December 2, 2024 | The Rental Boom

Happy Monday morning!

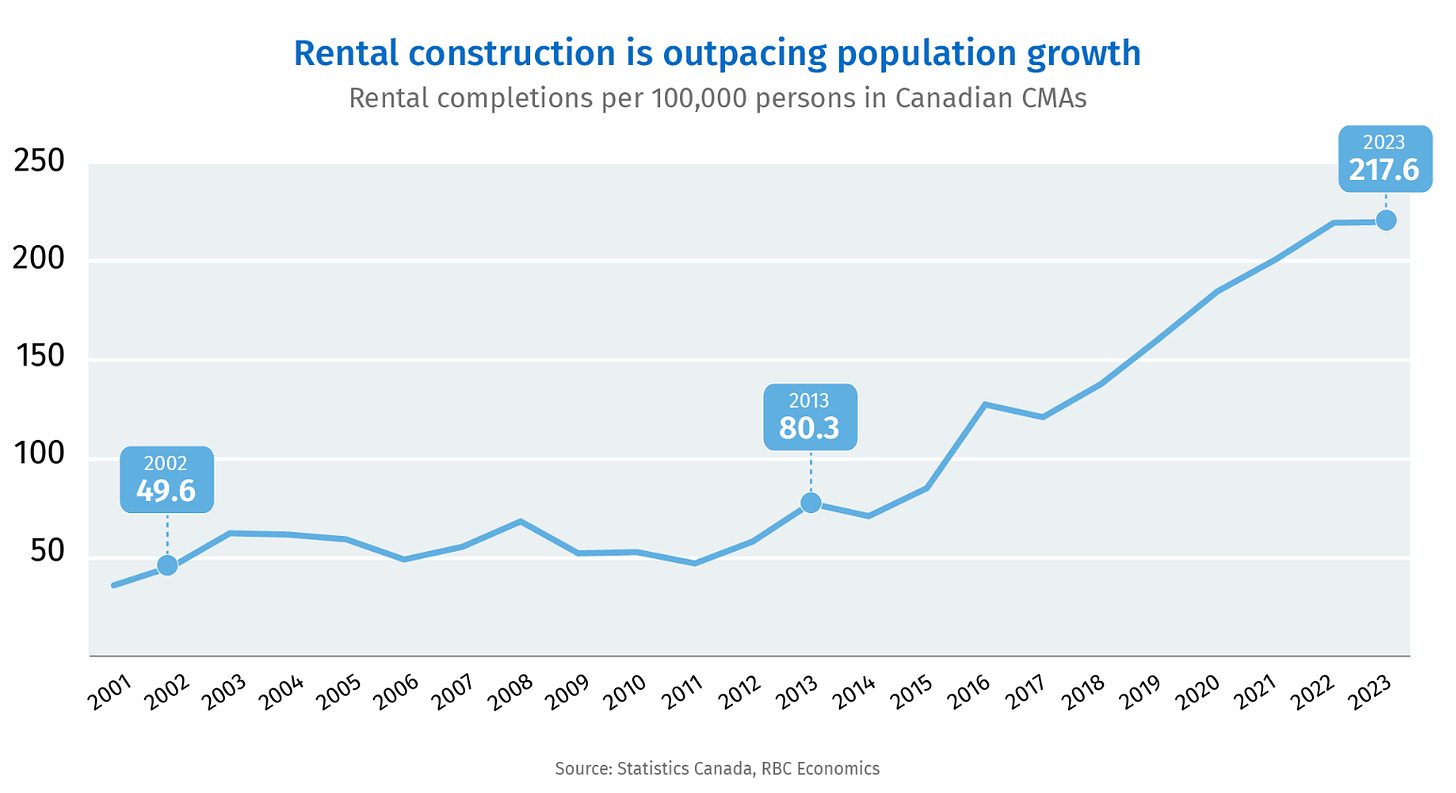

We’ve been talking a lot about the weakness in the rental market. Rents are declining in some of Canada’s largest major metros. In Toronto and Vancouver asking rents have dipped close to 10% over the past year. Part of this is from a massive boom in rental housing development. Per RBC, we are currently completing 217 rental homes for every 100,000 people. This is the highest in over two decades.

It turns out, supply and demand curves still work. If supply grows faster than demand, prices fall. It’s a concept as old as time and still holds true today.

The boom in rental construction is largely a function of favourable CMHC financing terms. Policy makers have screwed up a lot of things, immigration, taxes, red tape, but one thing they got right was creating the CMHC MLI Select program. The program provides up to 95% LTV on new construction rental buildings and up to 50 year amortizations. Through the stroke of the pen, the government made developing rental buildings more economical and the incentive was enough to unleash the powers of the private sector. As Charlie Munger once said, “Show me the incentives, and I will show you the outcome.”

The boom in rental housing is one of the very few bright spots in the housing landscape.

However, cautious optimism is warranted.

As we have noted through this newsletter for the past year, housing completions are a reflection of the hard work a developer put in four or five years ago. From acquiring a land site, raising capital, tendering architectural drawings, submitting applications for rezoning, waiting for cities to approve permits, and then actually building the homes, this process takes years. In other words, what is being completed today is a reflection of the enthusiasm of the private sector several years ago.

That enthusiasm has obviously faded in recent years, as one would expect when interest rates surge 500bps, and the economy plunges into a per capita recession for six consecutive quarters, and eight of the last nine.

