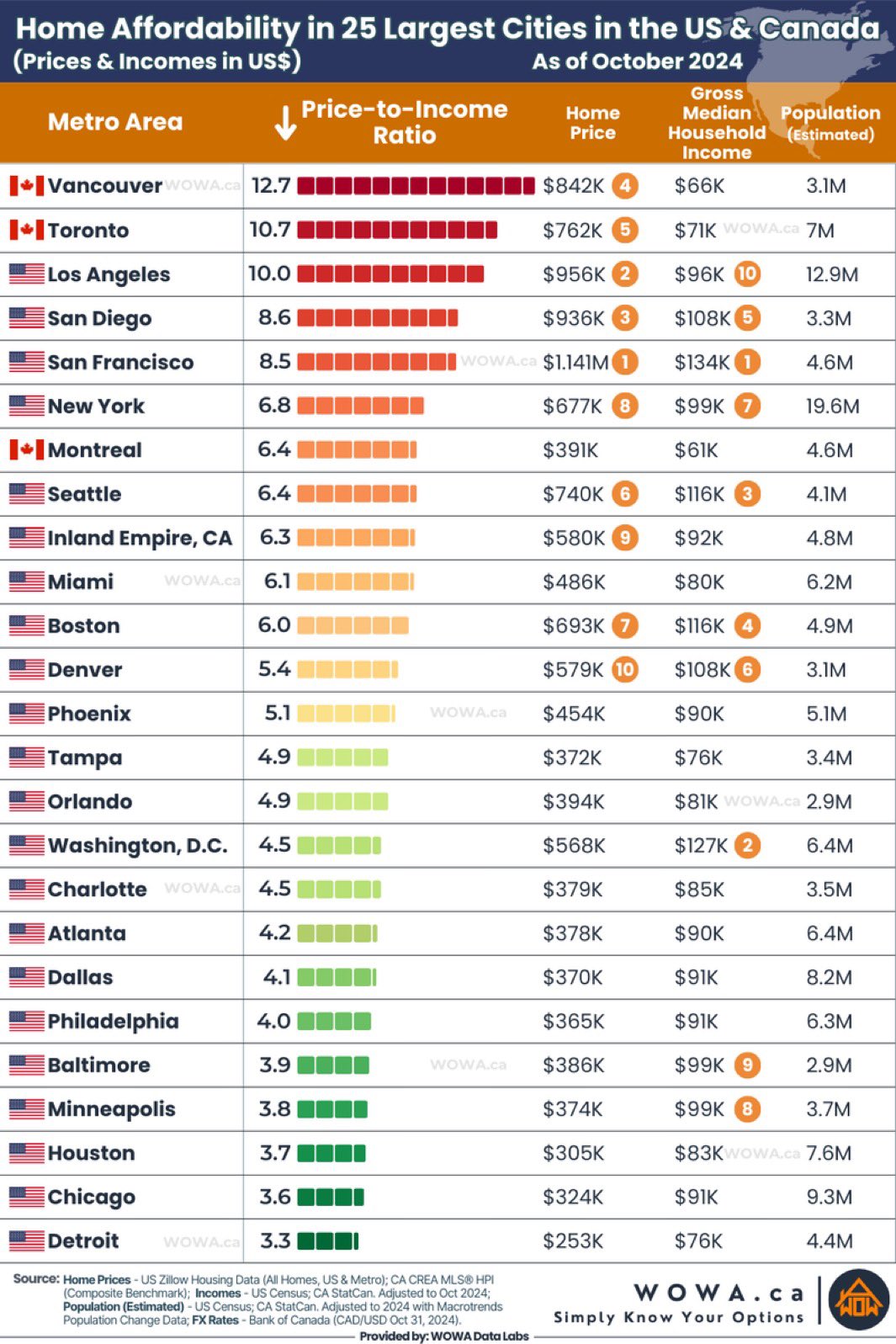

About 15 million, or 37% of Canada’s 40 million people, live in the Vancouver, Toronto, and Montreal areas, three of the top seven least affordable cities in America and Canada.

Over 25% live in the two least affordable cities—Vancouver and Toronto—where the average sale price in 2024 was 12.7x and 10.7x the median household incomes of $66k and $71k, respectively. That’s right: Housing is less affordable there than in LA, San Diego, San Francisco, New York, and every other major American metropolis (table below, courtesy of WOWA.ca). And it’s not much more affordable within a two-hour drive of the major cities.

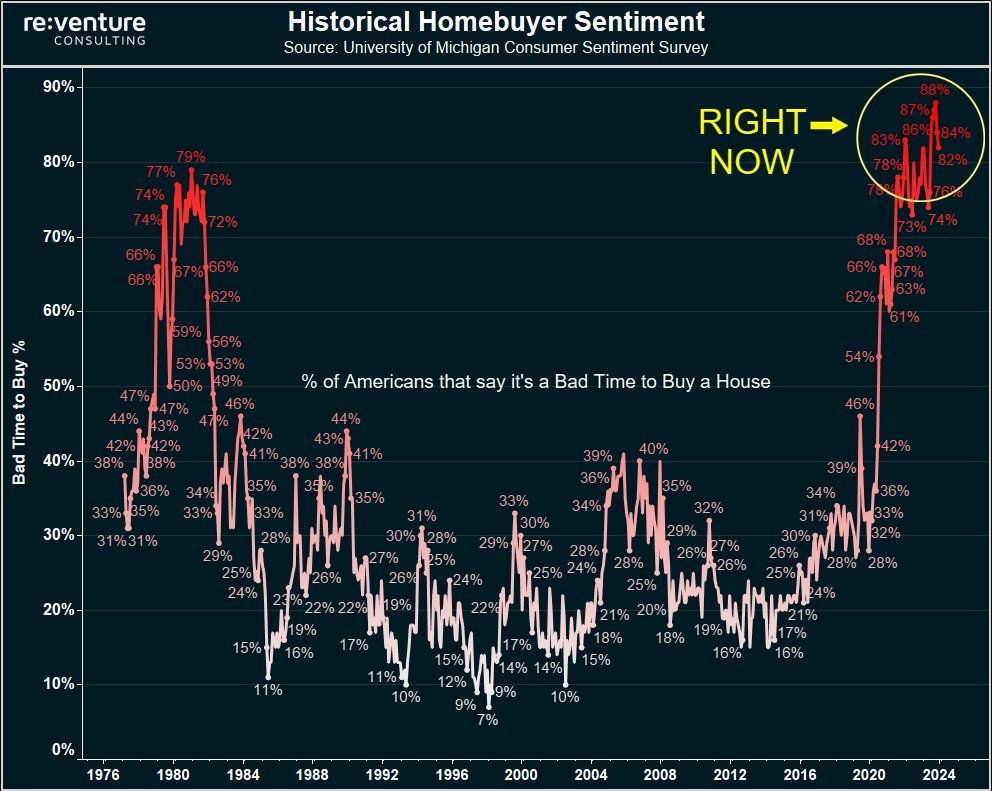

That’s a big red flag, considering the historically insightful University of Michigan Consumer Sentiment Survey shows that the percentage of Americans saying now’s a bad time to buy a house is above 80% and worse than in 1981 when conventional fixed mortgage rates briefly topped 16% (chart below via Nick Gerli and re: venture).

Today, fixed mortgage rates are just over 7% in America and 4% in Canada, yet home affordability has never been worse. In other words, interest rates are not the problem; it’s prices that have risen much more than household incomes.

During the 2006-08 U.S. real estate bubble, negative U.S. homebuyer sentiment peaked at 40%, less than half the current level of pessimism (see above).

To restore 2019 levels of home affordability, the median U.S. single-family home would need to fall 36%, or the median household income would need to rise more than 60% (Fannie Mae data). History shows that the former is more likely than the latter. And since Canada’s home-to-price and rent ratios are much worse than America’s, restoring Canadian affordability requires even bigger adjustments than south of the border.

As we saw after the 1980, 1990, and 2008 housing bubbles, impossible pricing has a habit of imploding as interest rates fall. There’s no evidence that this time will be different.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Danielle Park December 3rd, 2024

Posted In: Juggling Dynamite

Next: California’s Energy Surplus »