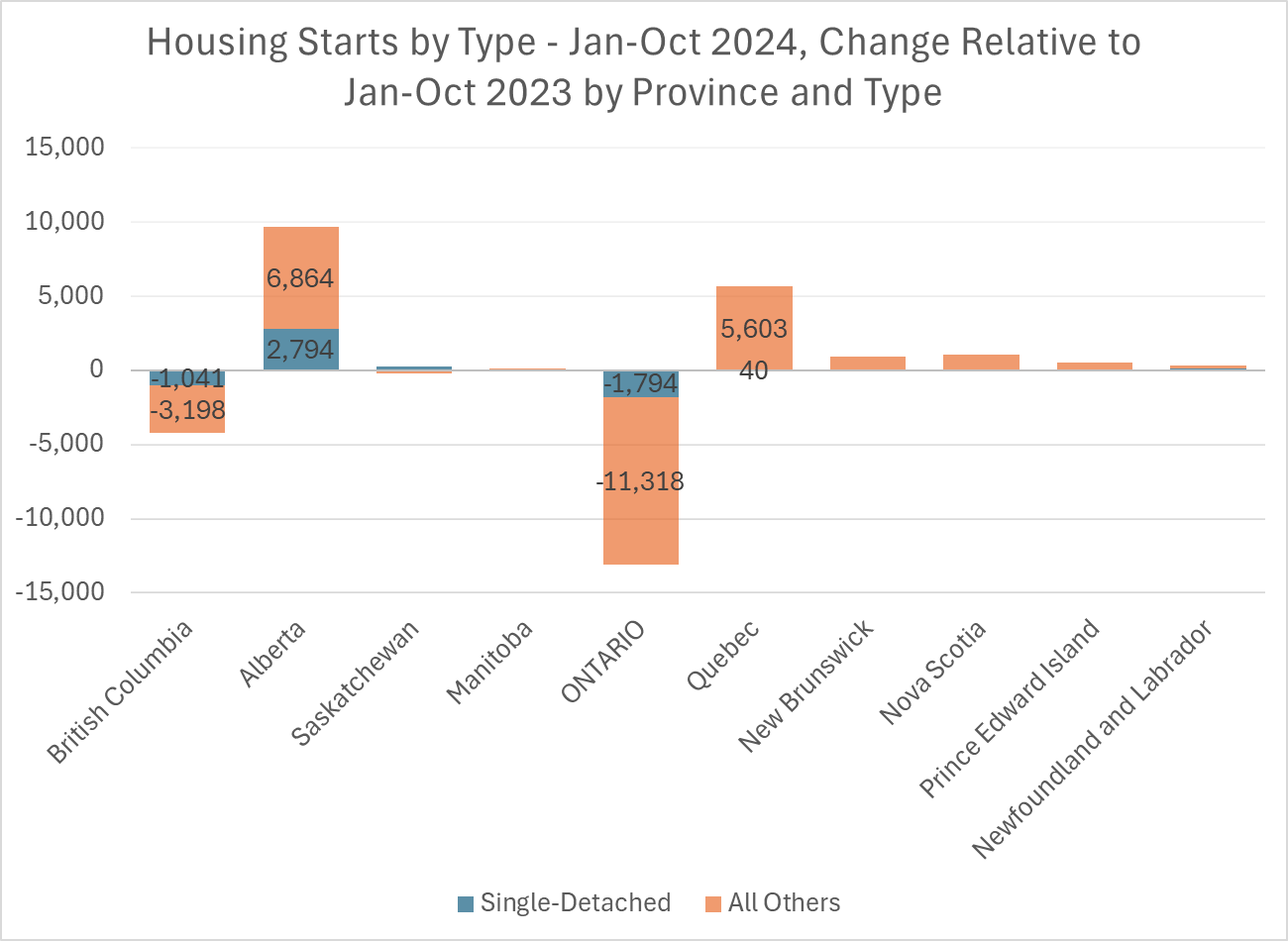

Yes, housing starts are in the process of falling of a cliff, and not even rental construction can halt this wile e coyote.

Housing starts, which lead housing completions but are still a lagging indicator, are plunging in BC and Ontario, and being held up by Alberta and Quebec.

I can assure you, the 27 year lows in GTA pre-sales means these numbers are only going to get worse.

The numbers are just really hard to pencil, and not just in the rental market or the pre-sale market.

Look what’s happened in the resale market. To qualify for a home in Toronto and Vancouver you need to be earning over $230K, at which point the government thinks you’re rich and taxes you at over 50%.

Don’t forget that home in the chart above, assuming its brand new, is made up of 30% taxes. So $252,600 of that $842,000 home in Vancouver is taxes. This means if you buy a new home that year while making $230,000 you would have paid $80,000 in income tax and $16,776 in mortgage costs a year for 25 years on the portion of the new home taxes. We’ve left out property taxes to save you the heartache.

I think this chart helps explain why rental construction has been surging. Home ownership is fading. The math has become insurmountable for those not already on the housing ladder.

They say the first step to recovery is admitting you have a problem. Houston, I think we have a problem.

STAY INFORMED! Receive our Weekly Recap of thought provoking articles, podcasts, and radio delivered to your inbox for FREE! Sign up here for the HoweStreet.com Weekly Recap.

Steve Saretsky December 2nd, 2024

Posted In: Steve Saretsky Blog